PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911496

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911496

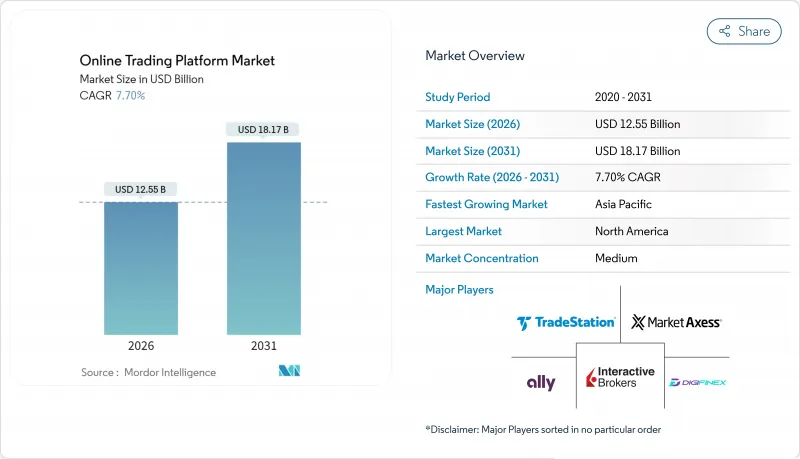

Online Trading Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The online trading platform market is expected to grow from USD 11.65 billion in 2025 to USD 12.55 billion in 2026 and is forecast to reach USD 18.17 billion by 2031 at 7.7% CAGR over 2026-2031.

The current growth phase is characterized by a decisive pivot from desktop terminals to mobile-first, cloud-native architectures that serve retail and institutional users alike. Harmonized regulations, rising infrastructure investments and rapid adoption of artificial intelligence (AI) in trade execution and decision support are accelerating platform upgrades. Strategic consolidation among leading brokers is reshaping competitive dynamics, while steady retail participation sustains transaction volumes. Regulatory approvals for crypto derivatives and fractional shares signal additional product breadth that will keep the online trading platform market on an upward trajectory.

Global Online Trading Platform Market Trends and Insights

Mobile-First Retail Trading Surge in Asia

Smartphone-centric investing is redefining platform design standards across the online trading platform market. SBI Securities surpassed 14 million accounts, while Monex manages JPY 5.9 trillion of client assets (USD 37.7 billion). Regional challengers such as Tiger Brokers and Robinhood's new Singapore hub extend zero-commission trading to the ASEAN middle class. Platforms prioritizing intuitive touch interfaces, biometric log-ins and in-app education are gaining share as retail users shift away from legacy desktop screens. Institutional desks have started mirroring mobile workflows to match client expectations, accelerating a virtuous cycle of mobile feature releases. As a result, Asia's retail adoption is adding incremental 2.1 percentage points to forecast CAGR across the online trading platform market.

AI-Driven Robo-Advisory Integration by North-American Brokers

North American leaders are blending AI tools with human oversight to scale advisory capacity without triggering regulatory pushback. Robinhood's SEC ADV filing outlines a robo-advisor that relies on humans for portfolio allocations, while Firstrade's FirstradeGPT delivers natural-language analytics to retail clients. PortfolioPilot accumulated USD 20 billion in AUM within months by coupling generative AI with machine-learning risk models. Divergent adoption paths reflect uncertainty around liability for algorithmic decisions, yet firms that operationalize AI within defined fiduciary guardrails are improving client engagement and lowering service costs. Over the long term this driver adds 1.8 percentage points to the online trading platform market growth rate and reshapes expectations for personalized digital wealth services.

EU MiFID III Compliance Cost Inflation

The European Parliament's consolidated tape mandate forces platforms to overhaul data pipelines, surveillance and reporting systems. ESMA requires members to meet new bond transparency rules by September 28 2025, intensifying near-term capital outlays. Smaller brokers risk exit or forced mergers, pushing up client acquisition costs for survivors. Moreover, global operators must maintain duplicate compliance stacks, diluting scale benefits and shaving an estimated 1.4 percentage points off online trading platform market CAGR in the short run.

Other drivers and restraints analyzed in the detailed report include:

- Multi-Asset Crypto-Derivatives Consolidation in Europe

- Cloud-Native Micro-Services Accelerating Product Launches

- Rising Cyber-Security Breaches in North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform components generated 77.68% of the online trading platform market size in 2025 as core execution engines, matching engines and risk modules remain indispensable. Services, encompassing research, analytics and advisory add-ons, are forecast to expand at a 10.05% CAGR to 2031 by bundling compliance-ready data feeds with customer-centric tools. Deutsche Borse's cloud-native engine illustrates the capital intensity and intellectual property advantages required to maintain latency leadership. Platforms are investing in modular DevOps pipelines, which reduce release cycles from quarterly to weekly, thereby responding faster to regulatory tweaks and customer feedback.

Service-oriented growth is catalyzed by stricter best-execution rules, requiring richer post-trade analytics delivered as SaaS. Vendors offering plug-and-play surveillance APIs secure rapid adoption among mid-tier brokers that cannot build internally. The interplay of high-spec infrastructure and differentiated services anchors the online trading platform market value proposition, making it difficult for new entrants to scale without deep capital or partnerships.

Transaction fees accounted for 59.45% of the online trading platform market share and are growing at a 9.10% CAGR, underscoring their resilience versus headline commissions. The fee model aligns revenue with traded notional, providing downside protection when average ticket sizes fall. SEBI's "true-to-label" rules, effective October 2024, prohibit hidden rebates and enforce fee transparency, yet they reaffirm the legitimacy of pass-through charges tied to exchange costs.

Institutional desks still pay explicit commissions for high-touch services such as direct-market access and algorithmic strategy consulting. That coexistence cushions revenue even as retail apps advertise zero commissions. Platform operators increasingly apply tiered transaction fee schedules based on volume, reinforcing user stickiness and cross-selling potential. In turn, the revenue predictability encourages sustained R&D budgets that further advance the online trading platform market.

The Online Trading Platform Market is Segmented by Component (Platform, Services), Type (Commissions, and Transaction Fees), Deployment Mode (On-Premise, and Cloud), Application (Institutional Investors, and Retail Investors), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 34.10% of revenue in 2025, supported by an entrenched brokerage ecosystem and accommodative regulation for options and ETFs. Charles Schwab posted USD 5.6 billion in Q1 2025 revenue and gathered USD 137.7 billion in core net new assets, proving that platform loyalty remains strong when paired with robust research and advisory add-ons. However, cybersecurity breaches costing hundreds of millions spur regulatory probes and could slow new feature launches as firms divert resources to remediation.

Asia-Pacific is the fastest-growing bloc, expanding at a 10.42% CAGR and adding the most incremental accounts to the online trading platform market each year. Robinhood's Singapore base and Tiger Brokers' zero-commission SGX trades highlight an appetite for cost-efficient access to U.S. and regional equities. Japan's SBI Securities and Monex demonstrate the scale advantage of early mobile adoption, while rising middle-class wealth in Indonesia and Vietnam opens fresh customer pools. Government sandboxes for digital-asset products accelerate product diversity, allowing platforms to hedge against commission compression elsewhere.

Europe shows balanced growth as MiFID III imposes cost headwinds yet fosters single-passport expansion. One Trading's license and Kraken's MiFID registration anchor institutional confidence in regulated crypto derivatives. Middle Eastern regulators permit fractional ownership and crypto tokens, creating a stepping-stone for pan-GCC trading corridors. Latin America benefits from API-based brokerage-as-a-service offerings that bypass legacy banking infrastructure and reduce onboarding friction. Collectively, these developments intensify global competition and raise the strategic importance of jurisdictional agility within the online trading platform market.

- TradeStation Group Inc.

- Interactive Brokers LLC

- Ally Financial Inc.

- MarketAxess Holdings Inc.

- DigiFinex Limited

- Robinhood Markets Inc.

- Charles Schwab Corporation

- TD Ameritrade Holding Corporation

- Plus500 Ltd.

- IG Group Holdings plc

- E*TRADE Financial LLC

- Huobi Global

- Saxo Bank A/S

- CMC Markets plc

- OANDA Corporation

- XTB S.A.

- AvaTrade Ltd.

- Futu Holdings Ltd. (Moomoo)

- Zerodha Broking Ltd.

- Upstox (RKSV Securities India Pvt. Ltd.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mobile-First Retail Trading Surge in Asia

- 4.2.2 AI-Driven Robo-Advisory Integration by North-American Brokers

- 4.2.3 Multi-Asset Crypto-Derivatives Consolidation in Europe

- 4.2.4 Regulatory Green-Light for Fractional Shares in Middle East

- 4.2.5 Cloud-Native Micro-services Accelerating Product Launches

- 4.2.6 API-based Brokerage-as-a-Service Demand in Latin America

- 4.3 Market Restraints

- 4.3.1 EU MiFID III Compliance Cost Inflation

- 4.3.2 Rising Cyber-security Breaches in North America

- 4.3.3 Revenue Compression from Zero-Commission Model Saturation (US)

- 4.3.4 Retail-FX Leverage Restrictions in APAC

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Type

- 5.2.1 Commissions

- 5.2.2 Transaction Fees

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.4 By Application

- 5.4.1 Institutional Investors

- 5.4.2 Retail Investors

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TradeStation Group Inc.

- 6.4.2 Interactive Brokers LLC

- 6.4.3 Ally Financial Inc.

- 6.4.4 MarketAxess Holdings Inc.

- 6.4.5 DigiFinex Limited

- 6.4.6 Robinhood Markets Inc.

- 6.4.7 Charles Schwab Corporation

- 6.4.8 TD Ameritrade Holding Corporation

- 6.4.9 Plus500 Ltd.

- 6.4.10 IG Group Holdings plc

- 6.4.11 E*TRADE Financial LLC

- 6.4.12 Huobi Global

- 6.4.13 Saxo Bank A/S

- 6.4.14 CMC Markets plc

- 6.4.15 OANDA Corporation

- 6.4.16 XTB S.A.

- 6.4.17 AvaTrade Ltd.

- 6.4.18 Futu Holdings Ltd. (Moomoo)

- 6.4.19 Zerodha Broking Ltd.

- 6.4.20 Upstox (RKSV Securities India Pvt. Ltd.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment