PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911308

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911308

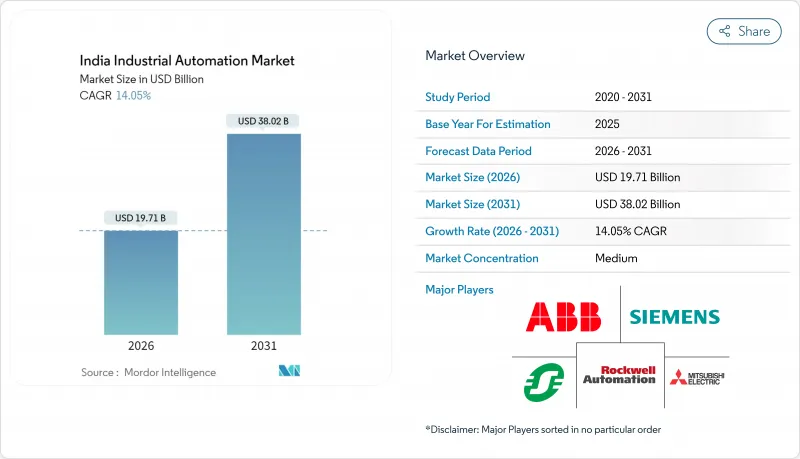

India Industrial Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India industrial automation market was valued at USD 17.28 billion in 2025 and estimated to grow from USD 19.71 billion in 2026 to reach USD 38.02 billion by 2031, at a CAGR of 14.05% during the forecast period (2026-2031).

Ongoing policy support, rapid modernization of legacy plants, and falling sensor prices together sustain double-digit expansion. Foreign direct investment swelled after the Production Linked Incentive program linked cash disbursements to Industry 4.0 readiness, triggering a wave of brownfield retrofits that lift productivity and export competitiveness. Multinationals increased local manufacturing footprints to shorten supply chains and avoid import duties, while mid-tier enterprises adopted cloud-based execution software to overcome capital constraints. Meanwhile, private 5G pilots and edge computing platforms reduced latency concerns and encouraged predictive maintenance rollouts in process plants. Cybersecurity readiness and skilled labour availability remain watchpoints, yet the policy-driven upgrade cycle keeps demand on a strong growth path.[1]

India Industrial Automation Market Trends and Insights

Accelerated Make in India Manufacturing Investments Drive Automation Uptake

Foreign direct investment flowing into the country after 2024 elevated overall factory-automation budgets. Siemens committed INR 10,000 million (USD 120.5 million) to expand production of drives and controllers, while Mitsubishi Electric directed INR 2,200 million (USD 26.5 million) toward local assembly lines. These brownfield upgrades emphasize scalable, modular equipment rather than greenfield capacity, enabling faster returns and higher asset utilization. Clusters in Gujarat, Maharashtra, and Tamil Nadu attract allied suppliers, spreading technical know-how along the value chain. Export-oriented manufacturers also integrate global quality benchmarks, tightening demand for advanced motion control, energy-efficient drives, and machine safety systems.

Government PLI Scheme Incentives Accelerate Discrete Industry Modernization

The Production Linked Incentive program disbursed INR 140,200 million (USD 1.69 billion) by 2025 to discrete industries on the condition of demonstrable Industry 4.0 compliance. Automotive applicants must showcase fully networked production lines with PLC-controlled stations and real-time quality monitoring to keep receiving tranche payments. Electronics manufacturers face even stricter benchmarks such as predictive maintenance capability and 100 percent traceability across subcontractors. This rule design amplifies downstream demand because Tier-1 suppliers press Tier-3 vendors to install compatible automation layers, multiplying market pull across component, tooling, and packaging partners.

High CAPEX Sensitivity Among Tier-3 Suppliers Constrains Automation Adoption

Smaller component vendors often operate on 8-12% EBITDA margins and face 90-120-day receivable cycles, leaving limited free cash for automation. Comprehensive upgrades can require capital equal to 15-20% of annual revenue, a hurdle that many cannot clear without subsidized loans. While the credit guarantee scheme reduces risk weightings for lenders, collateral requirements and approval delays still deter quick uptake. This creates a bifurcated ecosystem where Tier-1 and Tier-2 firms digitize rapidly while Tier-3 lags, potentially undermining the synchronous production models favoured by OEMs.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Brownfield Digital Retrofits Across MSMEs

- Sharp Decline in Industrial Sensor Costs Enables Widespread IoT Adoption

- Fragmented System-Integrator Ecosystem Creates Quality Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial control systems retained 37.15% India industrial automation market share in 2025, anchored by robust PLC demand in automotive and DCS rollouts in chemicals. Software revenue, however, is climbing at a 15.05% CAGR as cloud-hosted manufacturing execution suites become subscription-priced, lowering entry hurdles. The India industrial automation market size for software solutions is projected to double between 2026 and 2031 as mid-tier firms integrate ERP, MES, and quality analytics into a single stack. Field devices gained from cheaper sensors, expanding predictive-maintenance deployments in steel mills and food processing plants. Service revenue also rose because hybrid architectures need ongoing cyber-patching and model retraining.

Enhanced cybersecurity modules and role-based access controls now come bundled inside most control-system upgrades, addressing rising insurance scrutiny. Meanwhile, product lifecycle management software wins orders in automotive and aerospace because regulatory audit trails demand digitally signed design revisions. Human-machine interfaces adopt tablet-style touchscreens, shortening operator training to under three days. Collectively, these shifts pivot revenue toward recurring software subscriptions and managed services, though hardware remains foundational.

Programmable automation accounted for 41.45% revenue in 2025, favoured for mixed-model assembly lines that need rapid recipe changes. Yet integrated hyper-automation is expanding at a 16.35% CAGR as plants converge AI, machine vision, and edge analytics into closed-loop optimization. Early adopters like Tata Steel logged a 20% cut in unplanned downtime after overlaying AI predictive models on legacy SCADA. The India industrial automation market size tied to hyper-automation could reach USD 12.35 billion by 2031 if current adoption curves hold.

Transitioning to hyper-automation requires unified data layers, so vendors bundle MQTT brokers and OPC-UA gateways with controller upgrades. Workforce retraining budgets rose 25% in 2025 as firms invest in multi-skilling programs to align operators with AI-assisted workflows. Regulatory audits now prefer automation systems that log every process parameter for traceability, further reinforcing the move toward integrated stacks.

The India Industrial Automation Market Report is Segmented by Solution (Industrial Control Systems, Field Devices, Software, and Services), Automation Type (Fixed, Programmable, Flexible, and Integrated), End-User Industry (Automotive, Oil and Gas, Food and Beverage, Pharmaceuticals, Power, Electronics, and More), and Deployment Mode (On-Premise, Cloud, and Hybrid). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens Limited

- ABB India Limited

- Yokogawa India Ltd.

- Rockwell Automation India Pvt. Ltd.

- Schneider Electric India Pvt. Ltd.

- Honeywell Automation India Ltd.

- Emerson Automation Solutions India Pvt. Ltd.

- Mitsubishi Electric India Pvt. Ltd.

- Omron Automation Private Limited

- Bosch Rexroth India Pvt. Ltd.

- B and R Industrial Automation Pvt. Ltd.

- Larsen and Toubro Ltd.

- Fanuc India Pvt. Ltd.

- Delta Electronics India Pvt. Ltd.

- GE Power India Ltd.

- Tata Elxsi Ltd.

- Wipro Enterprises Pvt. Ltd.

- Akyapak India Pvt. Ltd.

- Bajaj Electricals Ltd.

- Bharat Heavy Electricals Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated "Make in India" manufacturing investments

- 4.2.2 Government PLI scheme incentives for discrete industries

- 4.2.3 Rapid expansion of brownfield digital retrofits across MSMEs

- 4.2.4 Sharp decline in industrial sensor costs

- 4.2.5 Under-the-radar: Start-up led AI-driven predictive maintenance demand from mid-tier plants

- 4.2.6 Under-the-radar: Carbon-credit linked automation for energy-intensive metals vertical

- 4.3 Market Restraints

- 4.3.1 High CAPEX sensitivity among Tier-3 suppliers

- 4.3.2 Fragmented system-integrator ecosystem quality gaps

- 4.3.3 Under-the-radar: Cyber-insurance premium escalation for OT networks

- 4.3.4 Under-the-radar: Skilled labour flight from industrial clusters

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Solution

- 5.1.1 Industrial Control Systems

- 5.1.1.1 Distributed Control System (DCS)

- 5.1.1.2 Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.3 Programmable Logic Controller (PLC)

- 5.1.1.4 Human Machine Interface (HMI)

- 5.1.1.5 Other Control Systems

- 5.1.2 Field Devices

- 5.1.2.1 Sensors and Transmitters

- 5.1.2.2 Valves and Actuators

- 5.1.2.3 Motors and Drives

- 5.1.2.4 Robotics

- 5.1.2.5 Other Field Devices

- 5.1.3 Software

- 5.1.3.1 Product Lifecycle Management (PLM)

- 5.1.3.2 Enterprise Resource Planning (ERP)

- 5.1.3.3 Manufacturing Execution System (MES)

- 5.1.3.4 Other Software

- 5.1.4 Services

- 5.1.4.1 Integration

- 5.1.4.2 Maintenance and Training

- 5.1.1 Industrial Control Systems

- 5.2 By Automation Type

- 5.2.1 Fixed Automation

- 5.2.2 Programmable Automation

- 5.2.3 Flexible or Modular Automation

- 5.2.4 Integrated or Hyper-Automation

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Oil and Gas

- 5.3.3 Food and Beverage

- 5.3.4 Pharmaceuticals and Life Sciences

- 5.3.5 Power and Utilities

- 5.3.6 Electronics and Semiconductors

- 5.3.7 Chemicals and Petrochemicals

- 5.3.8 Metals and Mining

- 5.3.9 Fast-Moving Consumer Goods (FMCG)

- 5.3.10 Packaging

- 5.3.11 Others

- 5.4 By Deployment Mode

- 5.4.1 On-Premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Siemens Limited

- 6.4.2 ABB India Limited

- 6.4.3 Yokogawa India Ltd.

- 6.4.4 Rockwell Automation India Pvt. Ltd.

- 6.4.5 Schneider Electric India Pvt. Ltd.

- 6.4.6 Honeywell Automation India Ltd.

- 6.4.7 Emerson Automation Solutions India Pvt. Ltd.

- 6.4.8 Mitsubishi Electric India Pvt. Ltd.

- 6.4.9 Omron Automation Private Limited

- 6.4.10 Bosch Rexroth India Pvt. Ltd.

- 6.4.11 B and R Industrial Automation Pvt. Ltd.

- 6.4.12 Larsen and Toubro Ltd.

- 6.4.13 Fanuc India Pvt. Ltd.

- 6.4.14 Delta Electronics India Pvt. Ltd.

- 6.4.15 GE Power India Ltd.

- 6.4.16 Tata Elxsi Ltd.

- 6.4.17 Wipro Enterprises Pvt. Ltd.

- 6.4.18 Akyapak India Pvt. Ltd.

- 6.4.19 Bajaj Electricals Ltd.

- 6.4.20 Bharat Heavy Electricals Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment