PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911296

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911296

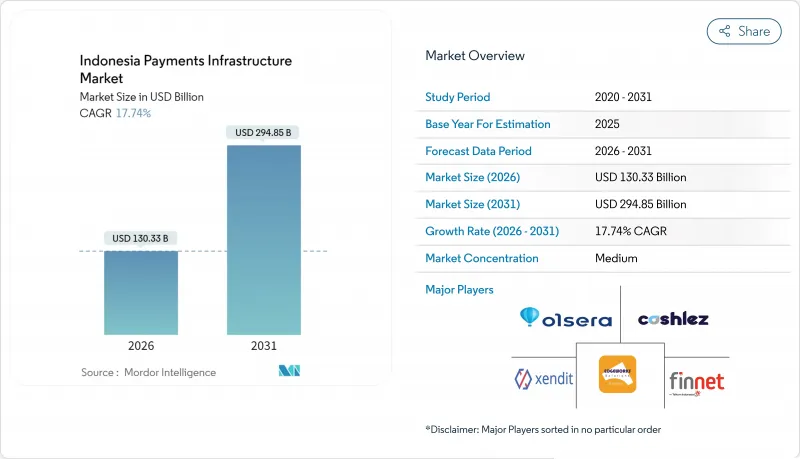

Indonesia Payments Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia payments infrastructure market is expected to grow from USD 110.69 billion in 2025 to USD 130.33 billion in 2026 and is forecast to reach USD 294.85 billion by 2031 at 17.74% CAGR over 2026-2031.

The market's momentum stems from Bank Indonesia's real-time rail (BI-FAST), rapid merchant onboarding to the national QRIS code, and rising mobile-wallet use among the 282 million-strong population spread across 17,500 islands. Digital payments now anchor the nation's position as Southeast Asia's largest internet economy, supported by record foreign investment inflows and policy alignment between Bank Indonesia and the Financial Services Authority (OJK). Interoperable rails have compressed settlement cycles from T+1 to real time, unlocking liquidity benefits for 64.2 million MSMEs. At the same time, infrastructure gaps beyond Java keep latency-sensitive services from achieving uniform quality nationwide.

Indonesia Payments Infrastructure Market Trends and Insights

Increasing Mobile-Wallet Adoption among Unbanked Population

Mobile wallets are closing Indonesia's 74% unbanked and underbanked gap by providing first-time access to formal finance, especially outside Java. DANA's user base climbed to 140 million in early 2025 by embedding micro-savings and bill-payment features suited to rural needs. Government programs such as SisBerdaya channel working-capital grants to women-led micro firms, strengthening wallet stickiness for everyday commerce. Improved 4G coverage under the Palapa Ring project reduces connectivity barriers, letting households in Maluku and Papua leapfrog branch-based banking. As wallets become primary stores of value rather than add-on payment methods, transaction frequency and average balances rise, lifting fee and float income for providers.

Government Push for QRIS Unified QR Code Accelerating Merchant Acceptance

QRIS removes the need for multiple QR codes, enabling 34.7 million merchants to accept payment from any licensed wallet or mobile-bank app. The merchant discount rate caps at 0.7%, well below the 2-3% typical of international card schemes. Mandatory use for selected tax and utility payments forces even micro stores to adopt the standard, creating a network effect that drives daily usage. Cross-border extensions allow Indonesian tourists to pay with QRIS in Thailand and Malaysia and will include Japan and China by late 2025. The standard therefore evolves from domestic harmonization to a regional acceptance brand, lifting transaction volumes for service providers positioned to handle multi-currency settlement.

Inter-Island Telecom Infrastructure Gaps Limiting Latency-Sensitive Transactions

Only 4.9 fixed-broadband lines per 100 citizens slows real-time payment reliability outside Java. Failed QRIS scans and BI-FAST time-outs erode consumer trust, especially in Maluku and Nusa Tenggara where submarine cable repairs remain protracted. Government-funded SATRIA satellite and private entrants such as Starlink extend coverage, yet high tariff plans impede mass adoption. The resulting two-speed payment ecosystem compels PSPs to retain fallback offline QR modes, increasing operating cost.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Domestic Real-Time Payment Rail BI-FAST Boosting Bank-Fintech Integrations

- Rising Foreign Investment in Indonesia's O2O Payments Acquiring Market

- Fragmented Regulatory Oversight between BI and OJK Complicates Licensing Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Server-based e-wallets form the fastest-growing category with 21.05% CAGR for 2026-2031, whereas card payments maintain scale leadership with 44.32% share of Indonesia payments infrastructure market in 2025. The Indonesia payments infrastructure market size for wallet-based transactions is projected to rise alongside super-app penetration and Buy-Now-Pay-Later integrations. BNPL volumes grew 41.9% in Q1 2025, adding credit-led stickiness to wallet ecosystems. Card tokenization and contactless support remain vital for higher-ticket categories, yet issuers face margin pressure from lower interchange and QRIS cost advantages. Second-tier instruments such as virtual accounts and interbank transfers continue to link high-value corporate payments, but growth trails the consumer wallet surge.

E-wallet providers bundle micro-loans, insurance, and investment tabs, creating ecosystem lock-in that suppresses customer churn. Kredivo captures offline instalment spending in tier-2 cities via QRIS PayLater plugs at convenience stores, broadening network effects. Card issuers seek relevance by co-branding with e-commerce giants and embedding tokenized cards into wallets, exemplified by BRI's partnership with Tokopedia for one-click checkout. Real-time direct-debit mandates through BI-FAST are scheduled for 2026, promising new hybrid flows that blur lines between card and wallet rails within the Indonesia payments infrastructure market.

Software and platform solutions commanded 59.45% of revenue in 2025 and should grow at 20.12% CAGR through 2031. Middleware that unifies API calls across QRIS, BI-FAST, SKNBI, and RTGS grants acquirers a single-point orchestration layer. Fraud-detection modules leveraging machine learning screen volumes in milliseconds, a prerequisite for scaling Indonesia payments infrastructure market transactions without inflating chargeback losses. POS hardware continues to sell into micro-merchant segments, yet profit pools migrate to recurring SaaS fees for device management and data analytics.

Cloud-native deployment trims capex and speeds roll-outs in remote islands, aligning with Bank Indonesia's 2030 blueprint for interoperable micro-services. National Payment ID and Digital Rupiah pilots require high-assurance identity verification stacks, prompting local integrators to license biometric SDKs from global vendors such as Fiserv. Services teams earn revenue maintaining PCI-DSS compliance and orchestrating penetration tests, while international firms partner with Indonesian datacenter operators to satisfy data-residency rules.

Indonesia Payments Infrastructure Market is Segmented by Payment Instrument (Card-Based Payments and More), Component (Hardware and More), Payment Channel (In-Store (POS), Online (E-Commerce & In-App), In-App P2P Transfers), (Merchant Vertical Retail & Grocery and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- GHL Indonesia (GHL Systems Bhd)

- PT Cashlez Worldwide Indonesia

- Xendit

- Moka POS (GoTo Financial)

- PT Jalin Pembayaran Nusantara

- Pawoon Indonesia

- OY! Indonesia

- PT Finnet Indonesia

- iPaymu (Inti Prima Mandiri Utama)

- PT Artajasa Pembayaran Elektronis

- Ant Group (Dana - PT Espay Debit Indonesia Koe)

- ShopeePay (SeaMoney)

- Centerm

- Ingenico (Worldline Group)

- Pax Technology

- Fiserv, Inc.

- Pine Labs

- Payfazz

- MC Payment Indonesia

- Edgeworks Solutions Pte Ltd

- Olsera.com

- Kredivo (PT FinAccel Teknologi Indonesia)

- Midtrans

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing mobile wallet adoption among unbanked population in outer islands

- 4.2.2 Government push for QRIS unified QR code accelerating merchant acceptance

- 4.2.3 Rapid expansion of domestic real-time payment rail BI-FAST boosting bank-fintech integrations

- 4.2.4 Rising foreign investment in Indonesia's O2O payments acquiring market

- 4.2.5 Migration of government social disbursements to digital channels in Eastern Indonesia

- 4.3 Market Restraints

- 4.3.1 Inter-island telecom infrastructure gaps limiting latency-sensitive transactions

- 4.3.2 Fragmented regulatory oversight between BI and OJK complicates licensing timelines

- 4.3.3 High merchant attrition due to price wars among acquirers

- 4.3.4 Limited consumer trust outside Java in card-not-present transactions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Payment Instrument

- 5.1.1 Card-based Payments

- 5.1.2 Real-Time Bank Transfers (BI-FAST, SKNBI, RTGS)

- 5.1.3 E-money

- 5.1.4 QRIS Payments

- 5.1.5 Other Emerging Instruments (BNPL, Tokenized Cards)

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software / Platform

- 5.2.3 Services

- 5.3 By Payment Channel

- 5.3.1 In-store (POS)

- 5.3.2 Online (E-commerce & In-app)

- 5.3.3 In-app P2P Transfers

- 5.4 By Merchant Vertical

- 5.4.1 Retail & Grocery

- 5.4.2 F&B & Quick-service Restaurants

- 5.4.3 Transportation & Mobility

- 5.4.4 Travel & Hospitality

- 5.4.5 Other Merchant Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 GHL Indonesia (GHL Systems Bhd)

- 6.4.2 PT Cashlez Worldwide Indonesia

- 6.4.3 Xendit

- 6.4.4 Moka POS (GoTo Financial)

- 6.4.5 PT Jalin Pembayaran Nusantara

- 6.4.6 Pawoon Indonesia

- 6.4.7 OY! Indonesia

- 6.4.8 PT Finnet Indonesia

- 6.4.9 iPaymu (Inti Prima Mandiri Utama)

- 6.4.10 PT Artajasa Pembayaran Elektronis

- 6.4.11 Ant Group (Dana - PT Espay Debit Indonesia Koe)

- 6.4.12 ShopeePay (SeaMoney)

- 6.4.13 Centerm

- 6.4.14 Ingenico (Worldline Group)

- 6.4.15 Pax Technology

- 6.4.16 Fiserv, Inc.

- 6.4.17 Pine Labs

- 6.4.18 Payfazz

- 6.4.19 MC Payment Indonesia

- 6.4.20 Edgeworks Solutions Pte Ltd

- 6.4.21 Olsera.com

- 6.4.22 Kredivo (PT FinAccel Teknologi Indonesia)

- 6.4.23 Midtrans

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment