PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910901

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910901

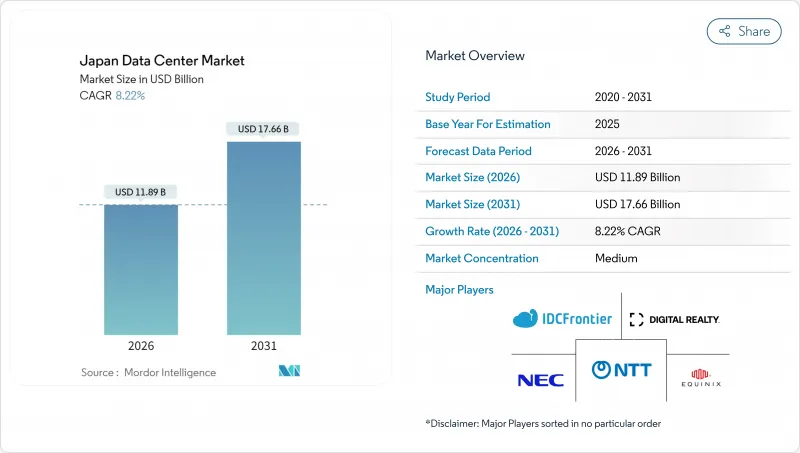

Japan Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan Data Center Market is expected to grow from USD 10.99 billion in 2025 to USD 11.89 billion in 2026 and is forecast to reach USD 17.66 billion by 2031 at 8.22% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 3.34 thousand megawatt in 2025 to 6.46 thousand megawatt by 2030, at a CAGR of 14.12% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Fueled by public-sector cloud mandates, hyperscale capital outlays, and proliferating artificial-intelligence workloads, the cluster is already the largest in Asia-Pacific and is on course to consolidate regional primacy. Domestic operators benefit from policy preferences for sovereign cloud while global cloud providers localize capacity to satisfy data-residency rules. Sustained 5G rollout and Internet-of-Things (IoT) adoption intensify edge-computing needs, encouraging medium-scale deployments near population and manufacturing centers. Simultaneously, land scarcity, electricity tariffs and seismic engineering premiums compel developers to optimize facility footprints, innovate in cooling and diversify toward suburban corridors to keep the Japan data center market growth momentum intact.

Japan Data Center Market Trends and Insights

Government Digital Transformation Programs Accelerating Cloud Migration

The Digital Agency targets complete migration of central-government workloads to cloud platforms by 2025, creating an anchor tenant for new capacity located inside Japan to preserve data sovereignty. Amazon Web Services has earmarked JPY 2.26 trillion (USD 15.24 billion) through 2027 to scale facilities in Tokyo and Osaka to meet this surge. Similar modernization waves in municipalities and state-owned corporations extend demand into regional prefectures, ensuring that new builds achieve rapid pre-commit rates. Domestic providers gain selection preference in public tenders, while global hyperscalers accelerate joint-venture strategies to satisfy procurement rules. The outcome is a steady pipeline of government workloads that underpins multi-year utilization visibility for the Japan data center market.

Surge in Hyperscale Investments to Meet AI and OTT Traffic Growth

Artificial-intelligence model training pushes power density above 30 kW per rack, prompting Microsoft to pledge USD 2.9 billion for GPU-rich campuses serving Japanese customers. Google's USD 1 billion Proa and Taihei subsea cables improve trans-Pacific throughput, positioning Tokyo and Osaka as primary aggregation nodes. Domestic champion SoftBank collaborates with NVIDIA on AI-optimized halls, reinforcing that high-density compute has become a strategic asset. These commitments shorten supply-demand cycles, compress permitting windows, and intensify competition for scarce megawatt allocations, all of which add tailwinds to Japan data center market expansion.

Scarcity and High Cost of Land in Prime Hotspots

Average land prices in central Tokyo rose 69% during 2024, inflating facility-development budgets and squeezing internal rates of return. Community pushback in Koto ward underscores social-license barriers, forcing operators to scout suburban areas such as Inzai, where larger parcels exist and municipal incentives improve project economics. While relocation mitigates land cost, it demands parallel investment in dark-fiber routes and redundant sub-stations, elongating project timelines and tempering near-term Japan data center market supply.

Other drivers and restraints analyzed in the detailed report include:

- 5G-Enabled IoT Proliferation Driving Edge Deployments

- Decommissioning of Ageing Enterprise Sites Boosting Colocation Demand

- Long Grid-Connection Approval Lead Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-sized halls between 5 MW and 20 MW are on track for a 12.02% CAGR to 2031, outpacing the overall Japan data center market. These footprints deliver economies of scale in cooling and security while retaining siting flexibility that circumvents the land and power constraints dogging mega-campuses. Large-scale sites retain 38.10% share because hyperscalers like Amazon Web Services reserve contiguous land for clusters exceeding 100 MW. Yet the regulatory and community hurdles tied to such projects prolong gestation periods, giving medium builds a speed-to-market edge. The Fukushima AI facility, backed by the Ministry of Economy and Trade illustrates policy support for distributed 15-MW blocks that can be replicated across regions.

Developers favor modular designs that allow phased power rollouts, letting them match capital deployment to contract wins while limiting stranded capacity. Enterprises migrating legacy rooms find the medium footprint ideal for consolidating multiple on-premise sites under one roof. Moreover, edge-compute nodes supporting 5G and IoT often scale within this band, enhancing utilization resilience. Consequently, medium halls are expected to become the volume engine for future Japan data center market size additions, even as hyperscale complexes command headlines.

Tier 3 facilities hold 66.05% share of Japan data center market size in 2025 and are expanding at 15.28% CAGR. Their 99.982% uptime rating meets most audit and disaster-recovery thresholds without incurring the dual utility feeds and concurrent-maintenance redundancy of Tier 4. Operators integrate base-isolation bearings, dampers, and reinforced frames so these halls withstand magnitude-7 quakes while maintaining service levels, a design approach that balances risk and cost. Tier 1 and Tier 2 footprints serve dev-test and non-critical storage use cases, especially in regional sites where power budgets are tighter. Tier 4 remains confined to latency-sensitive trading platforms and core switching sites for telecom carriers due to capex intensity.

Standardization accelerates Tier 3 development. Prefabricated electrical and mechanical skids reduce field labor, compressing build schedules from 24 to 18 months. The model also simplifies regulatory submissions because templates have pre-approved seismic and energy-efficiency calculations. Accordingly, Tier 3 is likely to deepen its lead, anchoring how the Japan data center market architecturally evolves.

The Japan Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Equinix Inc.

- MC Digital Realty (Digital Realty Trust Inc. and Mitsubishi Corporation JV)

- AT TOKYO Corporation

- Amazon Web Services Inc.

- NTT Global Data Centers (NTT Ltd.)

- netXDC (SCSK Corporation)

- IDC Frontier Inc. (Yahoo Japan subsidiary)

- AirTrunk Operating Pty Ltd.

- NEC Corporation

- IBM Japan Ltd.

- Colt Data Centre Services Holdings Ltd.

- Alibaba Cloud (Alibaba Group Holding Ltd.)

- Microsoft Corporation

- Telehouse (KDDI Corporation)

- Additional regional and niche operators

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Government digital transformation programs accelerating cloud migration

- 4.1.2 Surge in hyperscale investments to meet AI and OTT traffic growth

- 4.1.3 5G-enabled IoT proliferation driving edge deployments

- 4.1.4 Data localisation rules favour domestic capacity additions

- 4.1.5 Decommissioning of ageing enterprise sites boosting colocation demand

- 4.1.6 Municipal waste-heat reuse incentives in Osaka and Tokyo

- 4.2 Market Restraints

- 4.2.1 Scarcity and high cost of land in prime hotspots

- 4.2.2 Elevated electricity tariffs versus regional peers

- 4.2.3 Earthquake and disaster-resilience cost premium

- 4.2.4 Long grid-connection approval lead times

- 4.3 Market Outlook

- 4.3.1 IT Load Capacity

- 4.3.2 Raised Floor Space

- 4.3.3 Colocation Revenue

- 4.3.4 Installed Racks

- 4.3.5 Rack Space Utilization

- 4.3.6 Submarine Cable

- 4.4 Key Industry Trends

- 4.4.1 Smartphone Users

- 4.4.2 Data Traffic Per Smartphone

- 4.4.3 Mobile Data Speed

- 4.4.4 Broadband Data Speed

- 4.4.5 Fiber Connectivity Network

- 4.4.6 Regulatory Framework

- 4.5 Value Chain and Distribution Channel Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Osaka City

- 5.5.2 Takamatsu

- 5.5.3 Tokyo

- 5.5.4 Rest of Japan

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Equinix Inc.

- 6.4.2 MC Digital Realty (Digital Realty Trust Inc. and Mitsubishi Corporation JV)

- 6.4.3 AT TOKYO Corporation

- 6.4.4 Amazon Web Services Inc.

- 6.4.5 NTT Global Data Centers (NTT Ltd.)

- 6.4.6 netXDC (SCSK Corporation)

- 6.4.7 IDC Frontier Inc. (Yahoo Japan subsidiary)

- 6.4.8 AirTrunk Operating Pty Ltd.

- 6.4.9 NEC Corporation

- 6.4.10 IBM Japan Ltd.

- 6.4.11 Colt Data Centre Services Holdings Ltd.

- 6.4.12 Alibaba Cloud (Alibaba Group Holding Ltd.)

- 6.4.13 Microsoft Corporation

- 6.4.14 Telehouse (KDDI Corporation)

- 6.4.15 Additional regional and niche operators

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment