PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911390

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911390

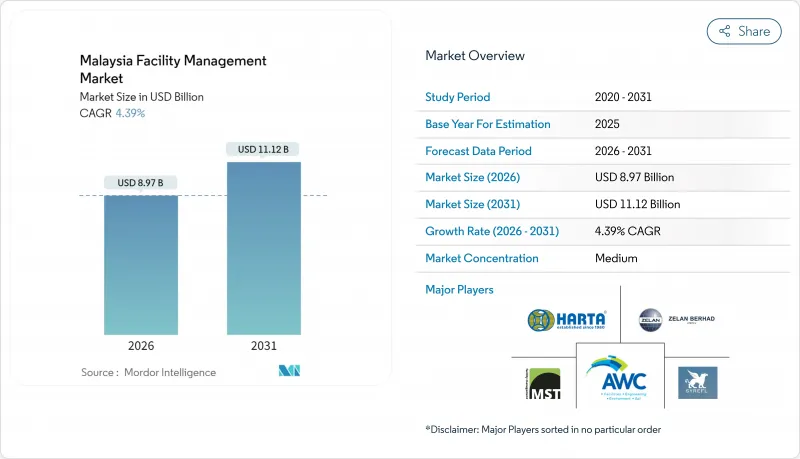

Malaysia Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia facility management market is expected to grow from USD 8.59 billion in 2025 to USD 8.97 billion in 2026 and is forecast to reach USD 11.12 billion by 2031 at 4.39% CAGR over 2026-2031.

The solid growth outlook shows how quickly service providers are adapting to new safety rules, smart-building mandates, and expanding infrastructure projects. Strong public-private partnership spending, led by an airport modernization program worth RM10 billion (USD 2.36 billion), is pulling integrated suppliers into long-term contracts. Digital twin platforms, artificial intelligence scheduling, and IoT sensors are reshaping day-to-day maintenance tasks while improving uptime and energy use. Stricter ESG reporting rules and the National Energy Transition Roadmap are prompting clients to demand measurable sustainability results in their facility tenders. At the same time, currency swings and labor shortages are prompting companies to automate repetitive work and renegotiate imported equipment contracts in advance.

Malaysia Facility Management Market Trends and Insights

Regulatory overhaul reshapes compliance rules

The Occupational Safety and Health Amendment Act 2022, effective 1 June 2024, broadens coverage to every workplace and raises violation fines tenfold to RM500,000 (USD 117,771.76). Hospitals, private schools, and co-working sites now hire specialist facility managers to conduct risk audits, train OSH coordinators, and keep digital compliance logs. Healthcare operators are absorbing higher operating costs, with Universiti Malaya Medical Centre raising some specialist fees by over 200% to offset safety investments. Demand is strongest in Kuala Lumpur, where high-rise density and multi-tenant structures complicate evacuation plans. Service providers with certified safety engineers and real-time incident dashboards are winning multi-year contracts that embed performance penalties for non-compliance.

Technology integration lifts operational efficiency

Digital Nasional Berhad's AI-driven network management delivered 99.8% uptime and cut alarm counts by 500%, offering a clear benchmark for predictive building maintenance. IoT meters feed energy dashboards that spot abnormal consumption patterns within minutes rather than days. Digital twin rollouts trim maintenance expenses by 30% and slash unscheduled equipment failures by 70%. A Kuala Lumpur office block recorded comfort improvements and lower HVAC runtime after deploying an IoT energy management system. AI chiller optimization at a luxury hotel yielded 9% energy savings plus faster compliance reporting. Integrated platforms, such as UEM Edgenta's SmartConnect, enable remote portfolio oversight and standardized KPI scorecards.

Labor market dynamics challenge service delivery

Businesses across Malaysia report 25% understaffing in food-service operations, forcing shorter opening hours and lowering revenue by 15%. The construction trades that underpin hard-service capacity still rely on foreign workers, with plantations running at more than 70% overseas labor share. The government has waived industry quotas to speed recruitment, yet visa processing bottlenecks persist, especially for skilled technicians. Wage inflation is accelerating; large Government-Linked Investment Companies set a RM3,100 (USD 730.18) living-wage floor, cascading into cleaning, security, and maintenance pay scales. Providers now deploy autonomous cleaning robots and centralized help-desks to mitigate rising payroll costs, yet talent scarcity remains the top short-term operational risk.

Other drivers and restraints analyzed in the detailed report include:

- ESG compliance gains strategic weight

- Outcome-based contracts deepen partnerships

- Currency volatility lifts imported tech costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard Services generated 62.08% of the Malaysia facility management market share in 2025, supported by rising compliance spending on fire safety, MEP, and asset integrity inspections. Data-center expansion in Johor Bahru alone adds 1.6 GW of critical capacity that requires round-the-clock mechanical and electrical coverage. Soft Services, although smaller in value, will grow at a 4.42% CAGR to 2031 as workplace experience becomes a competitive tool in hybrid offices. Contactless cleaning robots, on-demand catering platforms, and predictive staffing engines are gaining traction among blue-chip tenants. Providers leverage visitor analytics and mobile help-desks to raise occupant satisfaction scores, backing the shift from cost-center to revenue-protection logic.

The Malaysia Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AWC Berhad

- MST Facilities Sdn Bhd.

- Harta Maintenance Sdn Bhd

- Zelan AM Services Sdn Bhd

- SDE Facilities Management Sdn Bhd

- SYREFL Holdings Sdn Bhd

- UDA Dayaurus Sdn. Bhd.

- Sepadu Group

- TH Properties Sdn Bhd

- Savills Malaysia

- SPS Facilities

- ISS Facility Services

- GFM Services Berhad

- CBRE

- Cushman & Wakefield Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Malaysia's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Regulatory Overhaul Reshapes Compliance Requirements

- 4.2.2 Technology Integration Drives Operational Efficiency

- 4.2.3 ESG Compliance Becomes Competitive Differentiator

- 4.2.4 Outcome-Based Contracting Anchors Long-Term Partnerships

- 4.2.5 Smart Building Mandates Propel Demand for FM Digital Twins

- 4.2.6 Public-Private Partnership Projects Accelerate FM Outsourcing

- 4.3 Market Restraints

- 4.3.1 Labor Market Dynamics Challenge Service Delivery

- 4.3.2 Rising Interest Rates Constrain Capital Budgets

- 4.3.3 Fragmented Vendor Landscape Limits Standardization

- 4.3.4 Currency Volatility Increases Cost of Imported FM Technologies

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AWC Berhad

- 6.4.2 MST Facilities Sdn Bhd.

- 6.4.3 Harta Maintenance Sdn Bhd

- 6.4.4 Zelan AM Services Sdn Bhd

- 6.4.5 SDE Facilities Management Sdn Bhd

- 6.4.6 SYREFL Holdings Sdn Bhd

- 6.4.7 UDA Dayaurus Sdn. Bhd.

- 6.4.8 Sepadu Group

- 6.4.9 TH Properties Sdn Bhd

- 6.4.10 Savills Malaysia

- 6.4.11 SPS Facilities

- 6.4.12 ISS Facility Services

- 6.4.13 GFM Services Berhad

- 6.4.14 CBRE

- 6.4.15 Cushman & Wakefield Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)