PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911489

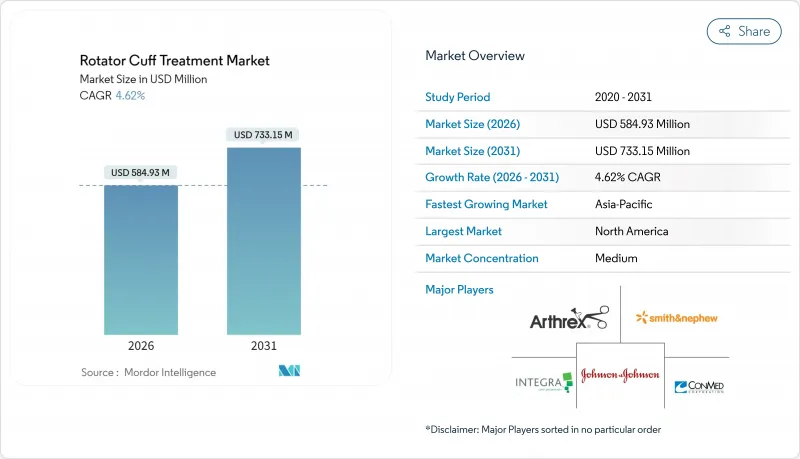

Rotator Cuff Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The rotator cuff treatment market is expected to grow from USD 559.11 million in 2025 to USD 584.93 million in 2026 and is forecast to reach USD 733.15 million by 2031 at 4.62% CAGR over 2026-2031.

Demographic pressures from a rapidly aging population, heavier participation in overhead sports, and steady advances in arthroscopic devices, biologic implants, and bundled-payment care models collectively lift procedure volumes and product demand. Hospitals continue to anchor procedure throughput, yet ambulatory surgical centers (ASCs) and specialty orthopedic clinics capture share as payers reward lower-cost sites. Early-stage adoption of robotic platforms, AI-enabled imaging, and bioinductive materials allows premium pricing while addressing failure rates that have historically ranged between 20% and 70%, depending on tear size. Companies that can combine hardware, biologics, and digital tools into a single workflow gain a defensible edge as surgeons and payers look for solutions that shorten rehabilitation times and curb revision procedures.

Global Rotator Cuff Treatment Market Trends and Insights

Rising Sports-Related Shoulder Injuries

Athletic participation in overhead sports steadily increases rotator cuff injury incidence, especially among adolescents and weekend warriors whose training loads often exceed physiological limits. Swimming contributed more than 82,000 upper-extremity injuries over five years, with most events occurring in the 10-19 age group. Contact sports such as American football show injury patterns ranging from contusions to massive tears that frequently progress to surgical intervention when conservative care fails. The resulting case load fuels both surgical and non-surgical demand, with sports medicine centers positioned as the fastest-growing end-user channel. As competitive seasons lengthen and recreational leagues proliferate, healthcare systems allocate more resources to early diagnosis, imaging, and rehabilitation pathways that widen the rotator cuff treatment market.

Rapid Ageing of Global Population

More than half of people aged 60 years or older show some degree of rotator cuff degeneration, converting naturally occurring asymptomatic tears into symptomatic disease that drives procedure demand. Annual shoulder arthroplasty volumes in the United States alone are projected to reach 250,000 by 2025, underlining the economic burden of cuff tear arthropathy in senior cohorts. Long-term studies show 88% revision-free survivorship for reverse shoulder arthroplasty at 10 years, reinforcing surgeon confidence in implant longevity and sparking wider adoption across Europe and Asia. Rising life expectancy, combined with a preference for active lifestyles among seniors, sustains procedure volumes and underpins a stable revenue base across device, biologic, and rehabilitation segments of the rotator cuff treatment market.

High Cost of Arthroscopic Implants and Instruments

Average episode cost for arthroscopic repair is USD 4,094, with anchor choice and procedure duration the main cost drivers. Bioinductive devices carry premium list prices, limiting access in emerging markets where insurance reimbursements lag. U.S. insurers label balloon spacers "unproven and not medically necessary", illustrating the reimbursement risk attached to newer technologies. Japan's regulatory environment, favoring proven implants, further complicates launch timelines for novel products. These cost and regulatory pressures temper growth, especially where healthcare budgets remain tight.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Minimally Invasive Arthroscopic Devices

- Growing Adoption of Biological Augmentation & Orthobiologics

- Shortage of Trained Orthopedic Surgeons in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surgical modalities account for 68.94% of rotator cuff treatment market size in 2025, supported by refined arthroscopic techniques and improved implant survivorship. Bioinductive patches, double-row fixation, and reverse shoulder arthroplasty extend indications and reduce re-tear concerns. Robotic applications shorten learning curves, facilitating wider diffusion into community settings. Yet physiotherapy and palliative care post 5.98% CAGR and gain traction among payers seeking value-based alternatives. Randomized studies show up to 96% symptom relief in select massive tears when structured exercise is coupled with anti-inflammatory injections. Pharmaceutical interventions featuring corticosteroids or hyaluronic acid are prescribed to delay surgery and curb pain, while orthobiologics sit at the innovation frontier, attracting investment as evidence matures.

Fast uptake of conservative regimens changes referral patterns and elongates time to surgery, but it does not diminish long-term demand for definitive procedures. When exercise or injections fail, patients often progress to arthroscopy or arthroplasty where the technology stack becomes more sophisticated and expensive. Thus, the interplay between aggressive early rehabilitation and late-stage surgical innovation collectively enlarges the rotator cuff treatment market rather than cannibalizing it.

The Rotator Cuff Treatment Market Report is Segmented by Treatment Type (Surgical/Curative Treatment, Physiotherapy/Palliative Treatment, Pharmaceutical/Preventive Treatment, Orthobiologics), Injury Severity (Full-Thickness Tear, Partial-Thickness Tear), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 39.82% of rotator cuff treatment market size in 2025, sustained by procedure volumes exceeding 500,000 annual repairs and clear Medicare guidelines for reimbursement. Robust ASC growth stems from bundled-payment experiments that reward cost-efficiency without sacrificing outcomes. Established supply partnerships allow rapid uptake of bioinductive implants and robotic systems, while AI-driven imaging protocols shorten diagnostic cycles. Canada's universal coverage keeps access wide but wait-time pressures spur a private market that pulls medical tourism into adjacent U.S. states, reinforcing regional dominance of the rotator cuff treatment market.

Asia-Pacific is the fastest-growing territory at 6.28% CAGR. Japan's USD 40 billion medical device sector favors proven technology yet shows rising interest in next-gen implants as domestic manufacturers collaborate with global giants to localize production. China's reform of public insurance widens orthopedic coverage, while top hospitals install advanced arthroscopy suites. India's booming sports community, centered on cricket and badminton, propels injury volumes similar to Western patterns. Surgeon shortages and regulatory heterogeneity remain challenges, but fellowship exchanges and harmonization efforts gradually ease barriers, enabling the rotator cuff treatment market to gain scale in populous economies.

Europe posts steady but lower growth, powered by aging demographics and high evidence thresholds that favor products with clear clinical data. Germany and the United Kingdom lead in adopting biologic implants and robotic platforms, whereas Mediterranean markets lean toward cost-efficient physiotherapy first, advancing to surgery only when conservative care fails. Brexit brought regulatory divergence, but mutual recognition agreements maintain device flow. The European Union's Medical Device Regulation tightens post-market surveillance requirements, prompting companies to invest heavily in clinical evidence generation. These factors collectively shape a balanced but evidence-driven rotator cuff treatment market across the continent.

- Arthrex

- Smiths Group

- Stryker

- Johnson & Johnson (DePuy Mitek)

- Zimmer Biomet

- Conmed

- Integra LifeSciences Corp.

- 3S Ortho

- Breg

- Karl Storz

- Evolutis India

- Medtronic

- Anika Therapeutics

- Orthofix

- Enovis

- Parcus Medical

- Exactech

- Ossur hf.

- Biorez Inc.

- Acumed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Sports-Related Shoulder Injuries

- 4.2.2 Rapid Ageing of Global Population

- 4.2.3 Advances In Minimally Invasive Arthroscopic Devices

- 4.2.4 Growing Adoption of Biological Augmentation & Orthobiologics

- 4.2.5 Growing Public-Private Funding Grants and Educational Awareness Initiatives

- 4.2.6 ASC-Focused Bundled-Payment Models Boosting Procedure Volumes

- 4.3 Market Restraints

- 4.3.1 High Cost of Arthroscopic Implants & Instruments

- 4.3.2 Shortage of Trained Orthopedic Surgeons in EMs

- 4.3.3 Regulatory Ambiguity around Stem-Cell/Exosome Therapies

- 4.3.4 Payer Scrutiny Due to High Revision Re-Tear Rates

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Treatment Type

- 5.1.1 Surgical / Curative Treatment

- 5.1.1.1 Arthroscopic Repair Devices

- 5.1.1.2 Open / Mini-open Repair Devices

- 5.1.1.3 Reverse Shoulder Arthroplasty Systems

- 5.1.2 Physiotherapy / Palliative Treatment

- 5.1.3 Pharmaceutical / Preventive Treatment

- 5.1.4 Orthobiologics

- 5.1.1 Surgical / Curative Treatment

- 5.2 By Injury Severity

- 5.2.1 Full-Thickness Tear

- 5.2.2 Partial-Thickness Tear

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Orthopedic Clinics

- 5.3.4 Sports Medicine Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Arthrex Inc.

- 6.3.2 Smith & Nephew plc

- 6.3.3 Stryker Corporation

- 6.3.4 Johnson & Johnson (DePuy Mitek)

- 6.3.5 Zimmer Biomet Holdings

- 6.3.6 CONMED Corporation

- 6.3.7 Integra LifeSciences Corp.

- 6.3.8 3S Ortho

- 6.3.9 Breg Inc.

- 6.3.10 Karl Storz SE & Co. KG

- 6.3.11 Evolutis India Pvt. Ltd.

- 6.3.12 Medtronic plc

- 6.3.13 Anika Therapeutics

- 6.3.14 Orthofix Medical Inc.

- 6.3.15 Enovis (DJO Global)

- 6.3.16 Parcus Medical

- 6.3.17 Exactech Inc.

- 6.3.18 Ossur hf.

- 6.3.19 Biorez Inc.

- 6.3.20 Acumed LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment