PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911434

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911434

Printing Blanket - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

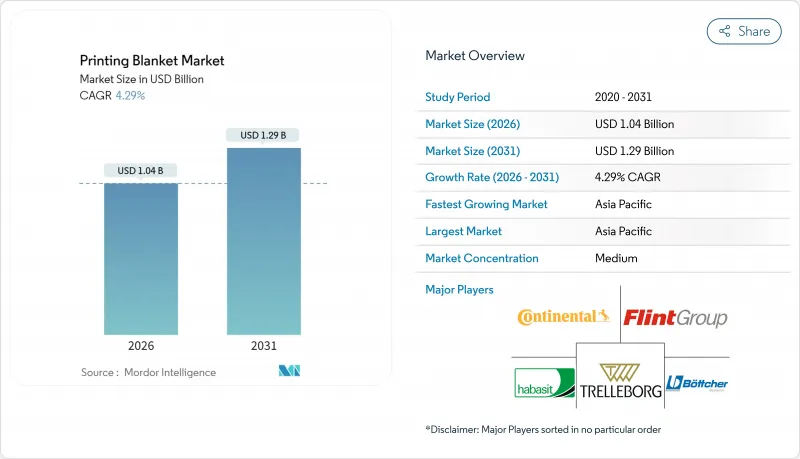

The printing blanket market is expected to grow from USD 1 billion in 2025 to USD 1.04 billion in 2026 and is forecast to reach USD 1.29 billion by 2031 at 4.29% CAGR over 2026-2031.

This advance reflects steady demand from packaging converters, continued investment in LED-UV presses, and the need for high-definition graphics across premium consumer goods. Packaging, label, and specialty security work keep offset equipment running even as shorter commercial runs migrate to inkjet. Manufacturers focus on UV-compatible compounds, quick-release bars, and compressible layers that cut make-ready time and hold dot structure. Raw-material volatility and stricter environmental rules raise input costs, yet scale efficiencies in Asia Pacific temper margin pressure and sustain orderly pricing in the printing blanket market.

Global Printing Blanket Market Trends and Insights

Surging Demand for UV-Compatible Blankets in LED-UV and H-UV Presses

LED-UV and H-UV retrofits reduce energy use by approximately 70% compared to mercury lamps, enabling printing on heat-sensitive films. These capabilities, prized by packaging plants, require blankets that endure intensified UV exposure without glazing or premature swelling. Suppliers now market low-swelling rubber compounds and reinforced compressible layers that extend life cycles. Adoption is strongest in Japan, the United States, and coastal China, where converters are racing to shrink drying times and increase press uptime. Stricter volatile organic compound limits further accelerate UV migrations, anchoring a positive mid-term impact on the printing blanket market.

Boom in Short-Run Customised Packaging Driving Blanket Changeovers

E-commerce and brand personalization have reduced average folding-carton runs from 50,000 to roughly 35,000 units, effectively doubling the annual blanket swaps in many sheetfed plants.Premium blankets with quick-release bars and stable surface micro-geometry command higher prices yet save hours in make-ready labor. North American brand owners demand seasonal variants, while European converters automate blanket handling to offset rising wages. The increased turnover stimulates volume growth in the printing blanket market, despite the total number of printed meters remaining stable.

Accelerating Shift to Digital Inkjet Printing (Blanket-Free)

High-speed inkjet lines now achieve speeds of 300 m/min on coated stock, eroding offset volumes in catalogs and books. Smithers forecasts digital revenues rising from USD 165.3 billion in 2024 to USD 251.1 billion in 2035, while offsetting declines . Each decommissioned web tower removes a steady stream of blanket replacements. Packaging remains more resistant because inkjet still struggles with film adhesion and dense whites, yet the medium-term drag on the printing blanket market is clear.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of Flexible-Packaging Applications in Food and Beverage

- Rising Quality Requirements for High-Definition Graphics

- Decline in Newspaper and Magazine Print Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional designs held 47.35% printing blanket market share in 2025 due to proven reliability in commercial and packaging plants. UV-compatible blankets, however, log the fastest 4.38% CAGR as converters invest in LED-UV retrofits. The printing blanket market size for UV types is projected to reach USD 518 million by 2031, driven by premium unit pricing and expanding volumes. Manufacturers such as Trelleborg introduce UV-resistant rubber that maintains dimensional stability, allowing longer press runs before re-grinding. Compressible and metal-back products cater to security printing and high-speed directory presses, while hybrid blankets bridge film and paper jobs in mixed-substrate plants.

Cost-sensitive users still favor conventional nitrile blankets; however, rising energy prices and sustainability policies are pulling investment toward UV. The printing blanket market, therefore, tilts gradually, not abruptly, as converters amortize legacy heat-set assets while installing UV on new lines. Suppliers that bundle blankets with sleeve-mount kits capture service revenue and lock in customers during the transition.

Paper and board accounted for 51.65% of the printing blanket market size in 2025, driven by catalog, folding carton, and commercial stationery work. Despite digital pressures, demand for folding cartons rises with online retail, sustaining paper-centric blanket consumption. Textile printing logs a 4.53% CAGR, helped by on-trend micro-collections in fashion and sustainable local manufacturing. Blankets for fabric must flex across weave variations without edge-cracking, driving suppliers to engineer softer surface layers and anti-marking coatings.

Metal, plastic, and film collectively form a smaller slice yet show pockets of growth in specialty cans and stand-up pouches. Offset's ability to render opaque inks on aluminum keeps metal printing viable, while film applications rely on compressible blankets that manage web stretch. Thus, substrate diversification shields the printing blanket market from steep declines in single-use commercial print.

The Printing Blanket Market Report Segments the Industry Into Blanket Type (UV Printing Blankets, Conventional Printing Blankets, Combination Printing Blankets), Substrate Type (Paper and Board Printing, Metal Printing, Textile Printing (Fabric), Other Printing), Application Type (Packaging, Commercial, Newspaper, Other Application Types), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia Pacific commanded 61.30% of the printing blanket market in 2025 and is forecasted to record a 4.34% CAGR from 2025 to 2031. China operates extensive offset capacity for export packaging and domestic retail, while India's label segment is projected to rise from USD 2.3 billion to USD 3.6 billion by 2025. Japan's USD 50 billion print sector sets quality benchmarks and drives early adoption of UV blankets. Southeast Asia gains market share as Vietnam, Indonesia, and Thailand attract foreign investment into packaging hubs that offer lower labor costs and competitive tax regimes.

North America remains critical for high-margin specialty blankets thanks to strong brand oversight and tight regulatory control. U.S. converters lead LED-UV retrofits, and Canadian plants supply luxury spirits packaging to global markets. Europe mirrors North America in sophistication but faces steeper offset attrition in the commercial print sector. Environmental directives are accelerating the migration to low-VOC washes and bio-based rubber, spurring product innovation.

South America, the Middle East, and Africa collectively account for under 10% of the printing blanket market today, yet they offer upside potential through industrialization and rising per-capita consumption. Lower inkjet penetration sustains offset blanket volumes, while government infrastructure projects keep local newspaper presses in operation. Blanket makers deepen partnerships with regional dealers to secure after-sales service, a critical differentiator in price-sensitive geographies. Across all regions, currency volatility and logistics bottlenecks nudge manufacturers toward multi-plant footprints, balancing cost and proximity.

- Continental AG

- Trelleborg AB

- Flint Group Germany GmbH

- Habasit AG

- Kinyo Co., Ltd.

- Kinyosha Co., Ltd.

- Felix Battcher GmbH and Co. KG

- Birkan GmbH

- Prisco, Inc.

- Meiji Rubber and Chemical Co., Ltd.

- Fujikura Composites Inc.

- Shanghai Chen Jie Printing Material Co., Ltd.

- Phoenix Xtra Blankets GmbH

- Zhuhai Print-Rite New Materials Co., Ltd.

- Pacesetter Graphic Service, Inc.

- Komori Corporation

- Manroland Sheetfed GmbH

- Koenig and Bauer AG

- Pamarco Global Graphics, LLC

- Day International, LLC

- Sumitomo Riko Company Limited

- Zhejiang Juding New Material Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for UV-compatible blankets in LED-UV and H-UV presses

- 4.2.2 Boom in short-run, customised packaging driving blanket changeovers

- 4.2.3 Rapid growth of flexible-packaging applications in FandB

- 4.2.4 Rising quality requirements for high-definition graphics

- 4.2.5 Expanding per-capita packaging consumption in emerging economies

- 4.2.6 Regulatory push toward low-VOC blanket-wash chemicals

- 4.3 Market Restraints

- 4.3.1 Accelerating shift to digital inkjet printing (blanket-free)

- 4.3.2 Decline in newspaper and magazine print volumes

- 4.3.3 Stringent VOC-emission norms raising compliance costs

- 4.3.4 Raw-rubber and polymer price volatility

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Microeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Blanket Type

- 5.1.1 UV Printing Blankets

- 5.1.2 Conventional Printing Blankets

- 5.1.3 Compressible Printing Blankets

- 5.1.4 Combination and Hybrid Blankets

- 5.1.5 Metal-Back Blankets

- 5.2 By Substrate Type

- 5.2.1 Paper and Board Printing

- 5.2.2 Metal Printing

- 5.2.3 Textile/Fabric Printing

- 5.2.4 Plastic and Film Printing

- 5.2.5 Other Substrates

- 5.3 By Application Type

- 5.3.1 Packaging

- 5.3.1.1 Flexible Packaging

- 5.3.1.2 Rigid Packaging

- 5.3.2 Commercial Printing

- 5.3.3 Newspaper Printing

- 5.3.4 Security Printing

- 5.3.5 Labels and Tags

- 5.3.6 Other Applications

- 5.3.1 Packaging

- 5.4 By Printing Process

- 5.4.1 Sheetfed Offset

- 5.4.2 Web Heatset Offset

- 5.4.3 Coldset Offset

- 5.4.4 Digital Offset (Thermal Blanket)

- 5.4.5 Flexographic Rubber-Sleeve

- 5.4.6 Gravure / Spot-Coating

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Trelleborg AB

- 6.4.3 Flint Group Germany GmbH

- 6.4.4 Habasit AG

- 6.4.5 Kinyo Co., Ltd.

- 6.4.6 Kinyosha Co., Ltd.

- 6.4.7 Felix Battcher GmbH and Co. KG

- 6.4.8 Birkan GmbH

- 6.4.9 Prisco, Inc.

- 6.4.10 Meiji Rubber and Chemical Co., Ltd.

- 6.4.11 Fujikura Composites Inc.

- 6.4.12 Shanghai Chen Jie Printing Material Co., Ltd.

- 6.4.13 Phoenix Xtra Blankets GmbH

- 6.4.14 Zhuhai Print-Rite New Materials Co., Ltd.

- 6.4.15 Pacesetter Graphic Service, Inc.

- 6.4.16 Komori Corporation

- 6.4.17 Manroland Sheetfed GmbH

- 6.4.18 Koenig and Bauer AG

- 6.4.19 Pamarco Global Graphics, LLC

- 6.4.20 Day International, LLC

- 6.4.21 Sumitomo Riko Company Limited

- 6.4.22 Zhejiang Juding New Material Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment