PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910887

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910887

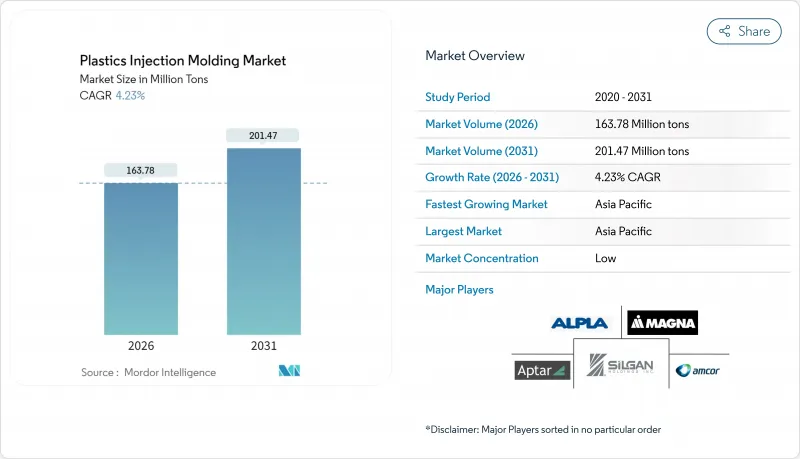

Plastics Injection Molding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Plastics Injection Molding Market was valued at USD 157.13 million tons in 2025 and estimated to grow from USD 163.78 million tons in 2026 to reach USD 201.47 million tons by 2031, at a CAGR of 4.23% during the forecast period (2026-2031).

This sustained expansion underscores the technology's centrality to cost-effective, large-volume manufacturing in packaging, automotive, electronics and medical devices. E-commerce growth, accelerating electric-vehicle (EV) production and regulatory pushes for circularity collectively widen the application base of the plastics injection molding market, while energy-efficient all-electric machines and advanced material formulations help producers offset rising input costs. Asia-Pacific's growing electronics clusters, North American reshoring initiatives and Europe's first-mover stance on recyclability regulations all amplify regional opportunities. At the same time, volatile crude-oil-linked resin pricing and tightening global anti-plastic rules temper profit margins and compel investments in recycled feedstocks, digital quality control and end-of-life traceability systems.

Global Plastics Injection Molding Market Trends and Insights

Surge in E-commerce-Driven Packaging Demand

Explosive parcel volumes have heightened requirements for durable yet lightweight protective solutions, prompting brand owners to specify mono-material polyethylene and polypropylene packages that minimize material use without compromising strength. The EU Packaging and Packaging Waste Regulation (PPWR), effective 2025, mandates 30% recycled content in PET food packaging by 2030, accelerating redesign of tooling and process parameters to handle higher-recycled blends. U.S. Extended Producer Responsibility (EPR) fees across 14 states create an additional cost signal that rewards eco-modulated designs and favors converters with advanced resin reclamation lines. These converging mandates bolster volume growth in the plastics injection molding market, particularly in thin-wall container and closure segments where cycle-time reductions deliver material savings and higher throughput. Progressive molders are adopting in-mold labeling and digital watermarking to streamline sorting, increasing the likelihood of post-consumer resin availability and ensuring feedstock continuity.

Lightweighting Requirements in Automotive and EVs

Automotive OEMs have intensified plastics substitution to achieve stringent fleet-average CO2 targets and maximize EV range. Tesla's gigacasting strategy showcases how large aluminum castings reduce part counts, but it simultaneously expands demand for injection-molded interior and exterior trims that integrate with cast structures. Battery manufacturers are exploring thermoplastic housings with flame-retardant sandwich walls that cut up to 40 kg per vehicle compared with steel alternatives, a shift exemplified by Engel's high-voltage battery enclosure prototype. ISO 14040 life-cycle assessments increasingly influence material choices, favoring recyclable resins over multi-material metal assemblies. These trends elevate engineering-grade polymers such as polyamide, polycarbonate and recycled polypropylene, widening the value pool of the plastics injection molding market through higher content per vehicle and sustained tooling demand for new EV platforms.

Volatile Crude-Oil-Linked Resin Pricing

Polyethylene and polypropylene spot prices rose as crude benchmarks responded to geopolitical disruptions. U.S. tariffs introduced in 2025 raised landed costs of some resin grades by 10-15%, while Chinese oversupply, estimated at an additional 5 million tons of capacity, depressed Asian quotes and widened inter-regional arbitrage spreads. Resin distributors cite unprecedented uncertainty, with 82% of converters pursuing multisourcing strategies to guard against price spikes. Margin volatility discourages long-term tooling commitments, raising the hurdle rate for capacity additions across the plastics injection molding market and nudging processors toward hedging instruments and formula-pricing contracts.

Other drivers and restraints analyzed in the detailed report include:

- Growing Need for Single-Use Medical Disposables

- OEM Adoption of Injection-Molded EV Battery Housings

- Tightening Global Anti-Plastic Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene secured a commanding 36.05% share of the plastics injection molding market in 2025 and is on track for a 5.02% CAGR through 2031 as recycled-content mandates reinforce its recyclability advantage. This leadership is fueled by thin-wall packaging, cap-and-closure systems and emerging automotive fuel-cell components that capitalize on the resin's chemical resistance. Polypropylene follows closely in interior automotive trims, HVAC housings and appliance parts, leveraging high heat deflection and stiffness-to-weight ratios. Acrylonitrile butadiene styrene retains niche in consumer electronics casings, while polystyrene faces structural decline in single-use cutlery amid regulatory crackdowns.

Advanced recycling facilities capable of depolymerization and solvent-based purification are improving the quality of post-consumer polyethylene, enabling drop-in replacement for virgin resin and lowering scope-3 emissions for converters. Polycarbonate uptake advances steadily in headlamp lenses and transparent protective shields, with thin-gauge glazing options replacing heavier glass in certain automotive models. Bio-based polyamides produced from castor-bean oil are gaining interest in under-hood parts due to inherent flame retardancy and lower carbon intensity. These material-level shifts deepen the diversification of the plastics injection molding market while supporting clients' environmental, social and governance (ESG) objectives.

The Plastics Injection Molding Report is Segmented by Raw Material Type (Polypropylene, Acrylonitrile Butadiene Styrene, Polystyrene, Polyethylene, Polyvinyl Chloride, and More), Application (Packaging, Building and Construction, Consumer Goods, Electronics, Automotive and Transportation, Healthcare, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific held 34.10% of the plastics injection molding market in 2025 and is expanding at a 5.24% CAGR to 2031 as China, India, and Southeast Asia scale electronics and automotive output. Government incentives, lower labor costs, and proximity to downstream assembly plants underpin capacity additions. Japan is leveraging digital twins and carbon-footprint dashboards across more than 80% of factories to heighten productivity and sustainability. North America benefits from reshoring and nearshoring, with Mexico securing USD 43.9 billion in FDI during 2023 that spurs tooling imports and turnkey cell installations for automotive interiors.

The United States' USD 1.4 trillion reindustrialization plan supports semiconductor, EV battery and medical-device capacity that will boost domestic resin offtake. Canada's mold-making clusters in Ontario continue to supply high-cavitation tools for consumer-packaging programs, though wage premiums encourage higher degrees of automation.

European converters are investing in depolymerization and solvent-based purification plants to meet PPWR requirements for 30% recycled content in PET packaging by 2030. Germany's engineering prowess underpins advanced multi-component molding for premium vehicles, while France scales bio-based cosmetic packaging aligned with consumer eco-preferences. South America depends on Brazilian automotive demand, with localized content rules compelling higher domestic plastic part production.

The Middle East and Africa are expanding through Saudi Arabia's polymer downstream investments and South Africa's tooling grant scheme aimed at stimulating localized part production. These diverse regional dynamics collectively broaden the geographic footprint of the plastics injection molding market.

- ALPLA

- Amcor PLC

- Antolin

- AptarGroup, Inc.

- BERICAP

- CVA Plastics

- EVCO Plastics

- FORVIA Faurecia

- HTI Plastics

- Husky Technologies

- IAC Group

- Magna International Inc.

- Marelli Holdings Co. Ltd

- Naber Plastics BV

- Quantum Plastics

- SCHAUENBURG Industrietechnik

- SEKISUI CHEMICAL CO., LTD.

- Silgan Holdings Inc.

- The Rodon Group

- TOYOTA BOSHOKU CORPORATION

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in E-Commerce?Driven Packaging Demand

- 4.2.2 Lightweighting Requirements in Automotive and EVs

- 4.2.3 Growing Need for Single-Use Medical Disposables

- 4.2.4 Industrialisation in APAC Electronics Manufacturing

- 4.2.5 OEM Adoption of Injection-Molded EV Battery Housings

- 4.3 Market Restraints

- 4.3.1 Volatile Crude-Oil-Linked Resin Pricing

- 4.3.2 Tightening Global Anti-Plastic Regulations

- 4.3.3 Cap-Ex and Skills Gap for All-Electric High-Tonnage Presses

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material Type

- 5.1.1 Polypropylene

- 5.1.2 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.3 Polystyrene

- 5.1.4 Polyethylene

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Polycarbonate

- 5.1.7 Polyamide

- 5.1.8 Other Raw Materials

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Consumer Goods

- 5.2.4 Electronics

- 5.2.5 Automotive and Transportation

- 5.2.6 Healthcare

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ALPLA

- 6.4.2 Amcor PLC

- 6.4.3 Antolin

- 6.4.4 AptarGroup, Inc.

- 6.4.5 BERICAP

- 6.4.6 CVA Plastics

- 6.4.7 EVCO Plastics

- 6.4.8 FORVIA Faurecia

- 6.4.9 HTI Plastics

- 6.4.10 Husky Technologies

- 6.4.11 IAC Group

- 6.4.12 Magna International Inc.

- 6.4.13 Marelli Holdings Co. Ltd

- 6.4.14 Naber Plastics BV

- 6.4.15 Quantum Plastics

- 6.4.16 SCHAUENBURG Industrietechnik

- 6.4.17 SEKISUI CHEMICAL CO., LTD.

- 6.4.18 Silgan Holdings Inc.

- 6.4.19 The Rodon Group

- 6.4.20 TOYOTA BOSHOKU CORPORATION

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment