PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910908

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910908

Latin America Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

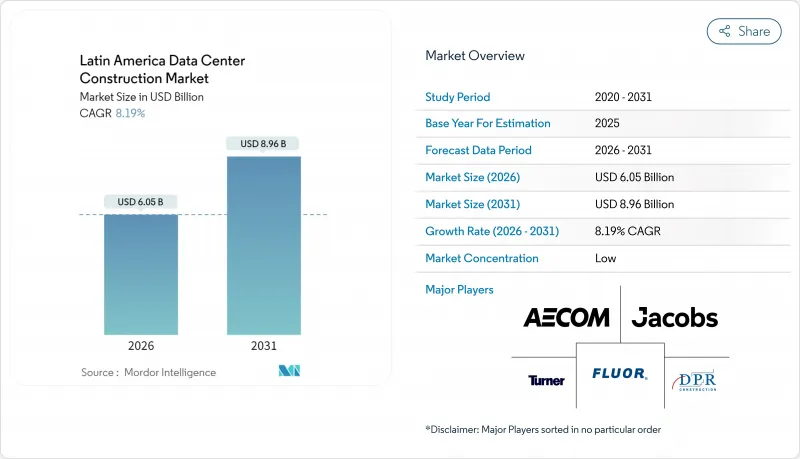

The Latin America Data Center Construction market is expected to grow from USD 5.59 billion in 2025 to USD 6.05 billion in 2026 and is forecast to reach USD 8.96 billion by 2031 at 8.19% CAGR over 2026-2031.

Robust investment momentum stems from sovereign-cloud mandates, hyperscale campus build-outs by United States cloud majors, and mounting artificial-intelligence workloads that require specialized, high-density facilities. Brazil leads regional spending with 40% of total 2024 investments, while Mexico's Queretaro corridor attracts fresh capital thanks to proximity to U.S. demand and state incentives. Mechanical infrastructure dominated 2024 spending at 38% because tropical heat loads elevate cooling requirements, yet IT infrastructure posts the quickest gains at an 8.52% CAGR through 2030. Tier III sites prevailed with 62% share in 2024, but Tier IV projects advance at an 8.90% CAGR as hyperscalers insist on fault-tolerant uptime. Supply-chain bottlenecks and grid constraints lengthen project cycles; however, sweeping deregulation in Chile and abundant renewable-energy opportunities across Brazil, Chile, and Colombia sustain a positive investment outlook.

Latin America Data Center Construction Market Trends and Insights

Accelerating cloud, AI and big-data workloads

Artificial-intelligence applications now demand three to five times the power density of legacy computing, compelling operators to redesign thermal architectures and electrical topologies. Microsoft's USD 2.7 billion Brazil investment and Scala's USD 50 billion AI City illustrate the scale of new requirements. Liquid-cooling adoption accelerates, with locally manufactured Delta Cube systems reducing energy usage in ODATA sites. Regional policy makers regard AI infrastructure as a pillar of digital competitiveness, prompting expedited permits and targeted tax breaks. Contractors report surging bids for high-density MEP packages, and suppliers of busway, pumps, and plate-heat exchangers scale up regional production footprints.

Hyperscale campus build-outs by U.S. cloud majors

Amazon Web Services, Microsoft Azure, and Google Cloud collectively earmark more than USD 10 billion for Latin America by 2030. Multi-gigawatt campuses in Sao Paulo, Queretaro, and Bogota require redundant 400 kV utility feeds, advanced fire suppression, and prefabricated power rooms that cut commissioning cycles to 12-18 months. Regional fiber conglomerate V.tal alone budgets USD 1 billion to deliver hyperscale-ready shells in Brazil. The build-to-suit model favors EPC firms proficient in integrated design-build, and demand spills into secondary metros as power availability tightens in first-tier cities.

Grid-power bottlenecks and surging electricity tariffs

Mexico struggles with 18-month utility-interconnection queues, pushing developers to procure diesel generation that adds up to 25% to project CAPEX and inflates operating expenses. Argentina's macro-economic volatility amplifies tariff risk, while localized transmission congestion in Sao Paulo forces developers toward Campinas and Porto Alegre. AI workloads multiply power density, stressing grids originally designed for commercial office loads. Operators increasingly sign 15-year renewable PPAs to secure predictable pricing, but smaller enterprises lack the balance-sheet to pursue such deals, slowing adoption in mid-market segments.

Other drivers and restraints analyzed in the detailed report include:

- 5G-driven edge-DC demand in secondary LATAM metros

- Sovereign-cloud and data-residency regulations

- Scarcity of Tier-III/IV-certified MEP labor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical infrastructure contributed 37.35% to the Latin America Data Center Construction market size in 2025, as hot-humid conditions across Brazil, Peru, and Colombia require robust chilled-water loops, evaporative cooling, and custom containment systems. Power distribution units, switchgear, and UPS arrays within electrical infrastructure stay essential for banking and telecom uptime mandates. General construction captures resilient shell-and-core outlays, including seismic bracing and hurricane-rated envelopes that safeguard mission-critical halls.

IT infrastructure is the fastest-growing category with an 8.16% CAGR, driven by servers optimized for AI inference, NVMe storage arrays, and 400 Gbps networking fabric. Hyperscale clients standardize on high-density racks requiring direct-to-chip liquid manifolds, which boosts demand for stainless-steel piping and redundant coolant pumps. Services such as consulting, commissioning, and facility management add value by ensuring regulation compliance and PUE optimization. The Latin America Data Center Construction market share within energy-efficiency consulting rises as carbon disclosure norms tighten in stock exchanges across the region.

Tier III sites held 61.10% of the Latin America Data Center Construction market share in 2025, balancing 99.982% availability against manageable capex. Banks, insurers, and public clouds select this level for core workloads that tolerate brief maintenance windows. Conversely, content-delivery networks and regional edge nodes often deploy Tier II to limit cost while placing nodes closer to users.

Tier IV construction will grow 8.55% CAGR through 2031 on the back of hyperscalers and fintech platforms seeking 99.995% service-level commitments. Multiple independent distribution paths, fault-tolerant chillers, and concurrently maintainable generators inflate capital budgets by up to 60%, yet clients accept the premium to satisfy uptime-linked revenue clauses. Builders partner with certification bodies early in design to avoid late-stage retrofit costs that have plagued first-time entrants.

The Latin America Data Center Construction Market is Segmented by Infrastructure (Electrical Infrastructure, Mechanical Infrastructure, and More), Tier Standard (Tier I and II, Tier III, and More), End User (Banking Financial Services & Insurance, IT & Telecommunications, and More), Data Center Type (Colocation, Hyperscale, and More), and Geography (Brazil, Mexico, and More). Forecasts are in USD.

List of Companies Covered in this Report:

- AECOM

- Turner Construction Company

- DPR Construction

- Jacobs Solutions Inc.

- Fluor Corporation

- Skanska AB (Latin America)

- Ferrovial S.A.

- Grupo ACS (Dragados)

- ACCIONA Construccion

- Andrade Gutierrez Engenharia

- Camargo Correa Infra

- Novonor (Odebrecht Engenharia)

- Queiroz Galvao S.A.

- Techint EandC

- Sacyr Ingenieria e Infraestructuras

- Mota-Engil LATAM

- Constructora Norberto Odebrecht LatAm

- Grupo Carso Infraestructura

- COSAPI Ingenieria y Construccion

- Constructora Colpatria

- Grupo Marhnos

- Constructora Sudamericana

- Ghella S.p.A.

- Besix Watpac

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating cloud, AI and big-data workloads

- 4.2.2 Hyperscale campus build-outs by US cloud majors

- 4.2.3 5G-driven edge-DC demand in secondary LATAM metros

- 4.2.4 Sovereign-cloud and data-residency regulations

- 4.2.5 Power-purchase-agreement (PPA) availability for renewables

- 4.2.6 Modular and prefabricated construction adoption

- 4.3 Market Restraints

- 4.3.1 Grid-power bottlenecks and surging electricity tariffs

- 4.3.2 Scarcity of Tier-III/IV-certified MEP labour

- 4.3.3 Water-stress curbing liquid-cooling deployments

- 4.3.4 Lengthy environmental licensing and community opposition

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Latin America Data Center Construction Statistics

- 4.8.1 Data Centers Total Installed Capacity (MW) in the Latin America, 2023 and 2024

- 4.8.2 Total IT Load Under Construction in the Latin America, MW, 2025 - 2030

- 4.8.3 Average Capex and Opex for the Latin America Data Center Construction

- 4.8.4 Top Capex Spenders on Data Center Infrastructure in Latin America

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Infrastructure

- 5.1.1 By Electrical Infrastructure

- 5.1.1.1 Power Distribution Solutions

- 5.1.1.1.1 Power Distribution Unit

- 5.1.1.1.2 Switchgears

- 5.1.1.1.3 Others Electrical Infrastructure

- 5.1.1.2 Power Backup Solutions

- 5.1.1.2.1 UPS

- 5.1.1.2.2 Generators

- 5.1.1.1 Power Distribution Solutions

- 5.1.2 By Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.1.1 Liquid-based Cooling

- 5.1.2.1.2 Air-based Cooling

- 5.1.2.2 Racks and Cabinets

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.3 By IT Infrastructure

- 5.1.3.1 Servers

- 5.1.3.2 Storage

- 5.1.3.3 Other IT Infrastructure

- 5.1.4 General Construction

- 5.1.5 Services

- 5.1.5.1 Design and Consulting

- 5.1.5.2 Integration

- 5.1.5.3 Support and Maintenance

- 5.1.1 By Electrical Infrastructure

- 5.2 By Tier Standard

- 5.2.1 Tier I and II

- 5.2.2 Tier III

- 5.2.3 Tier IV

- 5.3 By End-User Industry

- 5.3.1 Banking, Financial Services and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 By Data Center Type

- 5.4.1 Colocation Data Centers

- 5.4.2 Hyperscale / Self-built Data Centers

- 5.4.3 Others (Enterprise / Edge / Modular)

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Chile

- 5.5.3 Argentina

- 5.5.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 AECOM

- 6.2.2 Turner Construction Company

- 6.2.3 DPR Construction

- 6.2.4 Jacobs Solutions Inc.

- 6.2.5 Fluor Corporation

- 6.2.6 Skanska AB (Latin America)

- 6.2.7 Ferrovial S.A.

- 6.2.8 Grupo ACS (Dragados)

- 6.2.9 ACCIONA Construccion

- 6.2.10 Andrade Gutierrez Engenharia

- 6.2.11 Camargo Correa Infra

- 6.2.12 Novonor (Odebrecht Engenharia)

- 6.2.13 Queiroz Galvao S.A.

- 6.2.14 Techint EandC

- 6.2.15 Sacyr Ingenieria e Infraestructuras

- 6.2.16 Mota-Engil LATAM

- 6.2.17 Constructora Norberto Odebrecht LatAm

- 6.2.18 Grupo Carso Infraestructura

- 6.2.19 COSAPI Ingenieria y Construccion

- 6.2.20 Constructora Colpatria

- 6.2.21 Grupo Marhnos

- 6.2.22 Constructora Sudamericana

- 6.2.23 Ghella S.p.A.

- 6.2.24 Besix Watpac

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment