PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910935

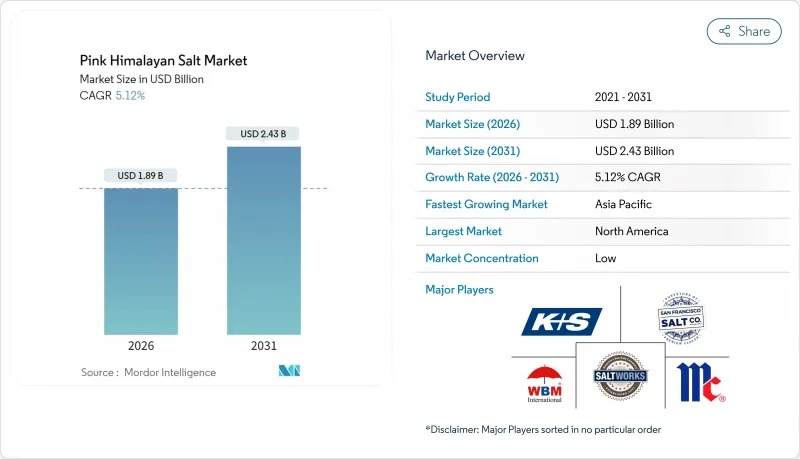

Pink Himalayan Salt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Pink himalayan Salt market size in 2026 is estimated at USD 1.89 billion, growing from 2025 value of USD 1.80 billion with 2031 projections showing USD 2.43 billion, growing at 5.12% CAGR over 2026-2031.

The market demonstrates robust growth as consumers increasingly prioritize minimally processed ingredients and clean-label products in their purchasing decisions. Retailers benefit from premium positioning strategies, which enable them to command higher profit margins. The market expansion is further accelerated by packaged-food manufacturers incorporating pink himalayan salt into their product formulations, mining companies implementing vertical integration strategies to control quality and supply, and the proliferation of e-commerce platforms enhancing product accessibility. While North American consumers continue to demonstrate strong purchasing power in this segment, the Asia-Pacific region emerges as the fastest-growing market, driven by urban households transitioning from traditional table salt to premium condiment options. The competitive landscape remains dynamic, with companies focusing on distinctive branding strategies, rigorous source verification processes, and innovative packaging solutions to differentiate their products, rather than competing on supply availability.

Global Pink Himalayan Salt Market Trends and Insights

Rising Demand for Premium and Gourmet Food Products

Consumer preferences in the salt industry are evolving as people increasingly consider culinary ingredients part of their lifestyle choices rather than basic necessities. This shift is particularly evident in metropolitan areas, where specialty food retailers have witnessed substantial growth in artisanal salt purchases, driven by urbanization and higher disposable incomes. A notable example is ITC Aashirvaad's launch of himalayan Pink Salt in May 2024 across major Indian cities, which focuses on natural qualities and minimal processing to meet sophisticated consumer demands. The product's adoption by restaurants and culinary professionals for both flavor enhancement and visual appeal has influenced consumer purchasing decisions. This evolution has also reached the beverage and specialty food sectors, where businesses incorporate premium salts into their products to meet market demands and justify higher price points.

Increasing Health Consciousness Leads Consumers to Prefer Natural, Unprocessed Salts

Consumer preferences for health-conscious products are changing salt purchasing patterns, with many buyers moving away from processed table salt. Pink himalayan salt's appeal stems from its minimal processing and trace mineral content, though health claims remain under regulatory scrutiny. The Food and Drug Administration's December 2024 "healthy" claim regulations set specific sodium limits for products, restricting mixed products to 15% of the Daily Value per reference amount . These regulations enable pink himalayan salt manufacturers to align their products with compliance requirements while highlighting their natural origin. Research shows consumers increasingly consider mineral-rich salts as functional ingredients rather than basic seasonings, particularly among health-conscious consumers. While overall sodium consumption decreases, premium salt categories benefit as consumers opt to use smaller amounts of higher-priced specialty salts, seeking both enhanced flavor and potential nutritional advantages.

Regulatory Uncertainties Related to Health Claims and Labeling

The regulatory framework for pink himalayan salt marketing involves strict compliance requirements, particularly regarding health claims and mineral content declarations. The Food and Drug Administration mandates scientific validation for health-related marketing claims through its structure/function requirements, while its revised "healthy" claim criteria establish specific sodium limits that influence product marketing. In European markets, EFSA implements rigorous assessment procedures for nutrition and health claims, creating a complex regulatory landscape for global marketing operations. Companies must carefully navigate the boundaries between permissible structure/function claims and prohibited disease treatment statements, as violations can result in regulatory actions including warning letters, recalls, and market restrictions. The limited international regulatory alignment requires companies to implement region-specific labeling and marketing strategies, increasing operational costs. Small-scale producers face particular challenges due to limited resources for legal compliance and scientific validation studies.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Organic, Clean-Label, and Eco-Friendly Products

- Expanding Innovation in Flavor-Enhanced and Infused Salt Products

- Stringent Food Safety and Import Regulations in Key Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The pink himalayan salt market demonstrates a clear preference for granular formats, which currently hold 56.02% of the market share in 2025. This substantial market presence reflects the format's versatility and practical benefits across the food industry. Commercial kitchens value its consistent dissolution properties for precise seasoning, while home cooks appreciate its aesthetic appeal when used as a finishing salt. The granular format's widespread adoption in both professional and residential settings has established it as the industry standard.

The powder segment, though smaller in market share, is experiencing remarkable growth with a 6.28% CAGR projected through 2031. This acceleration is primarily driven by changing consumer preferences toward convenience and versatility in food preparation. The powder format's ability to blend seamlessly into smoothies, baked goods, and seasoning mixtures has made it increasingly popular among health-conscious consumers and home bakers. Meanwhile, block and slab formats maintain a specialized position in the market, catering to high-end restaurants and culinary enthusiasts who seek distinctive cooking methods and presentation options for their dishes.

The Pink Himalayan Salt Market Report is Segmented by Form (Granular, Block / Slab, and Powder), Grade (Food Grade, and Industrial/Animal Grade), End User (Food Processing, Foodservice, Industrial, and Retail), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

North America maintains its market leadership with a commanding 31.05% share in 2025. The region's market strength is built on a foundation of sophisticated consumer understanding, deeply rooted premium food culture, and an extensive distribution infrastructure that spans specialty retail and foodservice channels. North American consumers demonstrate a mature appreciation for specialty salt varieties, showing consistent willingness to invest in products that deliver superior quality and tangible health benefits. The region's distribution network efficiency ensures products reach consumers through multiple touchpoints, from high-end specialty stores to mainstream retail outlets.

Asia-Pacific has emerged as the market's primary growth catalyst, recording an impressive 6.05% CAGR through 2031. This remarkable growth trajectory is powered by fundamental shifts in consumer dynamics, including substantial increases in disposable income, accelerated urbanization patterns, and evolving dietary preferences across major economies like China, India, and Japan. The Japanese market exemplifies this transformation, with its sophisticated convenience store networks playing an instrumental role in premium food product distribution. The region's growth story is further strengthened by increasing consumer education about specialty food products and growing appreciation for international culinary influences.

Europe maintains its position with steady growth, characterized by increasing consumer preference for organic and clean-label products. The Middle East and Africa markets demonstrate promising development, leveraging their diverse expatriate communities and robust tourism sectors to drive market expansion. South American markets, while currently showing lower penetration rates, represent significant untapped potential as regional economies continue to develop and consumer awareness strengthens. Success in these diverse markets requires carefully calibrated strategies that address specific local regulations, optimize distribution channels, meet regional packaging requirements, and align with cultural preferences, all while maintaining unwavering product quality standards across all territories.

- McCormick & Company Inc.

- K+S AG

- SaltWorks Inc.

- WBM International

- San Francisco Salt Company

- Frontier Co-op

- Evolution Salt Co.

- Morton Salt Inc.

- Himalayan Salt Company

- Natierra Superfoods

- Olde Thompson LLP

- Premier Foods plc

- Ittefaq Salt

- Standard Salt

- Saltan Ltd.

- Kutch Brine Chem Ind.

- Nature Vit

- NutroActive Industries

- Organic India Pvt Ltd.

- Sherpa Pink

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for premium and gourmet food products

- 4.2.2 Increasing health consciousness leads consumers to prefer natural, unprocessed salts

- 4.2.3 Growing preference for organic, clean-label, and eco-friendly products

- 4.2.4 Expanding innovation in flavor-enhanced and infused salt products

- 4.2.5 Enhanced transparency and traceability in supply chains

- 4.2.6 Popularity of salt-based decorative products

- 4.3 Market Restraints

- 4.3.1 Regulatory uncertainties related to health claims and labeling

- 4.3.2 Stringent food safety and import regulations in key markets

- 4.3.3 Limited awareness in some emerging markets

- 4.3.4 Challenges in maintaining product consistency across suppliers

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Form

- 5.1.1 Granular

- 5.1.2 Block / Slab

- 5.1.3 Powder

- 5.2 By Grade

- 5.2.1 Food Grade

- 5.2.2 Industrial/Animal Grade

- 5.3 By End User

- 5.3.1 Food Processing

- 5.3.2 Foodservice

- 5.3.3 Industrial

- 5.3.4 Retail

- 5.3.4.1 Supermarket/Hypermarket

- 5.3.4.2 Convenience Store

- 5.3.4.3 Online Retailer

- 5.3.4.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 McCormick & Company Inc.

- 6.4.2 K+S AG

- 6.4.3 SaltWorks Inc.

- 6.4.4 WBM International

- 6.4.5 San Francisco Salt Company

- 6.4.6 Frontier Co-op

- 6.4.7 Evolution Salt Co.

- 6.4.8 Morton Salt Inc.

- 6.4.9 Himalayan Salt Company

- 6.4.10 Natierra Superfoods

- 6.4.11 Olde Thompson LLP

- 6.4.12 Premier Foods plc

- 6.4.13 Ittefaq Salt

- 6.4.14 Standard Salt

- 6.4.15 Saltan Ltd.

- 6.4.16 Kutch Brine Chem Ind.

- 6.4.17 Nature Vit

- 6.4.18 NutroActive Industries

- 6.4.19 Organic India Pvt Ltd.

- 6.4.20 Sherpa Pink

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK