PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911446

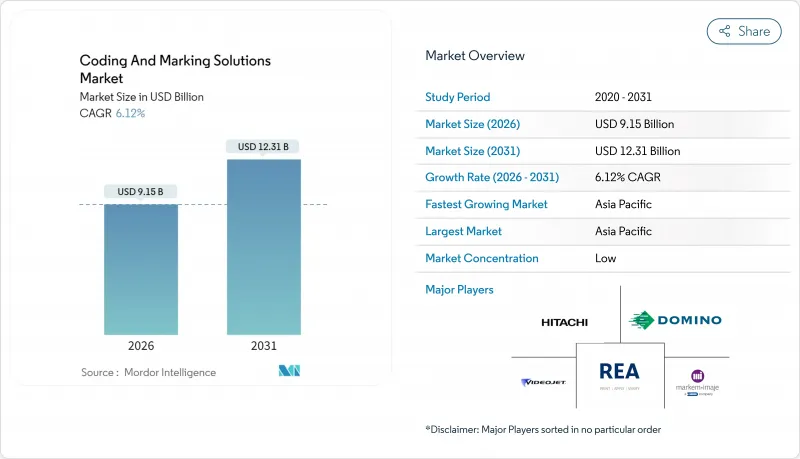

Coding And Marking Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The coding and marking solutions market size in 2026 is estimated at USD 9.15 billion, growing from 2025 value of USD 8.62 billion with 2031 projections showing USD 12.31 billion, growing at 6.12% CAGR over 2026-2031.

Robust demand for unique product identifiers, end-to-end traceability and tighter regulatory compliance across manufacturing industries underpins this expansion. Migrating from solvent-based inks to fiber-laser systems is accelerating as environmental regulations tighten, while software-centric platforms that enable remote analytics and predictive maintenance are redefining customer value propositions. Pharmaceutical serialization deadlines, the proliferation of 2D barcodes and the rollout of GS1 Digital Link standards are creating non-discretionary investments through 2030. Meanwhile, semiconductor shortages have prompted redesigns of printer controls and consumables, added cost pressures yet opening white-space opportunities for suppliers with diversified sourcing. Asia-Pacific's manufacturing scale, coupled with policy harmonization, keeps the region at the forefront of capacity expansions and equipment upgrades, consolidating its lead in the coding and marking solutions market.

Global Coding And Marking Solutions Market Trends and Insights

Expansion of production and packaging industry

Capacity additions across emerging markets generate sustained orders for integrated identification systems. Rapid uptake of flexible packaging, coupled with shorter product life cycles, pushes manufacturers toward printers that adapt to multiple substrates and SKU changes without line stoppages. Coca-Cola's refillable bottle program uses GS1 Digital Link-enabled QR codes, and refillable formats now account for more than 50% of sales in select Latin American markets. These objectives drive greater reliance on high-throughput continuous inkjet units and rugged laser coders that preserve legibility on curved or returnable surfaces. As sustainability guidelines take hold, reuse-focused packaging creates incremental print volumes for date, batch and deposit-refund information.

Demand for end-to-end traceability

Pharmaceutical serialization has become a model for food, beverage and cosmetics producers that seek to mitigate recalls and demonstrate authenticity. Woolworths achieved a 40% reduction in food waste after deploying GS1 DataMatrix codes, illustrating the operational gains from granular inventory visibility. Blockchain pilots that connect on-pack identifiers with distributed ledgers are beginning to offer real-time custody records, allowing brand owners to monetize traceability data services. Solution vendors respond by embedding cloud connectors and open APIs into coding hardware, positioning themselves as data enablers rather than stand-alone machine suppliers.

High capital and running costs

Fiber-laser units range from USD 10,000 to over USD 100,000, while continuous inkjet models require a steady supply of make-up fluids that inflate the total cost of ownership. Smaller contract packers hesitate to commit capital in tight-margin categories and often defer upgrades until regulators enforce new labeling rules. Managed service contracts and leasing schemes are gaining popularity because they shift investments from capital expenditure to predictable operating expenses, yet uptake remains modest among micro-enterprises.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory mandates for batch coding

- Industry 4.0-enabled predictive maintenance

- Semiconductor shortages in printer controls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equipment generated the bulk of 2025 revenue as factories continued multi-line installations; the coding and marking solutions market size for hardware reached USD 4.99 billion. Services and software, however, posted a 6.78% CAGR and are on track to exceed USD 2.18 billion by 2031 on the back of analytics subscriptions and remote-monitoring dashboards. Predictive-maintenance modules embedded in VideojetConnect alert operators to solvent levels, temperature deviations and nozzle health, cutting downtime by up to 20%. Spares and consumables preserve an annuity-style revenue model, with ribbon and ink sales closely mirroring overall print-volume growth and thereby buttressing vendor profitability.

The shift toward cloud-hosted code-management suites reflects mounting SKU complexity and the need for centralized governance of print rules across dispersed plants. Open API architecture enables seamless exchanges with ERP and MES platforms, simplifying compliance reporting during audits. As Industry 5.0 discussions advance, vendors frame coding devices as collaborative assets that integrate human oversight with AI-assisted decision making.

Continuous inkjet retained 43.78% of 2025 shipments, underscoring its versatility on high-speed bottling and canning lines. The coding and marking solutions market share for laser coders expanded as brands embraced solvent-free, permanent marks that withstand abrasion and moisture. Markem-Imaje's SmartLase F500 engraves up to 2,000 aluminum cans per minute, a performance benchmark that eased laser entry barriers for beverage producers. Fiber-laser coders eliminate consumable costs and reduce VOC emissions, strengthening their position in jurisdictions with rigorous environmental acts.

Thermal inkjet and drop-on-demand systems remain vital in porous applications such as corrugated boxes, while thermal-transfer overprinters cater to flexible packaging that demands crisp variable graphics at moderate speeds. Component makers such as Epson are quadrupling printhead capacity to satisfy anticipated demand spikes; its new plant in Japan embodies USD 5.1 billion in strategic investment.

The Coding and Marking Solutions Market Report is Segmented by Solution (Equipment, Fluids and Ribbons, Spares, Services and Software), Equipment Technology (Continuous Inkjet, Thermal Inkjet and More), Application (Component Identification, Brand Recognition and Marketing, and More), End-User Industry (Food & Beverage, Pharmaceutical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 33.55% of global revenue in 2025 and continues to lead growth with a 6.45% CAGR. China's large-scale FMCG plants consume fleets of high-speed continuous inkjets, while India's pharmaceutical exporters retrofit lines to satisfy DSCSA import requirements. Local distributors such as DKSH pair regional market knowledge with Koenig & Bauer Coding's hardware, improving aftermarket coverage in Southeast Asia. Government incentives that fund smart-factory upgrades further stimulate hardware and software uptake, embedding coding units into automated inspection cells across electronics and automotive clusters.

North America shows high regulatory stability anchored by DSCSA and FDA food-safety statutes. The looming 2027 deadline for full 2D barcode transition across retail channels spurs early adoption of printers capable of 300 dpi graphics at line speeds above 1,000 units per minute. Mexico leverages USMCA proximity to attract electronics and white-goods assembly, resulting in incremental installations of drop-on-demand coders on packaging films destined for U.S. retailers.

Europe maintains a mature installed base yet demonstrates steady replacement demand, particularly for laser coders aligned with circular-economy objectives to cut solvent emissions. Germany's OEMs specify OPC UA-ready coders, easing their integration into existing PLC architecture. Brexit has not altered United Kingdom compliance expectations, keeping EN-aligned regulations intact and supporting ongoing investments in print-and-apply systems for warehouse automation.

- Videojet Technologies Inc.

- Domino Printing Sciences plc

- Markem-Imaje Corporation

- Hitachi, Ltd.

- REA Elektronik GmbH

- Linx Printing Technologies Ltd.

- Matthews International Corporation

- Keyence Corporation

- Paul Leibinger GmbH & Co. KG

- Koenig & Bauer Coding GmbH

- Control Print Limited

- ITW FoxJet

- United Barcode Systems S.L.

- KGK Jet Group

- ID Technology, LLC (ProMach)

- SATO Holdings Corporation

- Danaher Corporation

- Squid Ink Manufacturing, Inc.

- Guangzhou EC-JET Technology Co., Ltd.

- Diagraph Corporation (ITW)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of production and packaging industry

- 4.2.2 Demand for end-to-end traceability

- 4.2.3 Regulatory mandates for batch coding

- 4.2.4 Industry 4.0-enabled predictive maintenance

- 4.2.5 Shift to solvent-free fiber-laser coding

- 4.3 Market Restraints

- 4.3.1 High capital and running costs

- 4.3.2 Growth of pre-printed packaging alternatives

- 4.3.3 Semiconductor shortages in printer controls

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investments Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Solution

- 5.1.1 Equipment

- 5.1.2 Fluids and Ribbons

- 5.1.3 Spares

- 5.1.4 Services and Software

- 5.2 By Equipment Technology

- 5.2.1 Continuous Inkjet (CIJ)

- 5.2.2 Thermal Inkjet (TIJ)

- 5.2.3 Laser Coders

- 5.2.4 Drop-on-Demand and Valve Jet

- 5.2.5 Thermal Transfer Overprinting

- 5.3 By Application

- 5.3.1 Component Identification

- 5.3.2 Brand Recognition and Marketing

- 5.3.3 Traceability and Anti-counterfeiting

- 5.3.4 Compliance and Regulatory Coding

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Pharmaceutical

- 5.4.3 Cosmetics and Personal Care

- 5.4.4 Construction and Industrial

- 5.4.5 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Videojet Technologies Inc.

- 6.4.2 Domino Printing Sciences plc

- 6.4.3 Markem-Imaje Corporation

- 6.4.4 Hitachi, Ltd.

- 6.4.5 REA Elektronik GmbH

- 6.4.6 Linx Printing Technologies Ltd.

- 6.4.7 Matthews International Corporation

- 6.4.8 Keyence Corporation

- 6.4.9 Paul Leibinger GmbH & Co. KG

- 6.4.10 Koenig & Bauer Coding GmbH

- 6.4.11 Control Print Limited

- 6.4.12 ITW FoxJet

- 6.4.13 United Barcode Systems S.L.

- 6.4.14 KGK Jet Group

- 6.4.15 ID Technology, LLC (ProMach)

- 6.4.16 SATO Holdings Corporation

- 6.4.17 Danaher Corporation

- 6.4.18 Squid Ink Manufacturing, Inc.

- 6.4.19 Guangzhou EC-JET Technology Co., Ltd.

- 6.4.20 Diagraph Corporation (ITW)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis