PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911485

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911485

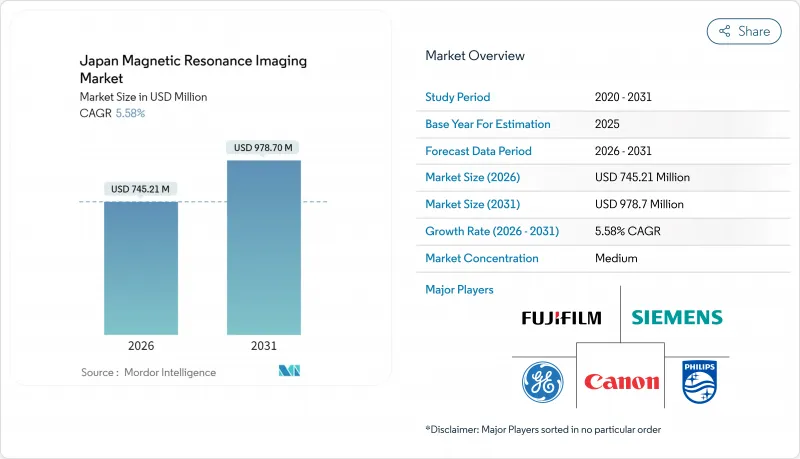

Japan Magnetic Resonance Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan MRI market was valued at USD 705.84 million in 2025 and estimated to grow from USD 745.21 million in 2026 to reach USD 978.7 million by 2031, at a CAGR of 5.58% during the forecast period (2026-2031).

Sustained demand arises from universal health-insurance coverage that reimburses 70% of imaging costs. Closed systems remain the preferred technology because hospitals place a premium on high-resolution images for stroke and dementia care. Artificial-intelligence-based reconstruction shortens scan times and elevates 1.5 T image quality to near-3 T levels, allowing facilities to manage Japan's radiologist shortage while improving throughput. Meanwhile, the aging population and a growing network of stand-alone imaging centers expand outpatient demand for oncology and musculoskeletal scans.

Japan Magnetic Resonance Imaging Market Trends and Insights

Introduction of Hybrid MRI Systems

Hybrid platforms deliver simultaneous structural and functional data, boosting diagnostic yield in fewer sessions. Canon Medical's horizontally open 1.2 T kinematic system enables real-time joint studies critical to Japan's sports-medicine programs . Research institutions apply hybrid imaging to quantify glymphatic-system dynamics that underpin neurodegenerative-disease studies. Hospitals welcome the technology because one machine now supports both standard and interventional workflows, improving room utilization. The platform also reduces anesthesia exposure for pediatric cases because fewer separate scans are required. Collectively, these advantages accelerate capital-budget approvals despite higher upfront costs.

Universal Health-Insurance Coverage

Japan's single-payer system guarantees predictable reimbursement, which shields MRI demand from economic cycles. Out-of-pocket co-payments average JPY 20,000-50,000 (USD 125-312) in public hospitals, keeping utilization high yet discouraging unnecessary repeat scans . The reimbursement schedule is reviewed biennially, offering providers visibility into future cash flows and enabling long-range equipment-refresh planning. Consistent payment levels also lower investment risk for new entrants operating stand-alone centers. Nevertheless, looming demographic-driven healthcare-finance pressures could prompt higher co-payments, tempering volume growth after 2030.

Shortage of Board-Certified Radiologists

Japan has 36 radiologists per million residents compared with the OECD average of 101, forcing each specialist to interpret 6,130 CT/MR studies per year. Overwork elevates burnout risk and could compromise diagnostic accuracy. Rural areas experience the sharpest gaps; more than half of prefectures report vacancy rates above 25% for hospital radiology posts. Teleradiology firms step in but add cost and potential turnaround delays. The Japan Radiological Society expanded fellowship quotas in 2024, yet training pipelines lag equipment proliferation. Without a larger workforce, under-utilization of installed scanners will cap volume growth despite favorable reimbursement.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of 3 T Installations in Secondary-Care Hospitals

- Emergence of AI-Based Image Reconstruction

- High Acquisition & Maintenance Costs of 3 T & 7 T Units

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Closed scanners accounted for 75.21% of the Japan MRI market share in 2025, reflecting hospital preference for maximum gradient performance in neurological and oncological protocols. Open units, however, are gaining traction with a 6.02% CAGR as providers target claustrophobic, pediatric and interventional cases. The Japan MRI market size for open configurations is projected to exceed USD 235.4 million by 2031, underpinning diversification of vendor portfolios. Manufacturers now launch semi-open 1.2 T systems that preserve gradient strength while offering 270-degree patient access, balancing comfort and image quality. Private imaging centers located in retail clinics leverage these units to differentiate on patient experience and drive evening operation schedules that appeal to working adults.

The shift also aligns with Japan's strategy to expand outpatient surgical suites. Arthroscopic and pain-management procedures increasingly rely on real-time imaging; open magnets facilitate physician access without compromising sterility. Government safety guidelines published in 2024 set standardized RF-exposure limits for intraoperative use, accelerating approvals. In parallel, AI-reconstruction algorithms mitigate lower signal-to-noise ratios inherent in open designs, narrowing the image-quality gap with closed scanners and bolstering clinical confidence among skeptical radiologists.

High-Field 1.5 T scanners hold 55.64% of current installations, supported by broad clinical versatility and favorable cost-of-ownership metrics. Deep-learning upgrades further solidify their position by delivering 3 T-like clarity at reduced helium consumption. Hospitals in regional hubs often deploy dual-1.5 T rooms to manage night-shift emergency imaging, reducing wait times while circumventing the need for extra 3 T personnel. As AI platforms mature, the 1.5 T segment of the Japan MRI market size is estimated to grow at 4.72% CAGR through 2031, sustaining replacement demand.

Ultra-High-Field 7 T devices, though fewer, represent the research frontier with a 5.71% CAGR and will surpass 35 installed units nationwide by 2031. Neuroscience centers leverage 7 T's superior susceptibility contrast to map micro-vascular dementia biomarkers, an area of heightened interest for Japan's aging society. The Japan MRI market share for 7 T is small but commands premium service contracts that entice vendors to localize coil-manufacturing and physicist support teams. Regulatory clarity arrived in 2024 when the Pharmaceuticals and Medical Devices Agency published dedicated RF-safety protocols, shortening site-planning cycles and boosting buyer confidence among tertiary hospitals.

The Japan MRI Market Report is Segmented by Architecture (Closed MRI Systems, Open MRI Systems), Field Strength (Low-Field (<1 T), High-Field (1. 5 T), Very High-Field (3 T), Ultra-High-Field (7 T)), Application (Neurology, Oncology, Cardiology, Musculoskeletal, Abdominal & Pelvic, Pediatric Imaging), End User (Hospitals, Stand-Alone Imaging Centers, Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Canon

- Fujifilm Healthcare Corp.

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips

- United Imaging Healthcare

- Esaote

- Shimadzu

- Hitachi Ltd. (Legacy Systems)

- Neusoft Medical Systems

- Shenzhen Anke High-tech

- Hyperfine

- Aspect Imaging

- Elekta AB (MR-Linac)

- Synaptive Medical

- Time Medical Systems

- Paramed Medical Systems

- Aurora Imaging

- SinoVision

- Medonica

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Introduction Of Hybrid Mri Systems

- 4.2.2 Universal Health-Insurance Coverage

- 4.2.3 Rapid Expansion Of 3 T Installations In Secondary-Care Hospitals

- 4.2.4 Government Funding For Neuro-Imaging Research

- 4.2.5 Emergence Of AI-Based Image Reconstruction Reducing Scan Time

- 4.2.6 Move Toward Out-Of-Hospital Imaging Suites In Retail Clinics

- 4.3 Market Restraints

- 4.3.1 High Acquisition & Maintenance Costs Of 3 T & 7 T Units

- 4.3.2 Shortage Of Board-Certified Radiologists

- 4.3.3 Stringent RF-Safety Guidelines Limiting High-Field Usage

- 4.3.4 Reimbursement Cuts For Follow-Up Musculoskeletal MRI

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Architecture

- 5.1.1 Closed MRI Systems

- 5.1.2 Open MRI Systems

- 5.2 By Field Strength

- 5.2.1 Low-Field (<1 T)

- 5.2.2 High-Field (1.5 T)

- 5.2.3 Very High-Field (3 T)

- 5.2.4 Ultra-High-Field (7 T)

- 5.3 By Application

- 5.3.1 Neurology

- 5.3.2 Oncology

- 5.3.3 Cardiology

- 5.3.4 Musculoskeletal

- 5.3.5 Abdominal & Pelvic

- 5.3.6 Pediatric Imaging

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Stand-alone Imaging Centers

- 5.4.3 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Canon Medical Systems Corp.

- 6.3.2 Fujifilm Healthcare Corp.

- 6.3.3 Siemens Healthineers

- 6.3.4 GE HealthCare

- 6.3.5 Philips

- 6.3.6 United Imaging Healthcare

- 6.3.7 Esaote SpA

- 6.3.8 Shimadzu Corp.

- 6.3.9 Hitachi Ltd. (Legacy Systems)

- 6.3.10 Neusoft Medical Systems

- 6.3.11 Shenzhen Anke High-tech

- 6.3.12 Hyperfine Inc.

- 6.3.13 Aspect Imaging

- 6.3.14 Elekta AB (MR-Linac)

- 6.3.15 Synaptive Medical

- 6.3.16 Time Medical Systems

- 6.3.17 Paramed Medical Systems

- 6.3.18 Aurora Imaging

- 6.3.19 SinoVision

- 6.3.20 Medonica

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment