PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910893

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910893

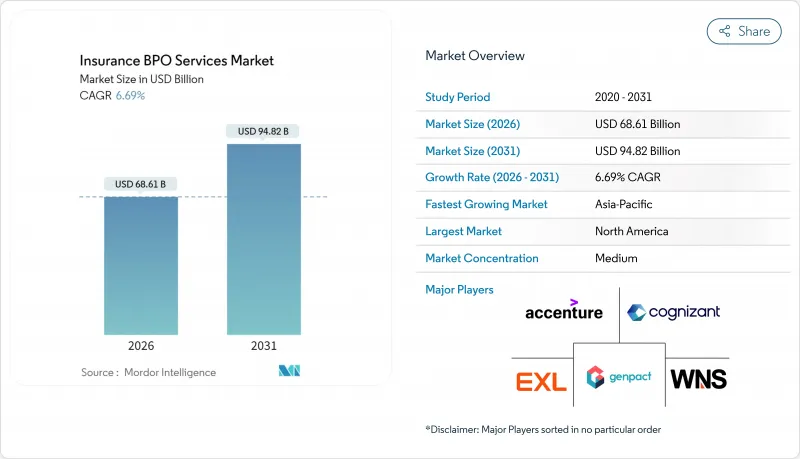

Insurance BPO Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Insurance BPO Services market is expected to grow from USD 64.31 billion in 2025 to USD 68.61 billion in 2026 and is forecast to reach USD 94.82 billion by 2031 at 6.69% CAGR over 2026-2031.

As insurers pivot from purely cost-focused outsourcing toward technology-rich partnerships, the Insurance BPO Services market is redefining itself around automation, analytics, and domain-specific expertise. Rising regulatory complexity, the push for omnichannel customer experience, and ongoing pressure to lower fixed costs are driving sustained demand for external service providers able to deliver measurable efficiency gains. Digital transformation at scale is shifting BPO providers from labor arbitrage models toward outcome-based contracts that reward innovation and continuous improvement. At the same time, consolidation among leading vendors is reshaping competitive dynamics, with larger platforms leveraging size and capability breadth to capture enterprise-wide mandates.

Global Insurance BPO Services Market Trends and Insights

Cost-Reduction Pressure & Efficiency Focus

Elevated interest rates and tighter underwriting margins have accelerated insurers' shift toward variable-cost operating models. Procurement teams now demand end-to-end outsourcing that bundles digital tools, lean processes, and outcome guarantees. Life insurers alone are expected to outsource USD 28 billion of IT and operations by 2026, amplifying growth for vendors able to prove ROI within the first contract year. Decision-makers favor partners that blend domain expertise with straight-through processing, cutting administrative expense ratios without compromising compliance. This cost-centric environment is turning scale, automation depth, and robust governance into decisive vendor-selection criteria..

Digital Transformation (RPA, AI, Analytics) Adoption

Artificial intelligence has moved out of the pilot phase; production-grade deployments now automate 50-90% of tasks once handled manually in claims and policy administration. Platforms like Hyperscience cut document-review cycle times by 90%, freeing headcount for higher-value risk analysis. Generative models support underwriting by synthesizing unstructured data, enabling faster quote turnaround and more accurate risk segmentation. Providers who embed proprietary AI in their delivery stack differentiate on both speed and insight, creating sticky client relationships. Investment in explainable AI and human-in-the-loop workflows also addresses regulators' transparency expectations.

Data-Security & Privacy Concerns

Tighter rules, such as GDPR fines and new U.S. state laws, raise the bar for cyber-resilience, complicating cross-border data flows. Breach penalties as high as USD 500,000 in certain jurisdictions force carriers to scrutinize supplier certifications and data-residency models. Smaller vendors without ISO 27001 or SOC 2 credentials face longer sales cycles and higher compliance costs. Conversely, large platforms investing in zero-trust architectures and in-region data centers convert security into a competitive edge. Enhanced encryption, continuous monitoring, and transparent incident-response plans are now table stakes for contract awards.

Other drivers and restraints analyzed in the detailed report include:

- Core-Versus-Context Outsourcing Trend

- Reg-Tech & Compliance Complexity Escalation

- Attrition & Knowledge-Loss Risk in Delivery Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Claims Processing generated the largest revenue pool, representing 38.05% of the Insurance BPO Services market in 2025 as carriers sought scalable engines to manage rising claim counts and litigation complexity. The segment's continued relevance stems from its direct connection to customer satisfaction and loss ratio management, areas that insurers rarely compromise. However, AI-driven Fraud Detection & Analytics is projected to record the fastest 7.69% CAGR, buoyed by machine-learning models that flag anomalies in near real time, driving loss avoidance savings potentially worth USD 160 billion by 2032. Vendors are rapidly packaging fraud analytics alongside core claims workflows, enabling turnkey implementations that shorten time-to-value. This convergence is reshaping purchasing criteria, with carriers preferring single-suite partners that can orchestrate intake, adjudication, fraud scoring, and payment in an integrated environment.

Advances in data ingestion, computer vision, and conversational AI further disrupt traditional labor-heavy setups by automating document review, damage assessment, and claimant communication. As throughput speeds climb, cycle times compress, and customer NPS scores improve, reinforcing the business case for externalizing claims functions. Meanwhile, Policy Administration remains the second-largest contributor, driven by the modernization of legacy policy systems that cannot natively support digital engagement layers. Underwriting Support and Customer Service services also expand steadily as insurers demand pre-configured modules that bolt onto core systems, reducing integration pain. Overall, competitive advantage is accruing to BPOs delivering full-stack, cloud-native platforms under outcome-based pricing models tied to cost savings and customer-experience metrics.

The Insurance BPO Services Market Report is Segmented by Service Type (Claims Processing, Policy Administration, Underwriting Support, and More), Insurance Type (Life & Annuity, Property & Casualty, and More), Organization Size (Large Enterprises, Small & Mid-Sized Enterprises), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 41.45% of global revenue in 2025, underpinned by mature lines of business, high insurance penetration, and well-established vendor ecosystems. Carriers in the United States and Canada continue to outsource complex, compliance-heavy tasks but are tempering spend growth as they near process optimization ceilings. Near-shore sites in Mexico and Costa Rica provide cost relief while maintaining time-zone alignment, preserving North America's influence on delivery footprints. Conversely, the Asia-Pacific region is forecast to register a leading 8.98% CAGR through 2031, propelled by double-digit insurance premium growth in India and China, regulatory liberalization, and accelerating digital adoption.

Asia-Pacific's dual role as both a consumption market delivery hub creates virtuous circles: expanding domestic insurer demand enlarges vendor scale, which in turn enhances expertise exported back to Western clients. Europe delivers stable mid-single-digit growth, shaped by strict solvency and privacy regimes that favor specialized compliance-as-a-service offerings. Germany, France, and the United Kingdom remain sizeable consumers, while Central and Eastern Europe attract investment as niche delivery locales offering multilingual talent and competitive costs.

Latin America is emerging from historically low insurance penetration; markets such as Mexico, Brazil, and Colombia are prioritizing digital transformation to expand coverage and streamline claims, lifting outsourcing spend. Munich Re projects P&C real premium growth averaging 3.5-4% in several LatAm economies through 2025, bolstering the regional case for third-party processing. The Middle East & Africa trail in absolute value but present greenfield opportunities as regulatory frameworks modernize and insurers seek turnkey solutions to bridge capability gaps.

- Accenture

- Cognizant

- Genpact

- EXL Service

- WNS Global Services

- Infosys BPM

- Tata Consultancy Services

- Capgemini

- IBM

- DXC Technology

- Teleperformance

- Conduent

- Tech Mahindra

- Mphasis

- HCLTech

- Sutherland

- NTT DATA

- Wipro

- Concentrix

- Sedgwick

- Gallagher Bassett

- Crawford & Company

- Flatworld Solutions

- Fusion Business Solutions (FBSPL)

- Canon Business Process Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - Insurance BPO Services Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Cost?reduction pressure & efficiency focus

- 5.2.2 Digital transformation (RPA, AI, analytics) adoption

- 5.2.3 Core-versus-context outsourcing trend

- 5.2.4 Reg-tech & compliance complexity escalation

- 5.2.5 Surge in annuity block & PRT administration volumes

- 5.2.6 Severe licensed-talent shortage in mature markets

- 5.3 Market Restraints

- 5.3.1 Data-security & privacy concerns

- 5.3.2 Attrition & knowledge-loss risk in delivery hubs

- 5.3.3 Low-code / no-code automation displacing manual tasks

- 5.3.4 On-shoring political pressure in key buyer nations

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

6 Market Size & Growth Forecasts

- 6.1 By Service Type

- 6.1.1 Claims Processing

- 6.1.2 Policy Administration

- 6.1.3 Underwriting Support

- 6.1.4 Customer Service & Contact Center

- 6.1.5 Billing, Accounting & Reconciliation

- 6.1.6 Fraud Detection & Analytics

- 6.2 By Insurance Type

- 6.2.1 Life & Annuity

- 6.2.2 Property & Casualty (P&C)

- 6.2.3 Health

- 6.2.4 Specialty / Workers' Compensation

- 6.3 By Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 Small & Mid-Sized Enterprises (SMEs)

- 6.4 By Geographic

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.2 South America

- 6.4.2.1 Brazil

- 6.4.2.2 Argentina

- 6.4.2.3 Chile

- 6.4.2.4 Peru

- 6.4.2.5 Rest of South America

- 6.4.3 Europe

- 6.4.3.1 United Kingdom

- 6.4.3.2 Germany

- 6.4.3.3 France

- 6.4.3.4 Spain

- 6.4.3.5 Italy

- 6.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 6.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 6.4.3.8 Rest of Europe

- 6.4.4 Asia-Pacific

- 6.4.4.1 China

- 6.4.4.2 India

- 6.4.4.3 Japan

- 6.4.4.4 South Korea

- 6.4.4.5 Australia

- 6.4.4.6 South-East Asia

- 6.4.4.7 Rest of Asia-Pacific

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Nigeria

- 6.4.5.5 Rest of Middle East and Africa

- 6.4.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves & Partnerships

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Accenture

- 7.4.2 Cognizant

- 7.4.3 Genpact

- 7.4.4 EXL Service

- 7.4.5 WNS Global Services

- 7.4.6 Infosys BPM

- 7.4.7 Tata Consultancy Services

- 7.4.8 Capgemini

- 7.4.9 IBM

- 7.4.10 DXC Technology

- 7.4.11 Teleperformance

- 7.4.12 Conduent

- 7.4.13 Tech Mahindra

- 7.4.14 Mphasis

- 7.4.15 HCLTech

- 7.4.16 Sutherland

- 7.4.17 NTT DATA

- 7.4.18 Wipro

- 7.4.19 Concentrix

- 7.4.20 Sedgwick

- 7.4.21 Gallagher Bassett

- 7.4.22 Crawford & Company

- 7.4.23 Flatworld Solutions

- 7.4.24 Fusion Business Solutions (FBSPL)

- 7.4.25 Canon Business Process Services

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-need Assessment