PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910923

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910923

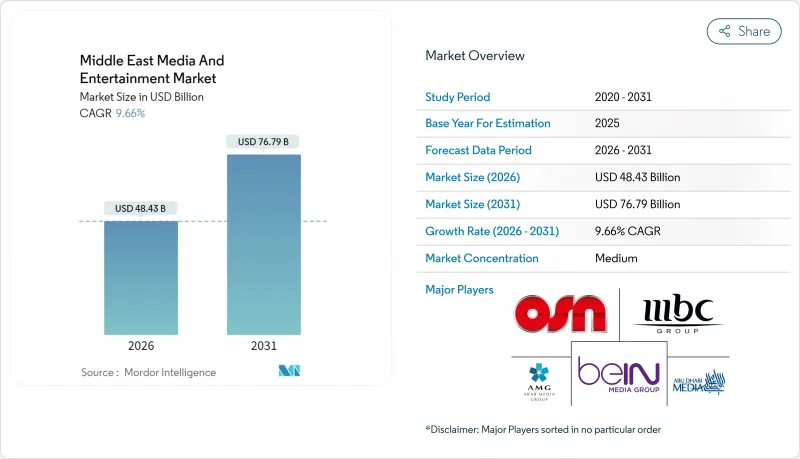

Middle East Media And Entertainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East media and entertainment market size in 2026 is estimated at USD 48.43 billion, growing from 2025 value of USD 44.16 billion with 2031 projections showing USD 76.79 billion, growing at 9.66% CAGR over 2026-2031.

This rapid trajectory springs from Vision 2030-driven economic diversification, region-wide 5G and fiber roll-outs, and an audience skewed toward digitally native youth. Saudi Arabia anchors demand through large-scale state investment, while the United Arab Emirates (UAE) races ahead by commercializing advanced connectivity and a pro-innovation regulatory climate. Online video, gaming, and immersive formats gain momentum as smartphone ubiquity, cloud infrastructure, and metaverse programs converge. Strategic partnerships between regional broadcasters and global streamers are reshaping competitive rules, and flexible monetization mixes are becoming essential to offset currency-linked advertising volatility.

Middle East Media And Entertainment Market Trends and Insights

Accelerated Rollout of 5G Networks and Fiber Broadband

Telecommunications incumbents continue to blanket major cities with 5G coverage, furnishing latency below 10 milliseconds and enabling 4K streaming, cloud gaming, and real-time augmented-reality services. Saudi Telecom Company allocated more than USD 2.4 billion to 5G and fiber upgrades in 2024, underscoring its pivot from voice carrier to digital-service orchestrator. UAE operators have already surpassed 95% fiber-to-the-home penetration in core emirates, creating a competitive scramble to monetize bandwidth with premium OTT bundles and interactive advertising inventory.

Booming Smartphone and Smart-TV Penetration Enabling OTT Growth

Regional smartphone penetration crossed 90% in 2024, and smart-TV connections doubled in Saudi homes over the past three years. This device base encourages consumers to bypass legacy satellite boxes in favor of direct-to-consumer apps, lifting paid subscription loyalty while widening addressable audiences for targeted programmatic ads. As internet connection speeds climb, average viewing hours on mobile screens have overtaken linear television among audiences below 35.

High Levels of Piracy and Illicit Streaming Sites

The 2024 takedown of Cima4U, an illegal portal with 30 million monthly visits, underscored the revenue leakage jeopardizing premium platforms. Despite improved enforcement, 23% of regional users still access pirate IPTV boxes, and account sharing hits 35% in Saudi Arabia, diluting subscription value and deterring premium advertisers who demand verified reach metrics.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Mega-Events Boosting Content Demand

- Rapid Rise of Esports and In-App Micro-Transactions

- Fragmented Regulatory and Censorship Regimes Across Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated USD 13.22 billion in 2025, amounting to 29.93% of the Middle East media and entertainment market. Advertising, worth USD 7.24 billion, is expected to expand at an 11.05% CAGR as programmatic tools mature. Premium series, live sports replays, and diversified genres keep subscription renewal high, aided by improved measurement that helps brands allocate budgets confidently. The Middle East media and entertainment market size for advertising-supported formats could therefore outpace transactional video once real-time bidding and audience graphs reach scale. Regional music streaming consolidations-such as Anghami's union with OSN+-point to synergistic cross-sell prospects, while video-game revenues ride mobile penetration and national esports leagues.

Content localization remains central; incentive funds underwrite Arabic scripts, and dubbing contests ensure regional dialect authenticity. Publishers see e-books gain traction as educational ministries digitize curricula, though monetization relies on micropayments rather than outright downloads. Meanwhile, internet access services furnish the substrate for all categories; yet price competition and regulatory fee caps constrain their growth contribution relative to higher-margin content verticals.

Online and app-based environments contributed 59.62% of the total 2025 revenue, affirming the primacy of direct-to-consumer delivery in the Middle East media and entertainment market. Fast-growing hybrid models merging linear channels with on-demand libraries now track a 10.65% CAGR, a pace that reflects consumer appetite for choice without sacrificing live communal viewing. MBC's bundling of Netflix inside the MBCNOW TV box illustrates how incumbents protect linear ad pools while upselling global catalogs. Traditional satellite still serves rural homes and older viewers, positioning hybrid set-tops as a soft migration path instead of abrupt cord-cutting.

For advertisers, platform diversity complicates reach but opens granular targeting. Cross-screen campaigns integrate linear ratings, OTT impressions, and social video engagements to maximize frequency without redundancy. As data-privacy codes tighten, first-party data from hybrid login environments strengthens value propositions, giving operators leverage over pure-play digital rivals lacking broadcast networks.

The Middle East Media and Entertainment Market is Segmented by Type (Digital Music, Video Games, and More), Platform (Online/Digital, Traditional/Linear, and Hybrid), Revenue Model (Subscription-Based, Advertising-Supported, and More), End-User Age Group (Generation Z, Millennials, and More), Device (Smartphones, Smart TVs and Connected TV Devices, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Middle East Broadcasting Center FZ-LLC (MBC Group)

- Orbit Showtime Network FZ-LLC

- beIN MEDIA GROUP LLC

- Abu Dhabi Media Company PJSC

- Arab Media Group LLC

- StarzPlay Arabia FZ-LLC

- Anghami Inc.

- Rotana Media Group Holding Company

- Intigral Inc.

- Eye Media LLC

- Moby Group FZ-LLC

- CMT Technologies FZ-LLC

- Zawya Limited

- VOX Cinemas LLC

- twofour54 FZ-LLC

- Telfaz11 Creative Media Productions LLC

- Gulf Film LLC

- Dubai Media Incorporated

- Saudi Research and Media Group (SRMG) JSC

- Kuwait National Cinema Company (KNCC) K.S.C.P.

- Qatar Media Corporation

- Al Arabiya News Channel FZ-LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated rollout of 5G networks and fibre broadband

- 4.2.2 Booming smartphone and smart-TV penetration enabling OTT growth

- 4.2.3 Government-funded mega-events (Vision 2030, Expo City) boosting content demand

- 4.2.4 Rapid rise of esports and in-app micro-transactions

- 4.2.5 Arabic-language original production incentives

- 4.2.6 Growing diaspora demand for Middle-East content on global platforms

- 4.3 Market Restraints

- 4.3.1 High levels of piracy and illicit streaming sites

- 4.3.2 Fragmented regulatory and censorship regimes across countries

- 4.3.3 Talent shortage in advanced VFX/game development

- 4.3.4 Currency-linked ad-spend volatility due to oil price swings

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Social Media Landscape

- 4.8.1 Market Overview and Key Growth Areas

- 4.8.2 Outlook of Platforms (Facebook, X, Instagram, YouTube, Messaging)

- 4.8.3 Key Social-Media Advertising Statistics

- 4.8.4 Regulatory Landscape and Censorship

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Digital Music

- 5.1.1.1 Music Downloads

- 5.1.1.2 Music Streaming

- 5.1.2 Video Games

- 5.1.3 Video-on-Demand

- 5.1.3.1 Subscription VoD (SVoD)

- 5.1.3.2 Transaction VoD (TVoD)

- 5.1.3.3 Electronic Sell-Through/Downloads

- 5.1.4 E-Publishing

- 5.1.5 Advertising

- 5.1.5.1 Digital Advertising

- 5.1.5.2 Newspaper

- 5.1.5.3 Magazine

- 5.1.5.4 Television

- 5.1.5.5 Radio

- 5.1.5.6 Outdoor Advertising

- 5.1.6 Internet Access Services

- 5.1.1 Digital Music

- 5.2 By Platform

- 5.2.1 Online/Digital

- 5.2.2 Traditional/Linear

- 5.2.3 Hybrid (Omnichannel)

- 5.3 By Revenue Model

- 5.3.1 Subscription-Based

- 5.3.2 Advertising-Supported

- 5.3.3 Pay-Per-View/Transactional

- 5.3.4 Freemium/In-App Purchase

- 5.4 By End-User Age Group

- 5.4.1 Generation Z (<=24)

- 5.4.2 Millennials (25-40)

- 5.4.3 Generation X (41-56)

- 5.4.4 Baby Boomers (57+)

- 5.5 By Device

- 5.5.1 Smartphones

- 5.5.2 Smart TVs and Connected TV Devices

- 5.5.3 PCs and Laptops

- 5.5.4 Tablets

- 5.5.5 Gaming Consoles

- 5.5.6 VR/AR Headsets

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Kuwait

- 5.6.5 Bahrain

- 5.6.6 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Middle East Broadcasting Center FZ-LLC (MBC Group)

- 6.4.2 Orbit Showtime Network FZ-LLC

- 6.4.3 beIN MEDIA GROUP LLC

- 6.4.4 Abu Dhabi Media Company PJSC

- 6.4.5 Arab Media Group LLC

- 6.4.6 StarzPlay Arabia FZ-LLC

- 6.4.7 Anghami Inc.

- 6.4.8 Rotana Media Group Holding Company

- 6.4.9 Intigral Inc.

- 6.4.10 Eye Media LLC

- 6.4.11 Moby Group FZ-LLC

- 6.4.12 CMT Technologies FZ-LLC

- 6.4.13 Zawya Limited

- 6.4.14 VOX Cinemas LLC

- 6.4.15 twofour54 FZ-LLC

- 6.4.16 Telfaz11 Creative Media Productions LLC

- 6.4.17 Gulf Film LLC

- 6.4.18 Dubai Media Incorporated

- 6.4.19 Saudi Research and Media Group (SRMG) JSC

- 6.4.20 Kuwait National Cinema Company (KNCC) K.S.C.P.

- 6.4.21 Qatar Media Corporation

- 6.4.22 Al Arabiya News Channel FZ-LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment