PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911465

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911465

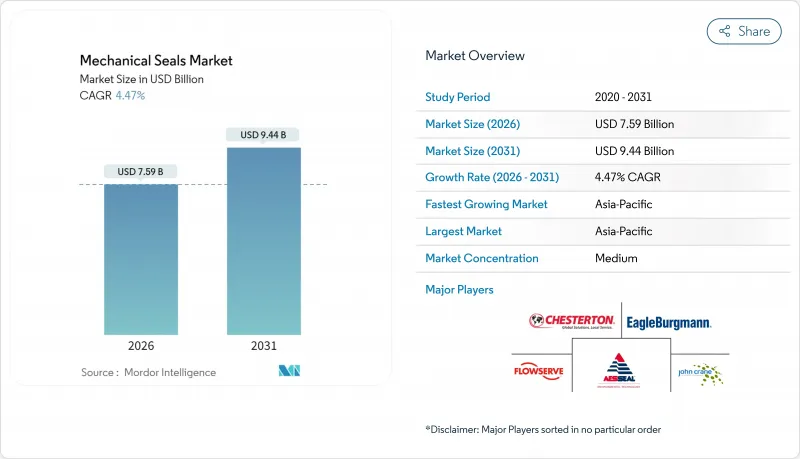

Mechanical Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Mechanical Seals Market size in 2026 is estimated at USD 7.59 billion, growing from 2025 value of USD 7.27 billion with 2031 projections showing USD 9.44 billion, growing at 4.47% CAGR over 2026-2031.

Demand tracks the critical need to prevent leakage in rotating equipment, as 70% of pump failures originate with seal issues. Growth is reinforced by tightening fugitive-emission rules, including the U.S. EPA mandate that rotary pumps handling volatile organic compounds above 1.5 psia must employ compliant mechanical seals. Expansion of hydrogen and carbon-capture infrastructure, coupled with large-scale petrochemical and power projects, adds structural tailwinds for the mechanical seals market across the next decade.

Global Mechanical Seals Market Trends and Insights

Growing Demand from Oil and Gas Projects

Massive pipeline and processing expansions elevate seal demand by requiring units designed for pressures surpassing 150 bar and gas compositions rich in H2S, CO2, and high condensate fractions. Saudi Arabia's Master Gas System Phase 3 alone raises network capacity to 12.5 billion cubic feet per day, mandating large inventories of engineered cartridge seals that maintain integrity under sour-gas conditions. ADNOC's historical warranty claims of USD 2.8 million for seal failures illustrate the cost of under-specifying such equipment. Dry-gas seal contracts tied to ADNOC's 1.5 million-tons-per-year carbon-capture facility confirm the segment's strategic importance. Partnerships between pump OEMs and seal specialists are deepening to co-engineer solutions, a trend evidenced by EagleBurgmann's high-pressure seal packages for Russian trunk pipelines. Collectively, these projects underpin robust, multi-year growth for the mechanical seals market.

Surge in New Power-Generation Capacity Additions

Nuclear renaissance, thermal retrofits, and renewable hybrids expand the installed base of high-speed pumps, compressors, and turbine auxiliary systems that all require specialized sealing arrangements. Flowserve recorded nuclear orders topping USD 100 million for the third straight quarter in 2025, highlighting capital acceleration toward carbon-neutral generation. Concentrated solar power projects are introducing molten-salt loops operating near 565 °C, prompting suppliers to develop graphite- and grafoil-lined seal faces that withstand extreme temperatures. Across renewable and conventional builds, utilities prioritize seals that can run maintenance-free across 18- to 24-month outage cycles, lifting preference for robust cartridge designs equipped with Plan 32 buffer fluid systems. This momentum supports a durable uplift in the mechanical seals market across the coming decade.

Rapid Uptake of Non-Contact Magnetic Seals

Magnetic couplings eliminate friction, extend service life, and cut water consumption, attributes that are resonating in pharmaceutical, food, and certain chemical processes. Their applicability remains limited by torque capacity and heat dissipation constraints, restricting penetration to low-power services. Nonetheless, niche substitution pressures may trim incremental growth from the mechanical seals market in selected segments.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Fugitive-Emission Regulations Worldwide

- Capacity Expansion in Chemical and Petrochemical Complexes

- High Lifecycle Cost in Abrasive Slurry Services

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pump seals generated 64.35% of the mechanical seals market revenue in 2025, reflecting ubiquitous deployment across crude-oil transfer, chemical reactors, and municipal water stations. Suppliers are pairing embedded sensors with cloud dashboards to log vibration and temperature, enabling predictive maintenance that lowers downtime. Compressor seals occupy a crucial but smaller share focused on gas pipelines and LNG facilities, where dry-gas designs eliminate oil entrainment and curtail methane slip. Mixer seals round out the portfolio by servicing batch reactors in pharma and food processing, a niche that values hygienic designs and CIP-friendly elastomers. Rising pump installations underpin the fastest CAGR at 4.56% for this group, locking in continued dominance within the mechanical seals market.

Demand tailwinds include heightened midstream construction and stricter emission caps that disfavor packing solutions. John Crane's USP-series pumps display a 40% reduction in lifecycle cost versus traditional pusher types over five-year spans. Compressor seal suppliers are capitalizing on decarbonization by bundling carbon-capture service agreements. Mixer-seal makers focus on speed variation tolerance and radial misalignment compensation. Across categories, rapid replacement programs support resilience in the mechanical seals industry despite cyclical capex swings.

The Mechanical Seals Report is Segmented by Seal Type (Pump Seals, Compressor Seals, and Mixer Seals), Design Type (Component/Pusher, Cartridge, and Split), End-User Industry (Oil and Gas, Power Generation, Chemical, Water and Waste-Water, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 36.35% holding in the mechanical seals market reflects petrochemical and gas-pipeline megaprojects that require thousands of rotary seals per site. Sustained 4.68% CAGR stems from long-lead projects like India's refinery upgrades and China's coal-to-chemicals complexes, each demanding cartridge and bellows technology able to tackle abrasive and high-temperature feeds. Local manufacture under license is expanding, yet complex faces and coatings still rely on imports, preserving pricing power for global suppliers. Service-center expansion, such as John Crane's Baton Rouge-style model replicated in Singapore, shores up aftermarket revenues and lifetime customer loyalty.

North America benefits from shale liquids logistics, LNG export terminals, and the U.S. government's 45Q tax credit for carbon capture, all of which specify API-compliant dual seals and dry-gas seals. The mechanical seals market size in North America is forecast to pass USD 2.12 billion by 2031, supported by retrofit programs that align with stringent methane-reduction rules.

Europe's strict TA-Luft implementation, coupled with accelerating renewables penetration, positions the region as a technology test bed for ultra-low-leakage solutions. Operators add seal-monitoring probes tied to supervisory control systems to ensure compliance, feeding demand for digital-ready cartridge units.

Hydrogen refueling stations and ammonia bunkering ventures in the North Sea drive niche, high-value orders. While overall mechanical seals market share is smaller than Asia-Pacific's, European unit values are highest because of complex specification layers and long warranty terms. Suppliers that can certify materials to EN 10204 and adhere to PED and ATEX regulations maintain strategic advantage in this tightly regulated arena.

- A.W. Chesterton Company

- AESSEAL

- Dana Limited

- Eagle Industry Co., Ltd.

- EagleBurgmann

- Flexaseal Engineered Seals and Systems, LLC

- Flowserve Corporation

- Gallagher Seals

- Garlock

- Hutchinson Industries Inc.

- John Crane

- Parker Hannifin Corp

- SKF

- Technetics Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from Oil and Gas Projects

- 4.2.2 Surge in New Power-Generation Capacity Additions

- 4.2.3 Tightening Fugitive-Emission Regulations Worldwide

- 4.2.4 Capacity Expansion in Chemical and Petrochemical Complexes

- 4.2.5 Cryogenic Hydrogen and Green-Ammonia Infrastructure Build-Out

- 4.3 Market Restraints

- 4.3.1 Rapid Uptake of Non-Contact Magnetic Seals

- 4.3.2 High Lifecycle Cost in Abrasive Slurry Services

- 4.3.3 3-D Printed Seal Housings Reducing Aftermarket Volumes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Seal Type

- 5.1.1 Pump Seals

- 5.1.2 Compressor Seals

- 5.1.3 Mixer Seals

- 5.2 By Design Type

- 5.2.1 Component / Pusher

- 5.2.2 Cartridge

- 5.2.3 Split

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Power Generation

- 5.3.3 Chemical

- 5.3.4 Water and Waste-water

- 5.3.5 Other End-user Industries (Mining and Mineral Processing, Food, Pharma, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A.W. Chesterton Company

- 6.4.2 AESSEAL

- 6.4.3 Dana Limited

- 6.4.4 Eagle Industry Co., Ltd.

- 6.4.5 EagleBurgmann

- 6.4.6 Flexaseal Engineered Seals and Systems, LLC

- 6.4.7 Flowserve Corporation

- 6.4.8 Gallagher Seals

- 6.4.9 Garlock

- 6.4.10 Hutchinson Industries Inc.

- 6.4.11 John Crane

- 6.4.12 Parker Hannifin Corp

- 6.4.13 SKF

- 6.4.14 Technetics Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment