PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911428

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911428

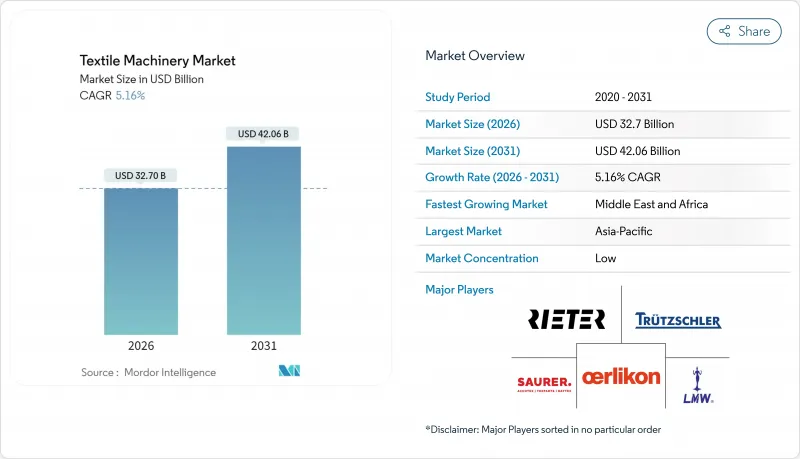

Textile Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Global Textile Machinery Market was valued at USD 31.10 billion in 2025 and estimated to grow from USD 32.7 billion in 2026 to reach USD 42.06 billion by 2031, at a CAGR of 5.16% during the forecast period (2026-2031).

Factory investments increasingly revolve around Industry 4.0 tools that counter skilled-labor shortages and raise uptime. Smart sensors, cloud analytics, and AI-driven defect detection push equipment upgrades, while recycling mandates spur orders for automated sorting and fiber-to-fiber systems. Technical-textile demand in medical, protective, and sporting goods continues to outpace traditional apparel, opening fresh profit pools. Cost-efficient synthetic fibers and bio-based alternatives both lift machinery sales, and tariff-induced near-shoring in the Americas accelerates orders for flexible, low-lot production lines.

Global Textile Machinery Market Trends and Insights

Industry 4.0-driven Automation Demand

Manufacturing PMI readings showed textile mills expanding in April 2025, and operators now use robotics and AI to offset chronic labor gaps. U.S. producers adopted intelligent knitting software that optimizes pattern complexity and cuts scrap. IoT platforms let managers track humidity and energy in real time, as documented in Pakistan's mill trials. AI vision systems based on convolutional models push defect-detection accuracy into the high-90% range, reducing rework. The cumulative gains in throughput and waste reduction make automated lines a strategic rather than an optional investment.

Rising Apparel Consumption in Emerging Economies

India's cotton-yarn producers expect 7-9% revenue growth in fiscal 2025 as Chinese demand rebounds and local retail expands. Favorable yarn spreads and improved cotton availability underpin mill upgrades. Demographic tailwinds across ASEAN and Africa add fresh capacity requirements for spinning and knitting lines. While tariffs unsettle traditional supply chains, developing-market brands still need scale, prompting balanced investments in cost-efficient yet modern machinery. For suppliers, flexible financing and modular upgrades remain critical selling points.

High CAPEX & Uncertain Payback Periods

Complete spinning or weaving lines can exceed USD 10 million, a hurdle for mid-size mills. Even large suppliers carefully model ROI because technology cycles shorten; a state-of-the-art ring-spinning frame today risks obsolescence before amortization. Italian OEMs saw orders dip 16% in 2023 when macro uncertainty froze budgets. Currency swings further inflate imported equipment in South Asia and Africa. Vendors respond with trade-in programs, financing packages, and modular add-ons that spread costs and limit technological lock-in.

Other drivers and restraints analyzed in the detailed report include:

- Near-shoring & Tariff-driven Capacity Relocation

- Expansion of Technical-Textile Production

- Raw Material Cost Volatility Affecting Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spinning equipment accounted for 44.02% of the textile machinery market share in 2025, underscoring its central role in yarn conversion. Global installed short-staple spindle capacity hit 232 million units, and replacement demand remains steady as mills chase higher speed and lower breakage. Rieter's draw-frame patent win and Trutzschler's 12-head comber that lifts output 50% illustrate how OEMs defend margins through innovation. Weaving and knitting machines follow as core pillars but face slower growth relative to recycling shredders, digital printers, and bio-fiber extruders.

Other machine categories, while smaller, are set to post a 6.66% CAGR to 2031. Investors favor recycling lines that separate cotton and polyester streams or dissolve blended fabrics chemically. Specialty looms that weave basalt or aramid for automotive composites also gain traction. As apparel cycles compress, direct-to-garment printers that deliver one-off designs create new revenue for machinery vendors willing to straddle textile and digital domains. The broadening equipment menu positions suppliers to chase diverse cash flows rather than rely solely on commodity yarn systems.

Semi-automatic platforms led with 43.05% of the textile machinery market size in 2025, reflecting the balance between labor costs and automation pricing. These lines still need operators for doffing and quality checks, but integrate sensors for tension and speed control. The pathway to fully automatic operations is clear; data connectivity and AI vision add only incremental hardware but deliver exponential uptime gains.

Fully automatic, Industry 4.0-ready systems are forecast to grow at a 6.78% CAGR through 2031. Mills cite the inability to recruit technicians as a bigger constraint than loan financing, tipping decisions toward lights-out production floors. IoT dashboards allow predictive maintenance that slashes unplanned downtime. Manual machines persist in low-wage clusters yet continuously lose share as wage inflation erodes the cost gap. Vendors market modular upgrades such as robotic doffers that let owners transition stepwise without scrapping entire lines.

The Textile Machinery Market Report is Segmented by Machine Type (Spinning Machines, Weaving Machines, and More), by Automation Type (Manual, Semi-Automatic and Fully Automatic), by Application (Garments & Apparels, Household and Home Textiles, and More), by Raw Material (Cotton, Synthetic Fibers, and More), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 55.10% of 2025 demand for the textile machinery market, anchored by China's large installed base and India's seven-park PM MITRA scheme worth USD 535 million. Tier-2 Chinese mills still modernize to cut labor dependence, while Indian parks promise cluster synergies and shared utilities that spur equipment packages covering spinning to finishing. Rising wages in coastal China drive inland relocation, lengthening the domestic upgrade cycle rather than shrinking it.

The Middle East and Africa are projected to log the fastest 6.31% CAGR through 2031 as trade diversification sends orders to Egypt, Morocco, and Ethiopia. Gulf investors bankroll integrated polyester plants tied to low-cost energy, requiring downstream texturizing and warp-knitting lines. African mills leverage AGOA and EU trade preferences to secure apparel contracts shifted from tariff-hit Asia. Equipment suppliers partner with local universities on skill programs, mitigating operator shortages that could blunt adoption.

North America benefits from USMCA rules that shield Mexican and Canadian yarn and fabric, fueling new ring-spinning and air-jet weaving projects near the U.S. border. Brands calculate that a 10-day supply-chain lead beats the cost delta with Asia once tariffs, freight, and inventory risks are considered. Europe focuses on value-added segments technical fabrics, recycling, and luxury wool, underpinned by automation that offsets energy and labor costs. Turkey and Germany export high-spec looms to neighboring regions and capture service revenue from retrofits complying with EU eco-design regulations.

- Rieter Holding AG

- Trutzschler Group SE

- Saurer Intelligent Technology AG

- OC Oerlikon

- Lakshmi Machine Works Ltd

- Murata Machinery Ltd

- Savio Macchine Tessili S.p.A

- Santoni S.p.A.

- Mayer & Cie. GmbH & Co. KG

- Picanol NV

- Toyota Industries Corporation

- Itema S.p.A.

- Tsudakoma Corporation

- Karl Mayer Holding GmbH & Co. KG

- Shima Seiki Mfg., Ltd.

- TMT Machinery, Inc.

- Hangzhou Jingwei Textile Machinery Co., Ltd.

- Jiangsu Cixing Co., Ltd.

- Vardhman Textile Machinery

- Zhejiang Rifa Textile Machinery Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0-driven automation demand

- 4.2.2 Expansion of technical-textile production

- 4.2.3 Rising apparel consumption in emerging economies

- 4.2.4 Near-shoring & tariff-driven capacity relocation

- 4.2.5 Circular-economy recycling machinery investments

- 4.2.6 Specialty equipment for bio-based fiber processing

- 4.3 Market Restraints

- 4.3.1 High CAPEX & uncertain payback periods

- 4.3.2 Raw-material cost volatility impacting budgets

- 4.3.3 Skilled-operator shortage for advanced machinery

- 4.3.4 Export controls on precision motion components

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts(Values, In USD Billion)

- 5.1 By Machine Type

- 5.1.1 Spinning Machines

- 5.1.2 Weaving Machines

- 5.1.3 Knitting Machines

- 5.1.4 Texturing Machines

- 5.1.5 Other Machine Types

- 5.2 By Automation Type

- 5.2.1 Manual

- 5.2.2 Semi-Automatic

- 5.2.3 Fully Automatic(Smart / Industry 4.0 Integrated Systems)

- 5.3 By Application

- 5.3.1 Garments & Apparels

- 5.3.2 Household and Home Textiles

- 5.3.3 Technical Textiles (Medical, Protective, Sports, etc.)

- 5.4 By Raw Material

- 5.4.1 Cotton

- 5.4.2 Synthetic Fibers (Polyester, Nylon, Acrylic)

- 5.4.3 Wool

- 5.4.4 Silk

- 5.4.5 Other Fibers (Bast, Bio-based, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Rieter Holding AG

- 6.4.2 Trutzschler Group SE

- 6.4.3 Saurer Intelligent Technology AG

- 6.4.4 OC Oerlikon

- 6.4.5 Lakshmi Machine Works Ltd

- 6.4.6 Murata Machinery Ltd

- 6.4.7 Savio Macchine Tessili S.p.A

- 6.4.8 Santoni S.p.A.

- 6.4.9 Mayer & Cie. GmbH & Co. KG

- 6.4.10 Picanol NV

- 6.4.11 Toyota Industries Corporation

- 6.4.12 Itema S.p.A.

- 6.4.13 Tsudakoma Corporation

- 6.4.14 Karl Mayer Holding GmbH & Co. KG

- 6.4.15 Shima Seiki Mfg., Ltd.

- 6.4.16 TMT Machinery, Inc.

- 6.4.17 Hangzhou Jingwei Textile Machinery Co., Ltd.

- 6.4.18 Jiangsu Cixing Co., Ltd.

- 6.4.19 Vardhman Textile Machinery

- 6.4.20 Zhejiang Rifa Textile Machinery Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment