PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911493

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911493

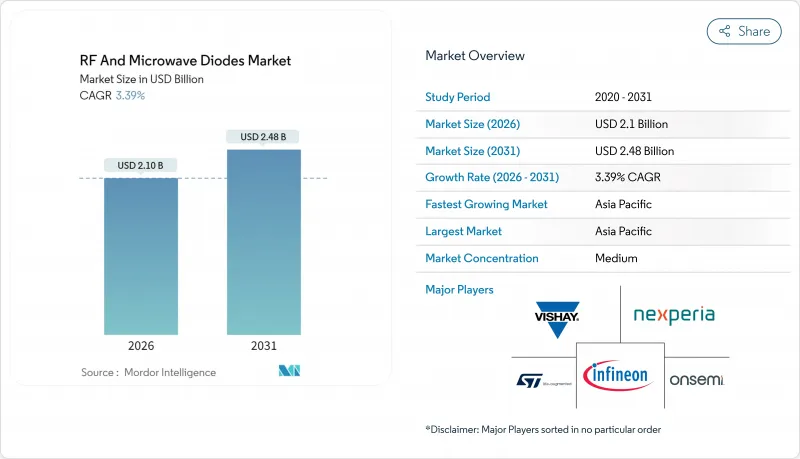

RF And Microwave Diodes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The RF and microwave diodes market is expected to grow from USD 2.03 billion in 2025 to USD 2.1 billion in 2026 and is forecast to reach USD 2.48 billion by 2031 at 3.39% CAGR over 2026-2031.

This market size growth reflects steady momentum from 5G base-station roll-outs, expanding automotive radar programs, and heightened demand for space-qualified components in LEO satellite constellations. Telecommunications infrastructure upgrades continue to drive bulk procurement, while the automotive sector accelerates diode consumption for mandatory advanced driver-assistance systems. Material substitution toward gallium nitride, tighter export-control enforcement, and proactive capacity additions by leading suppliers shape competitive positioning in the current period.

Global RF And Microwave Diodes Market Trends and Insights

Proliferation of Global 5G Infrastructure

Massive MIMO base-stations, fronthaul links, and handset RF front-ends collectively lift diode demand. Microwave backhaul already supports more than half of worldwide cell-site connections and requires throughput upgrades above 10 Gbps as 5G traffic scales. GaN-based diodes deliver 34% power-added efficiency in N78 and N77 bands, yet thermal constraints intensify at reduced 3.4 V supply rails. Component makers are responding with low-parasitic packaging that maintains linearity across wide bandwidths. Spectrum re-farming toward 26-28 GHz further increases the volume of mmWave-class diodes needed in phased-array modules.

Rising IoT and Smart-Consumer Electronics Demand

Global connected-device counts are set to exceed 25 billion by 2025, feeding sustained orders for small-signal diodes in battery-powered wearables, smart meters, and edge sensors. Designers require ultra-low-leakage switches and envelope-tracking circuits to meet stringent power-budget targets. Multi-protocol devices combining 5G, LTE, Wi-Fi 7, and Bluetooth Low Energy have spurred the adoption of integrated diode arrays that consolidate bill-of-materials while shrinking form factors. Automotive wireless battery-management systems provide a visible use case where low-loss RF paths enable real-time voltage monitoring over BLE links.

Volatile Raw-Material Prices

Beijing's export-licensing requirements on gallium and germanium lifted spot prices, pushing GaN epi-wafer costs upward by triple digits. The United States sources 95% of gallium from China, creating procurement risk for high-electron-mobility transistor wafers that underpin many microwave diodes. Manufacturers react by dual-sourcing, recycling scrap, and increasing long-term contracts, yet near-term volatility still compresses gross margins.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Automotive Radar and ADAS Adoption

- Growth of LEO Satellite Constellations

- Semiconductor Capacity Constraints and Supply-Chain Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PIN variants accounted for 28.75% of the RF and microwave diodes market share in 2025, anchored by their role in RF switching matrices and variable attenuators. Telecommunications OEMs value their robust power-handling capability and wide dynamic-range linearity, attributes critical for base-station upgrades. Defense radar retrofits and satellite transponders also lock in long-lifecycle design wins that stabilize volume demand. The RF and microwave diodes market size for Schottky devices is projected to expand at 5.12% CAGR, reflecting mmWave circuit migration that favors their low forward voltage and fast recovery properties. Emerging 60-90 GHz automotive imaging radar and 77 GHz short-range modules continue to displace PIN solutions in detector chains, reinforcing Schottky-unit momentum.

Designers maintain varactor adoption for frequency synthesis in VCOs because hyperabrupt junction profiles afford tuning ratios exceeding 8:1. Gunn and tunnel diodes remain niche, yet specialized high-power instrumentation and very-low-phase-noise oscillators preserve consistent demand. Zener regulation diodes capture share in bias networks for high-power GaN MMICs, especially where precise over-voltage protection is mandatory.

The 3-8 GHz class retained 31.85% revenue in 2025, driven by radar altimeters, satellite downlinks, and 5 GHz Wi-Fi access points. Solid installed bases in civil aviation and maritime radar extend product lifetime and underpin after-market diode sales. However, above-40 GHz mmWave demand grows at a 5.42% CAGR as operators commercialize fixed-wireless access and automotive OEMs transition from traditional 24 GHz to 77 GHz radar platforms. The RF and microwave diodes market size contribution from the Ka/V-band (20-40 GHz) segment rises with LEO feeder-links and airborne satcom installations that require narrow beamwidth antennas. Up-to-3 GHz devices keep supplying high-volume IoT modules where cost outweighs performance. Ku/K-band diodes slated for 12-18 GHz remain steady, buoyed by defense seeker upgrades and moderate growth in broadcast satcom ground terminals.

The RF and Microwave Diodes Report is Segmented by Product Type (PIN Diodes, Schottky Diodes, and More), Frequency Band (Up To 3 GHz, 3-8 GHz C-/X-Band, and More), Material Technology (Silicon, Gallium Arsenide, and More), End-User Industry (Automotive, Consumer Electronics, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 44.25% of 2025 revenue and is projected to grow at 4.51% CAGR to 2031, supported by China's USD 295 billion domestic semiconductor initiative and Japan's JPY 3.9 trillion (USD 26 billion) revival program that anchors next-generation wafer capacity. Government incentives accelerate build-outs in epi-growth, wafer-level packaging, and RF front-end module assembly. The vibrant contract-manufacturing base in Taiwan and South Korea augments scale advantages that sustain regional leadership.

North America benefits from the USD 39 billion CHIPS Act, which subsidizes new 200 mm and 300 mm fabs dedicated to RF power and analog devices. Clean-room expansions by MACOM in Massachusetts and North Carolina will reinforce domestic GaN-on-SiC supply and mitigate geopolitical supply risk. Export-control tightening restricts high-frequency device transfers, channeling government and defense demand toward U.S. suppliers. Canada and Mexico contribute niche assembly and test capacity, leveraging USMCA rules of origin to serve automotive clients.

Europe enjoys steady diode consumption through automotive radar mandates and Industry 4.0 factory upgrades. Germany's tier-1 OEMs employ 77 GHz radar in premium and mass-market models, propelling continental demand. France and the United Kingdom support aerospace and satellite programs that specify radiation-hardened diodes. Meanwhile, Middle East and African operators deploy 5G fixed-wireless access in underserved rural areas, but macroeconomic headwinds keep near-term volumes modest.

- Microchip Technology Inc.

- Infineon Technologies AG

- Diodes Incorporated

- MACOM Technology Solutions Holdings, Inc.

- Nexperia B.V. (Wingtech Technology Co., Ltd.)

- onsemi (Semiconductor Components Industries, LLC)

- ROHM Co., Ltd.

- Vishay Intertechnology, Inc.

- Toshiba Electronic Devices & Storage Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- PANJIT International Inc.

- Suzhou Good-Ark Electronics Co., Ltd.

- Skyworks Solutions, Inc.

- Qorvo, Inc.

- Broadcom Inc. (Avago Technologies)

- Excelitas Technologies Corp.

- SemiGen, Inc.

- Richardson Electronics, Ltd.

- Central Semiconductor Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of global 5G infrastructure

- 4.2.2 Rising IoT and smart-consumer electronics demand

- 4.2.3 Expansion of automotive radar and ADAS adoption

- 4.2.4 Growth of LEO satellite constellations

- 4.2.5 mmWave radar uptake in industrial drones and robots

- 4.2.6 Shift toward wide-bandgap (GaN/SiC) diode technology

- 4.3 Market Restraints

- 4.3.1 Volatile raw-material prices (Ga, Si, SiC, InP)

- 4.3.2 Semiconductor capacity constraints and supply chain risk

- 4.3.3 Thermal-management challenges at more than 40 GHz

- 4.3.4 Export-control restrictions on high-freq devices

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Investment Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 PIN Diodes

- 5.1.2 Schottky Diodes

- 5.1.3 Varactor (Tuning) Diodes

- 5.1.4 Gunn Diodes

- 5.1.5 Tunnel Diodes

- 5.1.6 Zener Diodes

- 5.1.7 Other Diodes

- 5.2 By Frequency Band

- 5.2.1 Up to 3 GHz

- 5.2.2 3 - 8 GHz (C-/X-Band)

- 5.2.3 8 - 20 GHz (Ku-/K-Band)

- 5.2.4 20 - 40 GHz (Ka-/V-Band)

- 5.2.5 Above 40 GHz (mmWave)

- 5.3 By Material Technology

- 5.3.1 Silicon (Si)

- 5.3.2 Gallium Arsenide (GaAs)

- 5.3.3 Gallium Nitride (GaN)

- 5.3.4 Silicon Carbide (SiC)

- 5.3.5 Other Materials

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Consumer Electronics

- 5.4.3 Telecommunications and Networking

- 5.4.4 Industrial Manufacturing and Automation

- 5.4.5 Medical and Healthcare

- 5.4.6 Aerospace and Defense

- 5.4.7 Energy and Utilities

- 5.4.8 Other Industries

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microchip Technology Inc.

- 6.4.2 Infineon Technologies AG

- 6.4.3 Diodes Incorporated

- 6.4.4 MACOM Technology Solutions Holdings, Inc.

- 6.4.5 Nexperia B.V. (Wingtech Technology Co., Ltd.)

- 6.4.6 onsemi (Semiconductor Components Industries, LLC)

- 6.4.7 ROHM Co., Ltd.

- 6.4.8 Vishay Intertechnology, Inc.

- 6.4.9 Toshiba Electronic Devices & Storage Corporation

- 6.4.10 Renesas Electronics Corporation

- 6.4.11 STMicroelectronics N.V.

- 6.4.12 PANJIT International Inc.

- 6.4.13 Suzhou Good-Ark Electronics Co., Ltd.

- 6.4.14 Skyworks Solutions, Inc.

- 6.4.15 Qorvo, Inc.

- 6.4.16 Broadcom Inc. (Avago Technologies)

- 6.4.17 Excelitas Technologies Corp.

- 6.4.18 SemiGen, Inc.

- 6.4.19 Richardson Electronics, Ltd.

- 6.4.20 Central Semiconductor Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment