PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910909

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910909

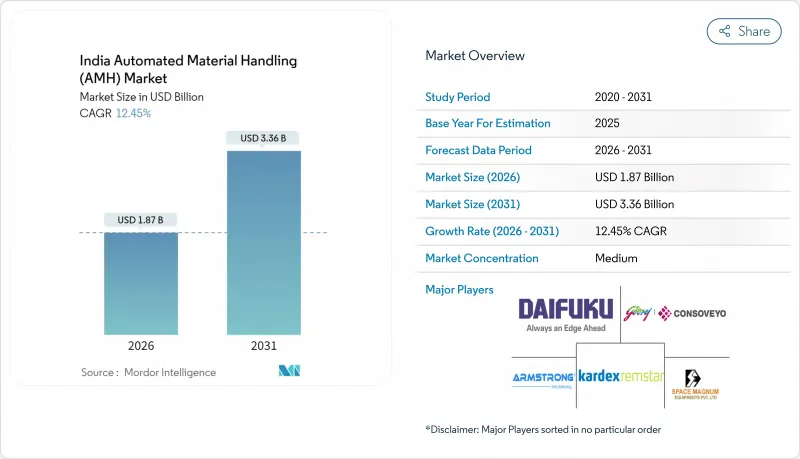

India Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India automated material handling market size in 2026 is estimated at USD 1.87 billion, growing from 2025 value of USD 1.66 billion with 2031 projections showing USD 3.36 billion, growing at 12.45% CAGR over 2026-2031.

E-commerce fulfilment centers are setting the demand pace, with retailers enlarging warehousing footprints to keep up with same-day delivery promises. Government Production Linked Incentive programs are steering factory capital toward integrated automation to boost export competitiveness, while the deployment of 5G private networks is unlocking real-time fleet coordination for AGV and AMR platforms. Unit-load standardization is gaining ground as companies seek scalable solutions that can flex with seasonal demand swings. Rising urban wage costs, especially in Tier-1 cities, are compressing payback periods for automation investments and nudging firms toward flexible, modular architectures that fit both greenfield and brownfield sites.

India Automated Material Handling (AMH) Market Trends and Insights

E-commerce Fulfilment Expansion Accelerating Warehouse Automation

Warehouse footprints reached 533.1 million ft2 in 2024 as online retailers scaled capacity to meet rapid delivery promises. The move into Tier-2 and Tier-3 cities is pushing demand for modular systems that can drop into smaller facilities without lengthy buildouts. Quick-commerce players are adopting high-speed sorters and robotic picking to handle mixed-SKU orders that conventional conveyors cannot manage. Throughput-first layouts are displacing storage-heavy designs as operators favour velocity over density. These shifts reinforce the need for orchestration software that can harmonize AS/RS, AMRs, and robotic pick stations in real time.

Government Production Linked Incentive Scheme Catalysing Factory Automation Investments

PLI-backed manufacturers must meet output thresholds that make automation a practical necessity rather than a discretionary upgrade. Electronics and automotive clusters are layering AS/RS with palletizing robots to secure quality and throughput. Shared infrastructure inside industrial parks lowers per-site capex, encouraging smaller firms to participate. The program's export-orientation demands traceable processes and world-class uptime, nudging adopters toward predictive-maintenance modules baked into WMS and WCS layers. Vendors able to bundle equipment, software, and lifecycle services are best placed to ride this policy tailwind.

High Upfront Capex and Long ROI Cycles for SMEs

Comprehensive warehouse automation can cost USD 500,000-2 million, levels that stretch most SME balance sheets. Traditional lenders still struggle to evaluate robotics credit risk, delaying loan approvals and upping collateral requirements. Robotics-as-a-Service contracts and subscription models are beginning to bridge this gap, but adoption remains low. Unbox Robotics has raised USD 14.1 million to develop modular platforms that deploy in phases, trimming first-phase pricing to levels SMEs can digest. Wider uptake hinges on more tailored financing products from banks and fintech capable of underwriting performance-based payback.

Other drivers and restraints analyzed in the detailed report include:

- Rising Urban Wage Costs and Labor Scarcity in Tier-1 Logistics Hubs

- Cold-Chain Pharma Distribution Demanding Temperature-Controlled Automated Storage

- Legacy Brown-Field Layouts Limiting Retrofit Feasibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The India automated material handling market size for AS/RS reached USD 561 million in 2025, translating to a 33.78% India automated material handling market share, as large multinationals and PLI-funded factories bank on high-density storage to reclaim floor space. Demand also stems from pharmaceutical cold-chain operators who need validated environments with traceable inventory retrieval. AGV and AMR platforms, while holding a smaller base, are advancing at a 14.10% CAGR, thanks to decreasing sensor costs and maturing fleet-management software.

Second-generation AGV/AMR designs can reposition shelving, tow unit loads, and serve mezzanine levels without fixed guidance infrastructure. Brownfield friendliness is the key appeal; installations rarely require structural changes, making them a preferred entry point for SMEs. System integrators are bundling AGV fleets with cloud-hosted WMS dashboards that deliver real-time heat maps of robot utilization and battery health. As 5G rollouts progress across industrial corridors, latency-free coordination will further reduce cycle times and widen the addressable market for mobile robots.

Storage accounted for USD 624 million in 2025, representing a 37.62% the India automated material handling market share. Verticals ranging from automotive to electronics depend on dense racking systems paired with shuttles that slash retrieval errors. Retrofit AS/RS modules that slide between existing pallet racks are seeing brisk orders among mid-sized distributors seeking gradual automation.

The picking and sorting function posted revenue of roughly USD 405 million yet shows the strongest runway, forecast at a 14.52% CAGR to 2031. Quick-commerce players are deploying AI-driven robotic arms that handle polybagged apparel one minute and fragile cosmetics the next. Machine-vision upgrades allow each arm to recognize thousands of SKUs without re-teaching, cutting changeover time during flash sales. Edge-deployed inference engines ensure latency stays below 100 milliseconds, enabling robots to match human pick rates while improving accuracy.

The India Automated Material Handling Report is Segmented by Solution Type (Automated Conveyor, AS/RS, AGV/AMR, Palletiser and Sortation Systems, WMS/WCS, and Robotic Picking Systems), Function (Storage, Transportation, and More), End-User Industry (Airports, Manufacturing, Retail and E-Commerce, and More), Load Type (Unit Load, and Bulk Load), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Daifuku India Private Limited

- Godrej Consoveyo Logistics Automation Limited

- Kardex India Storage Solutions Private Limited

- GreyOrange Pte. Ltd.

- Addverb Technologies Limited

- Armstrong Dematic Private Limited

- Bastian Solutions India Private Limited

- Falcon Autotech Private Limited

- Space Magnum Equipment Private Limited

- The Hi-Tech Robotic Systemz Limited

- Hinditron Group of Companies

- Murata Machinery India Private Limited

- Schaefer Systems International Private Limited

- Honeywell Intelligrated India Private Limited

- SSI Schaefer Automation India Private Limited

- Interroll Automation India Private Limited

- Knapp India Automation Private Limited

- Vanderlande Industries India Private Limited

- Beumer Group India Private Limited

- Cleveron India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce fulfilment expansion accelerating warehouse automation

- 4.2.2 Government Production Linked Incentive (PLI) scheme catalysing factory automation investments

- 4.2.3 Rising urban wage costs and labour scarcity in Tier-1 logistics hubs

- 4.2.4 Cold-chain pharma distribution demanding temperature-controlled automated storage

- 4.2.5 Sustainability mandates driving adoption of energy-efficient AMH systems

- 4.2.6 Roll-out of 5G private networks enabling real-time control of AGV fleets

- 4.3 Market Restraints

- 4.3.1 High upfront capex and long ROI cycles for SMEs

- 4.3.2 Legacy brown-field layouts limiting retrofit feasibility

- 4.3.3 Escalating cybersecurity risks across connected AMH assets

- 4.3.4 Grid reliability gaps causing unplanned system downtime

- 4.4 Industry Value-Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Technological Outlook

- 4.7 Regulatory Landscape

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Automated Conveyor

- 5.1.2 Automated Storage and Retrieval System (AS/RS)

- 5.1.3 Automated Guided Vehicles and Autonomous Mobile Robots (AGV/AMR)

- 5.1.4 Palletiser and Sortation Systems

- 5.1.5 Warehouse Management System and Warehouse Control Software (WMS/WCS)

- 5.1.6 Robotic Picking Systems

- 5.2 By Function

- 5.2.1 Storage

- 5.2.2 Transportation

- 5.2.3 Picking and Sorting

- 5.2.4 Retrieval

- 5.2.5 Packaging and Palletising

- 5.3 By End-User Industry

- 5.3.1 Airports

- 5.3.2 Manufacturing

- 5.3.3 Retail, E-commerce Warehouses and Logistics Centres

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals and Healthcare

- 5.3.6 Other End-User Industries

- 5.4 By Load Type

- 5.4.1 Unit Load

- 5.4.2 Bulk Load

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daifuku India Private Limited

- 6.4.2 Godrej Consoveyo Logistics Automation Limited

- 6.4.3 Kardex India Storage Solutions Private Limited

- 6.4.4 GreyOrange Pte. Ltd.

- 6.4.5 Addverb Technologies Limited

- 6.4.6 Armstrong Dematic Private Limited

- 6.4.7 Bastian Solutions India Private Limited

- 6.4.8 Falcon Autotech Private Limited

- 6.4.9 Space Magnum Equipment Private Limited

- 6.4.10 The Hi-Tech Robotic Systemz Limited

- 6.4.11 Hinditron Group of Companies

- 6.4.12 Murata Machinery India Private Limited

- 6.4.13 Schaefer Systems International Private Limited

- 6.4.14 Honeywell Intelligrated India Private Limited

- 6.4.15 SSI Schaefer Automation India Private Limited

- 6.4.16 Interroll Automation India Private Limited

- 6.4.17 Knapp India Automation Private Limited

- 6.4.18 Vanderlande Industries India Private Limited

- 6.4.19 Beumer Group India Private Limited

- 6.4.20 Cleveron India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment