PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910907

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910907

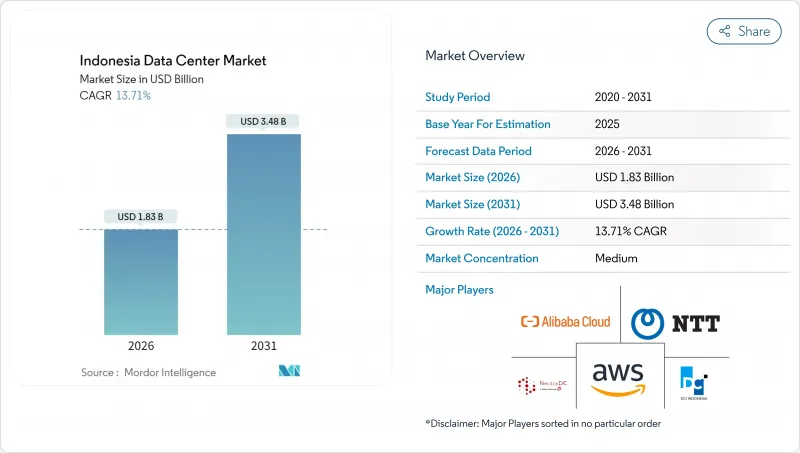

Indonesia Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia Data Center Market was valued at USD 1.61 billion in 2025 and estimated to grow from USD 1.83 billion in 2026 to reach USD 3.48 billion by 2031, at a CAGR of 13.71% during the forecast period (2026-2031).

In terms of IT load capacity, the market is expected to grow from 1.44 thousand megawatt in 2025 to 3.56 thousand megawatt by 2030, at a CAGR of 19.89% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Rapid hyperscaler roll-outs, tax exemptions that allow 100% foreign ownership in Special Economic Zones, and a sharp rise in digital consumption among 272 million residents position the Indonesia data center market as one of Southeast Asia's most dynamic digital infrastructure frontiers. Jakarta dominates capacity deployment due to its dense fiber network and submarine cable landing points, while Batam's proximity to Singapore attracts spillover demand, accelerating greenfield builds. Colocation still commands most deployments, yet hyperscale investments are advancing more than 21% a year as global cloud providers localize platforms to comply with strict data-residency laws. Tier 3 designs remain the default architecture, reflecting enterprises' need for concurrent maintainability without the premium of Tier 4, and long-term PLN power-purchase agreements unlock renewable megawatt blocks that support AI-ready configurations.

Indonesia Data Center Market Trends and Insights

Accelerating Hyperscaler Cloud Region Roll-outs

AWS, Google Cloud, and Microsoft have each activated or announced multi-AZ regions, guaranteeing sub-20 ms latency for domestic workloads and driving a pipeline of wholesale colocation deals exceeding 250 MW in Jakarta and Batam. The Indosat-NVIDIA USD 250 million AI factory that went live in October 2024 already serves more than 20 Indonesian enterprises and plans to migrate from H100 to Blackwell GB200 GPUs within 18 months to satisfy generative-AI inferencing demand. Hyperscalers' strict renewable-energy procurement policies catalyze long-term power contracts with PLN that bundle renewable certificates, helping operators meet sustainability targets. Local carriers benefit by bundling last-mile connectivity and managed services, which embeds stickiness in an enterprise market still migrating core systems to the cloud. These deployments anchor Indonesia in global traffic routes, redirecting workloads that would otherwise terminate in Singapore or Kuala Lumpur. The resulting capex cycle raises construction wages and tightens the skilled-labor pool, hastening the need for workforce upskilling agreements between providers and polytechnic institutes.

Government Tax Incentives and Eased Foreign Ownership

Indonesia allows 100% foreign ownership in data-center projects located within Special Economic Zones and grants accelerated depreciation on digital-infrastructure investments, lowering effective project IRR thresholds by 250-300 basis points for greenfield builds. Cikarang and Batam SEZs each offer 0% VAT on imported equipment, shaving up-front capex by around 11%. The streamlined Online Single Submission (OSS) system compresses approval timelines from 24 to as little as 10 weeks for compliant projects. These incentives have attracted joint ventures such as Korea Investment Partners-Sinar Mas Land and Digital Realty-Mitra Aditama, which collectively announced more than USD 750 million in commitments since 2024. Policymakers view digital infrastructure as a cornerstone for the USD 130 billion digital economy target by 2025, ensuring continuity of fiscal privileges even under changing administrations. While tariff holidays lower barriers, developers must still meet stringent local content requirements for construction materials, prompting partnerships with Indonesian EPC contractors.

Grid Carbon Intensity Increases Compliance Costs

Coal still accounts for 40.5% of the national generation mix, exposing operators to Scope 2 emissions that conflict with the net-zero mandates of multinational clients. PLN's financial reliance on IDR 123 trillion (USD 8 billion) in subsidies constrains the rapid build-out of renewable energy, forcing data-center developers to source off-grid solar-plus-storage or biomass co-firing contracts to meet their carbon budgets. Renewable energy certificates (RECs) sell at premium prices because supply lags behind demand, adding roughly USD 6 per MWh to power costs. Hyperscalers negotiate virtual PPAs but face counterparty risk until PLN finalizes unbundling of grid-injection rights. Further complicating matters, Bank Indonesia's data center accreditation checklist now requires life-cycle carbon disclosures, increasing audit overhead for BFSI clients. Until large-scale hydropower from Papua is delivered in the 2030s, the Indonesian data center industry must balance growth aspirations with steep decarbonization expenses.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Internet and Mobile Data Consumption

- Undersupply of Tier 3/4 Capacity

- High Import Tariffs on Critical Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities held 46.12% of the Indonesia data center market share in 2025, reflecting enterprises' preference for single-campus solutions that offer resilient power, carrier-neutral connectivity, and campus-wide PUE below 1.5. The Indonesia data center market size for large builds is predicted to widen further as Telkom's Cikarang expansion raises its campus capacity to 60 MW by 2025, and EdgeConneX commits to multi-phase developments of 30 MW each in Bekasi. Medium-sized facilities, however, are pacing the field with a 21.18% CAGR because distributed enterprises deploy edge nodes closer to users. Operators such as NeutraDC already run 19 micro-edge sites branded neuCentrIX across tier-2 cities, highlighting how geography drives smaller footprints. Mega and massive categories are emerging, exemplified by the Indosat-NVIDIA AI factory that reserves 80 MW for future phases, underlining how GPU clusters skew power density design toward 80 kW per rack. Small modular data centers remain niche, mainly supporting government edge workloads and rural connectivity pilots on outer islands. Overall, operators are diversifying build templates to strike a balance between Jakarta megawatts and the islands' distributed latency needs, thus sustaining parallel demand across size cohorts.

Medium-size capacity gains are likely to accelerate once PLN's substation upgrades in Surabaya and Bandung unlock 150 MVA of spare load by 2027. Developers deploying 4 - 6 MW pods in those metros can monetize demand from fintechs and e-commerce platforms that require sub-5 ms latency for payment processing. Meanwhile, hyperscalers continue to sign pre-lease agreements for entire data halls exceeding 10 MW each, anchoring large-site expansions. As a result, project financing models increasingly bundle diversified revenue streams, wholesale anchor tenants plus retail edge cages, to optimize capex payback under Indonesia's 10-year tax-holiday horizon. The resulting hybrid business models underscore how the Indonesia data center market incentivizes flexible capacity planning to capture both scale and reach.

Tier 3 facilities captured 83.90% of the Indonesia data center market share in 2025 and will remain the de facto standard owing to concurrent maintainability that satisfies BFSI and telecom SLAs without the 35% cost premium of Tier 4 builds. Tier 4 supply is restricted to a handful of suites within major campuses where gaming publishers and high-frequency traders demand fault-tolerant uptime. Tier 1-2 footprints persist in edge deployments serving IoT and smart-city pilots in Balikpapan and Yogyakarta, where lifecycle economics trump redundancy. Regulatory checklists issued under the Personal Data Protection Law require dual-power feeds and N + 1 cooling, effectively making Tier 3 the entry barrier for new builds. NeutraDC's Cikarang complex holds both Uptime Tier III and Tier IV certifications and utilizes modular electrical skids to facilitate seamless transitions between tiers, eliminating the need to migrate racks, a feature that appeals to enterprises scaling over time.

Future tier designs will incorporate sustainability metrics such as WUE and render traditional classifications less comprehensive. Operators are already integrating rooftop solar that supplies 5% of annual consumption, a figure expected to double once PLN finalizes net-metering rules. In addition, GPU-dense halls demand liquid-cooling loops that complicate tier labels because cooling redundancy becomes rack-level rather than hall-level. Despite such shifts, Tier 3 will retain dominance because it balances cost, compliance, and reliable uptime for 90% of enterprise workloads, thereby remaining integral to Indonesia's data center market growth.

The Indonesia Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-Built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- PT. Telkom Data Ekosistem (NeutraDC)

- PT DCI Indonesia

- Amazon Web Services, Inc.

- Alibaba Cloud

- K2 Data Centers-Sinar Mas Land

- Indosat Tbk PT (Big Data Exchange (BDx))

- Biznet Data Center

- Space DC Pte Ltd

- Bersama Digital Data Centres (BDDC)

- Princeton Digital Group

- Tencent Cloud

- Digital Edge (Singapore) Holdings Pte. Ltd. (Indonet)

- Google LLC

- MettaDC

- NTT Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating hyperscaler cloud region roll-outs (AWS, Microsoft, Google)

- 4.2.2 Government tax incentives and eased foreign ownership for digital infrastructure

- 4.2.3 Rapidly rising internet and mobile data consumption among Indonesia's young population

- 4.2.4 Undersupply of Tier-3/4 capacity versus estimated 1 GW demand by 2030

- 4.2.5 Secured long-term PLN PPAs enabling AI-ready megawatt blocks

- 4.2.6 Batam SEZ emerging as spill-over hub for Singapore load balancing

- 4.3 Market Restraints

- 4.3.1 Grid carbon intensity and coal reliance increasing sustainability compliance costs

- 4.3.2 High import tariffs and non-tariff barriers on critical IT and cooling equipment

- 4.3.3 Permitting complexity and land-acquisition hurdles across multi-agency approvals

- 4.3.4 Limited domestic skilled workforce for GPU-dense operations driving wage inflation

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Standard

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-Built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User Industry

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Jakarta

- 5.5.2 Batam

- 5.5.3 Rest of Indonesia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 PT. Telkom Data Ekosistem (NeutraDC)

- 6.4.2 PT DCI Indonesia

- 6.4.3 Amazon Web Services, Inc.

- 6.4.4 Alibaba Cloud

- 6.4.5 K2 Data Centers-Sinar Mas Land

- 6.4.6 Indosat Tbk PT (Big Data Exchange (BDx))

- 6.4.7 Biznet Data Center

- 6.4.8 Space DC Pte Ltd

- 6.4.9 Bersama Digital Data Centres (BDDC)

- 6.4.10 Princeton Digital Group

- 6.4.11 Tencent Cloud

- 6.4.12 Digital Edge (Singapore) Holdings Pte. Ltd. (Indonet)

- 6.4.13 Google LLC

- 6.4.14 MettaDC

- 6.4.15 NTT Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment