PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911374

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911374

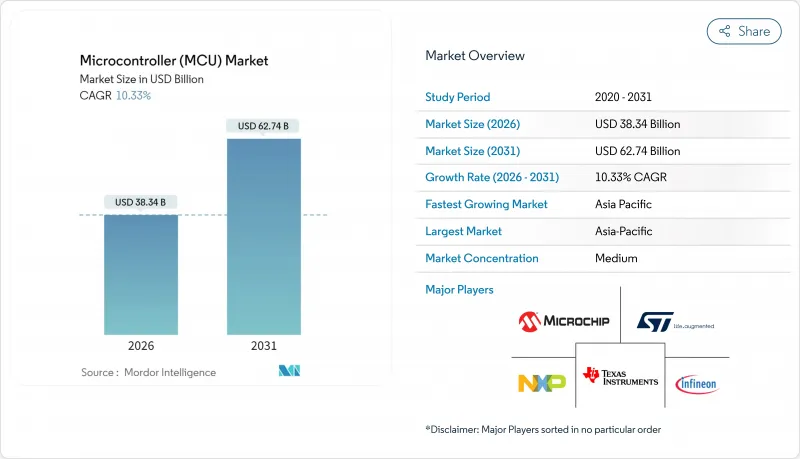

Microcontroller (MCU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Microcontroller market was valued at USD 34.75 billion in 2025 and estimated to grow from USD 38.34 billion in 2026 to reach USD 62.74 billion by 2031, at a CAGR of 10.33% during the forecast period (2026-2031).

This trajectory reflects the rising demand for embedded intelligence across electrified vehicles, Internet of Things (IoT) endpoints, and next-generation consumer devices. Content per car is increasing as functional-safety mandates expand MCU counts, while predictive-maintenance programs in factories accelerate the rollout of smart sensors. Open instruction-set architectures reduce licensing costs, helping smaller vendors address edge-AI workloads. Meanwhile, regional near-shoring and supply-chain diversification stimulate fresh capacity investments even as average selling prices (ASP) remain under pressure.

Global Microcontroller (MCU) Market Trends and Insights

IoT Node Proliferation Drives Embedded Intelligence Demand

Connected endpoints are projected to exceed 20 billion units by 2030, forcing manufacturers to embed multi-protocol radios and efficient processors into cost-sensitive designs. Nordic Semiconductor's nRF54 series combines Bluetooth LE 5.4, Thread, and Matter in a single device, while maintaining a battery-friendly current draw, thereby reducing the bill of materials and firmware complexity . Premium-priced analytics services, enabled by richer local processing, shift revenue models away from pure hardware sales. Semiconductor suppliers, such as Synaptics, are repositioning their portfolios toward IoT-optimized solutions rather than pursuing general-purpose computing.

Automotive Electrification and ADAS Integration Accelerate MCU Content Growth

A battery-electric vehicle can host up to 3,000 semiconductor components, quadrupling the MCU footprint versus internal-combustion models. Mercedes-Benz relies on discrete microcontroller clusters to manage the battery, thermal, and regenerative braking systems in accordance with ISO 26262. Continental's cooperation with NXP centralizes multiple chassis functions into software-upgradable domain controllers, cutting wiring weight and enabling seamless over-the-air updates. EU regulations mandating the deployment of advanced driver-assistance systems across all classes by 2026 further amplify this shift. Honda's partnership with Renesas to co-develop 2,000 TOPS SoCs highlights how computational demands are reshaping the Microcontroller market.

Supply-Chain Cyclicality Creates Inventory and Pricing Volatility

Foundry scheduling swings expose MCU vendors to abrupt wafer-allocation shifts. Recent inventory digestion phases forced Nordic Semiconductor to cut 8% of its workforce after revenue fell 30% in 2023 . The oversupply of metal-silicon pulled benchmark spot prices down 2.3% to USD 2.95/kg in April 2025, yet tariffs threaten to reverse the cost gains . The concentration of mature-node capacity in Taiwan, mainland China, and South Korea magnifies geopolitical risk premiums, prompting OEMs to fund buffer stocks that tie up working capital.

Other drivers and restraints analyzed in the detailed report include:

- Smart-Home and Appliance MCU Integration Transforms Consumer Electronics

- Shift to RISC-V Open ISA Disrupts Traditional Licensing Models

- ASP Erosion from Chinese Fabs Intensifies Pricing Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, 32-bit devices captured 56.35% of the Microcontroller market share, illustrating a decisive tilt toward complex workloads. The segment is projected to grow at an 8.76% CAGR, driven by ADAS sensor fusion, industrial drive control, and voice-enabled consumer gadgets. 32-bit architectures enable larger addressable memory and integrate digital-signal-processing extensions, thereby reducing the need for external components. MCU designers now embed neural engines and cybersecurity accelerators directly on the die, eliminating the need for discrete coprocessors. Lower-cost 8-bit and 16-bit parts remain viable in interface logic, while sub-4-bit variants linger in remote controls and thermostats serving ultra-thin margin categories.

Developers are increasingly requesting single-chip prototypes that incorporate secure boot, CAN-FD, and multi-protocol radio in a single package. This all-in-one trend supports platform reuse across product lines, reducing firmware maintenance. Meanwhile, integrated FRAM options on 32-bit units provide instant-write capability without charge-pump overhead, which is critical for data-logging sensors that operate in high-vibration environments.

Cortex-M cores supplied 68.25% of shipments in 2025, bolstered by mature toolchains and robust middleware stacks. Customers value out-of-the-box RTOS support and expansive community libraries that shorten debug cycles. Yet RISC-V's 15.09% CAGR points to mounting enthusiasm for instruction-set customization at zero royalty cost. Governments deploy domestic RISC-V programs to safeguard technology sovereignty, funneling subsidies toward open-ISA chiplets spanning wearables to automotive gateway nodes. Proprietary cores persist in niche avionics and industrial drives that require deterministic, cycle-accurate responses, whereas x86 processors are used in server-class board management controllers.

For the Microcontroller market, vendor success hinges on the richness of the development environment. ARM continues to extend TrustZone, PSA-Certified security, and M-Profile Vector Extensions, whereas RISC-V groups invest in unified software-layer harmonization to stave off fragmentation. Some suppliers hedge bets by offering pin-compatible ARM or RISC-V alternatives within the same product family.

The Microcontroller Market Report is Segmented by Bit Class (4-Bit and Below, 8-Bit, 16-Bit, and More), Core Architecture (ARM Cortex-M, RISC-V, X86, and More), On-Chip Memory Type (Embedded Flash, FRAM, and More), Application (Automotive, Industrial and Factory Automation, Healthcare, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC retained 47.30% of global revenue in 2025 on the strength of China's consumer-electronics assembly ecosystem and Japan's automotive semiconductor depth. Chinese five-year plans targeting local silicon autonomy create pull for domestic MCU tape-outs across home appliances and public-charging infrastructure. Japanese suppliers maintain traction with powertrain-qualified microcontrollers specifically designed for hybrid drive cycles, leveraging their long-standing OEM ties. South Korean conglomerates integrate native memory IP with logic blocks to build one-chip solutions for smartphones and smart TVs. Rising labor, energy, and geopolitical costs prompt some diversification into Vietnam and Thailand, yet the region's cohesive component ecosystem preserves its comparative advantage, keeping it as the fastest-growing market for microcontrollers.

South America emerges as one of the fastest-growing regions in the microcontroller market, with a 10.22% CAGR from 2020 to 2031. Brazil's renewed automotive-production incentives and Mexico's USMCA-enabled export corridors lure EV platform assembly that requires localized MCU sourcing. Government-directed renewable energy grids are driving the rollout of smart meters, which in turn boosts demand for secure, low-power 32-bit controllers. Local-content mandates spur joint ventures between global silicon vendors and regional design houses, catalyzing the development of talent around embedded software stacks. North America centers on high-value safety-critical niches. The CHIPS Act earmarks billions for wafer-fab construction, though most capacity targets sub-10 nm nodes rather than mature MCU geometries. Defense contractors stipulate onshore production and supply-chain attestations, ensuring steady demand for ITAR-compliant parts. Europe focuses on adhering to ISO 26262 and IEC 62443 within the automotive and process automation verticals. TSMC's planned Dresden fab will supply 40,000 300 mm wafers monthly to European Tier-1s, shortening lead times for high-reliability microcontrollers .

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Silicon Laboratories Inc.

- Nordic Semiconductor ASA

- Espressif Systems (Shanghai) Co., Ltd.

- GigaDevice Semiconductor Inc.

- Nuvoton Technology Corporation

- Toshiba Electronic Devices and Storage Corporation

- Rohm Co., Ltd.

- onsemi Corporation

- Holtek Semiconductor Inc.

- Ambiq Micro, Inc.

- ASR Microelectronics (Shanghai) Co., Ltd.

- Realtek Semiconductor Corp.

- Zilog, Inc.

- Analog Devices, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 IoT Node Proliferation

- 4.2.2 Automotive Electrification and ADAS

- 4.2.3 Smart-Home and Appliance MCU Integration

- 4.2.4 Shift to RISC-V Open ISA

- 4.2.5 Ultra-Low-Power Edge AI MCUs

- 4.2.6 Industrial Cybersecurity Mandates

- 4.3 Market Restraints

- 4.3.1 Supply-chain Cyclicality

- 4.3.2 ASP Erosion from Chinese Fabs

- 4.3.3 Rising NRE for sub-28 nm Embedded Flash

- 4.3.4 Talent Shortage in Mixed-Signal Design

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Bit Class

- 5.1.1 4-bit and below

- 5.1.2 8-bit

- 5.1.3 16-bit

- 5.1.4 32-bit

- 5.2 By Core Architecture

- 5.2.1 ARM Cortex-M

- 5.2.2 RISC-V

- 5.2.3 x86

- 5.2.4 Proprietary / Others

- 5.3 By On-Chip Memory Type

- 5.3.1 Embedded Flash

- 5.3.2 FRAM

- 5.3.3 EEPROM/OTP

- 5.3.4 SRAM-only (code-in-RAM)

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Consumer Electronics and Home Appliances

- 5.4.3 Industrial and Factory Automation

- 5.4.4 Healthcare

- 5.4.5 Aerospace and Defense

- 5.4.6 Data-Com and Cloud Infrastructure

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Taiwan

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Microchip Technology Inc.

- 6.4.3 NXP Semiconductors N.V.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Texas Instruments Incorporated

- 6.4.6 Renesas Electronics Corporation

- 6.4.7 Silicon Laboratories Inc.

- 6.4.8 Nordic Semiconductor ASA

- 6.4.9 Espressif Systems (Shanghai) Co., Ltd.

- 6.4.10 GigaDevice Semiconductor Inc.

- 6.4.11 Nuvoton Technology Corporation

- 6.4.12 Toshiba Electronic Devices and Storage Corporation

- 6.4.13 Rohm Co., Ltd.

- 6.4.14 onsemi Corporation

- 6.4.15 Holtek Semiconductor Inc.

- 6.4.16 Ambiq Micro, Inc.

- 6.4.17 ASR Microelectronics (Shanghai) Co., Ltd.

- 6.4.18 Realtek Semiconductor Corp.

- 6.4.19 Zilog, Inc.

- 6.4.20 Analog Devices, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment