PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911298

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911298

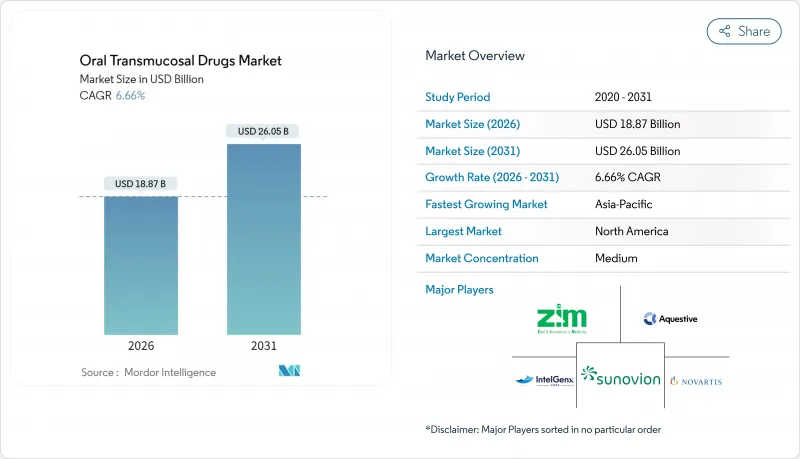

Oral Transmucosal Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The oral transmucosal drugs market was valued at USD 17.69 billion in 2025 and estimated to grow from USD 18.87 billion in 2026 to reach USD 26.05 billion by 2031, at a CAGR of 6.66% during the forecast period (2026-2031).

Sustained growth comes from established use in opioid dependence treatment, rapid adoption in seizure rescue, and expanding applications in pain and psychedelic therapies. Continuous advances in sublingual and buccal film technologies shorten onset times and improve bioavailability, while the preference for needle-free, swallow-free dosing boosts uptake among pediatric and geriatric patients. Regulatory agencies in the United States, Europe, and China have accelerated reviews for innovative formulations, encouraging pipelines that target high-value CNS indications. Competitive intensity has risen as large pharmaceutical companies license specialty film platforms and as intellectual-property cliffs for first-generation buprenorphine products open the door to generics and next-generation designs.

Global Oral Transmucosal Drugs Market Trends and Insights

Growing burden of CNS and pain disorders

Rising prevalence of opioid use disorder, epilepsy, and breakthrough cancer pain sustains demand for fast-acting transmucosal options. The FDA approval of buccal non-opioid pain drug suzetrigine in 2025 signals regulator support for safer pain alternatives . Pediatric seizure-cluster needs were addressed when Libervant received pediatric approval, broadening age coverage for rapid benzodiazepine rescue. Aging populations with dysphagia further tilt prescribing toward films and sprays that dissolve without water. Together, epidemiology and usability reinforce the long-run trajectory of the oral transmucosal drugs market.

Post-2023 surge in R&D pipelines and approvals

Expanded breakthrough and orphan-drug designations after 2023 shortened review cycles. Examples include RizaFilm for migraine and the re-scoped buprenorphine dosing guidance that cleared higher-strength products. Psychedelic candidates such as atai Life Sciences' DMT buccal film advanced to Phase 2, pointing to novel CNS indications entering late-stage development. Faster approvals encourage investment, lifting the market growth curve.

Limited drug-load and taste-masking challenges

Films rarely exceed a few milligrams of active ingredient without compromising dissolution, restricting the modality to potent molecules. Bitter APIs such as buprenorphine demand sophisticated flavor-blocking that lengthens development and raises cost . Formulators are evaluating permeation enhancers, yet every new excipient faces toxicology hurdles that may delay approvals and weigh on near-term market growth.

Other drivers and restraints analyzed in the detailed report include:

- Patient preference for needle-free, swallow-free dosing

- Rapid adoption of transmucosal rescue in EMS protocols

- Patent cliffs for first-generation opioid-dependence films

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sublingual tablets held 41.98% share of oral transmucosal drugs market size in 2025 on the strength of established prescribing habits and broad reimbursement. Continuous film innovation, however, allows buccal tablets to register a 7.12% CAGR to 2031, propelled by pediatric formulations that dissolve slowly and reduce dosing frequency. Oro-dispersible films benefit from PharmFilm technology, giving poorly soluble molecules higher bioavailability in migraine and psychiatric pipelines. Liquids and sprays carve out rescue niches for anaphylaxis and neonatal seizures, while medicated confectionaries improve compliance in chronic settings. Temperature-stable tablet formats targeting 40°C ambient storage broaden access in tropical regions.

Although tablets dominate, manufacturers integrate mucoadhesive polymers to extend retention time and enhance permeation. Films deliver rapid relief-often within two minutes-making them strategic for breakthrough pain episodes. Elevated demand in emerging markets encourages investment in ambient-stable blister packs that reduce cold-chain burden. Collectively, product diversity maintains growth momentum across the oral transmucosal drugs market.

The sublingual pathway commanded 35.22% oral transmucosal drugs market share in 2025 thanks to rich vascularization that speeds systemic uptake. Buccal delivery grows 7.70% annually through 2031 by catering to therapies that require longer contact time, such as mood stabilizers and analgesics. Lingual and gingival routes remain specialized, addressing localized periodontal pain or targeted hormone therapy.

Permeation enhancers such as bile-salt derivatives improve buccal absorption of peptides that previously required injection. Mucoadhesive patches anchored to the cheek maintain plasma levels over eight hours, reducing rescue-dose frequency. As bioavailability data build, formularies are widening coverage, reinforcing the upward path for buccal applications in the oral transmucosal drugs market.

The Oral Transmucosal Drugs Market Report Segments the Industry Into by Product Type (Sublingual Tablets, Buccal Tablets, and More), by Route of Administration (Sublingual Mucosa, Buccal Mucosa, and More), by Indication (Opioid Dependence, and More), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.10% revenue in 2025, benefiting from breakthrough-therapy pathways and wide insurance coverage. The FDA's 2024 update removing buprenorphine dose ceilings has encouraged higher-strength films that enhance retention in opioid-use-disorder programs. Academic-industry collaborations at leading U.S. epilepsy centers speed recruitment for pediatric trials, consolidating the region's leadership.Asia-Pacific registers the fastest 8.52% CAGR through 2031. China's National Medical Products Administration implemented accelerated reviews that cleared more than 60 innovative drugs in 2024, including transmucosal formulations for pain and oncology. Investment in peptide and high-potency-film production by contract manufacturer WuXi STA underscores the region's scale advantage. Regulatory harmonization initiatives in ASEAN facilitate cross-border market entry, expanding total addressable patients.Europe maintains steady growth on the back of the European Medicines Agency Pediatric-Use Marketing Authorization, which encourages child-friendly formulations. Recent approval of Buprenorphine Neuraxpharm illustrates ongoing innovation within mature indications . National health systems increasingly reimburse films that demonstrate superior adherence over oral tablets.Middle East & Africa and South America deliver incremental volume where temperature-stable films bypass cold-chain gaps. Humanitarian programs that stock oral transmucosal naloxone films for opioid toxicity build early market presence, offering future upside once economic conditions improve. Combined, geographic diversification supports sustained expansion of the oral transmucosal drugs market.

- Aquestive Therapeutics

- Intelgenx

- ZIM Laboratories

- C.L. Pharm Co., Ltd.

- Novartis

- Sunovion Pharmaceuticals

- Pfizer

- GW Pharmaceuticals (Jazz)

- Seoul Pharmaceuticals

- Shilpa Therapeutics

- Indivior

- Cure Pharmaceutical

- Catalent

- Takeda Pharmaceuticals

- Dr. Reddy's Laboratories

- Glenmark Pharmaceuticals

- AdhexPharma

- Astellas Pharma

- BioDelivery Sciences (Collegium)

- Johnson & Johnson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Target CNS And Pain Disorders

- 4.2.2 Surge In R&D Pipelines & Regulatory Approvals Post-2023

- 4.2.3 Preference For Needle-Free, Swallow-Free Dosage Forms Among Geriatrics & Paediatrics

- 4.2.4 Rapid Take-Up Of Transmucosal Rescue Therapies In Community Ems Protocols

- 4.2.5 Micro-Dose Psychedelic & Cannabinoid Films Entering Phase-Ii Pipelines

- 4.2.6 Temperature-Stable Film Formulations Supporting Low-Cold-Chain Markets

- 4.3 Market Restraints

- 4.3.1 Limited Drug-Load & Taste-Masking Challenges

- 4.3.2 Patent Cliffs For First-Generation Opioid Dependence Films

- 4.3.3 Emerging Competition From Intranasal Powder Auto-Injectors

- 4.3.4 Persistent Fda Concerns On Paediatric Dosing Uniformity For High-Potency Apis

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Films, muco-adhesive polymers, permeation enhancers)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Product Type

- 5.1.1 Sublingual Tablets

- 5.1.2 Buccal Tablets

- 5.1.3 Oro-dispersible Films

- 5.1.4 Buccal Films

- 5.1.5 Liquids & Sprays

- 5.1.6 Medicated Confectionaries (Lozenges, Lollipops, Gums)

- 5.1.7 Others (Patches, Gels)

- 5.2 By Route of Administration

- 5.2.1 Sublingual Mucosa

- 5.2.2 Buccal Mucosa

- 5.2.3 Lingual

- 5.2.4 Gingival

- 5.3 By Indication

- 5.3.1 Opioid Dependence

- 5.3.2 Seizure Clusters & Epilepsy

- 5.3.3 Pain / Oncology Pain

- 5.3.4 Nausea & Vomiting

- 5.3.5 Erectile Dysfunction

- 5.3.6 Others

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online & Specialty Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Aquestive Therapeutics

- 6.3.2 IntelGenx Corp.

- 6.3.3 ZIM Laboratories

- 6.3.4 C.L. Pharm Co., Ltd.

- 6.3.5 Novartis AG

- 6.3.6 Sunovion Pharmaceuticals

- 6.3.7 Pfizer Inc.

- 6.3.8 GW Pharmaceuticals (Jazz)

- 6.3.9 Seoul Pharmaceuticals

- 6.3.10 Shilpa Therapeutics

- 6.3.11 Indivior PLC

- 6.3.12 Cure Pharmaceutical

- 6.3.13 Catalent Inc.

- 6.3.14 Takeda Pharmaceutical

- 6.3.15 Dr. Reddy's Laboratories

- 6.3.16 Glenmark Pharmaceuticals

- 6.3.17 AdhexPharma

- 6.3.18 Astellas Pharma

- 6.3.19 BioDelivery Sciences (Collegium)

- 6.3.20 Johnson & Johnson (Janssen)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment