PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911480

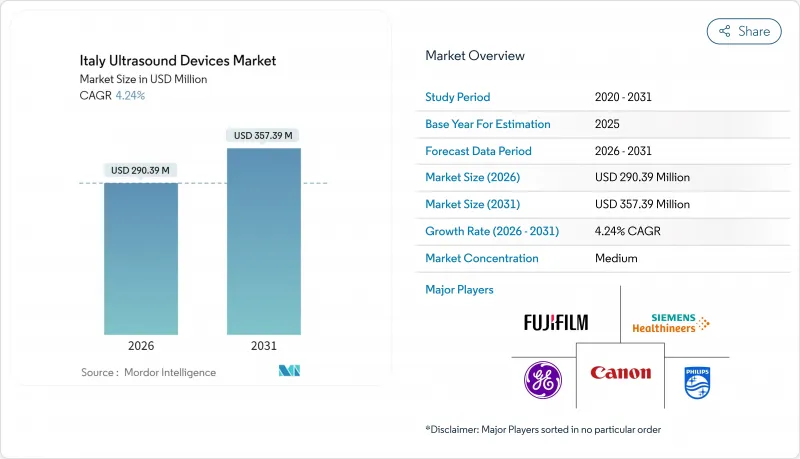

Italy Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Italy Ultrasound Devices Market is expected to grow from USD 278.58 million in 2025 to USD 290.39 million in 2026 and is forecast to reach USD 357.39 million by 2031 at 4.24% CAGR over 2026-2031.

The steady up-trend reflects the National Recovery and Resilience Plan (NRRP) budget allocation for replacing obsolete imaging equipment, the country's status as Europe's fourth-largest medical-device marketplace, and continued public-hospital dominance in procurement. Rising chronic-disease prevalence, rapid adoption of 3D/4D imaging, and an ongoing pivot to handheld point-of-care systems add further momentum, while EU MDR compliance costs and regional budget constraints temper the growth trajectory. Manufacturers concentrate on AI-enabled workflow tools that mitigate Italy's sonographer shortage, and on flexible financing models that help Southern regions bridge the North-South technology gap. Competitive advantage increasingly stems from end-to-end service contracts and cross-modality software suites that can be deployed quickly under time-bound NRRP tenders.

Italy Ultrasound Devices Market Trends and Insights

Increasing Burden of Chronic Diseases

Italy's aging profile 23.5% of residents are over 65 creates rising cardiovascular, musculoskeletal, and oncological screening needs that rely on ultrasound for first-line imaging. Hospital networks respond by prioritizing multi-application consoles that support cardiology, vascular, and abdominal exams within a single workflow, reinforcing capital demand in both tertiary and community hospitals. Handheld scanners are now embedded in chronic-care home-visits conducted by family physicians, reducing unnecessary travel for mobility-limited patients. Northern regions fund advanced 3D/4D units for complex cardiac follow-up, while Southern provinces channel NRRP grants toward baseline 2D systems to close diagnostic-access gaps. The predictable rise in chronic-care visits provides stable replacement cycles for vendors and underpins multi-year service contracts that guarantee uptime and staff training.

Technological Advancements in Imaging & AI

Research groups in Rome, Milan, and Bologna have validated convolutional-neural-network algorithms that auto-classify obstetric, musculoskeletal, and thyroid scans with 94-96% accuracy, cutting exam times by 28%. AI overlay is now embedded in premium consoles as an optional license, giving hospitals a modular upgrade path that circumvents full hardware replacement. Cloud-based decision-support dashboards enable remote over-reads by sub-specialists, a critical aid to smaller Southern facilities that lack experienced sonographers. Competitive tender documents increasingly include real-time quality-assurance metrics, pushing vendors to bundle AI software and standardized reporting templates. While reimbursement still applies to the scan and not the algorithm, early adopters leverage faster throughput to raise monthly exam volumes without adding staff.

EU MDR & Stringent Local Regulations

Certification queues at notified bodies extend device-launch lead times from 9 to 18 months, forcing several SMEs to freeze R&D pipelines or withdraw low-volume probes. Italian language-labeling and post-market surveillance updates add roughly EUR 120 thousands (USD 139 thousands) per product family, a heavy outlay for niche HIFU firms. Hospitals, wary of mid-cycle de-certification, stipulate MDR compliance as a hard tender requirement, effectively sidelining legacy CE-marked models. Larger multinationals absorb the cost by amortizing across global volumes, increasing their competitive edge. While the new rules raise clinical-evidence standards, they also suppress the pace at which novel transducers or AI modules reach clinicians, moderating near-term growth.

Other drivers and restraints analyzed in the detailed report include:

- NRRP Funding for Replacement of Obsolete Equipment

- Post-COVID Shift to Handheld/POC Ultrasound

- High Cost of Advanced Cart & HIFU Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiology commands 37.82% of Italy ultrasound devices market share, capitalizing on consolidated hospital imaging budgets and workflow-optimization software that routes referrals electronically. Multi-disciplinary reliance from oncology staging to abdominal emergencies anchors recurring probe-replacement demand and raises console utilization rates above 80% in tertiary centers. Gynecology/obstetrics sustains volume with three state-funded prenatal scans, and private clinics often add early-pregnancy 3D packages. Cardiology exploits handheld echocardiography for rapid triage, boosting outpatient throughput and reducing unnecessary CT scans.

Critical care, advancing at a 5.65% CAGR, benefits from protocolized lung, vascular-access, and cardiac-function assessments at the bedside. Clinical-engineering departments, intent on standardizing device fleets, increasingly favor cross-department consoles equipped with preset ICU, ED, and anesthesia workflows. Radiology departments, in turn, extend their influence by training non-radiologist clinicians and overseeing PACS integration, thereby preserving governance over rising point-of-care volumes.

3D & 4D platforms hold 41.45% of Italy ultrasound devices market share thanks to high-resolution volumetric rendering that enhances obstetric bonding and guides complex cardiac interventions. Integrated elastography modules add incremental liver-disease value and reduce MRI referrals. Doppler suites remain standard on upper-mid carts, supporting carotid-plaque and peripheral-artery monitoring in aging populations.

HIFU, the fastest-growing technology at 5.18% CAGR, gains traction in prostate, uterine-fibroid, and bone-metastasis indications after multi-center studies in Turin and Bologna reported pain-reduction rates above 60% at six months. Funding flows from mixed public-private partnerships, while manufacturers provide clinical-project management and physician training to accelerate adoption. The tilt toward therapeutic ultrasound encourages vendors to bundle diagnostic consoles with a path to future HIFU upgrades, locking in long-term customer relationships.

The Italy Ultrasound Devices Market Report is Segmented by Application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, and More), Technology (2D Ultrasound Imaging, 3D & 4D Ultrasound Imaging, and More), Portability (Stationary Systems, and More), End User (Hospitals, Diagnostic Centers, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Canon

- SonoScape Medical

- FUJIFILM

- GE Healthcare

- Hologic

- Koninklijke Philips

- Mindray

- Samsung Group

- Esaote

- Siemens Healthineers

- Hitachi

- Butterfly Network Inc.

- Terason Corporation

- BK Medical ApS

- Clarius Mobile Health Corp

- Chison Medical Imaging Co. Ltd.

- Supersonic Imagine SA

- Vinno Technology (Shenzhen) Co. Ltd.

- Analogic Corp.

- Echosens SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Chronic Diseases

- 4.2.2 Technological Advancements in Imaging & AI

- 4.2.3 NRRP Funding for Replacement of Obsolete Equipment

- 4.2.4 Post-COVID Shift to Handheld/POC Ultrasound

- 4.2.5 Centralized Procurement & E-Tender Harmonization

- 4.2.6 Growth In Ultrasound-Guided Pain-Management Procedures

- 4.3 Market Restraints

- 4.3.1 EU MDR & Stringent Local Regulations

- 4.3.2 High Cost of Advanced Cart & HIFU Systems

- 4.3.3 Limited Outpatient Reimbursement Tariffs

- 4.3.4 Shortage of Trained Sonographers in Southern Italy

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Application

- 5.1.1 Anesthesiology

- 5.1.2 Cardiology

- 5.1.3 Gynecology / Obstetrics

- 5.1.4 Musculoskeletal

- 5.1.5 Radiology

- 5.1.6 Critical Care

- 5.1.7 Urology

- 5.1.8 Vascular

- 5.1.9 Other Applications

- 5.2 By Technology

- 5.2.1 2D Ultrasound Imaging

- 5.2.2 3D & 4D Ultrasound Imaging

- 5.2.3 Doppler Imaging

- 5.2.4 High-Intensity Focused Ultrasound

- 5.2.5 Other Technologies

- 5.3 By Portability

- 5.3.1 Stationary Systems

- 5.3.2 Portable Cart-based Systems

- 5.3.3 Hand-held / Pocket Devices

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Home Healthcare Settings

- 5.4.5 Other End Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 Canon Medical Systems Corporation

- 6.3.2 SonoScape Medical Corp

- 6.3.3 Fujifilm Holdings Corporation

- 6.3.4 GE Healthcare

- 6.3.5 Hologic Inc.

- 6.3.6 Koninklijke Philips NV

- 6.3.7 Mindray Medical International Ltd.

- 6.3.8 Samsung Electronics Co. Ltd.

- 6.3.9 Esaote SpA

- 6.3.10 Siemens Healthineers AG

- 6.3.11 Hitachi Ltd.

- 6.3.12 Butterfly Network Inc.

- 6.3.13 Terason Corporation

- 6.3.14 BK Medical ApS

- 6.3.15 Clarius Mobile Health Corp

- 6.3.16 Chison Medical Imaging Co. Ltd.

- 6.3.17 Supersonic Imagine SA

- 6.3.18 Vinno Technology (Shenzhen) Co. Ltd.

- 6.3.19 Analogic Corp.

- 6.3.20 Echosens SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment