PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911281

Europe Luxury Hotel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

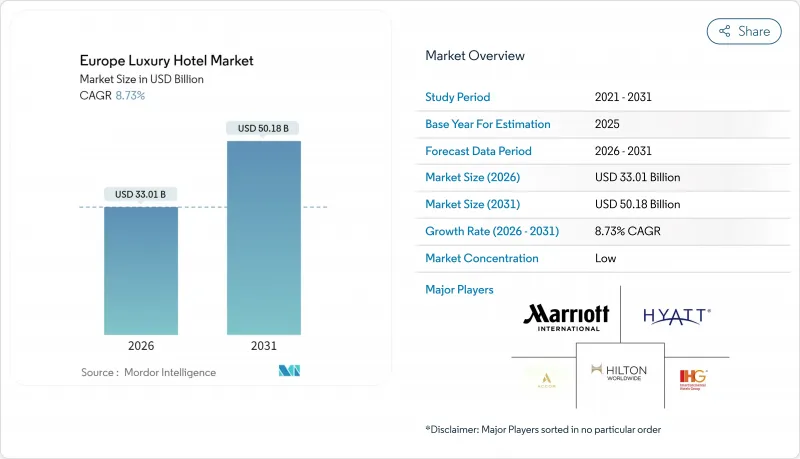

The Europe Luxury Hotel Market is expected to grow from USD 30.36 billion in 2025 to USD 33.01 billion in 2026 and is forecast to reach USD 50.18 billion by 2031 at 8.73% CAGR over 2026-2031.

The growth outpaces general lodging segments and positions the European luxury hotel market as one of the continent's fastest-advancing travel niches. Market performance benefits from expanding global wealth, with ultra-high-net-worth individuals surpassing 625,000 and controlling USD 30 trillion in assets in 2023, creating reliable demand for premium hospitality experiences that directly support rate integrity and occupancy resilience within the European luxury hotel market. Elevated pricing power is already visible, as Spain achieved an 11.50% RevPAR jump to USD 137.90 in 2024 while suite-focused properties in London and Paris have nightly averages well above EUR 1,000 (USD 1,165.70), underscoring how the European luxury hotel market monetizes exclusivity by matching robust demand with differentiated product mixes.

Europe Luxury Hotel Market Trends and Insights

Luxury-travel rebound driven by UHNWI wealth expansion

A robust expansion in ultra-high-net-worth wealth is translating into elevated discretionary outlays on experiential travel, and that spending spike directly lifts occupancy and rate trajectories across the European luxury hotel market. UHNWIs, who now command USD 30 trillion in assets, posted a 242% jump in experiential luxury spend since 2019, a pattern that mirrors the strong pricing dynamics reported by palace-category hotels in London and Paris. Property operators notice the shift because 35% of their guests already fall into the USD 100,000-30 million bracket, broadening the luxury customer base beyond the ultra-elite while still preserving healthy margins. Average European luxury room rates reached EUR 489.09 (USD 570.06) per night in 2024, and when UHNWIs reserve multi-bedroom configurations, the totals frequently exceed EUR 1,000 (USD 1,165.70), reinforcing the revenue-per-key premium that accompanies demand driven by extreme wealth. Hotels therefore continue to invest in curated concierge programs that match unique lifestyle requirements, a practice that solidifies brand loyalty while justifying price lifts that perpetuate revenue growth within the European luxury hotel market. This widening addressable base lowers demand volatility, cushioning operators against cyclical shocks because wealthier travelers historically trim frequency before downgrading quality during downturns. Financial resilience further strengthens expansion pipelines, as lenders grant favorable terms to projects anchored by demonstrated UHNW booking patterns.

Experiential "bleisure" demand among Gen Y & Gen Z travelers

Younger business travelers increasingly fuse workdays with vacation time, creating multi-night itineraries that reshape seasonality assumptions and fortify rate optimization opportunities inside the European luxury hotel market. The "bleisure" phenomenon is most pronounced in Mediterranean resort corridors, yet now reaches city centers, where hotels retrofit executive lounges into co-working studios that support remote calls and group collaboration sessions. Luxury properties that offer curated local activities, gastronomy tours, wellness sessions, and cultural excursions-capture incremental revenue while strengthening direct relationships, which is central because direct booking already rises 13.39% per year and returns commission savings that average twenty-five percentage points compared with OTAs. Spain's record 94 million arrivals in 2024 illustrate how digital nomad visas support longer stays that feed the European luxury hotel market, especially when combined with remote-work flexibility that loosens historical travel windows. Properties answer by bundling workspace amenities with wellness offerings, delivering personalized packages that boost ancillary spend and extend length of stay in both urban and resort settings. The strategy materially improves revenue-per-available-room as occupancy volatility narrows, and it positions luxury flags to withstand fluctuating corporate travel budgets that traditionally dictate weekday demand.

Persistent labor shortages inflating operating costs

Across Europe, the hospitality workforce remains 10-20% below 2019 levels, and luxury hotels feel disproportionate strain because premium service standards demand multilingual, high-skill employees who command pay premiums. Wage bills rose 11.90% between 2022 and 2023, while food-and-beverage departments posted 14.5% inflation, exerting pressure on gross operating profit margins that historically hover near 30% for luxury assets. Brexit compounds challenges in the United Kingdom, where immigration rules restrict seasonal labor, prompting 62% of general managers to cite talent scarcity as their chief operational concern. Properties invest in AI-assisted housekeeping robots and automated reservation chatbots to mitigate labor gaps, yet guests still equate human interaction with luxury, triggering a "Humans-as-Luxury" premium that raises training and retention costs. The tight labor market threatens to trim the overall Europe luxury hotel market CAGR by 1.90% through higher cost ratios unless operators unlock productivity via technology or adaptive service models. Larger chains use centralized human-resource analytics to forecast staffing needs and optimize scheduling, an advantage not easily replicated by independent properties. Over the medium term, vocational-training partnerships and government incentives could replenish talent pipelines, but their efficacy remains uncertain, keeping upward pressure on payroll expenses for at least the next two to four years.

Other drivers and restraints analyzed in the detailed report include:

- EU-wide relaxation of visa-free short-stay rules

- Asset-light management contracts accelerating pipeline conversions

- Rising energy prices eroding GOP margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Suites accounted for 42.86% of 2025 revenue, confirming their status as the largest single contributor to the European luxury hotel market size because affluent travelers display a sustained appetite for privacy, multiple living zones, and bespoke butler services. Villas / Bungalows rank as the fastest-growing sub-segment with an 7.93% CAGR, benefiting from post-pandemic demand for stand-alone units that minimize congregation in shared spaces, particularly on Mediterranean coasts where zoning favors low-density footprints. Operators convert standard floors into junior and executive suites to capture the higher average daily rate these units command, a trend that marginally constrains standard luxury room inventory, now at a 33.10% share. The strategic mix uplift raises revenue per square meter, a metric increasingly used by investors to benchmark asset productivity inside the European luxury hotel market. Penthouses and presidential suites, although only 12.45% of inventory, deliver nightly rates exceeding EUR 2,500 (USD 2,914.25), supporting headline RevPAR but limited by the scarcity of top-floor layouts in heritage buildings. Independent villa rentals introduce competition but often lack the amenity ecosystem of branded resorts, a gap that larger flags exploit through branded residence programs. Consequently, suites and expanded villa offerings continue to underpin premium positioning while fueling ancillary revenue streams such as in-room spa treatments and private chef services.

Consumer orientation toward experiential stays also influences design language and amenity configuration. Residential-style layouts integrate full kitchens, dedicated wellness rooms and flexible dining salons that adapt for private events, mirroring high-net-worth expectations at home and reinforcing stay extension. European regulators, especially in historic cores like Florence, support adaptive reuse guidelines that allow old palazzos to convert into multi-suite configurations without compromising facade integrity, accelerating supply growth in the top tier. Developers maintain cost discipline by employing modular engineering solutions that compress renovation downtime, preserving positive cash flow throughout the upgrade phase. Rate ceilings climb in lockstep with value perception, and technology allows revenue managers to auction premium inventory dynamically, resulting in 12-15% yield improvement over traditional seasonal pricing bands. The continued strength of UHNW demand implies sustained leadership for suites, while the robust trajectory for Villas / Bungalows introduces a second revenue pillar that diversifies the Europe luxury hotel market.

The Europe Luxury Hotel Market Report is Segmented by Room Type (Standard Luxury Room, Suites, Villas/Bungalows, Penthouses & Presidential Suites), Booking Channel (Direct Booking, Online Travel Agencies, and More), Service Type (Business Hotels, Airport Hotels, and More), and Geography (United Kingdom, Germany, France, Spain, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Marriott International (The Ritz-Carlton, St. Regis)

- Hilton Worldwide (Waldorf Astoria, Conrad)

- Accor S.A. (Raffles, Fairmont, Sofitel Legend)

- Hyatt Hotels Corporation (Park Hyatt, Andaz)

- InterContinental Hotels Group (InterContinental, Kimpton)

- Mandarin Oriental Hotel Group

- Four Seasons Hotels & Resorts

- Kempinski Hotels

- Jumeirah Group

- Belmond Ltd.

- Preferred Hotels & Resorts - Legend Collection

- Rocco Forte Hotels

- Rosewood Hotel Group

- Radisson Hotel Group (Radisson Collection)

- Leading Hotels of the World

- Dorchester Collection

- Sani/Ikos Group

- Barriere Group

- Oetker Collection

- Design Hotels AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Luxury-travel rebound driven by UHNWI wealth expansion

- 4.2.2 Experiential "bleisure" demand among Gen-Y & Gen-Z travellers

- 4.2.3 EU-wide relaxation of visa-free short-stay rules

- 4.2.4 Asset-light management contracts accelerating pipeline conversions

- 4.2.5 ESG-linked hotel financing lowering cost of capital (under-reported)

- 4.2.6 Data-driven dynamic pricing platforms boosting RevPAR (under-reported)

- 4.3 Market Restraints

- 4.3.1 Persistent labour shortages inflating operating costs

- 4.3.2 Rising energy prices eroding GOP margins

- 4.3.3 Heightened cyber-risk for direct-booking engines (under-reported)

- 4.3.4 Growing anti-over-tourism regulation in heritage cities (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, € Billion)

- 5.1 By Room Type

- 5.1.1 Standard Luxury Room

- 5.1.2 Suites

- 5.1.3 Villas / Bungalows

- 5.1.4 Penthouses & Presidential Suites

- 5.2 By Booking Channel

- 5.2.1 Direct Booking (Brand Website, Call Center)

- 5.2.2 Online Travel Agencies (OTA)

- 5.2.3 Travel Agents / Tour Operators

- 5.2.4 Corporate Contracts

- 5.3 By Service Type

- 5.3.1 Business Hotels

- 5.3.2 Airport Hotels

- 5.3.3 Suite Hotels

- 5.3.4 Resorts

- 5.3.5 Other Service Types

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Marriott International (The Ritz-Carlton, St. Regis)

- 6.4.2 Hilton Worldwide (Waldorf Astoria, Conrad)

- 6.4.3 Accor S.A. (Raffles, Fairmont, Sofitel Legend)

- 6.4.4 Hyatt Hotels Corporation (Park Hyatt, Andaz)

- 6.4.5 InterContinental Hotels Group (InterContinental, Kimpton)

- 6.4.6 Mandarin Oriental Hotel Group

- 6.4.7 Four Seasons Hotels & Resorts

- 6.4.8 Kempinski Hotels

- 6.4.9 Jumeirah Group

- 6.4.10 Belmond Ltd.

- 6.4.11 Preferred Hotels & Resorts - Legend Collection

- 6.4.12 Rocco Forte Hotels

- 6.4.13 Rosewood Hotel Group

- 6.4.14 Radisson Hotel Group (Radisson Collection)

- 6.4.15 Leading Hotels of the World

- 6.4.16 Dorchester Collection

- 6.4.17 Sani/Ikos Group

- 6.4.18 Barriere Group

- 6.4.19 Oetker Collection

- 6.4.20 Design Hotels AG

7 Market Opportunities & Future Outlook

- 7.1 Ultra-luxury eco-resort developments in under-penetrated Baltic coastlines

- 7.2 Hyper-personalised wellness retreats leveraging AI-driven guest genomics