PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910934

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910934

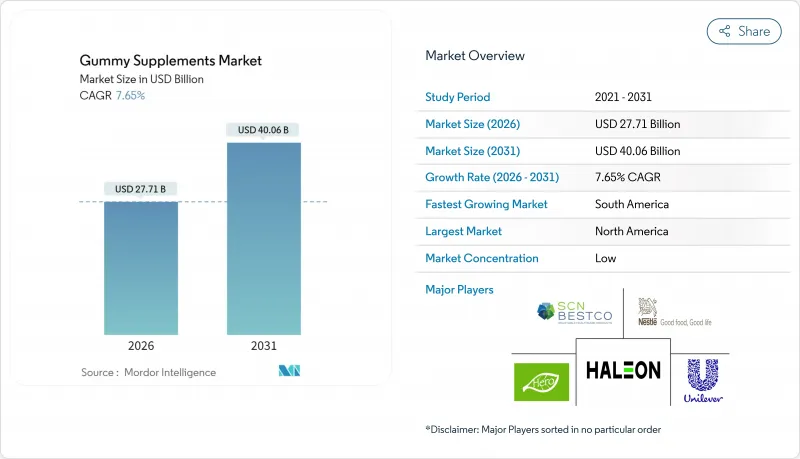

Gummy Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gummy supplements market is expected to grow from USD 25.74 billion in 2025 to USD 27.71 billion in 2026 and is forecast to reach USD 40.06 billion by 2031 at 7.65% CAGR over 2026-2031.

Consumers increasingly favor convenient and tasty delivery formats, streamlining their daily nutrient routines and aligning with a preventive health mindset. Multivitamin gummies dominate the market, with adults fueling the majority of demand. While pharmacies continue to lead in-store sales, e-commerce is rapidly gaining ground, especially as younger shoppers pivot to online health purchases. North America, bolstered by established regulatory frameworks, takes the lead regionally. However, South America is witnessing the fastest growth, driven by Brazil's burgeoning middle class and its robust food-processing sector. Ingredient innovations, particularly with pectin and plant-based gelling agents, are enhancing clean-label positioning, addressing challenges in texture and shelf stability. Meanwhile, a proposed inspection delegation in the U.S. could lead to inconsistent enforcement, favoring compliant firms while intensifying scrutiny on those lagging behind.

Global Gummy Supplements Market Trends and Insights

Convenience, taste, and palatability increase demand across all consumer segments

Shifting consumer preferences toward enjoyable supplementation experiences are driving significant changes in market dynamics. This trend spans across age groups, with gummy formats addressing medication adherence issues among seniors who face challenges with traditional tablets, while also appealing to younger consumers seeking enhanced sensory experiences. The Seattle Gummy Company's approval of the first FDA Investigational New Drug Application for gummy medications signals potential market expansion from supplements to pharmaceuticals. Advancements in manufacturing, such as starch-free production methods, are improving operational efficiency and hygiene standards while enabling faster production cycles. These innovations support scalable operations to meet increasing demand. Companies that excel in balancing taste optimization with the delivery of functional ingredients are gaining sustainable competitive advantages. Reflecting confidence in the market's growth potential, firms like Pharmavite are making substantial investments in new gummy production facilities, highlighting the anticipated longevity of demand.

Rising adoption of women's health and prenatal gummy supplements

Targeted research into hormonal health, bone density, and prenatal nutrition is significantly driving innovation and expansion within the women's formulations market. Supplements specifically designed for menopause management are demonstrating growth rates that exceed those of the broader category, highlighting a strong demand in this niche. Younger female consumers are increasingly emphasizing the importance of transparent product labeling and active community engagement, compelling brands to validate their claims through robust data and recognized certifications. The emergence of women-owned companies is further enriching the diversity of brand choices available in the market, while the incorporation of adaptogen blends is enhancing the functional positioning of products. Retailers are observing that strategies centered on education-driven merchandising and engaging digital storytelling are instrumental in fostering customer loyalty and driving repeat purchases. Additionally, certifications such as kosher, halal, and vegan are expanding market reach by appealing to previously underserved consumer groups, while simultaneously enhancing brand credibility and supporting premium pricing strategies.

Added-sugar concerns driving negative media & regulatory scrutiny

Health concerns and stricter regulations on sugar consumption are driving the need for advanced ingredient technologies to reduce sugar while maintaining taste. The German Federal Institute for Risk Assessment has updated guidelines, capping allowable levels of vitamins and minerals in food supplements to curb excessive nutrient intake and address sugar-related issues. Rising demand for sugar-free gummy formulations reflects consumer acceptance of alternative sweeteners that preserve taste. This trend is supported by increasing diabetes prevalence; in 2024, the International Diabetes Federation reported 589 million adults aged 20-79 living with diabetes, often linked to high sugar intake . Regulatory frameworks now emphasize front-of-pack labeling, highlighting nutritional content, and impacting high-sugar products. Manufacturers face the challenge of creating tasty, health-focused gummy supplements that justify premium pricing while meeting regulatory standards.

Other drivers and restraints analyzed in the detailed report include:

- Market growth driven by CBD and cannabinoid-infused gummy supplements

- Rising demand for plant-based and alternative gummy formulations

- Regulatory framework and growing consumer ingredient consciousness

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, multivitamin gummies led the gummy supplements market with a 41.78% share, driven by convenient daily dosages and diverse nutrients. Major pharmacy chains boosted sales, while private-label products on e-commerce platforms intensified price competition. Probiotic gummies, growing at a CAGR of 8.11% (2026-2031), are gaining popularity among consumers focused on gut health, immunity, and mood. As clinical research highlights the microbiome's importance, the probiotic gummy market is set to grow further. Single-nutrient products, like vitamin D gummies, address deficiency concerns and enable targeted upselling. Omega-3 gummies, using fruit flavors to mask the fish-oil taste, attract health-conscious consumers focused on heart health.

Investments in advanced formats, such as liquid-fill and layered gummies, are driving sensory differentiation and enabling premium pricing strategies. However, manufacturers face challenges in ensuring the stability of active ingredients while maintaining consistent product texture. Successfully addressing these challenges can enhance brand equity and improve profit margins. As the gummy supplements market evolves, products that combine robust scientific validation with appealing flavors are well-positioned to maintain shelf presence amid increasing competition.

Animal-derived gelatin, valued for its cost-effectiveness and texture, dominates gummy bases with a 62.88% share. However, plant-based alternatives are rising, with a 10.05% CAGR (2026-2031), as ethical and sustainability concerns shape consumer choices. The growth of plant-based gummy supplements is supported by mainstream retailers introducing vegan sections. Since 2023, pectin adoption in new launches has doubled, driven by stable citrus peel supply agreements. Gellan and carrageenan enhance texture flexibility, enabling heat-stable SKUs for warmer regions. Companies excelling in plant-based gelling technologies are addressing potential declines in gelatin demand due to religious or vegan preferences. Vertical sourcing agreements protect businesses from raw material price volatility, which pressures smaller players during pectin price hikes. Cruelty-free and eco-friendly brands are gaining a competitive edge in the gummy supplements market.

Simultaneously, hybrid systems that combine minimal gelatin with plant polysaccharides are addressing processing challenges while advancing toward fully animal-free formulations. This strategy enables product line extensions without requiring significant capital investment in retooling. Consumer education initiatives highlighting pectin's fruit-based origin are alleviating concerns about unfamiliar ingredient names, facilitating smoother adoption. Ultimately, transparent sourcing practices and clearly communicated functional benefits are driving the most sustainable growth opportunities in the market.

The Gummy Supplements Market Report is Segmented by Product Type (Single-Vitamin, Multivitamin, and More), Source Type (Animal-Based, Plant-Based), Packaging (Bottles and Jars, and More), End User (Children, Adults), Distribution Channel (Supermarkets/Hypermarkets, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America accounted for 43.70% of the global market value, driven by stringent DSHEA regulations and a well-established culture of supplement consumption. Canada's market growth is supported by its aging population's increasing demand for joint and immune health products. In Mexico, the expanding middle class with greater purchasing power is fueling market expansion. Gummy supplements have achieved significant penetration in pharmacy channels across the region, supported by endorsements from healthcare professionals. Companies adhering to the updated FDA inspection protocols are positioned to gain a competitive edge in the evolving regulatory environment.

Europe represents a large but complex market. Germany, operating under Directive 2002/46/EC, is the second-largest supplement market in the region. Consumer preferences for sugar-reduced formulations are driving ongoing research and development efforts into alternative sweeteners. The gummy supplements segment faces fragmented regulations for botanicals, prompting multinational companies to adapt product labels for individual countries to expedite market entry. In Spain, the sizable aging population increasingly turns to gummy supplements as a convenient alternative for vitamin intake. The chewable format is particularly appealing to individuals with swallowing difficulties or dental issues. According to 2024 data from INE Spain, 9.93 million people in the country are aged 65 and above, contributing to the growth of the gummy supplements market .

South America is experiencing robust growth, with a projected CAGR of 9.02% through 2031. Retailers report strong consumer interest in beauty and energy gummies, reflecting the success of aspirational lifestyle marketing strategies. Argentina and Chile are key contributors, driven by rising health awareness and improving macroeconomic conditions. While local registration processes can be time-consuming, the growing demand presents lucrative opportunities for long-term investors. In the region's dynamic retail environment, packaging that emphasizes flavor and natural colors resonates strongly with consumers. The Asia-Pacific region offers diverse growth prospects. Japan's streamlined functional food regulations under the Foods with Function framework facilitate faster market entry for science-backed products. In China, stringent dual filing registration requirements pose challenges, but the vast wellness economy attracts global players willing to collaborate with local partners. In 2024, India's Food Safety and Standards Authority introduced updated labeling regulations that incentivize brands for transparent sourcing practices.

- Unilever Plc

- Nestle S.A

- Hero Nutritionals LLC

- Aesthetic Nutrition Pvt Ltd

- Santa Cruz Nutritionals

- Herbaland Naturals Inc.

- Haleon Plc

- Jagzee Enterprises

- Minch Global Trade Inc, (Mulittea)

- Natrol LLC

- Better Nutritionals

- Amway Corporation

- Abbott Laboratories

- Hero Nutritionals LLC

- Herbaland Naturals Inc.

- Nature's Bounty Co.

- Nordic Naturals

- Otsuka Holdings Co. Ltd

- Vitakem Nutraceuticals

- Walmart Inc,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Convenience, taste, and palatability increase demand across all consumer segments

- 4.1.2 Rising adoption of women's health and prenatal gummy supplements

- 4.1.3 Market growth driven by CBD and cannabinoid-infused gummy supplements

- 4.1.4 Diversification of supplement flavor profiles to meet consumer preferences

- 4.1.5 Rising demand for plant-based and alternative gummy formulations

- 4.1.6 Functional gummies targeting specific health benefits are gaining traction among consumers.

- 4.2 Market Restraints

- 4.2.1 Added-sugar concerns driving negative media and regulatory scrutiny

- 4.2.2 Regulatory framework and growing consumer ingredient consciousness

- 4.2.3 Rising pectin and vegan-gelling input costs compressing margins

- 4.2.4 Counterfeits and mislabeling hinders growth

- 4.3 Supply-Chain Analysis

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Single-Vitamin

- 5.1.2 Multivitamin

- 5.1.3 Probiotic

- 5.1.4 Omega-3

- 5.1.5 Collagen

- 5.1.6 Other Product Types

- 5.2 By Source Type

- 5.2.1 Animal-based

- 5.2.2 Plant-based

- 5.3 By Packaging

- 5.3.1 Bottles and Jars

- 5.3.2 Stand-up Pouches

- 5.3.3 Others

- 5.4 By End User

- 5.4.1 Children

- 5.4.2 Adults

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Pharmacies/Drug Stores

- 5.5.3 Online Retailers

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Sweden

- 5.6.2.8 Netherlands

- 5.6.2.9 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 New Zealand

- 5.6.3.6 Malaysia

- 5.6.3.7 Singapore

- 5.6.3.8 Philippines

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Unilever Plc

- 6.4.2 Nestle S.A

- 6.4.3 Hero Nutritionals LLC

- 6.4.4 Aesthetic Nutrition Pvt Ltd

- 6.4.5 Santa Cruz Nutritionals

- 6.4.6 Herbaland Naturals Inc.

- 6.4.7 Haleon Plc

- 6.4.8 Jagzee Enterprises

- 6.4.9 Minch Global Trade Inc, (Mulittea)

- 6.4.10 Natrol LLC

- 6.4.11 Better Nutritionals

- 6.4.12 Amway Corporation

- 6.4.13 Abbott Laboratories

- 6.4.14 Hero Nutritionals LLC

- 6.4.15 Herbaland Naturals Inc.

- 6.4.16 Nature's Bounty Co.

- 6.4.17 Nordic Naturals

- 6.4.18 Otsuka Holdings Co. Ltd

- 6.4.19 Vitakem Nutraceuticals

- 6.4.20 Walmart Inc,

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK