PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910879

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910879

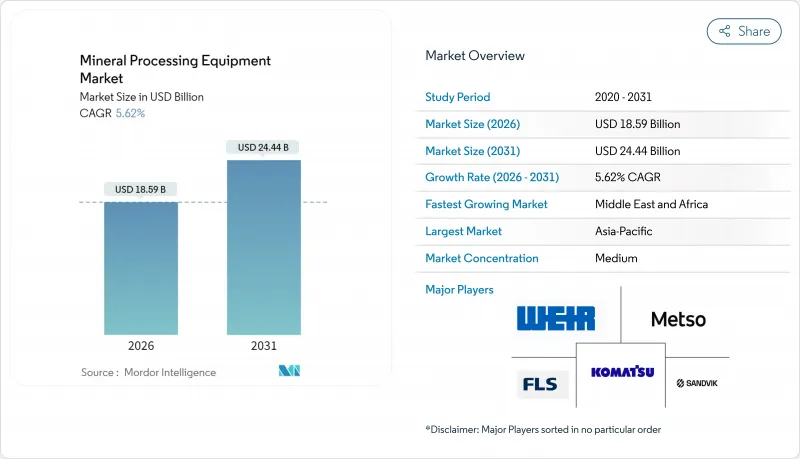

Mineral Processing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Mineral Processing Equipment market was valued at USD 17.61 billion in 2025 and estimated to grow from USD 18.59 billion in 2026 to reach USD 24.44 billion by 2031, at a CAGR of 5.62% during the forecast period (2026-2031).

Continuous ore-grade decline, the energy-transition metals boom, and tightening environmental standards reinforce multi-year investment cycles favoring higher-capacity, digitally enabled plants. Growing demand for lithium, nickel, and rare earth elements pushes equipment orders toward finer-grinding, precision-separation, and advanced dust-control systems. Producers prioritize energy efficiency to reduce cost per tonne and Scope 1 emissions, elevating technologies such as high-pressure grinding rolls (HPGRs) and column flotation. Aftermarket services gain strategic importance as remote mine operators seek guaranteed uptime and predictive maintenance. Supply-chain nationalism adds urgency to domestic processing capacity in North America, Europe, and Asia, further broadening the mineral processing equipment market opportunity.

Global Mineral Processing Equipment Market Trends and Insights

EV-Battery Metal Boom (Lithium, Nickel)

Soaring demand for battery-grade inputs drives a pronounced shift in the Mineral Processing Equipment market. Lithium projects require specialized roasting, leaching, and crystallization circuits able to deliver 99.5%+ purity levels, prompting new orders for Metso's pCAM and calciner packages. Nickel laterite processing equally benefits larger autoclaves, sulfuric-acid leach reactors, and downstream solvent-extraction units. OEMs with high-temperature, high-pressure design credentials command premium margins as investors fast-track integrated battery-metal hubs in Australia, Indonesia, and Chile. The resulting capacity build-out sustains double-digit equipment demand even when bulk-commodity spending moderates. Suppliers also integrate ESG reporting modules that trace cradle-to-gate emissions for each tonne of battery metal.

Shift to Finer-Grade Ores Driving High-Capacity Crushers

Copper, gold, and iron ore head grades continue to fall, obliging plants to process larger tonnages to maintain metal output. HPGR circuits yield 20-40% energy savings and finer product size distributions that elevate downstream flotation recovery, as demonstrated by Weir Group's ENDURON installs Mines in Australia and Chile retrofit primary crushers with 20,000 t/h nameplate capacities, complemented by real-time particle-size analyzers that close the control loop. This cascading effect lifts demand for screens, cyclones, and dewatering equipment sized for higher slurry volumes. Suppliers that provide integrated comminution-to-classification packages capture added service revenue, reinforcing the Mineral Processing Equipment market's focus on high-throughput, low-specific-energy solutions.

ESG-Driven Capital Rationing for Green-Field Mines

Institutional investors apply stringent ESG filters, slowing approvals for new mines and delaying linked plant orders. Greenfield iron ore and copper projects in Canada now require upfront carbon-neutral processing designs, adding up to 20% to installed costs. Extended permitting cycles compress near-term demand for crushers and mills, even as retrofit orders for dust-suppression and water-recycling systems rise. OEMs respond with modular, relocatable plants that minimize land disturbance and shorten environmental reviews, preserving a pipeline of smaller, faster-moving purchase orders within the Mineral Processing Equipment market.

Other drivers and restraints analyzed in the detailed report include:

- CAPEX Surge in African Critical-Mineral Projects

- Digital-Twin Adoption for Plant-Wide Optimization

- Tightening Particulate-Matter Emission Norms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium's meteoric 13.58% CAGR through 2031 underscores structural change inside the mineral processing equipment market. Although bulk commodities under the "Others" banner still generated 89.55% of the mineral processing equipment market size in 2025, battery-metal plants are specifying calcination kilns, solvent-extraction mixers, and crystallizers built for ultra-low impurity thresholds. The Mineral Processing Equipment market captures investor enthusiasm as automakers seek secure, traceable supply chains. Traditional iron-ore and copper flows maintain large volumes; however, their single-digit growth contrasts sharply with double-digit expansion in critical mineral circuits.

Continued head-grade decline in copper and gold extends capex cycles for HPGR, fine-grinding, and flash-flotation gear. Though small in tonnage, rare-earth element circuits demand complex multi-stage separation that commands high unit pricing, lifting margin contribution. Suppliers thus allocate R&D toward hydrometallurgy and selective leaching, balancing legacy bulk-commodity exposure with high-growth specialty segments.

Crushers and mills represented the largest 32.72% slice of the mineral processing equipment market size in 2025, yet advanced flotation cells booked the quickest 5.88% CAGR through 2031. Plants processing complex lead-zinc or nickel ores adopt automated air-flow and froth-camera systems to sustain grade. Integrated skid-mounted flotation modules shorten delivery to six months, suiting fast-track lithium projects.

Downstream, high-rate thickeners and paste-fill plants address tailings dam risk, while smart slurry pumps with wear-performance sensors extend the mean time between overhauls. Therefore, the Mineral Processing Equipment market share mix tilts gradually toward separation and tailings handling, reflecting heightened water stewardship and value-recovery priorities.

The Mineral Processing Equipment Market Report is Segmented by Mineral Mining Sector (Bauxite, Copper, Iron, Lithium, Nickel, Rare-Earth Elements, Gold and Precious Metals, Others), Equipment (Crushers and Mills, Screens and Separators, and More), Processing Stage (Crushing and Grinding, and More), End-User Industry (Mineral/Ore Mining Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, with 67.92% of 2025 turnover, remains the nucleus of the mineral processing equipment market. China's vast smelting and refining backbone absorbs crushers, mills, and filtration packages on an unparalleled scale. Australian iron-ore majors commit to 700+ Mt/y capacity, sustaining HPGR and screening upgrades, while Indonesian nickel laterite projects specify autoclaves and acid-plant tie-ins. India's Production-Linked Incentive scheme for critical minerals and mining code reforms stimulates greenfield lithium and graphite developments that underpin incremental equipment demand in 2025-2030.

The Middle East and Africa deliver the fastest 9.82% CAGR through 2031, as Saudi Arabia, Namibia, and Angola deploy sovereign capital to monetize phosphate, copper, and rare-earth resources. Solar-powered desalination plants feed water-intensive concentrators, cutting unit opex. Ma'aden's mega-phosphate complex exemplifies integrated mine-to-fertilizer flows, capturing service contracts for pumps, thickeners, and rotary dryers. Localized maintenance hubs in Durban, Muscat, and Tema mitigate logistics delays, favoring OEMs that invest in on-ground technicians. North America and Europe record mid-single-digit growth rates anchored by supply-chain security agendas. United States federal grants fast-track domestic lithium-hydroxide refineries, benefitting calciner and crystallizer specialists. The EU's Critical Raw Materials Act subsidizes rare-earth separation and battery recycling, boosting column-flotation and hydromet plant orders. South America's lithium triangle retains momentum, although water-use restrictions in the high Andes propel the adoption of direct-lithium-extraction (DLE) modules that consume less brine. Geopolitics, ESG imperatives, and resource nationalism jointly reshape regional equipment procurement patterns, sustaining broad-based Mineral Processing Equipment market growth.

- FLSmidth A/S

- Metso Corporation

- Komatsu Ltd.

- Sandvik AB

- The Weir Group PLC

- ThyssenKrupp AG

- TAKRAF GmbH

- CITIC Heavy Industries Co., Ltd.

- Terex Corporation

- Wirtgen GmbH

- Multotec (Pty) Ltd

- FEECO International, Inc.

- McLanahan Corporation

- Tenova S.p.A.

- Haver & Boecker Niagara GmbH

- Derrick Corporation

- Eriez Manufacturing Co.

- Astec Industries, Inc.

- Sotecma S.L.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-Battery Metal Boom (Lithium, Nickel)

- 4.2.2 Shift To Finer-Grade Ores Driving High-Capacity Crushers

- 4.2.3 CAPEX Surge in African Critical-Mineral Projects

- 4.2.4 Digital-Twin Adoption for Plant-Wide Optimization

- 4.2.5 Green-Steel Initiatives Increasing Pelletizing Demand

- 4.2.6 AI-Based Ore-Sorting Reducing Downstream Energy Use

- 4.3 Market Restraints

- 4.3.1 ESG-Driven Capital Rationing for Green-Field Mines

- 4.3.2 Tightening Particulate-Matter Emission Norms

- 4.3.3 Skilled-Workforce Shortages in Remote Regions

- 4.3.4 Geopolitical Supply-Chain Nationalism on Key Spares

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Mineral Mining Sector

- 5.1.1 Bauxite

- 5.1.2 Copper

- 5.1.3 Iron

- 5.1.4 Lithium

- 5.1.5 Nickel

- 5.1.6 Rare-earth Elements

- 5.1.7 Gold and Precious Metals

- 5.1.8 Others

- 5.2 By Equipment

- 5.2.1 Crushers and Mills

- 5.2.2 Screens and Separators

- 5.2.3 Feeders and Conveyors

- 5.2.4 Drills and Breakers

- 5.2.5 Thickening and Clarification

- 5.2.6 Flotation Cells

- 5.2.7 Magnetic and Gravity Separators

- 5.2.8 Pumps and Valves

- 5.2.9 Filtration and Dewatering

- 5.3 By Processing Stage

- 5.3.1 Crushing and Grinding

- 5.3.2 Screening and Sorting

- 5.3.3 Concentration (Flotation/Separation)

- 5.3.4 Dewatering

- 5.3.5 Material Handling

- 5.4 By End-User Industry

- 5.4.1 Mineral/Ore Mining Companies

- 5.4.2 Contract Processing Plants

- 5.4.3 Recycling and Secondary Metals

- 5.4.4 Aggregates and Construction

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Chile

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Australia

- 5.5.4.4 Japan

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 FLSmidth A/S

- 6.4.2 Metso Corporation

- 6.4.3 Komatsu Ltd.

- 6.4.4 Sandvik AB

- 6.4.5 The Weir Group PLC

- 6.4.6 ThyssenKrupp AG

- 6.4.7 TAKRAF GmbH

- 6.4.8 CITIC Heavy Industries Co., Ltd.

- 6.4.9 Terex Corporation

- 6.4.10 Wirtgen GmbH

- 6.4.11 Multotec (Pty) Ltd

- 6.4.12 FEECO International, Inc.

- 6.4.13 McLanahan Corporation

- 6.4.14 Tenova S.p.A.

- 6.4.15 Haver & Boecker Niagara GmbH

- 6.4.16 Derrick Corporation

- 6.4.17 Eriez Manufacturing Co.

- 6.4.18 Astec Industries, Inc.

- 6.4.19 Sotecma S.L.

7 Market Opportunities and Future Outlook