PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910936

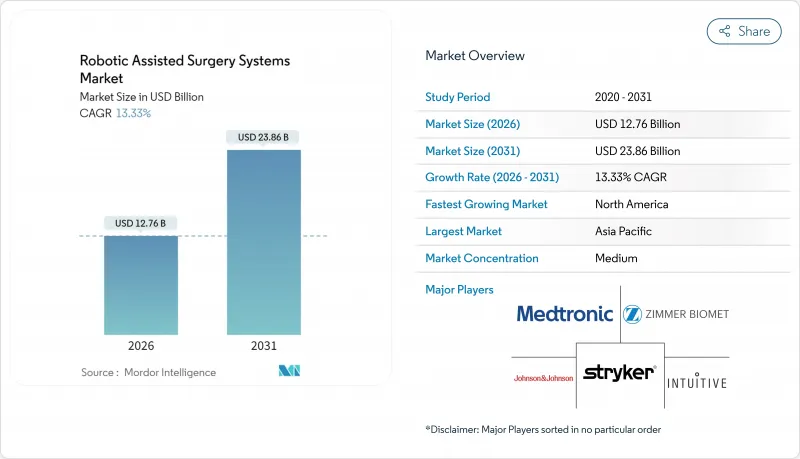

Robotic Assisted Surgery Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Robotic-Assisted Surgery Systems market was valued at USD 11.26 billion in 2025 and estimated to grow from USD 12.76 billion in 2026 to reach USD 23.86 billion by 2031, at a CAGR of 13.33% during the forecast period (2026-2031).

Rising demand for minimally-invasive procedures, rapid integration of artificial intelligence, and expansion of 5G-enabled telesurgery networks are accelerating platform deployment across major specialties. Leading health systems now treat robotics as a cornerstone of value-based care strategies because the technology consistently lowers complication rates, shortens length of stay, and reduces readmissions compared with conventional laparoscopy. Shifts in procedure volume toward ambulatory surgery centers (ASCs) are spurring interest in modular, mobile configurations that fit smaller footprints and support multi-suite rotation. Competitive intensity is increasing as incumbent leaders confront cost-focused challengers introducing open-architecture platforms that promise lower capital outlay and faster software upgrades. Long-term momentum is underpinned by aging populations, growing chronic-disease prevalence, and persistent surgeon shortages in many regions.

Global Robotic Assisted Surgery Systems Market Trends and Insights

Rapid Technology Upgrades & New Platform Launches

Next-generation systems such as the da Vinci 5 now integrate force-feedback modules that cut tissue strain by 43%, easing surgeon acceptance and widening the Robotic-Assisted Surgery Systems market. Component miniaturisation enables independent patient carts that manoeuvre in cramped rooms, trimming turnover times and freeing valuable OR minutes. Vendors are accelerating product cycles to counter nimble entrants offering niche platforms for single-specialty use, and health systems prefer software-upgradable units that evolve without replacing core hardware. Capital budgets therefore stretch further, making multi-robot fleets viable in community hospitals.

Surge in Minimally-Invasive & Same-Day Procedures

ASCs now handle 72% of all surgical volume in the United States, performing cases at 45-60% lower cost than hospital outpatient departments while maintaining 92% patient-satisfaction ratings. This migration fundamentally benefits the Robotic-Assisted Surgery Systems market because compact, portable robots can rotate between procedure rooms, maximizing utilisation. Reimbursement reforms that reward site neutrality encourage providers to invest in robotic suites designed for high-throughput joint, spine, and GI workflows. Platform vendors are responding by bundling consumables, analytics, and fleet-management software under pay-per-use contracts that align expenses with ASC revenue streams.

High Procurement & Lifecycle Costs

Flagship robots still list near USD 2 million, with annual service plans running USD 100,000-200,000 and instrument refresh after every 10 uses. Surgeons need 20-40 proctored cases to reach proficiency, adding to onboarding expense and temporarily depressing OR productivity. Financing schemes tied to per-procedure payments or outcome guarantees are emerging, yet CFOs in emerging markets remain cautious, slowing penetration of the Robotic-Assisted Surgery Systems market.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population & Rising Chronic-Disease Burden

- AI-Driven Workflow Optimisation & Autonomous Functions

- Protracted Multi-Jurisdiction Regulatory Clearance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Systems dominated the Robotic-Assisted Surgery Systems market size with a 57.84% revenue share in 2025 as hospitals continued to refresh or expand core hardware fleets. Subscription-based analytics and AI modules pushed the Software & Services category to an 17.62% CAGR, underscoring how software now differentiates performance more than mechanical design. Hardware lifecycles average 10 years, but quarterly firmware drops continuously enhance camera resolution, kinematic control, and workflow dashboards, encouraging fleet standardisation.

Consumables remain a steady annuity because single-use staplers, sealing devices, and drapes guarantee sterility as procedure counts climb. Open-source initiatives allow engineers to add bespoke imaging filters or ergonomic interfaces, ensuring innovation keeps pace with clinician demands while safeguarding earlier capital outlays. This architecture aligns with CFO priorities and sustains replacement demand across the Robotic-Assisted Surgery Systems market.

The Robot-Assisted Surgical Systems Market Report is Segmented by Product Type (System [Surgical Robot and Navigation System], Consumable and Accessories, Software and Services), Application (Gynecological Surgery, Cardiovascular, Neurosurgery, and More), End-User (Hospitals, Ambulatory Surgery Centers and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 45.10% of 2025 revenue as Medicare coverage decisions and private-payer parity ensured stable procedure economics. The Robotic-Assisted Surgery Systems market size in the region continues to climb on the back of fleet renewals, clinic-based procedure expansion, and early uptake of autonomous functions. Europe follows with broad diffusion across university hospitals after CE-mark approval of the da Vinci 5 broadened procurement pipelines.

Asia-Pacific leads growth with a 15.26% CAGR as China's Five-Year Plan subsidises domestic robot manufacturing and local proof-of-concept 5G telesurgery pilots shorten specialist wait times. India's tier-1 private chains deploy multi-disciplinary robotic centers to attract medical tourists seeking bariatric and cardiac procedures, adding incremental volume to the Robotic-Assisted Surgery Systems market.

Latin America shows gradual adoption centered in Mexico and Brazil, where public-private partnerships finance shared-use OR complexes. The Middle East and Africa remain nascent, yet demonstration projects in the United Arab Emirates have showcased fully remote prostatectomies supervised by European mentors, foreshadowing future penetration once reimbursement frameworks mature.

- Intuitive Surgical

- Stryker

- Johnson & Johnson (Ethicon/Auris)

- Medtronic

- Zimmer Biomet

- Smiths Group

- Accuray

- Renishaw

- Globus Medical

- Brain Lab

- SRI International

- CMR Surgical

- Asensus Surgical

- Siemens Healthineers (Corindus Vascular)

- Think Surgical

- Titan Medical

- MicroPort MedBot

- Meere Company

- Medicaroid

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Technology Upgrades & New Platform Launches

- 4.2.2 Surge In Minimally-Invasive & Same-Day Procedures

- 4.2.3 Ageing Population & Rising Chronic Disease Burden

- 4.2.4 AI-Driven Workflow Optimisation & Autonomous Functions

- 4.2.5 5G-Enabled Telesurgery Pilots Expanding Addressable Reach

- 4.2.6 Open-Architecture, Modular Robot-As-A-Platform Ecosystems

- 4.3 Market Restraints

- 4.3.1 High Procurement & Lifecycle Costs

- 4.3.2 Protracted Multi-Jurisdiction Regulatory Clearance

- 4.3.3 Cyber-Security & Data-Integrity Vulnerabilities

- 4.3.4 Limited Haptic Feedback Slowing Surgeon Adoption Curves

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 System

- 5.1.1.1 Surgical Robot

- 5.1.1.2 Navigation System

- 5.1.2 Consumables & Accessories

- 5.1.3 Software & Services

- 5.1.1 System

- 5.2 By Application

- 5.2.1 Gynecological Surgery

- 5.2.2 Cardiovascular

- 5.2.3 Neurosurgery

- 5.2.4 Orthopedic Surgery

- 5.2.5 Laparoscopy

- 5.2.6 Urology

- 5.2.7 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Intuitive Surgical

- 6.3.2 Stryker Corporation

- 6.3.3 Johnson & Johnson (Ethicon/Auris)

- 6.3.4 Medtronic

- 6.3.5 Zimmer Biomet

- 6.3.6 Smith & Nephew

- 6.3.7 Accuray

- 6.3.8 Renishaw

- 6.3.9 Globus Medical

- 6.3.10 Brainlab

- 6.3.11 SRI International

- 6.3.12 CMR Surgical

- 6.3.13 Asensus Surgical

- 6.3.14 Siemens Healthineers (Corindus Vascular)

- 6.3.15 Think Surgical

- 6.3.16 Titan Medical

- 6.3.17 MicroPort MedBot

- 6.3.18 Meere Company

- 6.3.19 Medicaroid

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment