PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910886

Europe Construction Machinery Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

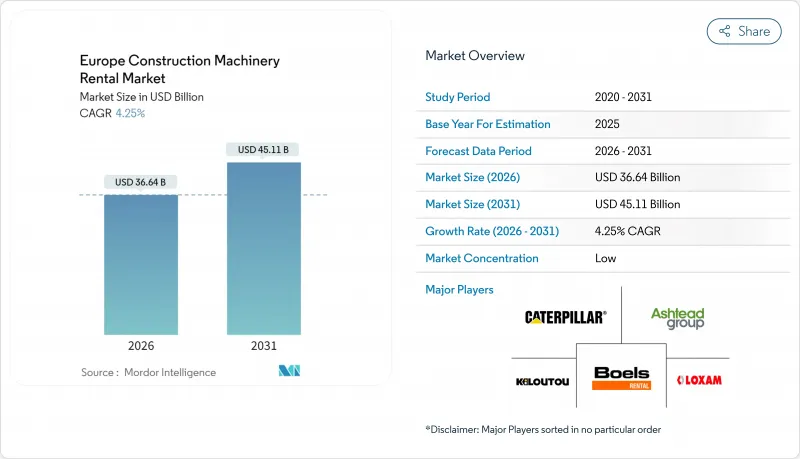

The European construction machinery rental market is expected to grow from USD 35.15 billion in 2025 to USD 36.64 billion in 2026 and is forecast to reach USD 45.11 billion by 2031 at 4.25% CAGR over 2026-2031.

This steady climb reflects resilient demand for rented machinery, expanding equipment-as-a-service agreements, and emission-driven fleet renewal across the region. The European construction equipment rental market benefits from EU-backed infrastructure stimulus, rapid electrification mandates, and ESG-linked lending that lowers capital costs for sustainable fleets. Operators prioritize telematics-enabled utilization gains, while governments reinforce demand with green transport corridors and digital connectivity projects. Competitive intensity is growing as OEMs form direct rental units, traditional rental giants accelerate pan-European acquisitions, and digital marketplaces shrink search and transaction costs for contractors.

Europe Construction Machinery Rental Market Trends and Insights

Surging EU Infrastructure Stimulus (Post-2025)

The European Investment Bank has earmarked EUR 1.1 trillion for climate-aligned infrastructure through 2030, triggering a sustained uptick in rentals of excavators, pavers, and tower cranes as projects break ground across transport and digital corridors . Germany is making a bold push to modernize its infrastructure and digital capabilities. A substantial investment commitment has been set aside to upgrade transport networks and accelerate digital transformation over the coming years, creating demand for specialized earthmoving fleets. Unlike past cycles, current allocations stress renewable energy and fiber rollout, forcing rental companies to secure niche machinery such as cable plows and wind-turbine erection cranes. Supply tightness amplifies utilization rates and elevates short-term pricing. Stimulus-driven linkages also ripple into private housing and commercial builds around upgraded transit hubs.

Accelerated Fleet Electrification Mandates

The European Commission's Fit for 55 package requires a 55% emissions cut by 2030, pressuring rental firms to pivot from diesel to battery and hydrogen powertrains . JCB's hydrogen engine program, now trialed in 11 countries, exemplifies OEM response. Early adopters in Sweden and Norway leverage subsidies to recoup higher purchase prices and pass premium rates to contractors looking to enter zero-emission zones. The mandate stimulates parallel investment in charging depots, technician retraining, and digital monitoring systems, raising capital intensity yet lowering lifecycle costs.

Disharmony in NRMM Stage V Adoption

Non-Road Mobile Machinery Stage V rules entered force in 2019 yet penalty rigor differs by member state, compelling rental fleets to juggle dual compliance standards. Companies operating across borders incur surging logistics and refitting costs to ensure each unit meets the strictest locale.

Other drivers and restraints analyzed in the detailed report include:

- ESG-Linked Financing Lowering CAPEX

- EU Taxonomy Focus on Embodied-Carbon Reporting

- Secondary Market Glut from Diesel Obsolescence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earthmoving equipment accounted for 41.88% of the European construction equipment rental market share in 2025, and this category is forecast to grow at a 4.55% CAGR through 2031. Excavators, particularly crawler variants, dominate heavy civil works while wheeled models support urban mobility. Skid-steer loaders gain traction in refurbishment projects that demand compact maneuverability. Motor graders and dozers sustain demand from Eastern Europe's expanding highway corridors. The European construction equipment rental market size within earthmoving is also a focal point for electrification pilots such as Hitachi's 1.7-ton battery excavator slated for 2027 rollout.

The segment's electrification cadence accelerates as contractors seek to meet city-center emission caps without compromising performance. OEMs experiment with swappable battery packs to mitigate charging downtime, and rental houses deploy mobile chargers to keep utilization high. Tier-one rental firms bundle earthmoving packages with on-site power units to capture higher value from integrated offerings.

Hydraulic systems retained 77.95% share of the European construction equipment rental market size in 2025 because of their proven reliability and wide service network. Yet purely electric drives are posting a 11.85% CAGR, aided by Nordic subsidies and expanding urban low-emission zones. Diesel-electric hybrids offer a transitional path, providing fuel savings without range anxiety on remote sites.

The European construction equipment rental market registers divergent adoption curves by equipment class. Compact excavators and scissor lifts shift first as battery energy density now supports full-shift operation. Heavier equipment awaits next-generation solid-state batteries or hydrogen fuel cells, where JCB's ongoing trials signal longer-term promise. Rental firms hedge by procuring modular fleets that can swap between diesel and electric drivelines.

The Europe Construction Machinery Rental Market Report is Segmented by Machinery Type (Earthmoving, and More), Drive Type (Hydraulic, Diesel-Electric Hybrid, and More), Application (Building Construction, and More), End-User Industry (Construction Contractors, and More), Payload Capacity (Light-Duty, Medium-Duty, and Heavy-Duty), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Loxam Group

- Ashtead Group (Sunbelt Rentals)

- Kiloutou Group

- Boels Rental

- Cramo (Renta Group)

- Zeppelin Rental

- Ahern Rentals

- Ramirent

- Ardent Hire Solutions

- Mateco

- Caterpillar Inc.

- Deere & Company

- Komatsu Ltd

- Hitachi Construction Machinery

- Liebherr Group

- JCB

- Manitou Group

- MECALAC

- Wacker Neuson

- Yanmar CE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging EU Infrastructure Stimulus (Post-2025)

- 4.2.2 Accelerated Fleet Electrification Mandates

- 4.2.3 ESG-Linked Financing Lowering CAPEX

- 4.2.4 Shift Toward Equipment-as-a-Service Models

- 4.2.5 EU Taxonomy Focus on Embodied-Carbon Reporting

- 4.2.6 On-Site Modular Power Units Enabling Zero-Idle Use

- 4.3 Market Restraints

- 4.3.1 Disharmony in NRMM Stage V Adoption

- 4.3.2 Operator Talent Shortage Inflating Labor Costs

- 4.3.3 Secondary Market Glut from Diesel Asset Obsolescence

- 4.3.4 High Telemetry Retrofit Cost for Legacy Fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Million)

- 5.1 By Machinery Type

- 5.1.1 Earthmoving Machinery

- 5.1.1.1 Excavators

- 5.1.1.1.1 Crawler

- 5.1.1.1.2 Wheeled

- 5.1.1.2 Loaders

- 5.1.1.2.1 Skid-Steer

- 5.1.1.2.2 Wheel

- 5.1.1.2.3 Backhoe

- 5.1.1.3 Motor Graders

- 5.1.1.4 Dozers

- 5.1.1.1 Excavators

- 5.1.2 Lifting and Material-Handling

- 5.1.2.1 Cranes

- 5.1.2.1.1 Mobile Cranes

- 5.1.2.1.2 Tower Cranes

- 5.1.2.2 Telescopic Handlers

- 5.1.2.3 Aerial Work Platforms

- 5.1.2.1 Cranes

- 5.1.3 Road Construction Equipment

- 5.1.3.1 Pavers

- 5.1.3.2 Road Rollers

- 5.1.3.3 Asphalt Mixers

- 5.1.4 Other Machinery Types

- 5.1.1 Earthmoving Machinery

- 5.2 By Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Diesel-Electric Hybrid

- 5.2.3 Fully Electric

- 5.2.4 Hydrogen Fuel Cell

- 5.3 By Application

- 5.3.1 Building Construction

- 5.3.1.1 Residential

- 5.3.1.2 Commercial

- 5.3.1.3 Industrial

- 5.3.2 Infrastructure Construction

- 5.3.2.1 Road and Highway

- 5.3.2.2 Rail

- 5.3.2.3 Airport

- 5.3.2.4 Energy Infrastructure

- 5.3.3 Mining and Quarrying

- 5.3.4 Disaster and Emergency Relief

- 5.3.5 Other Applications

- 5.3.1 Building Construction

- 5.4 By Payload Capacity

- 5.4.1 Light-Duty (Below 3 tons)

- 5.4.2 Medium-Duty (3-10 tons)

- 5.4.3 Heavy-Duty (10-30 tons)

- 5.4.4 Super Heavy-Duty (Above 30 tons)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Poland

- 5.5.9 Russia

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Loxam Group

- 6.4.2 Ashtead Group (Sunbelt Rentals)

- 6.4.3 Kiloutou Group

- 6.4.4 Boels Rental

- 6.4.5 Cramo (Renta Group)

- 6.4.6 Zeppelin Rental

- 6.4.7 Ahern Rentals

- 6.4.8 Ramirent

- 6.4.9 Ardent Hire Solutions

- 6.4.10 Mateco

- 6.4.11 Caterpillar Inc.

- 6.4.12 Deere & Company

- 6.4.13 Komatsu Ltd

- 6.4.14 Hitachi Construction Machinery

- 6.4.15 Liebherr Group

- 6.4.16 JCB

- 6.4.17 Manitou Group

- 6.4.18 MECALAC

- 6.4.19 Wacker Neuson

- 6.4.20 Yanmar CE

7 Market Opportunities & Future Outlook