PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910889

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910889

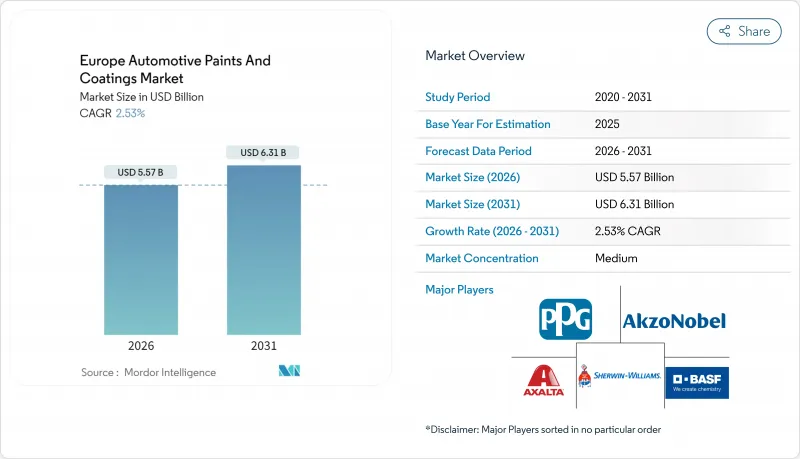

Europe Automotive Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe automotive paints and coatings market is expected to grow from USD 5.43 billion in 2025 to USD 5.57 billion in 2026 and is forecast to reach USD 6.31 billion by 2031 at 2.53% CAGR over 2026-2031.

Demand stems from the electrification of assembly lines, regulatory mandates that limit VOC emissions, and rising investment in predictive color-matching software. Electric vehicle (EV) production is accelerating OEM retrofits of paint shops, intensifying the shift from solvent-borne to water-borne chemistry. The European Commission's per- and polyfluoroalkyl substances (PFAS) proposal, effective 2025, compels wholesale reformulation of additives, while the Carbon Border Adjustment Mechanism (CBAM) raises raw-material costs, favoring suppliers with regional pigment and resin capacity. The integration of artificial-intelligence (AI) platforms with spray robots reduces overspray and shortens cycle times, enabling automakers to reduce energy consumption even amid volatile natural-gas prices.

Europe Automotive Paints And Coatings Market Trends and Insights

EV-Led Paint-Shop Upgrades

Electric platforms rely on aluminum-intensive bodies and battery enclosures that cannot tolerate legacy high-temperature cycles. Carmakers therefore adopt low-bake polyurethane and modified acrylic chemistries that cure at 80-100 °C. BMW reduced spray-booth energy consumption by 25% after commissioning AI-optimized pattern controls at its Munich assembly facility, confirming the capital efficiency benefits of digital-first coating lines. Suppliers that bundle chemistry, robotics, and analytics are capturing early-mover contracts as OEMs schedule whole-shop refurbishments to coincide with the launch of their EV platforms.

Shift to Low-VOC Waterborne Systems

New Industrial Emissions Directive thresholds of 35 g/m2 VOC pressure automakers to adopt water-borne basecoats. Mercedes-Benz achieved 20 g/m2 in 2024 across its German plants, representing an 85% reduction in solvent use, without any color-match deviations. PFAS curbs now eliminate fluorinated surfactants, prompting formulators to adopt next-generation silicon-free wetting aids. Companies able to stabilize film build, flow, and weathering with PFAS-free packages enjoy first-mover credentials while securing long-term supply agreements under OEM "green-chemistry" scorecards.

Feedstock Price Volatility

Titanium dioxide rose 18% in 2024 on energy-inflated Chinese output, while acrylic monomers swung 25% quarter-to-quarter. Regional independents lacking futures-hedging instruments face margin erosion, prompting merger activity as major companies acquire niche specialists to scale their procurement.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of European Vehicle Output

- Carbon Border Adjustment Mechanism Shaping Supply Contracts

- Tightening REACH and PFAS Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems held 41.82 of % European automotive paints and coatings market share in 2025, their versatility enabling deployment in primer, basecoat, and clearcoat film builds. Polyurethane chemistries, though smaller today, are on track for a 2.74% CAGR, the fastest among resins, as EV body structures mandate flexible, chip-resistant coatings that cure at lower bake temperatures. Epoxies retain critical e-coat and primer roles by anchoring corrosion-protection performance. Alkyd and polyester variants serve the bus and truck niches, where cost considerations often trump appearance. Bio-based polyurethane dispersions launched by BASF in 2024 reflect how sustainability converges with performance to rewrite resin portfolios.

Acrylic's entrenched position rests on cost-efficient bulk supply and compatibility with multistage water-borne lines. Yet warranty pressure for 12-year anti-perforation coverage compels OEMs to specify polyurethane topcoats on panels adjacent to battery trays. Reshoring resin manufacturing to meet CBAM constraints reinforces poly-purchase commitments inside the EU trading bloc. Consequently, polyurethane's advance erodes acrylic share gradually, with formulators blending both chemistries to achieve balanced cost-to-performance ratios across the coating stack. The European automotive paints and coatings market size for polyurethane grades alone could surpass USD 1.26 billion by 2031 if projected EV volumes materialize.

Solvent-borne systems still command 47.62% of the European automotive paints and coatings market size, a legacy of decades-old booth infrastructure and predictable rheology in high-line-speed operations. Water-borne basecoats, however, achieve a superior 2.99% CAGR, underpinned by EU VOC ceilings and consumer branding that emphasizes sustainability. Hybrid platforms combine solvent-borne flash primers with water-borne base layers to balance VOC totals and achieve optimal gloss depth. Powder technology, limited chiefly to truck frames and small-part lines, earns renewed interest as low-temperature polyester chemistries mature.

OEM capital spending shifts toward closed-loop water reclaim, fine-tuned humidity control, and advanced atomizers that accelerate water evaporation, narrowing the cycle-time gap with solvent finishes. Akzo Nobel's 2024 German expansion increases continental water-borne capacity by 35%, validating the momentum behind this chemistry. Although solvent systems remain for niche metallic effects, supplier roadmaps indicate that water-borne coatings' climb to near-parity will occur by the early 2030s, with regulatory certainty and carbon-audit transparency influencing procurement preferences.

The Europe Automotive Paints and Coatings Market Report is Segmented by Resin Type (Polyurethane, Epoxy, Acrylic, Other Resin Type), Technology (Solvent-Borne, Water-Borne, Powder), Layer (E-Coat, Primer, Basecoat, Clearcoat), Application (Automotive OEM, Automotive Refinish), and Geography (Germany, United Kingdom, France, Italy, Spain, NORDIC Countries, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE (Carlyle Group)

- Beckers Group

- Brila Coatings

- Jotun

- Kansai Paints Co., Ltd.

- Nippon Paint Holdings

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-led paint-shop upgrades

- 4.2.2 Shift to low-VOC waterborne systems

- 4.2.3 Recovery of European vehicle output

- 4.2.4 Carbon Border Adjustment Mechanism (CBAM) shaping supply contracts

- 4.2.5 AI-guided colour-on-demand mixing at OEM lines

- 4.3 Market Restraints

- 4.3.1 Feed-stock price volatility

- 4.3.2 Tightening REACH and PFAS restrictions

- 4.3.3 Energy-price driven curing-oven OPEX spikes

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Type

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.3 By Layer

- 5.3.1 E-coat

- 5.3.2 Primer

- 5.3.3 Basecoat

- 5.3.4 Clearcoat

- 5.4 By Application

- 5.4.1 Automotive OEM

- 5.4.2 Automotive Refinish

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 NORDIC Countries

- 5.5.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE (Carlyle Group)

- 6.4.4 Beckers Group

- 6.4.5 Brila Coatings

- 6.4.6 Jotun

- 6.4.7 Kansai Paints Co., Ltd.

- 6.4.8 Nippon Paint Holdings

- 6.4.9 PPG Industries Inc.

- 6.4.10 RPM International Inc.

- 6.4.11 Sika AG

- 6.4.12 Teknos Group

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment