PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910906

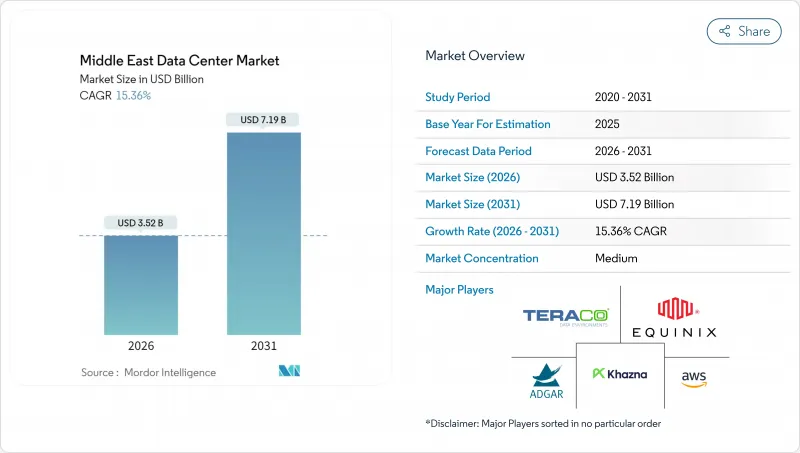

Middle East Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East Data Center Market is expected to grow from USD 3.05 billion in 2025 to USD 3.52 billion in 2026 and is forecast to reach USD 7.19 billion by 2031 at 15.36% CAGR over 2026-2031.

In terms of the installed base, the market is expected to grow from 1.82 thousand megawatts in 2025 to 2.84 thousand megawatts by 2030, at a CAGR of 9.23% during the forecast period from 2025 to 2030. The market segment shares and estimates are calculated and reported in terms of MW. Solid sovereign funding, hyperscale capacity mandates, dense subsea cable landings, and supportive cloud-first regulations combine to attract capital and talent to the region at a pace that shortens traditional build cycles and boosts utilization rates. Sovereign programs such as Saudi Arabia's HUMAIN and the UAE-France AI pact create guaranteed anchor demand for GPU-dense halls, while oil-field waste-gas-to-power pilots hint at structurally lower energy costs that could widen regional cost advantages over Europe and parts of Asia. Operators that pair land and power control with liquid-cooling know-how are securing long-term commitments from hyperscalers eager to hedge against capacity shortages elsewhere. Competitive pressure is mounting as domestic champions, global colocation brands, and energy majors jostle for sites in Riyadh, Abu Dhabi, and Tel Aviv, driving up land prices but also accelerating inter-campus fiber builds that improve cross-border workload mobility.

Middle East Data Center Market Trends and Insights

Rapid Adoption of National Cloud-First Policies in Saudi Arabia and the UAE

Binding cloud-first mandates oblige ministries and state-owned firms to migrate workloads on timelines that ignore typical cost optimization, effectively creating a demand floor that cushions developers against cyclical slowdowns. These directives also embed strict data-sovereignty clauses, encouraging sovereign-cloud zones that fetch premium pricing. Because compliance is required to win public-sector contracts, foreign cloud providers must partner with licensed local operators, reinforcing domestic value capture and accelerating skill transfer to the local workforce.

Government-Backed Hyperscale Capacity Targets Exceeding 1.3 GW by 2030

Flagship programs such as Saudi Telecom Company's center3 target a 1 GW roadmap, guarantee anchor tenancy, and often bundle power-purchase concessions, dropping risk premiums and compressing development timelines to 18-24 months. Sovereign financing removes the typical scramble for off-take agreements, enabling simultaneous multi-campus launches that would be hard to fund in purely commercial markets. The oversupply that results in early years further reduces entry barriers for international hyperscalers seeking low-latency redundancy between Europe and Asia.

Climate-Driven Cooling OPEX Escalation

Desert ambient temperatures push annual PUE up by 3-5% over temperate sites and force operators to finance large chilled-water plants or adopt liquid-cooling in order to keep GPU racks within spec. AI clusters exacerbate the heat profile, and water-scarcity regulations restrict evaporative systems, increasing dependence on electrically driven chillers that inflate operating costs just when price pressure from new entrants intensifies.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Sovereign AI Funding

- Sub-Sea Cable Densification Boosting Regional Inter-Connectivit

- Scarcity of Certified Data-Center Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities accounted for 39.62% of deployed capacity, thanks to enterprise loyalty and fully depreciated assets. However, as new-generation campuses come online, this share is set to decline. Meanwhile, massive campuses, driven by sovereign AI programs and hyperscalers requiring contiguous power blocks exceeding 50 MW, recorded the highest growth in the segment with a 16.69% CAGR. Between 2026 and 2031, the Middle East data center market is expected to more than double in size due to these massive builds. Operators securing multi-hundred-megawatt grid connections are currently enjoying a status of preferential procurement.

The shift favors developers like DataVolt, whose 1.5 GW net-zero AI factory in NEOM underlines how sovereign planning circumvents the incremental build logic of traditional colocation. Mega and medium formats remain relevant for regional cloud services that require country-specific presence yet cannot absorb the economics of massive footprints. Small edge nodes continue to address latency-critical use cases and regulatory residency clauses, ensuring a barbell-sized structure that blends both hyperscale and micro deployments within the same regional ecosystem.

Tier 3 facilities accounted for 67.05% of the Middle East data center market share in 2025, confirming their status as the cost-effective sweet spot for reliability in multi-tenant applications. Tier 4, however, is advancing at 16.55% CAGR as AI training, digital payments clearing, and national security workloads raise the bar on fault tolerance. The Middle East data center market size allocated to Tier 4 is expected to triple by the end of the decade, driven by expedited sovereign permitting for critical infrastructure projects.

Regional operators showcase Tier 4 ambitions to signal long-term reliability. Uptime Institute certifications, such as Etisalat's Tier III Gold for Operational Sustainability, illustrate a maturing quality culture that reduces perceived geopolitical risk. Yet the CAPEX per MW differential between Tier 3 and Tier 4 remains a hurdle for second-tier cities where price-sensitive tenants dominate. Developers must therefore calibrate redundancy levels to local demand elasticity, often blending Tier 3 and Tier 4 halls on the same site.

The Middle East Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Standard (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), End User Industry (BFSI, IT and ITES, E-Commerce, Government, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Khazna Data Centers LLC

- Digital Realty Trust Inc.

- Teraco Data Environments Proprietary Limited

- Adgar Investments and Development Ltd.

- MedOne Data Centers Ltd.

- Africa Data Centres Ltd.

- Electronia Company Limited

- Gulf Data Hub LLC

- Amazon Web Services Inc.

- Paratus Group Holdings Ltd.

- Etihad Etisalat Company

- Center3 Company

- Emirates Integrated Telecommunications Company PJSC

- Data Hub Integrated Solutions Moro L.L.C (Moro Hub)

- Equinix Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of national cloud-first policies in Saudi Arabia and UAE

- 4.2.2 Government backed hyperscale capacity targets exceeding 1.3 GW by 2030

- 4.2.3 Surge in sovereign AI funding (e.g., USD 100 B HUMAIN program)

- 4.2.4 Sub-sea cable densification boosting regional inter-connectivity

- 4.2.5 Under-utilised oil-field waste-gas repurposed for data-center power

- 4.2.6 AI-optimised liquid cooling exports from Israel to GCC operators

- 4.3 Market Restraints

- 4.3.1 Climate-driven cooling OPEX escalation

- 4.3.2 Scarcity of certified data-center engineers

- 4.3.3 LNG-indexed electricity tariff volatility

- 4.3.4 Geopolitical cyber-risk premium on insurance

- 4.4 Technological Outlook

- 4.5 Market Outlook

- 4.5.1 IT Load Capacity

- 4.5.2 Raised Floor Space

- 4.5.3 Colocation Revenue

- 4.5.4 Installed Racks

- 4.5.5 Rack Space Utilization

- 4.5.6 Submarine Cable

- 4.6 Key Industry Trends

- 4.6.1 Smartphone Users

- 4.6.2 Data Traffic Per Smartphone

- 4.6.3 Mobile Data Speed

- 4.6.4 Broadband Data Speed

- 4.6.5 Fiber Connectivity Network

- 4.6.6 Regulatory Framework

- 4.6.6.1 Saudi Arabia

- 4.6.6.2 United Arab Emirates

- 4.6.6.3 Israel

- 4.6.7 Value Chain and Distribution Channel Analysis

- 4.6.8 Poter's Five Forces Analysis

- 4.6.8.1 Bargaining Power of Buyers

- 4.6.8.2 Bargaining Power of Suppliers

- 4.6.8.3 Threat of New Entrants

- 4.6.8.4 Threat of Substitutes

- 4.6.8.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Standard

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale or Self-built

- 5.3.2 Enterprise or Edge

- 5.3.3 Colocation

- 5.3.3.1 Non Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User Industry

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End User Industries

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Israel

- 5.5.4 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Khazna Data Centers LLC

- 6.4.2 Digital Realty Trust Inc.

- 6.4.3 Teraco Data Environments Proprietary Limited

- 6.4.4 Adgar Investments and Development Ltd.

- 6.4.5 MedOne Data Centers Ltd.

- 6.4.6 Africa Data Centres Ltd.

- 6.4.7 Electronia Company Limited

- 6.4.8 Gulf Data Hub LLC

- 6.4.9 Amazon Web Services Inc.

- 6.4.10 Paratus Group Holdings Ltd.

- 6.4.11 Etihad Etisalat Company

- 6.4.12 Center3 Company

- 6.4.13 Emirates Integrated Telecommunications Company PJSC

- 6.4.14 Data Hub Integrated Solutions Moro L.L.C (Moro Hub)

- 6.4.15 Equinix Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White space and Unmet need Assessment