PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911494

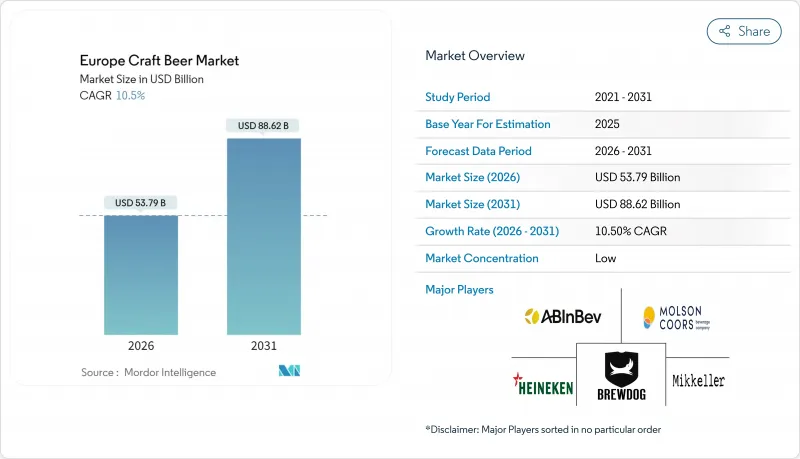

Europe Craft Beer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe craft beer market is expected to grow from USD 48.68 billion in 2025 to USD 53.79 billion in 2026 and is forecast to reach USD 88.62 billion by 2031 at 10.5% CAGR over 2026-2031.

Growing consumer appetite for premium beverages, tightening ESG regulations, and rapid adoption of indoor hop-growing technology are the primary forces expanding the Europe craft beer market. Surging female participation, the swift rebound of on-premise sales, and strategic pub-chain roll-outs reinforce demand, while brewery consolidation and aggressive sustainability targets sharpen competitive differentiation. Indoor cultivation now compresses hop crop cycles from six months to three and cuts water use 15-fold, lowering raw-material risk and underpinning price stability. Rapid innovation, changing consumption and distribution patterns, and mounting regulatory and operational challenges are shaping the European craft beer market, making it dynamic and appealing to both established players and new entrants.

Europe Craft Beer Market Trends and Insights

ESG-driven premiumization surge

Craft breweries are increasingly focusing on sustainability, integrating it as a core aspect of their operations. This shift goes beyond mere marketing strategies and is reflected in significant operational changes. Brewers are implementing circular bioeconomy models, utilizing spent grains, yeast, and hops in agro-food, cosmetics, and materials applications. The premiumization trend is clear: the non-alcoholic beer segment grew by 13.5% in 2023, while traditional alcoholic beer production declined by 5% in the EU. Regulatory initiatives like the Beer Product Environmental Footprint Category Rules (PEFCR) are establishing standards for measuring environmental impacts, giving early adopters a competitive edge. Supply chains are also adapting to this sustainability drive. Spanish startup Ekonoke exemplifies this by developing indoor hop cultivation methods that enhance alpha acid content and mitigate the 40% yield decline experienced by European hop farms due to climate change.

Growth of microbreweries and independent breweries

The expansion of microbreweries indicates a shift towards localized production models. In 2023, Europe had 12,848 active breweries, according to the Brewers of Europe. A notable regulatory change in Sweden now allows microbreweries to sell directly to visitors after educational sessions. This development not only reflects Sweden's progressive approach but also aligns with a broader European trend toward liberalizing taproom sales. These changes address previous licensing barriers, enabling direct-to-consumer sales and unlocking significant revenue potential for smaller producers. The growth of microbreweries is further supported by the implementation of EU Directive 2020/262, which introduced a unified certification system allowing small producers to access reduced tax rates across member states. Additionally, independent breweries are leveraging technological advancements, with onsite sales consistently outperforming distributed channels. This pattern highlights the importance of direct customer relationships as a sustainable competitive edge. Despite a contracting overall volume market, the craft brewery count remains stable, with slight increases showcasing the segment's resilience.

Stringent regulations and heavy taxation

European craft breweries are navigating an increasingly intricate regulatory framework, where tax disparities among member states create significant competitive imbalances. The EU enforces a minimum excise duty of EUR 1.87 per 100 liters (26.4 gallons) on beer, based on its alcohol content. These tax differences create structural challenges for craft breweries, affecting both production costs and pricing strategies. In addition to taxation, breweries must comply with a range of regulations, including HACCP-based food safety systems, obtaining producer approvals, and meeting complex labeling requirements that vary across jurisdictions, as noted by the UK Government. Smaller craft breweries, often lacking robust administrative resources, face greater difficulties in managing multi-jurisdictional compliance. However, EU-driven efforts, such as a unified certification system for small producers, are gradually reducing some of these barriers while ensuring quality and safety standards remain intact.

Other drivers and restraints analyzed in the detailed report include:

- Product innovation in flavors and styles

- Strategic expansion by pub and bar chains

- Consumers inclination towards functional beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Ale dominated Europe's craft beer market with a 38.14% share, driven by its established popularity, variety of styles, and growing consumer interest, particularly in traditional beer-drinking countries like the United Kingdom, Belgium, and Germany. At the same time, Lager's anticipated CAGR of 10.82% (2026-2031) highlights a significant shift in consumer preferences. Brewers are combining traditional bottom-fermentation methods with craft dry-hopping and extended cold maturation to create lagers that are both crisp and flavorful, appealing to those who prefer balance over bitterness. This trend is largely influenced by female drinkers, who are more sensitive to astringency. Brewers are also leveraging indoor-grown hops to introduce subtle citrus notes, which are difficult to replicate in mass-produced lagers. Specialty categories, such as Italian pilsners and German Kellerbiers, are merging heritage with innovation, enriching the SKU offerings in the European craft beer market.

This transformation supports portfolio risk management: Lagers ferment at lower temperatures, reducing contamination risks and improving batch consistency in expanding microbrew facilities. Faster tank turnovers enhance capital efficiency, which is crucial in the current environment of tightening credit conditions. Meanwhile, ale producers are staying relevant by offering limited barrel-aged releases and kettle-sours, providing consumers with unique sensory experiences. Looking forward, the European craft beer industry is expected to embrace co-existence rather than displacement, fostering a dynamic flavor landscape while retaining its loyal ale consumer base.

In 2025, men accounted for 67.62% of the European craft beer market. They are particularly attracted to the richer and more diverse flavor profiles of craft beers, with ales, IPAs, and stouts dominating the market. Meanwhile, the female segment is growing at a remarkable 11.16% CAGR (2026-2031), surpassing all other demographic groups. To appeal to female consumers, breweries are enhancing their tasting rooms with brighter decor, inclusive language, and smaller pour options. The perception of beer consumption is transitioning from a traditionally "masculine" image to a more "gender-neutral" one, with women now rating IPA and stout styles nearly as highly as men.

This change is driving new merchandising opportunities, such as apparel and curated gift packs, while also increasing basket sizes. It is also influencing sensory research and product development, with innovations like sweetness calibration, fruit adjuncts, and moderate ABV designs catering to a broader audience. Additionally, marketing efforts led by women-led collaborations are helping to break down stereotypes in beer culture, further supporting the growth of the European craft beer market.

The Europe Craft Beer Market Report is Segmented by Product Type (Ale, Lager, Other Beer Types), End User (Men, Women), Packaging (Bottles, Cans, Others), Distribution Channel (On-Trade, Off-Trade), and Geography (United Kingdom, Germany, France, Italy, Spain, Russia, Sweden, Belgium, Poland, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

List of Companies Covered in this Report:

- BrewDog PLC

- Beavertown Brewery

- Camden Town Brewery

- Cloudwater Brew Co.

- Omnipollo AB

- Mikkeller A/S

- Stone Brewing Co.

- Magic Rock Brewing Ltd.

- Sierra Nevada Brewing Co.

- D.G. Yuengling and Son Inc.

- Anheuser-Busch InBev (ZX Ventures)

- Heineken N.V. (Craft and Variety)

- Carlsberg Group (Jacobsen)

- Molson Coors Beverage Co. (Sharp's)

- Stone and Wood Brewing Co.

- La Trappe / De Koningshoeven

- Duvel Moortgat Brewery

- La Pirata Brewing

- Birra del Borgo

- Pohjala Brewery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ESG-driven premiumization surge

- 4.2.2 Growth of microbreweries and independent breweries

- 4.2.3 Product innovation in flavors and styles

- 4.2.4 Strategic expansion by pub and bar chains

- 4.2.5 Rising technological innovations in brewing

- 4.2.6 Consumer preferences for quality and variety

- 4.3 Market Restraints

- 4.3.1 Stringent regulations and heavy taxation

- 4.3.2 Consumers inclination towards functional beverages

- 4.3.3 Supply chain challenges

- 4.3.4 Licensing hurdles for taprooms

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Ale

- 5.1.2 Lager

- 5.1.3 Other Beer Types (Specialty Beers)

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.3 By Packaging

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Sweden

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Netherlands

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BrewDog PLC

- 6.4.2 Beavertown Brewery

- 6.4.3 Camden Town Brewery

- 6.4.4 Cloudwater Brew Co.

- 6.4.5 Omnipollo AB

- 6.4.6 Mikkeller A/S

- 6.4.7 Stone Brewing Co.

- 6.4.8 Magic Rock Brewing Ltd.

- 6.4.9 Sierra Nevada Brewing Co.

- 6.4.10 D.G. Yuengling and Son Inc.

- 6.4.11 Anheuser-Busch InBev (ZX Ventures)

- 6.4.12 Heineken N.V. (Craft and Variety)

- 6.4.13 Carlsberg Group (Jacobsen)

- 6.4.14 Molson Coors Beverage Co. (Sharp's)

- 6.4.15 Stone and Wood Brewing Co.

- 6.4.16 La Trappe / De Koningshoeven

- 6.4.17 Duvel Moortgat Brewery

- 6.4.18 La Pirata Brewing

- 6.4.19 Birra del Borgo

- 6.4.20 Pohjala Brewery

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK