PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911457

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911457

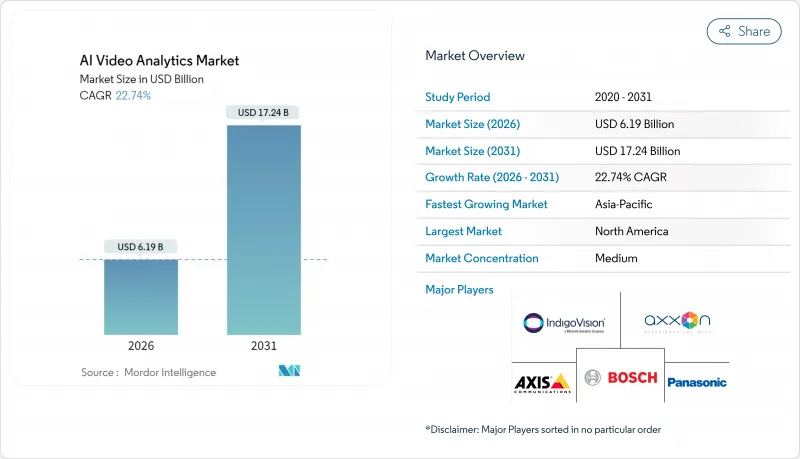

AI Video Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

AI video analytics market size in 2026 is estimated at USD 6.19 billion, growing from 2025 value of USD 5.04 billion with 2031 projections showing USD 17.24 billion, growing at 22.74% CAGR over 2026-2031.

Elevated urban-security risks, rapid smart-city rollouts, and sharply lower edge-AI chipset prices continue to expand the technology's addressable base. Municipal programs now treat AI-enabled cameras as multi-utility sensors, unlocking uses from traffic orchestration to predictive maintenance. Retailers deploy in-store behavior analytics to merge physical and digital customer journeys, while enterprises increasingly favor cloud workflows that keep models updated without large capital outlays. These shifts open room for outcome-based service models and vertical-specific offerings that promise faster ROI.

Global AI Video Analytics Market Trends and Insights

Integration of AI-equipped CCTV in Smart-City Projects

Municipal programs have evolved basic surveillance grids into real-time urban operating systems. Shenzhen's Futian District reduced incident response from 4 minutes to 50 seconds after rolling out an AI-driven event-routing platform that now guides traffic teams, utilities, and emergency services. Hangzhou's City Brain analyzes camera feeds from more than 100 intersections, detects accidents in seconds, and reshapes signal timing to trim average commutes by 4.6 minutes. These outcomes justify repeat municipal budgets and encourage neighboring cities to replicate blueprints, widening the AI video analytics market.

Rising Retail and E-commerce Demand for In-Store Behavior Analytics

Retail chains integrate vision data with loyalty and e-commerce platforms to reveal true customer journeys. Queue tracking, shelf-stock heatmaps, and demographic dashboards lift conversion and cut wait times, with some deployments reporting triple-digit ROI. Video-captured dwell patterns now feed recommendation engines to tailor online promotions. Quick-service restaurants apply the same feeds to enforce food-safety checklists and optimize staffing. As physical stores become data-rich touchpoints, investment in cloud-native analytics accelerates.

Data-Privacy Regulation Barriers to Facial Recognition

GDPR and similar statutes now require explicit consent and data-minimization, forcing vendors to mask or hash biometric information. Providers increasingly market metadata-only solutions that strip personal identifiers while preserving occupancy counts and flow maps. Compliance revamps add cost and delay rollouts, yet they also catalyze advances in federated learning and differential privacy that may future-proof offerings.

Other drivers and restraints analyzed in the detailed report include:

- Proactive Threat Detection Amid Escalating Security Risks

- Declining Cost of Edge-AI Chipsets

- High Integration Cost with Legacy CCTV

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 63.88% revenue share in 2025, underscoring how algorithm accuracy rather than hardware dictates purchase decisions. Services revenue is growing at a 23.96% CAGR as customers favor managed outcomes over perpetual licenses, often bundling model training and performance tuning in multiyear contracts. Continuous neural-network upgrades, including vision-language transformer models introduced in 2024, have kept replacement cycles brisk.

Intelligent search functions driven by generative AI let operators retrieve events using plain-language prompts instead of frame-by-frame review. Simultaneously, the hardware stack is shifting to chiplets optimized for sparsity and quantization, cutting power draw for passive installations. Software-centric subscription pricing gives vendors stable ARR while permitting users to activate specialized modules only when needed.

On-premises hosting accounted for 53.54% of revenue in 2025 thanks to government and critical-infrastructure clients that must retain footage locally. Yet the cloud segment is expanding at 23.74% CAGR as enterprises appreciate elastic GPU pools for frequent model retraining. Three-year TCO studies show cloud deployments lowering spend by 55% compared with edge appliances when video retention exceeds 90 days.

Hybrid patterns have emerged: inference runs at the camera, metadata streams to a regional hub, and intensive re-training tasks occur in a sovereign cloud to meet residency laws. Vendors position MLOps pipelines as differentiators, automating data labeling, drift detection, and rollback. As compliance clarity improves, many on-premises users pilot parallel cloud sandboxes to benchmark performance, nudging future migration.

The AI Video Analytics Market Report is Segmented by Component (Software, Hardware, and Services), Deployment Mode (On-Premises, and More), Analytics Type (Video Content Analytics, Facial Recognition, and More), Application (Security and Surveillance, Traffic and Transportation Management, and More), End-User (Government and Public Safety, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 38.22% revenue share in 2025, grounded in deep R&D, integrator ecosystems, and enterprise IT budgets. Federal grants for critical-infrastructure protection continue to refresh camera fleets, while big-box retail chains scale analytics to thousands of stores. Yet Asia Pacific is accelerating at a 23.18% CAGR to 2031 on the back of large-scale smart-city rollouts and expanding e-commerce platforms.

China's provincial projects, such as Hangzhou's 100-intersection City Brain, demonstrate how city-wide AI can cut emergency response times nearly in half. India's AI sector is forecast to hit USD 8 billion by 2025, with retail, manufacturing, and healthcare pilots already budgeting camera analytics. Japan channels automation spending toward elder-care robots and factory vision systems, offsetting workforce shortages. Europe enforces privacy-by-design mandates, leading vendors to export compliant templates worldwide, while Gulf states fund AI academies to cultivate 10,000 skilled practitioners

- Hikvision Digital Technology

- IndigoVision

- AxxonSoft

- Dahua Technology

- Axis Communications AB

- Huawei Technologies (Hisilicon/MindSpore)

- Bosch Security Systems

- Motorola Solutions (Avigilon)

- Canon (BriefCam)

- Honeywell International

- Panasonic Holdings Corporation

- NEC Corporation

- Gorilla Technology Group

- Verint Systems

- iOmniscient

- Agent Vi / Irisity

- Senstar Corporation

- AnyVision Ltd.

- SenseTime Ltd.

- Vintra Inc.

- IntelliVision Ltd.

- OpenCV.ai Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of AI-equipped CCTV in smart-city projects

- 4.2.2 Rising retail and e-commerce demand for in-store behavior analytics

- 4.2.3 Proactive threat detection amid escalating security risks

- 4.2.4 Declining cost of edge-AI chipsets

- 4.2.5 Legislation on visual process-transparency in industry (under-radar)

- 4.2.6 Privacy-preserving federated learning models (under-radar)

- 4.3 Market Restraints

- 4.3.1 Data-privacy regulation barriers to facial recognition

- 4.3.2 High integration cost with legacy CCTV

- 4.3.3 Model bias and false-positive risk (under-radar)

- 4.3.4 GPU supply-chain volatility (under-radar)

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Hardware

- 5.1.3 Services

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.2.3 Hybrid / Edge

- 5.3 By Analytics Type

- 5.3.1 Video Content Analytics

- 5.3.2 Facial Recognition

- 5.3.3 Crowd and Behavior Detection

- 5.3.4 Automatic Number-Plate Recognition

- 5.3.5 Gesture / Action Recognition

- 5.4 By Application

- 5.4.1 Security and Surveillance

- 5.4.2 Traffic and Transportation Management

- 5.4.3 Retail Customer Insight

- 5.4.4 Industrial Quality Inspection

- 5.4.5 Healthcare Monitoring

- 5.4.6 Others

- 5.5 By End-User (Value)

- 5.5.1 Government and Public Safety

- 5.5.2 Retail and E-commerce

- 5.5.3 Transportation and Logistics

- 5.5.4 Manufacturing

- 5.5.5 BFSI

- 5.5.6 Healthcare

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Hikvision Digital Technology

- 6.4.2 IndigoVision

- 6.4.3 AxxonSoft

- 6.4.4 Dahua Technology

- 6.4.5 Axis Communications AB

- 6.4.6 Huawei Technologies (Hisilicon/MindSpore)

- 6.4.7 Bosch Security Systems

- 6.4.8 Motorola Solutions (Avigilon)

- 6.4.9 Canon (BriefCam)

- 6.4.10 Honeywell International

- 6.4.11 Panasonic Holdings Corporation

- 6.4.12 NEC Corporation

- 6.4.13 Gorilla Technology Group

- 6.4.14 Verint Systems

- 6.4.15 iOmniscient

- 6.4.16 Agent Vi / Irisity

- 6.4.17 Senstar Corporation

- 6.4.18 AnyVision Ltd.

- 6.4.19 SenseTime Ltd.

- 6.4.20 Vintra Inc.

- 6.4.21 IntelliVision Ltd.

- 6.4.22 OpenCV.ai Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment