PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910919

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910919

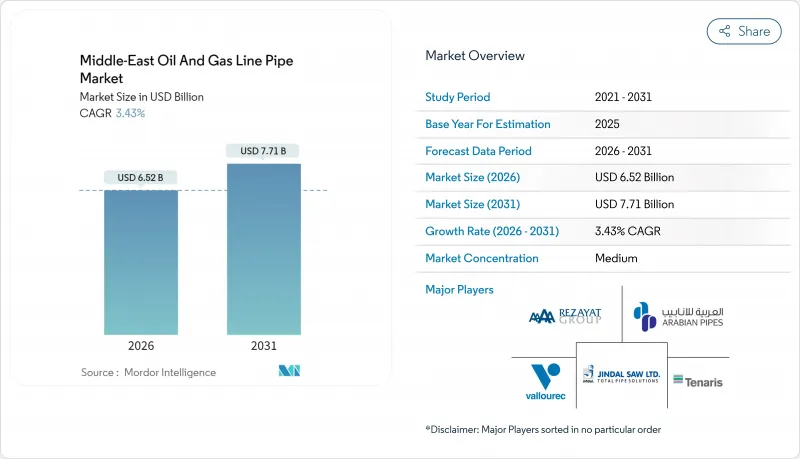

Middle-East Oil And Gas Line Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle-East Oil And Gas Line Pipe Market was valued at USD 6.30 billion in 2025 and estimated to grow from USD 6.52 billion in 2026 to reach USD 7.71 billion by 2031, at a CAGR of 3.43% during the forecast period (2026-2031).

Robust upstream gas programs, cross-border trunk lines, and hydrogen-ready pilots are the principal growth engines, while localization mandates tilt procurement in favor of domestic mills. Rising demand for large-diameter spiral-welded pipes, widening use of duplex alloys in sour-gas and hydrogen service, and supportive sovereign spending buffers are strengthening the competitive positions of regional manufacturers. At the same time, cost pressures from the EU Carbon Border Adjustment Mechanism (CBAM) and episodic oil-price shocks temper near-term expansion for exporters. Project deferrals in Iran and selective funding delays in Iraq demonstrate how geopolitical risk continues to impact spending trajectories.

Middle-East Oil And Gas Line Pipe Market Trends and Insights

Rising Upstream Investment in Arabian Gulf Offshore Gas Fields

ADNOC's USD 17 billion Hail & Ghasha program requires CRA-lined lines that can carry 1.5 billion cubic feet per day of ultra-sour gas, inserting premium corrosion-resistant requirements into every bid. Qatar's North Field West, budgeted at about USD 17-18 billion, adds substantial subsea pipe demand as EPCI contractors integrate 24-in-plus spools with elevated pressure ratings. Saudi Arabia's offshore Red Sea appraisals, linked to meeting a 60% gas production growth target by 2030, favor flexible flowlines in shallow waters-a niche opportunity for composite alternatives. Deeper water profiles across the Gulf now mandate diameters of>= 24 inches, shifting volumes toward welded SAW supply. Certification requirements are tightening, with ISO 14001 compliance compulsory for offshore contractors operating in the UAE and Saudi blocks, effectively lifting qualification thresholds.

Expansion of Cross-Border Crude Export Trunk Lines

The 1,200 km, USD 5 billion Basra-Aqaba pipeline, which won Iraqi cabinet clearance in March 2024, targets a 2.25 million bpd export capacity. However, banking sanctions complicate financing, lengthening the execution window. Saudi and Kuwaiti partners are designing shared pipelines for the Dorra gas field, underscoring how maritime unitization is enlarging pipe packages. Hydrogen corridors outlined in the India-Middle East-Europe Economic Corridor (IMEC) enhance material specifications toward hydrogen-compatible steels that exceed API 5L X70 by incorporating fracture-toughness metrics. Longer, politically sensitive routes are also specifying thicker walls and expanded cathodic protection, magnifying tonnage and value.

Oil-Price Volatility Postponing EPC Awards

Historical data indicate a 12-month lag between crude-price dips and Middle East EPC awards, with the 2014-2015 episode resulting in a 60% reduction in contracts over 18 months. Current hedging clauses in pipeline EPCTs include cost-escalation bandwidths of 15-20% once Brent oil prices fall below USD 50 per barrel for 90 consecutive days. In Iraq, several pipeline projects linked to the Ministry of Oil have been included in the 2026 budget cycle amid revenue shortfalls. Saudi and UAE sovereign funds are partially counter-cyclical; however, smaller GCC states lack similar buffers, thereby amplifying project timing risk.

Other drivers and restraints analyzed in the detailed report include:

- Aging Pipeline Network Replacement Demand

- Hydrogen-Ready Line-Pipe Pilots by ADNOC & Aramco

- EU CBAM Raising Cost for GCC Steel Pipe Exports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Welded pipe claimed a 62.25% share of the Middle East oil and gas line pipe market in 2025, underpinning long-distance crude and gas projects that favor SAW cost economics. G5PS secured a SAR 186 million (USD 50 million) Aramco spiral-welded order, reinforcing SAW acceptance in critical transmission. Seamless supply remains indispensable for high-pressure hydrogen pilots where material integrity trumps cost, but its share is inching down within bulk transmission. Localization makes welded plants more competitive because shipping savings and local-content credits outweigh the benefits of seamless imports. The Middle East oil and gas line pipe market size attributable to welded categories is projected to post a 3.44% CAGR through 2031 as trunk-line kilometers expand.

The growing adoption of automated ultrasonic inspection and robotic welding is enhancing quality levels, reducing field rejects, and lowering lifecycle cost profiles. Tenaris Saudi Steel Pipes doubled LSAW capacity in Jubail in July 2024 to address upcoming master-gas packages. Mills that integrate coating and threading lines in-house are capturing additional value and better meeting accelerated delivery timetables.

Carbon steel captured a 64.40% share in 2025 thanks to its cost-performance fit in conventional oil and gas flows. However, the duplex and super-duplex segment is growing at a 6.00% CAGR because hydrogen, blue ammonia, and ultra-sour gas service require superior corrosion and embrittlement resistance. SABIC's FEED for a 1.2 million tpa blue ammonia project calls for cryogenic-capable duplex lines, moving procurement beyond carbon grades. Alloy selections are also migrating toward API 5L X80 for high-pressure gas in Saudi Arabia's Master Gas System, cementing a trend toward higher strength.

Investment by Emirates Steel Arkan into super-duplex melt routes indicates regional mills are chasing specialty margins. The Middle East oil and gas line pipe market share for specialty alloys remains modest, but its contribution to profits is outsized, shielding mills from commodity price swings.

The Middle-East Oil and Gas Line Pipe Market Report is Segmented by Type (Seamless and Welded), Material (Carbon Steel, Alloy Steel, Stainless/CRA, and Duplex/Super-Duplex), Diameter (Below 12 Inch, 12 To 24 Inch, and Above 24 Inch), Application (Transmission, Down-Hole Casing and Tubing, Oil and Gas Gathering, and Water/Gas Injection), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, Iraq, and More).

List of Companies Covered in this Report:

- Arabian Pipes Company

- Rezayat Group

- EEW Group

- Sumitomo Corp.

- Vallourec SA

- Abu Dhabi Metal Pipes & Profiles

- Jindal SAW Ltd

- ArcelorMittal SA

- Tenaris SA

- National Pipe Company (NPC)

- TMK Group

- Tata Steel

- ChelPipe Group

- Nippon Steel Corp.

- Welspun Corp.

- Salzgitter AG

- Borusan Mannesmann

- JSW Steel

- SeAH Steel

- Al Jazeera Steel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising upstream investment in Arabian Gulf offshore gas fields

- 4.2.2 Expansion of cross-border crude export trunk lines

- 4.2.3 Aging pipeline network replacement demand

- 4.2.4 Hydrogen-ready line-pipe pilots by ADNOC & Aramco

- 4.2.5 Localization mandates under IKTVA & ICV programs

- 4.2.6 GTL & blue-ammonia projects needing low-temperature alloys

- 4.3 Market Restraints

- 4.3.1 Oil-price volatility postponing EPC awards

- 4.3.2 Shift toward composite flexible pipe in shallow offshore

- 4.3.3 Sanctions-driven funding limits in Iran & Iraq

- 4.3.4 EU CBAM raising cost for GCC steel pipe exports

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Installed Pipeline Capacity Analysis

- 4.8 Key Upcoming Projects

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Seamless

- 5.1.2 Welded (ERW and SAW)

- 5.2 By Material

- 5.2.1 Carbon Steel

- 5.2.2 Alloy Steel

- 5.2.3 Stainless/CRA

- 5.2.4 Duplex/Super-Duplex

- 5.3 By Diameter

- 5.3.1 Below 12 inch

- 5.3.2 12 to 24 inch

- 5.3.3 Above 24 inch

- 5.4 By Application

- 5.4.1 Transmission (Onshore and Offshore)

- 5.4.2 Down-hole Casing and Tubing

- 5.4.3 Oil and Gas Gathering

- 5.4.4 Water/Gas Injection

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

- 5.5.7 Iraq

- 5.5.8 Iran

- 5.5.9 Rest of Middle East

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Arabian Pipes Company

- 6.4.2 Rezayat Group

- 6.4.3 EEW Group

- 6.4.4 Sumitomo Corp.

- 6.4.5 Vallourec SA

- 6.4.6 Abu Dhabi Metal Pipes & Profiles

- 6.4.7 Jindal SAW Ltd

- 6.4.8 ArcelorMittal SA

- 6.4.9 Tenaris SA

- 6.4.10 National Pipe Company (NPC)

- 6.4.11 TMK Group

- 6.4.12 Tata Steel

- 6.4.13 ChelPipe Group

- 6.4.14 Nippon Steel Corp.

- 6.4.15 Welspun Corp.

- 6.4.16 Salzgitter AG

- 6.4.17 Borusan Mannesmann

- 6.4.18 JSW Steel

- 6.4.19 SeAH Steel

- 6.4.20 Al Jazeera Steel

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment