PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910940

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910940

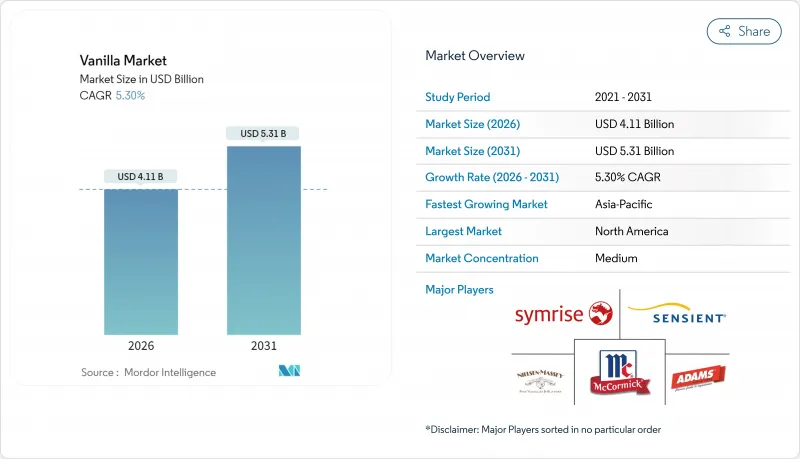

Vanilla - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vanilla market size in 2026 is estimated at USD 4.11 billion, growing from 2025 value of USD 3.90 billion with 2031 projections showing USD 5.31 billion, growing at 5.3% CAGR over 2026-2031.

Segmentation reveals significant opportunities, with paste and extracts holding a prominent position due to their widespread applications, while powder is gaining popularity as a versatile ingredient. Synthetic vanilla remains the dominant choice, attributed to its cost-effectiveness and availability, but natural vanilla is increasingly preferred by consumers seeking authentic and sustainable options. The food and beverage industry continues to be the largest application area, leveraging vanilla's flavor-enhancing properties, while the personal care and cosmetics sector is rapidly expanding, incorporating vanilla for its therapeutic and aromatic benefits. Regionally, North America leads the market due to established demand, while Asia-Pacific emerges as a high-growth region, supported by expanding franchise businesses and increasing consumer spending power.

Global Vanilla Market Trends and Insights

Increasing use in bakery and confectionery enhances market demand

Manufacturers are prioritizing clean-label formulations, driving increased vanilla consumption in the bakery and confectionery sector. Innovations like ultrafine vanilla powder as a clean-label flow additive enhance functionality and highlight the industry's focus on natural ingredients. Premium bakery segments prefer natural vanilla extracts over synthetic ones, commanding price premiums and justifying supply chain investments. This growth aligns with consumer trends favoring artisanal and gourmet foods, especially in developed markets with higher disposable incomes. To ensure authenticity and deter substitutes, the industry adheres to strict regulations, such as the FDA's requirement for vanilla extract to contain at least 35% ethyl alcohol and one unit of vanilla constituent per gallon.

Growing application in nutraceuticals and dietary supplements increases use

Vanillin's therapeutic properties, including anticancer, antidiabetic, antioxidant, and antimicrobial effects, position vanilla as a functional ingredient beyond traditional flavoring applications. FDA recognition of vanillin as Generally Recognized as Safe (GRAS) facilitates its integration into nutraceutical formulations, with pharmaceutical applications representing significant vanillin consumption globally. The nutraceutical market's growth trajectory, supported by aging populations and preventive healthcare trends, creates sustained demand for natural vanilla derivatives. Regulatory frameworks in key markets, including the European Union's Novel Foods Regulation, provide pathways for vanilla-based functional ingredients while ensuring safety standard. Manufacturing innovations, including microbial production methods for natural vanillin from agricultural waste, address supply constraints while maintaining regulatory compliance for health applications.

Limited cultivation regions restrict vanilla bean availability globally

Limited cultivation regions significantly restrain the global vanilla bean supply. Specific climatic conditions, such as tropical climates with consistent temperatures and humidity, are crucial for vanilla cultivation. These stringent requirements narrow down the regions suitable for vanilla farming, capping the production capacity and making it challenging to expand cultivation to new areas. In 2023, global vanilla production hit 7,432 tons, with Madagascar and Indonesia alone accounting for 66.5% of the total output (3,113 tons and 1,832 tons, respectively), according to the Food and Agricultural Organization (FAO) . The dominance of these two countries in production highlights the geographical concentration of vanilla farming, which increases the market's vulnerability to regional disruptions, such as adverse weather conditions or socio-political instability. As a result, these constraints on production directly affect the global availability of vanilla beans, leading to supply challenges and influencing market dynamics.

Other drivers and restraints analyzed in the detailed report include:

- Growing popularity of natural flavoring agents boosts adoption

- Evolving gourmet and premium food trends fuel market demand

- Increasing cases of adulteration reduce consumer confidence in products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paste and Extracts commands a dominant 60.82% market share in 2025, bolstered by their established foothold in food manufacturing and retail markets, where liquid formulations provide distinct processing benefits. Paste and extracts are particularly favored for their concentrated flavor profiles and ease of incorporation into various food and beverage applications. Their versatility makes them indispensable in premium product formulations, including ice creams, desserts, and beverages, where consistent flavor delivery is critical. Additionally, the growing consumer preference for natural and authentic ingredients further strengthens the demand for vanilla pastes and extracts, as they align with clean-label and organic trends.

The powder segment is projected to grow at a 6.39% CAGR through 2031, driven by advancements in ultrafine food powder technology that enhance flowability and processing efficiency. The food industry's shift towards dry blending and extended shelf life formulations boosts its popularity, especially in bakery and confectionery sectors where moisture control is critical. Clean-label trends are increasing demand for natural vanilla powders, which replace synthetic additives without compromising processing. Innovations like spray-drying and encapsulation protect volatile compounds, addressing past quality issues. Additionally, powders offer logistical advantages, such as lower shipping costs and reduced storage needs, particularly beneficial in emerging markets with infrastructure challenges.

The Vanilla Market Report is Segmented by Ingredient Type (Vanilla Bean, Paste and Extracts, and More), Source (Natural, Synthetic), Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands a leading 32.70% share of the global vanilla market in 2025. This dominance stems from the region's robust food processing infrastructure, a pronounced consumer inclination towards premium products, and regulatory policies favoring natural vanilla. The region's mature market, with its emphasis on high-quality ingredients, cements its pivotal role in the global vanilla landscape. Moreover, the region's major food and beverage manufacturers drive a steady demand for vanilla, especially in the premium and natural segments. In 2024, the United States imported vanilla beans worth USD 134,783 thousand, accounting for 30.67% of the global import value, as reported by ITC Trade Map . This significant import activity further underscores North America's reliance on vanilla to meet its market demand.

The Asia-Pacific region showcases the highest growth potential in the global vanilla market, with a projected CAGR of 6.52% through 2031. This growth is driven by the rapid expansion of franchise markets, rising disposable incomes, and evolving consumer preferences toward Western-style desserts and beverages. The increasing adoption of vanilla in bakery, confectionery, and beverage applications across emerging economies in the region further supports this upward trajectory. As urbanization and modernization continue to influence consumer behavior, the Asia-Pacific market is expected to remain a focal point for vanilla producers and suppliers seeking growth opportunities.

Europe represents a mature and highly regulated market, characterized by stringent quality standards and Maximum Residue Limits for pesticide content. These regulations create significant barriers for low-quality imports, thereby supporting the premium positioning of vanilla products in the region. European consumers' preference for high-quality and sustainably sourced vanilla aligns with the market's emphasis on ethical and transparent supply chains. Meanwhile, South America and the Middle East and Africa, though smaller in market size, offer promising growth opportunities. Economic development and urbanization in these regions are driving the expansion of the food industry, creating new avenues for vanilla applications in various food and beverage products.

- McCormick & Company Inc.

- Nielsen-Massey Vanillas Inc.

- Adams Flavors Foods & Ingredients LLC

- Sensient Technologies Corporation

- Symrise AG

- Solvay S.A.

- Givaudan SA

- B&G Foods Inc.

- PROVA SAS

- Firmenich SA

- Archer Daniels Midland Company

- Evolva Holding AG

- Kerry Group plc

- Synergy Flavors Inc.

- Frontier Co-op

- International Flavours & Fragrances Inc.

- Camlin Fine Sciences Ltd.

- Lemur International Inc.

- Lochhead Manufacturing Co.

- Heilala Vanilla Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing use in bakery and confectionery enhances market demand

- 4.2.2 Growing application in nutraceuticals and dietary supplements increases use

- 4.2.3 Growing popularity of natural flavoring agents boosts adoption

- 4.2.4 Evolving gourmet and premium food trends fuel market demand

- 4.2.5 Expansion of ice cream industry fuels vanilla consumption globally

- 4.2.6 High demand from fragrance and cosmetic industry encourages growth

- 4.3 Market Restraints

- 4.3.1 Availability of substitutes like almond extract, maple syrup, etc. hampers its demand

- 4.3.2 Increasing cases of adulteration reduce consumer confidence in products

- 4.3.3 Limited cultivation regions restrict vanilla bean availability globally

- 4.3.4 Stringent quality standards delay product approval and certification

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Ingredient Type

- 5.1.1 Vanilla Beans

- 5.1.2 Paste and Extracts

- 5.1.3 Powder

- 5.1.4 Others

- 5.2 By Source

- 5.2.1 Natural

- 5.2.2 Synthetic

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Bakery Products

- 5.3.1.2 Confectionery

- 5.3.1.3 Dairy Products

- 5.3.1.4 Beverages

- 5.3.1.5 Desserts and Sweets

- 5.3.1.6 Other Food and Beverage Applicationa

- 5.3.2 Personal Care and Cosmetics

- 5.3.3 Pharmaceuticals

- 5.3.4 Other Applications

- 5.3.1 Food and Beverages

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Colombia

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 McCormick & Company Inc.

- 6.4.2 Nielsen-Massey Vanillas Inc.

- 6.4.3 Adams Flavors Foods & Ingredients LLC

- 6.4.4 Sensient Technologies Corporation

- 6.4.5 Symrise AG

- 6.4.6 Solvay S.A.

- 6.4.7 Givaudan SA

- 6.4.8 B&G Foods Inc.

- 6.4.9 PROVA SAS

- 6.4.10 Firmenich SA

- 6.4.11 Archer Daniels Midland Company

- 6.4.12 Evolva Holding AG

- 6.4.13 Kerry Group plc

- 6.4.14 Synergy Flavors Inc.

- 6.4.15 Frontier Co-op

- 6.4.16 International Flavours & Fragrances Inc.

- 6.4.17 Camlin Fine Sciences Ltd.

- 6.4.18 Lemur International Inc.

- 6.4.19 Lochhead Manufacturing Co.

- 6.4.20 Heilala Vanilla Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK