PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910888

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910888

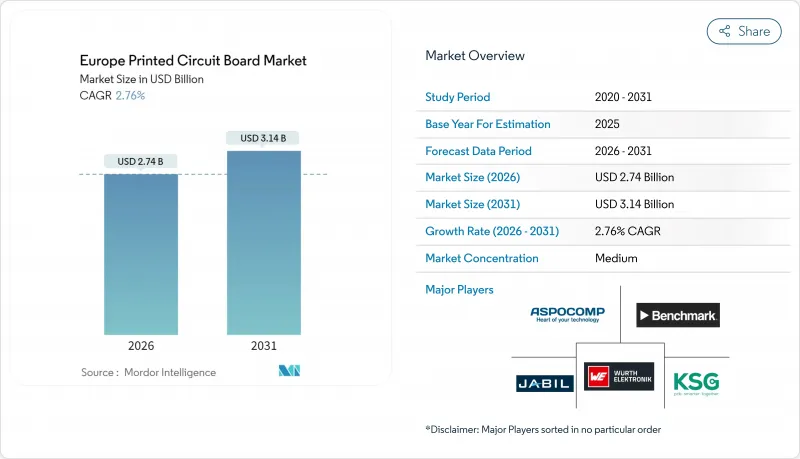

Europe Printed Circuit Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe PCB market size in 2026 is estimated at USD 2.74 billion, growing from 2025 value of USD 2.67 billion with 2031 projections showing USD 3.14 billion, growing at 2.76% CAGR over 2026-2031.

This trajectory reflects a strategic pivot away from commoditized volumes toward regulated high-value niches in automotive, medical, and industrial automation that support premium pricing. The Europe PCB market benefits from the European Union's EUR 43 billion (USD 48.6 billion) Chips Act stimulus, which channels investment into semiconductor fabs, advanced packaging hubs, and supporting interconnect suppliers. Supply-chain security, regulatory conformity, and proximity to demanding OEMs continue to reinforce regional orders, even as production represents less than 2% of global output. Competitive stress from low-cost Asian imports persists, yet European companies mitigate margin pressure through HDI leadership, rigorous quality programs, and specialized design services. Consolidation further defines the Europe PCB market, as illustrated by SOMACIS's medical-grade acquisition and Cicor's record intake, signaling a flight to scale or specialization among remaining players.

Europe Printed Circuit Board Market Trends and Insights

Growing Demand for Miniaturisation and High-Density Interconnect PCBs

The relentless push toward smaller, lighter electronic assemblies compels OEMs to specify HDI and ultra-HDI boards, elevating the Europe PCB market to a leadership role in microvia fabrication. Regional suppliers now qualify 50 micrometer conductor widths and microvias below 75 micrometers, enabling multilayer stack-ups that replace older through-hole designs with improved signal integrity. Investments in laser-drilling platforms, modified semi-additive processes, and X-ray inspection underpin these capabilities, with NCAB Group and Austrian specialists accelerating factory-readiness programs throughout 2025. The Europe PCB market thereby gains resilience through technical differentiation that deters price-based competition. In addition, stringent automotive and medical standards reward producers that document process control and traceability, reinforcing value extraction from HDI production. As adoption scales from German automotive clusters to Dutch industrial IoT hubs, HDI demand sustains a mid-term lift on regional revenue growth

Rapid Proliferation of Electric Vehicles Requiring Advanced Automotive PCBs

Tighter 2025 European CO2 thresholds ignited a 21% year-over-year spike in battery-electric vehicle registrations to more than 250,000 units in January alone, translating to a sharp uptick in complex multilayer board content per vehicle. Battery-management systems, traction inverters, and ADAS modules now rely on eight-plus-layer HDI designs with stringent vibration and thermal cycling prescriptions certified under IPC-6012 automotive addenda. Consequently, the Europe PCB market secures recurring orders from tier-one suppliers that mandate regional production for just-in-time assembly near German, French, and Italian EV plants. The electric-vehicle subsegment posts the fastest CAGR within automotive, ensuring a durable volume driver through 2030. Suppliers leverage long qualification cycles and punitive defect penalties to defend margins against imports, while collaborating with OEMs to co-optimize board layout and power-density within constrained pack footprints.

Volatile Copper and Laminate Prices Squeezing Margins

Copper traded above USD 11,000 per metric ton in May 2024 before retreating below USD 9,000 later that year, and research anticipates a rebound past USD 10,000 by late 2025 on electrification demand. Because copper forms 40% of raw-material spend and materials consume about 40% of total cost, swings directly compress EBITDA for European fabs already grappling with elevated labor and energy overheads. Laminate suppliers likewise pushed double-digit surcharges during the 2024 squeeze, compelling many board houses to renegotiate annual pricing or pass through quarterly adjustment clauses. The Europe PCB market therefore confronts margin volatility that disproportionately hurts smaller firms lacking hedging programs or long-term supply contracts. Some mitigate exposure by specializing in HDI prototypes where material share of selling price is lower, while others adopt dynamic quoting software that recalculates copper and laminate indices in real time.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidies for On-Shore Semiconductor and Packaging Capacity

- Increasing R and D Investment in European PCB Fabs

- High Capital Intensity of Next-Gen HDI Production Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HDI and micro-via boards accounted for 30.88% of the Europe PCB market share in 2025, underscoring the region's pivot to complex interconnect solutions for automotive ECUs and industrial controls. The Europe PCB market size for HDI applications continues to expand steadily as OEMs convert legacy through-hole designs to multilayer micro-via architectures that shrink footprint and enhance signal performance. Rigid-Flex formats, while only a fraction of volume, achieve a 3.13% CAGR to 2031 as medical device miniaturization and automotive radar harness bendable linkages between rigid zones.

Standard multilayer boards retain relevance in cost-sensitive industrial modules, though price pressure pushes commodity production toward Asia. Flexible circuits serve implantables and wearable biosensors that demand biocompatibility and sterilization compliance, domains where European fabs leverage ISO 13485 accreditation. Rigid 1-2-sided boards erode as producers exit low-margin runs. Overall, the Europe PCB market derives resilience from HDI and Rigid-Flex demand that values proximity, expertise, and documentation over lowest cost.

Automotive accounted for 26.12% of the Europe PCB market share in 2025, buoyed by surging electric-vehicle platforms that register a 3.08% CAGR through 2031. The Europe PCB market size for automotive electronics grows as battery-management systems, on-board chargers, and ADAS units integrate higher layer counts and thermal-enhanced substrates. Industrial automation and Industry 4.0 initiatives sustain mid-single-digit growth by embedding sensor-dense controller boards across smart factories.

Communications build-out, notably 5G and edge-data centers, uplifts multilayer demand, whereas aerospace and defense persist as small yet premium niches with rigorous qualification cycles. Medical electronics expand on the back of implantable stimulators and diagnostic wearables that rely on biocompatible flex boards. Consumer electronics remains the weakest cohort as European players relinquish high-volume commodity handsets and tablets, instead concentrating on specialized equipment demanding regulatory assurance.

The Europe PCB Market Report is Segmented by Category (Standard Multilayer PCBs, Rigid 1-2-Sided PCBs, and More), End-User Vertical (Industrial Electronics, Consumer Electronics, and More), PCB Substrate (FR-4, Metal Core, Polyimide, and More), Layer Count (1-2 Layers, 4-6 Layers, 8-10 Layers, and More), Assembly Type (Surface-Mount Technology, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AT&S Austria Technologie und Systemtechnik AG

- Wurth Elektronik Group

- KSG GmbH

- NCAB Group AB

- Aspocomp Group Plc

- Jabil Inc.

- TTM Technologies Inc.

- Benchmark Electronics Inc.

- ICAPE Group

- Schweizer Electronic AG

- LeitOn GmbH

- MicroCirtec Micro Circuit Technology GmbH

- Becker and Muller Schaltungsdruck GmbH

- Elvia PCB Group

- Cicor Group AG

- Multek Corporation

- MEKTEC Europe GmbH (Nippon Mektron Ltd.)

- Fujikura Ltd.

- Lab Circuits S.A.

- Exception PCB Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Miniaturisation and High-Density Interconnect PCBs

- 4.2.2 Rapid Proliferation of Electric Vehicles Requiring Advanced Automotive PCBs

- 4.2.3 Increasing Research and Development Investment in European PCB Fabs

- 4.2.4 Government Subsidies for On-Shore Semiconductor and Packaging Capacity

- 4.2.5 Regulatory Push For REACH-Compliant Halogen-Free Laminates

- 4.2.6 Surging Adoption of Bio-Compatible Flexible PCBs for Implantable Medical Devices

- 4.3 Market Restraints

- 4.3.1 Volatile Copper and Laminate Prices Squeezing Margins

- 4.3.2 High Capital Intensity of Next-Gen HDI Production Lines

- 4.3.3 Extended Lead Times Due To Asia-Centric Laminate Supply

- 4.3.4 PFAS Phase-Out Compliance Costs Across the Value Chain

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Ecosystem Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Standard Multilayer PCBs

- 5.1.2 Rigid 1-2-sided PCBs

- 5.1.3 HDI / Micro-via / Build-up

- 5.1.4 Flexible PCBs

- 5.1.5 Rigid-Flex PCBs

- 5.1.6 Other Categories

- 5.2 By End-User Vertical

- 5.2.1 Industrial Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Communications

- 5.2.5 Automotive

- 5.2.6 Medical

- 5.2.7 Other End-User Verticals

- 5.3 By PCB Substrate

- 5.3.1 FR-4

- 5.3.2 Metal Core

- 5.3.3 Polyimide

- 5.3.4 Ceramic

- 5.3.5 Other PCB Substrates

- 5.4 By Layer Count

- 5.4.1 1-2 Layers

- 5.4.2 4-6 Layers

- 5.4.3 8-10 Layers

- 5.4.4 more than 10 Layers

- 5.5 By Assembly Type

- 5.5.1 Surface-Mount Technology

- 5.5.2 Through-Hole Technology

- 5.5.3 Mixed Assembly

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AT&S Austria Technologie und Systemtechnik AG

- 6.4.2 Wurth Elektronik Group

- 6.4.3 KSG GmbH

- 6.4.4 NCAB Group AB

- 6.4.5 Aspocomp Group Plc

- 6.4.6 Jabil Inc.

- 6.4.7 TTM Technologies Inc.

- 6.4.8 Benchmark Electronics Inc.

- 6.4.9 ICAPE Group

- 6.4.10 Schweizer Electronic AG

- 6.4.11 LeitOn GmbH

- 6.4.12 MicroCirtec Micro Circuit Technology GmbH

- 6.4.13 Becker and Muller Schaltungsdruck GmbH

- 6.4.14 Elvia PCB Group

- 6.4.15 Cicor Group AG

- 6.4.16 Multek Corporation

- 6.4.17 MEKTEC Europe GmbH (Nippon Mektron Ltd.)

- 6.4.18 Fujikura Ltd.

- 6.4.19 Lab Circuits S.A.

- 6.4.20 Exception PCB Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment