PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910867

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910867

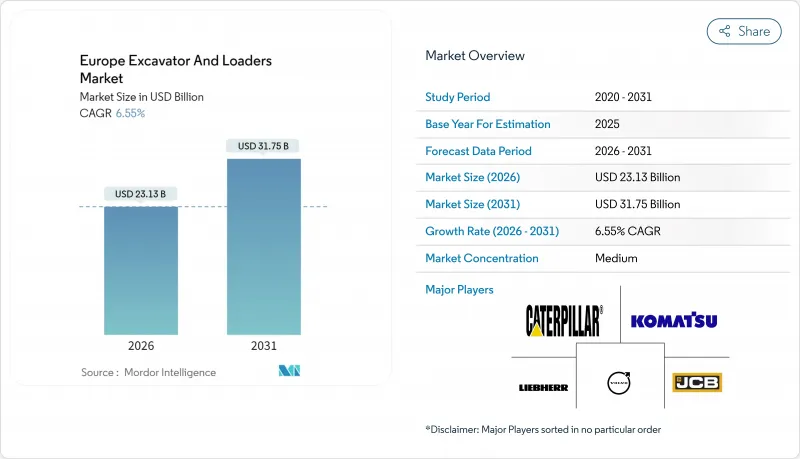

Europe Excavator And Loaders - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Excavator And Loaders market size in 2026 is estimated at USD 23.13 billion, growing from 2025 value of USD 21.71 billion with 2031 projections showing USD 31.75 billion, growing at 6.55% CAGR over 2026-2031.

A confluence of European Green Deal funding, pent-up post-pandemic project backlogs, and aggressive stage-V emission rules sustains a capital-expenditure upswing that is resilient to short-term economic volatility. Electric and hybrid machinery launches now occur on annual product-cycle cadences, accelerating the region's migration away from diesel powertrains and establishing Europe as an early-adopter laboratory for zero-emission job-sites. Equipment-as-a-Service models are gaining traction because high interest rates and complex compliance costs make usage-based access more attractive than outright ownership. Competitive dynamics increasingly revolve around digital-twin job-site automation, fleet telematics, and over-the-air software updates, turning heavy machines into connected assets that deliver lifetime data value in addition to physical productivity.

Europe Excavator And Loaders Market Trends and Insights

EU Green-Deal Infrastructure Funding Boom

The European Union has earmarked EUR 1 trillion for climate-aligned spending through 2030, channeling billions into rail electrification, energy-efficient public buildings, and renewable-ready grids. Public tenders increasingly stipulate stage-V or fully electric equipment, prompting rental fleets to overhaul aging diesel inventories. A EUR 100 million loan extended to a leading rental group for electric fleet expansion exemplifies how concessional finance levers private modernization cycles. Procurement policies that score bids on life-cycle emissions rather than upfront cost accelerate adoption, creating an upward spiral in demand for battery-powered excavators, telehandlers, and site-generators across Northern Europe.

Post-Pandemic Construction Backlog Release

Lockdowns delayed hundreds of municipal and commercial projects, inflating contractor order books to record highs entering 2025. As restrictions eased, simultaneous execution of deferred and new Green-Deal workstreams pushed utilization rates past historical ceilings. Rental day-rates for mid-range excavators climbed into double-digit premiums because contractors prioritized job completion over cost containment. The backlog convergence grants OEMs visibility on production runs through 2026, allowing them to localize component sourcing and justify regional battery pack assembly lines that shorten delivery lead-times.

Growth of Rental Fleets Suppressing Purchases

European rental turnover grow by over 2% in 2024 and continues to outpace construction GDP, with certain aerial platform categories now achieving over 80% rental penetration. Consolidators acquire regional depots, centralize procurement, and negotiate volume discounts that depress OEM line-item margins. As contractors shift toward variable costs, manufacturers pivot to servicing agreements and residual-value guarantees, but unit sales still temper as fleets sweat assets over longer cycles.

Other drivers and restraints analyzed in the detailed report include:

- Stage V Emission Norms Driving Fleet Renewal

- Zero-Emission Site Mandates in Scandinavia

- High Interest-Rate Environment Dampening CAPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators generated 58.10% of Europe construction equipment market revenue in 2025 and are forecasted for an 11.3% CAGR, illustrating how versatile boom-and-bucket platforms absorb many tasks once assigned to specialized machines. Agile mini models maneuver through tight urban sites subject to zero-emission ordinances, while 45-ton units tackle rail embankment cuts and offshore wind foundation work. Integrated tilt-rotators and quick-coupler systems shrink attachment change-over to seconds, amplifying utilization across day-parts. As OEMs embed machine-control software and over-the-air calibration, excavators evolve into autonomous workstations capable of centimeter-level grading guided by 3D site files. Remote-operation cabs stationed offsite improve safety and widen labor pools, a critical benefit amid an aging European workforce.

Skid steers, wheel loaders, and backhoes maintain relevance in material loading and multi-purpose municipal duties, yet their growth lags because excavators fitted with grapple or pallet-fork attachments can achieve similar throughput. High reach demolition excavators with telescopic booms are seeing increased demand as cities modernize post-war housing blocks. Telescopic handlers blur category lines further, as telematics measure fork-load angles in real time, assisting operators and satisfying insurer requirements. This convergence underscores why Europe construction equipment market participants redesign portfolios around modular platforms rather than traditional siloed categories.

Diesel/hydraulic systems still account for 92.70% of Europe construction equipment market size, but electric models' 19.1% CAGR reinforces that the tipping point has shifted from speculative to inevitable. Early adoption focused on <3 ton minis where duty cycles align with current battery density; today OEM roadmaps list 10-14 ton excavators and 6 m3 wheel loaders with shift-able swappable packs. Public agencies procure electric skid steers for noise-sensitive night work, citing operator health benefits and neighborhood acceptance. Grid-tethered cable machines re-emerge in quarries, linking regenerative braking to onsite crushers and improving energy efficiency.

Hybrid diesel-electric variants fill an interim niche on long-duration civil engineering jobs far from charging depots. Fuel-cell prototypes field-tested in Scandinavian mines demonstrate eight-hour runtimes without performance drop-off, though hydrogen supply chains remain nascent. The drive-type spectrum signals that the Europe construction equipment market is transitioning into a multi-energy landscape, where fleet managers weigh local emission rules, duty cycles, and total-energy pricing before specifying powertrains.

The Europe Excavator and Loaders Market Report is Segmented by Machinery Type (Excavators and Loaders), Drive Type (Diesel/Hydraulic, Electric, and More), Operating Weight (Below 6t, 6 To 14t, and More), End-Use Industry (Construction, Mining and Quarrying, and More), Application (Excavation and Earthmoving and More), and Country (Germany and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- CNH Industrial N.V. (CASE and New Holland)

- Deere and Company

- Hitachi Construction Machinery

- Liebherr-International Deutschland GmbH

- Doosan Bobcat Co.

- Kobelco Construction Machinery

- Manitou BF SA

- Yanmar Construction Equipment

- JCB Ltd.

- Kubota Corp.

- Sany Europe

- XCMG Europe

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

- Mecalac SAS

- Wirtgen Group (John Deere)

- Avant Tecno Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green-Deal Infrastructure Funding Boom

- 4.2.2 Post-Pandemic Construction Backlog Release

- 4.2.3 Stage V Emission Norms Driving Fleet Renewal

- 4.2.4 Zero-Emission Site Mandates in Scandinavia

- 4.2.5 Digital-Twin Job-Site Automation Uptake

- 4.2.6 Equipment-as-a-Service Business Models

- 4.3 Market Restraints

- 4.3.1 Growth of Rental Fleets Suppressing Purchases

- 4.3.2 High Interest-Rate Environment Dampening CAPEX

- 4.3.3 Battery-Material Cost Volatility

- 4.3.4 Dealer-Network Consolidation Blocking New Entrants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Excavators

- 5.1.1.1 Mini (Below 6 t)

- 5.1.1.2 Midi (6 to 14 t)

- 5.1.1.3 Crawler

- 5.1.1.4 Wheeled

- 5.1.1.5 Amphibious

- 5.1.1.6 Large (Above 45 t)

- 5.1.2 Loaders

- 5.1.2.1 Wheel Loader

- 5.1.2.2 Skid Steer Loader

- 5.1.2.3 Compact Track Loader

- 5.1.2.4 Backhoe Loader

- 5.1.2.5 Small Articulated Loader

- 5.1.1 Excavators

- 5.2 By Drive Type

- 5.2.1 Diesel / Hydraulic

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.2.4 Hydrogen Fuel-Cell (emerging)

- 5.2.5 Cable / Grid-tethered

- 5.3 By Operating Weight (t)

- 5.3.1 Below 6

- 5.3.2 6 to 14

- 5.3.3 14 to 30

- 5.3.4 30 to 45

- 5.3.5 Above 45

- 5.4 By End-Use Industry

- 5.4.1 Construction

- 5.4.2 Mining and Quarrying

- 5.4.3 Agriculture and Forestry

- 5.4.4 Waste and Recycling

- 5.4.5 Utilities and Urban Infrastructure

- 5.4.6 Rental Companies

- 5.5 By Application

- 5.5.1 Excavation and Earthmoving

- 5.5.2 Material Handling

- 5.5.3 Demolition

- 5.5.4 Landscaping

- 5.5.5 Snow Removal

- 5.5.6 Road Building and Maintenance

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Sweden

- 5.6.8 Norway

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Volvo Construction Equipment

- 6.4.4 CNH Industrial N.V. (CASE and New Holland)

- 6.4.5 Deere and Company

- 6.4.6 Hitachi Construction Machinery

- 6.4.7 Liebherr-International Deutschland GmbH

- 6.4.8 Doosan Bobcat Co.

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Manitou BF SA

- 6.4.11 Yanmar Construction Equipment

- 6.4.12 JCB Ltd.

- 6.4.13 Kubota Corp.

- 6.4.14 Sany Europe

- 6.4.15 XCMG Europe

- 6.4.16 Wacker Neuson SE

- 6.4.17 Hyundai Construction Equipment Europe

- 6.4.18 Mecalac SAS

- 6.4.19 Wirtgen Group (John Deere)

- 6.4.20 Avant Tecno Oy

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment