PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911406

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911406

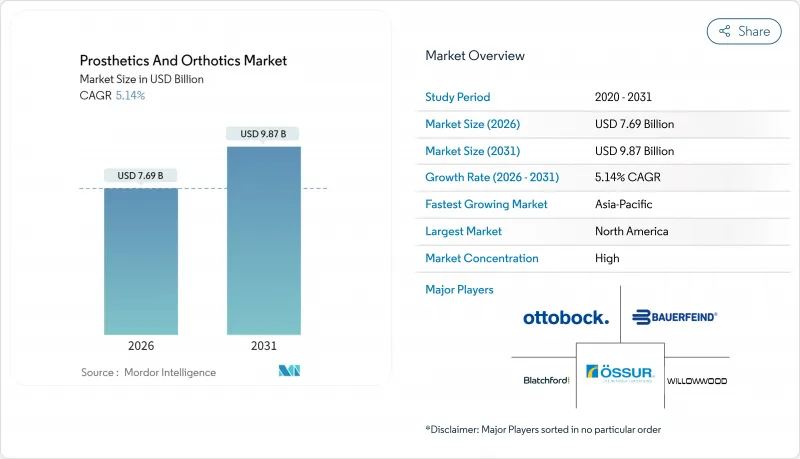

Prosthetics And Orthotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The prosthetics and orthotics market was valued at USD 7.31 billion in 2025 and estimated to grow from USD 7.69 billion in 2026 to reach USD 9.87 billion by 2031, at a CAGR of 5.14% during the forecast period (2026-2031).

Rising diabetes-related limb loss, rapid population aging, and steady reimbursement improvements are creating durable demand tailwinds. Technology upgrades-including microprocessor-controlled knees and sensor-guided bracing-are expanding clinical indications while supporting premium pricing. Consolidation is accelerating as manufacturers integrate service networks to secure recurring revenue. Meanwhile, supply-chain disruptions and clinician shortages remain key headwinds, encouraging firms to diversify materials and invest in workforce training.

Global Prosthetics And Orthotics Market Trends and Insights

Rapid Rise in Diabetes-Related Amputations

Diabetes complications now account for roughly two-thirds of lower-limb amputations, with diabetic patients experiencing a 21.7% amputation rate and peripheral neuropathy prevalence of 44.4%. In Canada alone, diabetes-related amputations triggered 7,720 hospitalizations in 2024, costing healthcare systems USD 750 million. With incidence climbing fastest in emerging Asia, demand for lower-extremity devices is set to remain robust through 2030.

Aging Population & Osteoarthritis Burden

Asia-Pacific's elderly cohort is projected to reach 923 million by 2050, equal to 18% of the region's population. Osteoarthritis prevalence is rising in tandem, shifting orthotic use from acute injury care to long-term mobility preservation. Japan and Singapore illustrate how private sector involvement broadens access to high-spec bracing solutions. As payers increasingly fund advanced supports to forestall joint surgery, orthotics volumes are poised for sustained growth.

High Device Cost & Uneven Reimbursement

Fewer than half of the 2.3 million Americans living with limb loss have received a prosthesis, largely due to coverage caps and prior-authorization hurdles. Advanced prosthetic technologies like the Genium X4 microprocessor knee represent significant investments, with pricing reflecting the sophisticated technology and improved functional outcomes that could offset long-term . Variable parity laws reinforce geographic inequities and temper advanced-device uptake despite documented functional advantages.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Microprocessor & Myoelectric Technology

- Expanding Reimbursement in Developed Markets

- Shortage of Certified O&P Clinicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Orthotics captured 57.65% of 2025 revenue, underscoring their versatility for chronic joint and spinal conditions. Lower-limb braces meet diabetes-linked foot complications, while spinal orthoses address both injury recovery and degenerative disease. Early intervention with bracing increasingly substitutes for surgery, shaping payer strategies. Prosthetics, though smaller, are on a faster 6.53% CAGR track as intelligent knees and customizable sockets improve gait efficiency. Lower-extremity solutions dominate, powered by diabetes-driven amputations, whereas upper-limb demand benefits from myoelectric advances and 3D-printed personalized parts. Component categories such as liners and modular joints anchor recurring replacement sales, reinforcing growth.

Continued microprocessor adoption and rising trauma survivorship position the prosthetics and orthotics market size for the prosthetics segment to outpace the broader industry average by the forecast horizon. Customized additive-manufactured sockets are lowering adjustment visits, while cloud-based outcome tracking supports value-based purchase contracts, further stimulating prosthetic adoption.

The Prosthetics and Orthotics Market Report is Segmented by Type (Orthotics, Prosthetics), Technology (Conventional, Electric-Powered, Microprocessor-Controlled, Hybrid, 3D-Printed), End User (Hospitals, P&O Clinics, Rehabilitation Centers, Home-Care, Military Facilities), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.90% of 2025 revenue, buoyed by Medicare rule changes that reimburse microprocessor knees for lower-functioning amputees and by a dense clinician network. The United States leads innovation, hosting DARPA-funded neural-interface trials that accelerate commercial spin-outs. Canada's universal coverage underwrites basic limb devices, while Mexico benefits from rising middle-class spending and maquiladora-based component production.

Europe's growth is anchored by Germany, the United Kingdom, and France, where comprehensive insurance schemes cover advanced braces and limbs. Regulatory coordination under the Medical Device Regulation streamlines cross-border product launches, though reimbursement ceilings vary. Italy and Spain present upside via aging demographics and rising public healthcare budgets.

Asia-Pacific is the fastest-growing territory at 8.12% CAGR. China is expanding disability services through public-private clinics, while local producers scale mid-range devices to meet mass demand. India's government subsidies and low-cost 3D printing spur uptake among rural amputees. Japan and South Korea remain leaders in robotic bracing and sensor integration, acting as proving grounds before broader regional deployment. Australia's well-developed reimbursement schemes and clinician training pipelines support early adoption of AI-enabled gait analytics.

Together, these regional dynamics ensure steady expansion of the prosthetics and orthotics market, with differential growth offering manufacturers opportunities to tailor portfolios and localization strategies.

- Ossur

- Ottobock

- Hanger Inc.

- Zimmer Biomet

- Blatchford Group

- Fillauer

- Steeper Group

- WillowWood Global

- College Park Industries

- Proteor

- Bauerfeind

- DJO Global

- Trulife

- Ortho Europe

- Spinal Technology Inc.

- Thuasne

- 3M Health Care

- Stryker

- Johnson & Johnson

- Smiths Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rise in diabetes-related amputations

- 4.2.2 Ageing population & osteoarthritis burden

- 4.2.3 Advances in microprocessor & myoelectric tech

- 4.2.4 Expanding reimbursement in developed markets

- 4.2.5 AI-driven predictive gait analytics adoption

- 4.2.6 Military R&D spill-over into civilian devices

- 4.3 Market Restraints

- 4.3.1 High device cost & uneven reimbursement

- 4.3.2 Shortage of certified O&P clinicians

- 4.3.3 Carbon-fiber supply-chain volatility

- 4.3.4 Pay-for-outcome reimbursement risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Reimbursement Landscape

5 Market Size & Growth Forecasts

- 5.1 By Type (Value)

- 5.1.1 Orthotics

- 5.1.1.1 Lower-Limb Orthotics

- 5.1.1.2 Upper-Limb Orthotics

- 5.1.1.3 Spinal Orthotics

- 5.1.2 Prosthetics

- 5.1.2.1 Lower-Extremity Prosthetics

- 5.1.2.2 Upper-Extremity Prosthetics

- 5.1.2.3 Liners, Sockets & Modular Components

- 5.1.1 Orthotics

- 5.2 By Technology (Value)

- 5.2.1 Conventional / Body-Powered

- 5.2.2 Electric-Powered / Myoelectric

- 5.2.3 Microprocessor-Controlled

- 5.2.4 Hybrid

- 5.2.5 3D-Printed / Additive Manufactured

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Prosthetics & Orthotics Clinics

- 5.3.3 Rehabilitation Centers

- 5.3.4 Home-Care Settings

- 5.3.5 Military & Veterans Affairs Facilities

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Ossur

- 6.3.2 Ottobock

- 6.3.3 Hanger Inc.

- 6.3.4 Zimmer Biomet

- 6.3.5 Blatchford Group

- 6.3.6 Fillauer LLC

- 6.3.7 Steeper Group

- 6.3.8 WillowWood Global

- 6.3.9 College Park Industries

- 6.3.10 Proteor

- 6.3.11 Bauerfeind AG

- 6.3.12 DJO Global (Enovis)

- 6.3.13 Trulife

- 6.3.14 Ortho Europe

- 6.3.15 Spinal Technology Inc.

- 6.3.16 Thuasne

- 6.3.17 3M Health Care

- 6.3.18 Stryker Corporation

- 6.3.19 Johnson & Johnson (DePuy Synthes)

- 6.3.20 Smith & Nephew

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment