PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910913

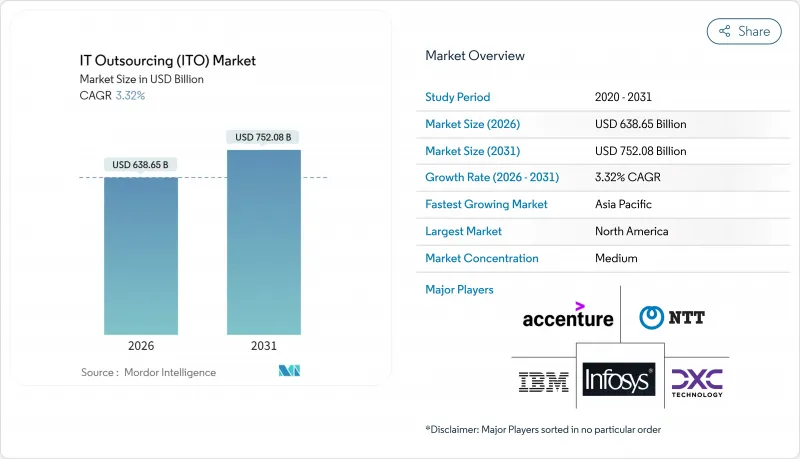

IT Outsourcing (ITO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The IT outsourcing market was valued at USD 618.13 billion in 2025 and estimated to grow from USD 638.65 billion in 2026 to reach USD 752.08 billion by 2031, at a CAGR of 3.32% during the forecast period (2026-2031).

The measured trajectory mirrors the sector's maturation as generative AI automation reshapes labor-intensive delivery models, spurring new AI-enabled services while compressing traditional headcount-driven contracts. Geopolitical tensions are prompting enterprises to diversify sourcing footprints in response to sovereign-cloud mandates and data-residency rules, leading many buyers to blend offshore, nearshore, and onshore centers for risk mitigation. The cybersecurity talent shortfall of 4.8 million positions worldwide is creating premium demand for managed detection and response offerings. Consolidation is accelerating: recent deals such as Cognizant's USD 1.3 billion Belcan purchase and Capgemini's negotiations to acquire WNS illustrate how scale players absorb niche specialists to deepen AI capabilities and broaden portfolios. Cloud-managed services are gaining prominence as enterprises struggle to govern hybrid, multicloud estates, while outcome-based pricing gains favor for its alignment with measurable business results.

Global IT Outsourcing (ITO) Market Trends and Insights

Cloud-native Application Modernization Demand

Enterprises are re-architecting monolithic systems into microservices, containers, and serverless functions, which opens sizable engagements for platform engineering, Kubernetes orchestration, and event-driven design. Providers increasingly deliver outcome-based contracts that guarantee performance, cost targets, and scalability rather than billing for effort, particularly in highly regulated verticals such as financial services and healthcare where compliance adds complexity. Cultural change management complements the technical shift, and external partners frequently guide agile processes that internal teams cannot easily instill.

GenAI-enabled Service-desk Automation

Generative AI is cutting Level 1 ticket volumes by up to 40% and trimming mean-time-to-resolution by 25% through intelligent routing and self-healing scripts. Virtual assistants now grasp context across multiple systems, drive personalized responses, and predict incidents before users notice disruption. Providers must, however, pair automation with human oversight for complex security issues that demand contextual judgment.

Escalating IP-theft and Ransomware Insurance Costs

Increasing cyber incidents raise premiums and narrow coverage, forcing enterprises to add encryption, access monitoring, and segregated development zones that inflate project costs EY. Buyers now demand providers carry higher insurance limits and submit to regular penetration tests, a hurdle that disadvantages smaller vendors and fuels consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Integration of AI and Automation in DevOps Outsourcing

- Talent-scarcity in Cybersecurity and Observability

- Rising Geopolitical Tensions Disrupting Offshore Delivery Centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure outsourcing commanded 45.05% of the IT outsourcing market in 2025 due to enterprises' reliance on resilient data center operations that need continuous monitoring and regulatory compliance. Cloud-managed services, however, are pacing the field with a 3.44% CAGR as organizations confront the complexity of hybrid estates spanning AWS, Azure, Google Cloud, and private environments. Providers now bundle unified management platforms that sequence workloads by cost, latency, and compliance preferences, challenging the boundaries between traditional infrastructure management and emerging multicloud orchestration.

Demand for application development and maintenance is being reshaped by low-code and AI-assisted development, pushing vendors to differentiate through domain knowledge and integration expertise. Edge computing and AI model lifecycle services sit in the "Others" bucket and represent nascent yet high-margin opportunities. As cloud adoption rises, incumbents pivot to automated site-reliability-engineering services that deliver guaranteed service-level objectives using AI-driven self-healing, thereby protecting infrastructure revenue streams against price compression.

Large enterprises retained 67.25% of spending in 2025 as their complex legacy estates require deep architectural know-how, yet SMEs are expanding faster at a 3.96% CAGR. Outcome-based contracts resonate with smaller firms because they align IT spending to tangible business outcomes instead of headcount. Cloud-native vendors lower entry barriers with self-service portals and automated provisioning, giving SMEs on-demand access to AI, analytics, and cybersecurity capabilities once exclusive to Fortune 500 budgets. This democratization of technology widens the total addressable IT outsourcing market and pressures established providers to create modular, standardized offerings that scale down economically without compromising margin.

IT Outsourcing (ITO) Market is Segmented by Service Type (Infrastructure Outsourcing, Application Development and Maintenance, and More), Organization Size (SMEs and Large Enterprises), Sourcing Location (On-Shore, Near-Shore, and More), End-User Industry (BFSI, Healthcare and Life-Sciences, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 24.12% share confirms its status as the prime adopter of AI and cloud modernization initiatives that demand seasoned providers. United States enterprises are renegotiating legacy contracts toward outcome-based terms that stipulate cost-per-transaction or revenue uplift metrics, reducing labor-arbitrage exposure. Canadian firms prioritize zero-trust security frameworks and sovereign cloud instances to comply with stringent privacy acts. Mexican nearshore centers expand agile pods and DevOps capabilities, reducing project latency and enhancing cultural alignment for US clients.

Asia-Pacific's 3.66% CAGR stems from India's continued dominance and rising contributions from ASEAN economies. Vietnam, Indonesia, and Malaysia are nurturing engineering talent pipelines through government incentives and academic partnerships, positioning themselves as secondary hubs for application development and testing. Japan and South Korea outsource next-generation network operations and edge-cloud orchestration to compensate for local workforce gaps, and Australia increases demand for managed cybersecurity and cloud FinOps services.

Europe combines stringent data-protection mandates with an appetite for digital sovereignty. Local providers form alliances with hyperscalers to launch region-specific sovereign cloud zones. Germany, France, and the Netherlands drive sectoral cloud migration while insisting on in-country data processing. The United Kingdom, despite Brexit, remains a hub for financial-services outsourcing, emphasizing resilience testing and operational-risk controls. Eastern Europe's software-engineering clusters offer high-end R&D outsourcing but navigate geopolitical uncertainty through diversification agreements with Western European clients.

- IBM Corporation

- Tata Consultancy Services

- Infosys Ltd

- Cognizant Technology Solutions

- Wipro Ltd

- HCLTech

- Capgemini SE

- DXC Technology

- NTT Data Corporation

- Atos SE

- CGI Inc.

- Tech Mahindra

- EPAM Systems

- LTI Mindtree

- Globant

- Endava plc

- Softtek

- Andela Inc.

- Persistent Systems

- Accenture plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native application modernisation demand

- 4.2.2 GenAI-enabled service-desk automation

- 4.2.3 Integration of AI and automation in DevOps outsourcing

- 4.2.4 Talent-scarcity in cybersecurity and observability

- 4.2.5 Rise of sovereign-cloud and data-residency mandates

- 4.2.6 Vendor shift to outcome-based pricing models

- 4.3 Market Restraints

- 4.3.1 Escalating IP-theft and ransomware insurance costs

- 4.3.2 Rising geopolitical tensions disrupting offshore delivery centers

- 4.3.3 Volatility in hyperscaler egress pricing

- 4.3.4 AI-enabled code-generation reducing outsourcing scope

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Infrastructure Outsourcing

- 5.1.2 Application Development and Maintenance

- 5.1.3 Cloud-Managed Services

- 5.1.4 Others

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Sourcing Location

- 5.3.1 On-shore

- 5.3.2 Near-shore

- 5.3.3 Off-shore

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life-Sciences

- 5.4.3 Media and Telecommunications

- 5.4.4 Retail and E-commerce

- 5.4.5 Manufacturing

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Tata Consultancy Services

- 6.4.3 Infosys Ltd

- 6.4.4 Cognizant Technology Solutions

- 6.4.5 Wipro Ltd

- 6.4.6 HCLTech

- 6.4.7 Capgemini SE

- 6.4.8 DXC Technology

- 6.4.9 NTT Data Corporation

- 6.4.10 Atos SE

- 6.4.11 CGI Inc.

- 6.4.12 Tech Mahindra

- 6.4.13 EPAM Systems

- 6.4.14 LTI Mindtree

- 6.4.15 Globant

- 6.4.16 Endava plc

- 6.4.17 Softtek

- 6.4.18 Andela Inc.

- 6.4.19 Persistent Systems

- 6.4.20 Accenture plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment