PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910929

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910929

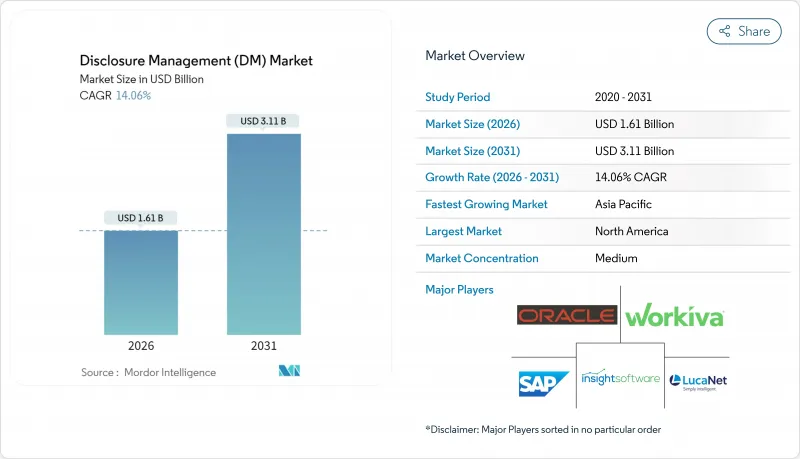

Disclosure Management (DM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Disclosure Management market was valued at USD 1.41 billion in 2025 and estimated to grow from USD 1.61 billion in 2026 to reach USD 3.11 billion by 2031, at a CAGR of 14.06% during the forecast period (2026-2031).

Enterprises are accelerating the adoption of automated compliance platforms to cope with mounting multi-jurisdictional regulations, from inline XBRL mandates to ESG reporting rules. Integrated solutions that combine structured data tagging with narrative generation are overtaking point tools as finance teams seek end-to-end control, lower cycle times, and stronger audit trails. Cloud maturity, AI-based anomaly detection, and hybrid architectures that respect data-sovereignty requirements further propel demand, while investor scrutiny of sustainability metrics cements ESG modules as a must-have feature set.

Global Disclosure Management (DM) Market Trends and Insights

Rising Compliance Complexity Across Multi-Format, Multi-Jurisdiction Filings

Regulators are widening the scope of machine-readable disclosures. The SEC's inclusion of cybersecurity exhibits in inline XBRL from July 2024 heightened tagging granularity and pushed issuers to modernize filing workflows. Simultaneously, Europe's ESEF framework demands XHTML-based annual reports, while Asia-Pacific regulators establish their own taxonomy timelines. Multinationals now juggle divergent schemes, prompting demand for platforms that harmonize data models, manage taxonomy updates and enable single-source publishing. Crypto-asset white-paper rules under MiCAR, effective December 2025, extend structured reporting to new asset classes and illustrate regulators' long-term commitment to digital filings.

Mandates for Inline XBRL and Real-Time Reporting by Regulators

Inline XBRL collapses the historical gap between human-readable HTML and machine-readable XBRL, letting algorithms parse data the instant it is filed. ESMA's ESRS Set 1 Taxonomy, published August 2024, enables machine-readable ESG statements that investors can benchmark at scale. The SEC's EDGAR Next program, which transitions filers to individual multifactor-authenticated accounts by September 2025, underscores regulators' drive for data integrity and cybersecurity. Financial institutions gain most, trimming audit fees and accelerating analytics thanks to standardized tags and near-real-time access.

Conflicting Global / Regional Taxonomy Standards and Updates

While IFRS offers a common baseline, regional overlays spawn incompatibilities. EU ESRS tags differ from SEC U.S. GAAP extensions, and Japan is building an ISSB-based taxonomy that still diverges in label structure. The SEC highlighted rising custom tag rates between 2022-2024 as issuers struggled to map unique disclosures onto standard elements. Vendors must maintain parallel schema libraries, inflating engineering overhead and slowing release cycles. Multinationals face re-tagging costs each quarter, dampening rapid platform migrations.

Other drivers and restraints analyzed in the detailed report include:

- Demand for ESG / Sustainability Transparency from Investors

- Automation Needs to Reduce Disclosure Cycle-Time and Manual Errors

- Cyber-Security and Data-Sovereignty Concerns in Cloud Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 70.68% of the Disclosure Management market in 2025 by bundling tagging, workflow and analytics in unified suites. Yet the Services segment is racing ahead at a 15.74% CAGR as enterprises seek advisory, implementation and managed-service expertise to keep pace with rule changes. Professional-service partners translate taxonomy updates into platform configurations and orchestrate change-management across finance, legal and IT teams. The managed-service model appeals to mid-sized filers that lack headcount and want predictable subscription fees tied to filing cycles. As a result, Services revenue is forecast to close a portion of the gap with Software by 2031, reshaping vendor economics around outcome-based engagements.

The surge in Services illustrates a structural shift toward "compliance-as-a-service." Providers leverage shared centers of excellence to spread regulatory surveillance costs across clients, while customers offload niche skill-sets such as XBRL taxonomy mapping or ESG materiality scoping. AI-enabled service desks now draft narrative sections and auto-resolve validation errors, raising productivity and margins. This operating model reinforces vendor-customer stickiness: once disclosure workflows are outsourced, switching costs rise, which in turn anchors recurring revenue streams that improve overall Disclosure Management market resilience.

Cloud deployments accounted for 63.64% revenue in 2025 and are forecast to grow 16.78% annually, underscoring enterprises' preference for elastic compute, automated updates and collaborative review. SaaS vendors ship taxonomy refreshes overnight, ensuring filings remain compliant without local patching. Automated scaling accommodates peak filing-week loads, while integrated e-signatures and audit logs simplify attestation. Remaining on-premise workloads cluster in heavily regulated verticals such as banking and defense, yet hybrid deployments that keep sensitive data on local nodes while piping rendered outputs to public-cloud portals are gathering momentum.

Cloud sovereignty concerns encourage multi-region architectures with dedicated encryption keys and customer-controlled HSMs. Major providers launched EU-specific sovereign-cloud zones in 2024, allowing institutions to satisfy Schrems II transfer rules. Workiva's multi-tenant SaaS design enables cross-team co-authoring, but the firm also introduced single-tenant government-cloud options for agencies handling classified disclosures. Collectively, these enhancements reinforce cloud as the default path for future implementations and cement its role as the Disclosure Management market's growth engine.

The Disclosure Management Market Report is Segmented by Component (Software, Services), Deployment Model (On-Premises, Cloud, Hybrid), End-User Enterprise Size (Large Enterprises, Smes), Application (Regulatory and Tax Filing, Financial Consolidation and Close, and More), End-User Industry (BFSI, IT and Telecom, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 33.68% of 2025 revenue, underpinned by the SEC's proactive stance on inline XBRL and cybersecurity exhibits. U.S. issuers rely on automated platforms to manage multifactor EDGAR Next logins and to synch exhibit tagging with evolving GAAP updates. Canadian regulators are aligning with U.S. taxonomy schedules, while Mexico's securities commission pilots XBRL templates for large caps. High cloud maturity and a deep bench of XBRL talent make the region an innovation laboratory for AI-driven narrative generation and anomaly detection engines.

Europe demonstrated steady expansion on the back of CSRD obligations and ESEF file-package requirements. More than 50,000 companies fall under CSRD scope, driving surge-capacity needs for double materiality and Scope 3 data aggregation. ESMA's release of the ESRS Set 1 taxonomy built a common digital language for sustainability statements, enabling cross-country comparability. Data-sovereignty mandates boost hybrid architectures; sovereign-cloud initiatives let issuers keep personal data within EU borders while using SaaS disclosure engines for rendering.

Asia-Pacific delivered the fastest 16.92% CAGR outlook as regulators modernize filing regimes. Japan's mandatory ESG rules for large caps and Singapore's AI-powered regulatory reporting sandbox spur early uptake of cloud platforms. China is trialing ESG indicators within its STAR Market filings, while India's growing public-company base pushes demand for low-cost tagging tools. Australia and South Korea refine climate-risk templates, widening cross-border platform opportunities. Regional appetite for mobile-first user experiences and subscription pricing accelerates cloud adoption once data-residency hurdles are addressed.

- SAP SE

- Oracle Corporation

- Workiva Inc.

- insightsoftware (incl. Certent)

- LucaNet AG

- DataTracks Services Ltd.

- Wolters Kluwer N.V. (CCH Tagetik)

- CoreFiling Ltd.

- Trintech Inc.

- IRIS Business Services Ltd. (IRIS Carbon)

- Donnelley Financial Solutions (DFIN)

- OCR Services Inc.

- BlackLine Inc.

- Fluence Technologies

- Sturnis365

- Certinia Inc.

- Deloitte (Disclosure Insight)

- PwC Workbench

- EY Canvas

- KPMG Clara

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising compliance complexity across multi-format, multi-jurisdiction filings

- 4.2.2 Mandates for Inline XBRL and real-time reporting by regulators

- 4.2.3 Demand for ESG/Sustainability transparency from investors

- 4.2.4 Automation needs to reduce disclosure cycle-time and manual errors

- 4.2.5 Cloud-native "report-as-a-service" platforms lowering TCO

- 4.2.6 AI-driven narrative generation and anomaly detection tools

- 4.3 Market Restraints

- 4.3.1 Conflicting global/regional taxonomy standards and updates

- 4.3.2 Cyber-security and data-sovereignty concerns in cloud adoption

- 4.3.3 Shortage of disclosure-specialised finance talent

- 4.3.4 High switching cost from legacy Excel/ERP add-ins

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Value Chain Analysis

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Stand-alone Disclosure Software

- 5.1.1.2 Integrated CPM/ERP Modules

- 5.1.2 Services

- 5.1.2.1 Professional (Implementation, Consulting)

- 5.1.2.2 Managed / BPO

- 5.1.1 Software

- 5.2 By Deployment Model

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By End-user Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Application

- 5.4.1 Regulatory and Tax Filing

- 5.4.2 Financial Consolidation and Close

- 5.4.3 Internal and External Financial Reporting

- 5.4.4 ESG and Sustainability Reporting

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Retail and E-commerce

- 5.5.5 Manufacturing

- 5.5.6 Energy and Utilities

- 5.5.7 Government and Public Sector

- 5.5.8 Other End-user Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East

- 5.6.4.1 United Arab Emirates

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Nigeria

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Workiva Inc.

- 6.4.4 insightsoftware (incl. Certent)

- 6.4.5 LucaNet AG

- 6.4.6 DataTracks Services Ltd.

- 6.4.7 Wolters Kluwer N.V. (CCH Tagetik)

- 6.4.8 CoreFiling Ltd.

- 6.4.9 Trintech Inc.

- 6.4.10 IRIS Business Services Ltd. (IRIS Carbon)

- 6.4.11 Donnelley Financial Solutions (DFIN)

- 6.4.12 OCR Services Inc.

- 6.4.13 BlackLine Inc.

- 6.4.14 Fluence Technologies

- 6.4.15 Sturnis365

- 6.4.16 Certinia Inc.

- 6.4.17 Deloitte (Disclosure Insight)

- 6.4.18 PwC Workbench

- 6.4.19 EY Canvas

- 6.4.20 KPMG Clara

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment