PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910894

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910894

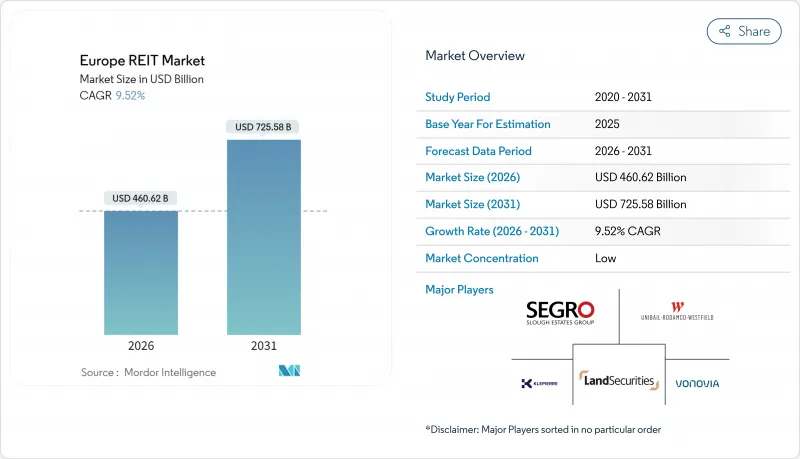

Europe REIT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe REIT market is expected to grow from USD 420.60 billion in 2025 to USD 460.62 billion in 2026 and is forecast to reach USD 725.58 billion by 2031 at 9.52% CAGR over 2026-2031.

Six interrelated forces sustain this momentum: moderated borrowing costs under the European Central Bank's (ECB) carefully sequenced rate-cutting cycle, deep institutional appetite for inflation-adjusted yields, enduring e-commerce logistics demand, rising data-center build-outs, expanding municipal partnerships for affordable housing, and supportive EU-wide capital-markets reforms such as ELTIF 2.0. Rising refinancing costs after 2024 created near-term volatility, yet well-capitalized vehicles refinanced at spreads still below the twenty-year average, protecting cash-flow coverage and preserving distribution visibility. Sector rotation into industrial and data-center assets compresses cap rates faster than in retail and secondary office segments, which now price in meaningful hybrid-working vacancy risk. Listed vehicles increasingly rely on sustainability-linked debt to fund green retrofits, turning energy-performance regulations from a cost overhang into a competitive differentiator with tenants and investors alike. The landscape remains fragmented-top-five players control only 31% of capitalization-which leaves ample room for consolidation plays by sponsors that can shoulder stricter covenant packages.

Europe REIT Market Trends and Insights

Sustained ECB Rate Moderation

The central bank cut policy rates by 50 basis points across 2024-2025, allowing well-rated REITs to roll maturities at sub-4% coupons while still attracting overseas capital seeking positive real yields. Liability management now extends weighted-average debt maturities beyond five years, shielding cash flows during forecast tightening cycles. Transatlantic rate divergence added relative-value appeal, prompting U.S. pension plans to raise strategic allocations. Germany's Vonovia exemplified the trend by closing USD 1.60 billion in syndicated loans at favorable spreads, preserving its investment-grade status. If inflation expectations re-anchor lower, the carry trade could narrow and reduce incremental fund inflows, but base-case forecasts still assume credit spreads remain below the 20-year mean. Consequently, financing visibility continues to underpin dividend stability across the Europe REIT market.

E-Commerce-Driven Logistics Expansion

European online sales penetration rose to 16% of retail turnover in 2024, tripling warehouse needs relative to brick-and-mortar formats. Grade-A facilities within 50 kilometres of dense population clusters now command rental uplifts exceeding 8% annually, outpacing headline CPI. Segro accelerated this pattern by accumulating 15 infill plots in Germany and the Netherlands that shorten delivery radii to less than 20 minutes. Development pipelines remain disciplined because land constraints and zoning hurdles cap speculative supply, protecting occupancy north of 97%. Cross-border fulfillment standards under the EU customs union further stimulate demand for pan-regional hubs with advanced automation. As a result, logistics remains the anchor growth pillar of the Europe REIT market for the foreseeable horizon.

Hybrid Work Shakes Office Utilization

Average office attendance settled near 65% of 2019 baselines by 2025, yet occupancy divergence between prime CBD towers and suburban stock has widened. Land Securities' West End assets maintain waiting lists, whereas secondary London periphery blocks face structural vacancy above 15%. Tenants prioritize wellness amenities and high-efficiency ventilation, forcing landlords to offer capital-intensive fit-outs that dilute initial yields. Flexible-lease providers absorb some footprint risk, but their month-to-month contracts introduce revenue volatility for host REITs. Office-heavy vehicles now pivot to mixed-use or life-science conversions to preserve relevance. Without adaptive strategies, office exposure will continue to weigh on the Europe REIT market's blended growth.

Other drivers and restraints analyzed in the detailed report include:

- Institutional Inflows Looking for Inflation Hedges

- ELTIF 2.0 Retail Capital Access

- Stricter ESG-Linked Debt Covenants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial assets (under the other commercial sectors) delivered 24.86 of % Europe REIT market share in 2025, underscoring irreplaceable e-commerce fulfillment needs close to consumption nodes. Rental escalations averaged 8% year-on-year across Germany's Rhine-Ruhr corridor, sustaining cap-rate compression to sub-4% levels. Data centers (under the other commercial sectors) posted the fastest growth, with a forecast 10.18% CAGR to 2031 underpinned by hyperscale and edge deployments requiring high-density power envelopes. Diversified vehicles now bundle last-mile warehouses with micro-data-hubs, creating blended income resilient to consumer-spending cycles. Residential REITs hold an enduring 24.73% share, leveraging urban housing undersupply and index-linked leases that hedge inflation. Meanwhile, retail footprints continue to rationalize, as experiential malls outperform vanilla shopping centers by capturing spill-over footfall from leisure anchors. This sectoral hierarchy illustrates how technological shifts and demographic constraints shape capital allocation inside the Europe REIT market.

Industrial dominance persists because brownfield availability near major ports is scarce, limiting disruptive oversupply. Segro's cross-docking design cuts average delivery windows by 22 minutes, a tangible economic advantage for tenants facing tight consumer-delivery promises. In data centers, Digital Realty expanded inter-connect nodes in Brussels and Vienna, monetizing cross-connect fees that enhance EBITDA margins above 60%. Healthcare REITs register 8.21% CAGR on aging-population fundamentals, with Aedifica's merger with Cofinimmo creating a USD 12.84 billion (EUR 12 billion) pan-regional champion. Office exposure bifurcates: prime CBD towers enjoy pricing power, whereas secondary blocks seek alternate uses. Each subsector's distinct cash-flow cadence allows portfolio managers to engineer risk-adjusted performance that meets rising dividend expectations in the Europe REIT market.

The Europe REIT Report is Segmented by Sector of Exposure (Retail, Industrial, Office, Residential, Diversified, Other Sectors, Data Centers, Healthcare), Market Capitalization (Large-Cap, Mid-Cap, Small-Cap), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Unibail-Rodamco-Westfield

- Segro plc

- Vonovia SE

- Land Securities Group plc

- Klepierre SA

- Merlin Properties

- Gecina SA

- Aroundtown SA

- Castellum AB

- LEG Immobilien SE

- Fabege AB

- Covivio SA

- Tritax Big Box REIT plc

- Hammerson plc

- Cofinimmo SA

- CPI Property Group

- Swiss Prime Site AG

- Shaftesbury Capital plc

- Aedifica SA

- Globalworth Real Estate Investments

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustained low interest-rate environment

- 4.2.2 Acceleration of e-commerce boosting logistics REITs

- 4.2.3 Institutional inflows seeking inflation-hedged yields

- 4.2.4 Regulatory shift toward EU ELTIF 2.0 capital

- 4.2.5 Under-radar: Municipal-backed affordable-housing mandates

- 4.2.6 Under-radar: Tokenised real-estate secondary markets

- 4.3 Market Restraints

- 4.3.1 Rising refinancing costs post-2024 rate hikes

- 4.3.2 Hybrid working pressuring office occupancies

- 4.3.3 Under-radar: Municipal-backed affordable-housing mandates

- 4.3.4 Under-radar: ESG-linked debt covenants tightening

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Commercial

- 5.1.1.1 Office

- 5.1.1.2 Retail

- 5.1.1.3 Hospitality

- 5.1.1.4 Healthcare

- 5.1.1.5 Other Commercial Sector

- 5.1.2 Residential

- 5.1.1 Commercial

- 5.2 By Market Capitalization

- 5.2.1 Large-Cap (more than USD 10 billion)

- 5.2.2 Mid-Cap (USD 2-10 billion)

- 5.2.3 Small-Cap (less than USD 2 billion)

- 5.3 By Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 BENELUX

- 5.3.6.1 Belgium

- 5.3.6.2 Netherlands

- 5.3.6.3 Luxembourg

- 5.3.7 NORDICS

- 5.3.7.1 Denmark

- 5.3.7.2 Finland

- 5.3.7.3 Iceland

- 5.3.7.4 Norway

- 5.3.7.5 Sweden

- 5.3.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Unibail-Rodamco-Westfield

- 6.4.2 Segro plc

- 6.4.3 Vonovia SE

- 6.4.4 Land Securities Group plc

- 6.4.5 Klepierre SA

- 6.4.6 Merlin Properties

- 6.4.7 Gecina SA

- 6.4.8 Aroundtown SA

- 6.4.9 Castellum AB

- 6.4.10 LEG Immobilien SE

- 6.4.11 Fabege AB

- 6.4.12 Covivio SA

- 6.4.13 Tritax Big Box REIT plc

- 6.4.14 Hammerson plc

- 6.4.15 Cofinimmo SA

- 6.4.16 CPI Property Group

- 6.4.17 Swiss Prime Site AG

- 6.4.18 Shaftesbury Capital plc

- 6.4.19 Aedifica SA

- 6.4.20 Globalworth Real Estate Investments

7 Market Opportunities & Future Outlook

- 7.1 Rising demand for green-certified REIT portfolios

- 7.2 Digital infrastructure (edge data-center) REIT expansion