PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911323

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911323

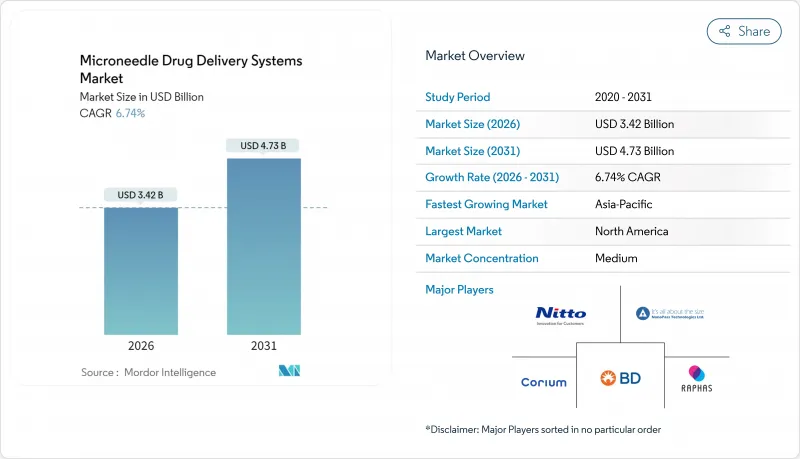

Microneedle Drug Delivery Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The microneedle drug delivery systems market is expected to grow from USD 3.20 billion in 2025 to USD 3.42 billion in 2026 and is forecast to reach USD 4.73 billion by 2031 at 6.74% CAGR over 2026-2031.

The expansion is propelled by thermostable vaccine patches that bypass cold-chain logistics, widening access in low-resource settings. Other growth catalysts include rising chronic-disease prevalence, regulatory clarity around combination products, and capacity additions by leading device manufacturers. Competitive advantage increasingly hinges on scalable roll-to-roll fabrication, precision drug-loading technologies, and integration with digital therapeutics. Meanwhile, technology risks-such as limited payload per patch and inter-patient skin-microflora variability-are being mitigated through nanoparticle encapsulation and real-time dose-feedback systems. As a result, the microneedle drug delivery systems market is transitioning from niche research to mainstream adoption across pharmaceutical and cosmetic value chains.

Global Microneedle Drug Delivery Systems Market Trends and Insights

Rising Prevalence of Chronic Diseases Requiring Painless Self-Administration

Growing diabetes and autoimmune caseloads amplify the need for self-deliverable, pain-free therapies. A randomized trial showed adalimumab bioavailability via microneedle delivery matching subcutaneous injection while cutting local reactions by 40%. Health-system labor shortages further elevate demand for home-use patches that keep patients adherent without clinician oversight. This confluence of demographics and workload pressure assures steady support for the microneedle drug delivery systems market.

Increasing Demand for a Safer Substitute to Conventional Hypodermic Injections

The growing concern over needlestick injuries and the prevalence of needle phobia are driving the demand for safer alternatives to conventional hypodermic injections. According to a research study published in October 2022, the overall prevalence rate of injuries from needlesticks and sharp objects was determined to be 25.2%, with nursing students experiencing the highest frequency. This significant risk to healthcare workers has created an urgent need for safer drug delivery alternatives. The prevalence of needle phobia is also substantial, with studies showing that 20-50% of teenagers and 20-30% of young adults experience this condition, leading to treatment avoidance and reduced medication effectiveness.

Limited Drug-Loading Capacity Per Patch

Most dissolving formats hold 1-10 mg per patch, constraining high-dose biologics. Multilayer casting and nanoparticle encapsulation can raise capacity but introduce extra validation hurdles. The FDA's 2024 draft guidance now requires explicit demonstration of consistent drug-release profiles, stretching development timelines.

Other drivers and restraints analyzed in the detailed report include:

- Advantages Over Conventional Injections Improving Patient Compliance

- Technological Advances in Dissolving/Biodegradable Microneedles

- Stringent Regulatory Hurdles & Lack of Specific Guidance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dissolving formats retained 33.12% microneedle drug delivery systems market share in 2025 due to sharps-waste elimination and biodegradability. Hydrogel-forming types, however, are pacing at a 6.95% CAGR given their reservoir-style drug release that suits complex regimens. Solid arrays continue serving skin-pretreatment niches, while hollow configurations enable larger-volume delivery despite costlier tooling. Hydrogel systems linked with glucose sensors are in late-stage trials for automated insulin titration, signaling disruptive potential.

Emerging automated coating lines and in-process vision inspection lower scrap rates, helping hydrogel units close the cost gap. As FDA guidance on combination products matures, regulatory parity between dissolving and hydrogel types is expected, opening broader revenue streams for the microneedle drug delivery systems market.

Polymers contributed 29.55% of microneedle drug delivery systems market size in 2025 due to tunable mechanics and established molding know-how. Carbohydrates are charting an 7.78% CAGR, driven by maltodextrin and trehalose patches that keep vaccines potent without refrigeration. Silicon remains critical for rigid solid arrays, whereas metals serve specialty high-strength use cases. Regulators increasingly favor naturally derived substrates, accelerating carbohydrate adoption.

Process simplicity and lower carbon footprints strengthen the economic case for carbohydrate arrays, especially in lower-income regions striving for sustainable healthcare solutions. This shift underpins diversification within the microneedle drug delivery systems market material landscape.

The Microneedle Drug Delivery Systems Market Report is Segmented by Device Type (Solid, Hollow, Coated, Dissolving, Hydrogel-Forming), Material (Silicon, Metals, Polymers, Carbohydrates, Others), Application (Vaccination, Insulin Delivery, and More), End-User (Hospitals & Clinics, Pharmaceutical & Biotech Companies, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's mature payor mix, coupled with early adopter clinicians, cements premium pricing power for next-gen patches. Government grants, such as the USD 50 million Patch Forward program, accelerate clinical translation, while private capital fuels start-up activity concentrated in Boston and the Bay Area.

Asia-Pacific's superior CAGR arises from large-scale immunization drives and chronic-disease caseloads. Supply-chain localization policies in China and India are prompting multinationals to site roll-to-roll lines regionally, tightening lead times and lowering labor costs. Harmonized ASEAN device rules, though nascent, are expected to trim duplicate testing expenses, lowering IFRS risk for exporters.

Europe's coordinated procurement channels through entities like GAVI spur volume buys once CE-mark approval lands. Sustainability regulations, including Germany's VerpackG, favor dissolving and carbohydrate arrays that shrink post-use waste. Emerging markets across Latin America and Africa are piloting thermostable measles and polio patches under WHO oversight, heralding future volume growth.

- 3M

- Beckton Dickinson

- CosMED Pharmaceutical Co., Ltd.

- Debiotech SA

- Kimoola Co., Ltd.

- Lohmann Therapie-Systeme AG

- Micron Biomedical Inc.

- Microdermics Inc.

- Nanopass Technologies Ltd.

- Nitto Denko

- QuadMedicine Inc.

- Raphas Co., Ltd.

- SNvia Co., Ltd.

- Valeritas Inc.

- Vaxxas Pty Ltd.

- Zosano Pharma Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic diseases requiring painless self-administration

- 4.2.2 Advantages over conventional injections improving patient compliance

- 4.2.3 Growing vaccination initiatives adopting patch-based delivery

- 4.2.4 Technological advances in dissolving/biodegradable microneedles

- 4.2.5 Cold-chain-independent thermostable patches for low-income settings

- 4.2.6 Integration with wearable IoT-enabled drug-delivery platforms

- 4.3 Market Restraints

- 4.3.1 Limited drug-loading capacity per patch

- 4.3.2 Stringent regulatory hurdles & lack of specific guidance

- 4.3.3 Skin-microflora variability impacting dose accuracy

- 4.3.4 High CAPEX for roll-to-roll microneedle fabrication lines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Solid Microneedles

- 5.1.2 Hollow Microneedles

- 5.1.3 Coated Microneedles

- 5.1.4 Dissolving Microneedles

- 5.1.5 Hydrogel-Forming Microneedles

- 5.2 By Material

- 5.2.1 Silicon

- 5.2.2 Metals (Stainless Steel, Titanium)

- 5.2.3 Polymers (PVP, PLA, PLGA, etc.)

- 5.2.4 Carbohydrates

- 5.2.5 Others (Ceramics, Composites)

- 5.3 By Application

- 5.3.1 Vaccination

- 5.3.2 Insulin Delivery

- 5.3.3 Pain Management/ Local Anesthesia

- 5.3.4 Dermatology & Cosmetics

- 5.3.5 Oncology

- 5.3.6 Others (Diagnostic Sampling)

- 5.4 By End-user

- 5.4.1 Hospitals & Clinics

- 5.4.2 Pharmaceutical & Biotech Companies

- 5.4.3 Academic & Research Institutes

- 5.4.4 Homecare Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M Company

- 6.4.2 Becton, Dickinson and Company

- 6.4.3 CosMED Pharmaceutical Co., Ltd.

- 6.4.4 Debiotech SA

- 6.4.5 Kimoola Co., Ltd.

- 6.4.6 Lohmann Therapie-Systeme AG

- 6.4.7 Micron Biomedical Inc.

- 6.4.8 Microdermics Inc.

- 6.4.9 Nanopass Technologies Ltd.

- 6.4.10 Nitto Denko Corporation

- 6.4.11 QuadMedicine Inc.

- 6.4.12 Raphas Co., Ltd.

- 6.4.13 SNvia Co., Ltd.

- 6.4.14 Valeritas Inc.

- 6.4.15 Vaxxas Pty Ltd.

- 6.4.16 Zosano Pharma Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment