PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911499

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911499

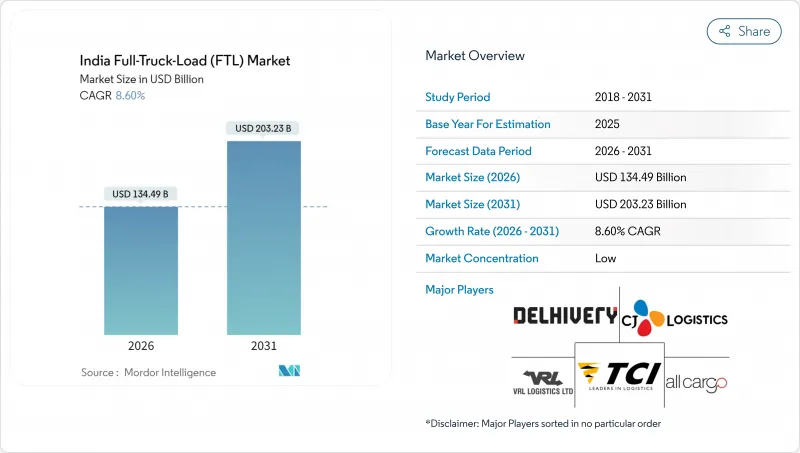

India Full-Truck-Load (FTL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India full-truck-load market was valued at USD 123.85 billion in 2025 and estimated to grow from USD 134.49 billion in 2026 to reach USD 203.23 billion by 2031, at a CAGR of 8.60% during the forecast period (2026-2031).

This sustained expansion stems from rising organized-retail activity, localization of manufacturing under Production Linked Incentive schemes, and accelerating infrastructure modernization-especially the dedicated freight corridors that are cutting transit times on trunk routes by as much as 65%. GST-enabled hub-and-spoke warehousing, National Logistics Policy incentives, and real-time digital freight platforms are further reshaping freight flows and allowing carriers to optimize capacity, cut empty miles, and achieve steadier yields. Meanwhile, FASTag's 98% penetration is eliminating cash toll queues and yielding daily toll receipts of INR 178 crore (USD 1.28 billion)-more than doubling FY21 levels-which directly boosts truck utilization and on-time delivery ratios. Heightened competition dovetails with progressive consolidation among asset-light operators, all while e-commerce logistics, quick-commerce demand, and multinational sourcing shifts continue to set an upward trajectory for the India Full-Truck-Load market.

India Full-Truck-Load (FTL) Market Trends and Insights

Surge in Organized Retail and E-Commerce Shipments

Rapid e-commerce penetration has prompted retailers to adopt just-in-time inventory strategies, generating higher-frequency yet smaller-batch full-truck runs that command premium rates. Quick-commerce players now expect intra-city refill cycles measured in hours, compelling carriers to dedicate urban-compatible fleets with superior temperature control and telematics tracking. Organized grocery chains supported by food-processing PLI incentives worth INR 10,900 crore have carved out predictable long-haul lanes between processing hubs and metropolitan distribution centers. In parallel, omnichannel retailers redesign distribution footprints using regional fulfillment nodes connected by trunk-route FTL shuttles, raising demand for medium-distance drayage and cross-dock operations. These changes reward operators that own scalable hub-and-spoke networks rather than point-to-point dispatch, cementing e-commerce as a durable growth flywheel for the India Full-Truck-Load market.

Expansion of Dedicated Freight Corridors Lowering Transit Times

The Western and Eastern Dedicated Freight Corridors already host 391 freight trains daily, and full commissioning by December 2025 is set to expand railhaul capacity dramatically. Although lower-cost rail captures bulk commodities on 1,500 km-plus hauls, the modal shift simultaneously widens first-mile and last-mile obligations for trucking fleets around new rail terminals. Carriers are repositioning assets toward time-critical, high-value, or fragile consignments that command higher yields and value-added handling. Operators investing in synchronized rail-road planning software benefit from the corridor's 25% rail cost advantage by aligning pickup and drop windows, thereby turning perceived competition into complementary revenue streams. Additionally, three more corridors worth INR 2 lakh (USD 24 billion) crore are in planning, indicating a sustained infrastructure pipeline that will reshape geographic demand distribution within the India Full-Truck-Load market over the next decade.

Acute Driver Shortage and High Attrition

Heavy-commercial-vehicle driver wages range from INR 30,000-50,000 per month for interstate lanes, yet retention remains problematic. Limited rest facilities, protracted dwell times at consignee docks, and inconsistent social-security coverage deter new entrants, pushing average driver age beyond 38 years. FY25 saw HCV retail deliveries slide 4.07% year-over-year even as freight demand climbed, underscoring a widening supply imbalance in the India Full-Truck-Load market. Operators routinely over-staff fleets by 15-20% to buffer against no-show risk, inflating fixed costs. Government interventions such as PM Mudra Yojana loans and E-Shram insurance are constructive but have yet to shift structural sentiment. As attrition hovers near 28%, fleet managers are rolling out skilling academies, telemedicine support, and incentive pay programs, yet meaningful relief is unlikely before wider adoption of autonomous safety aids and enhanced roadside infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- GST-Enabled Hub-and-spoke Warehousing Growth

- National Logistics Policy-Driven Multimodal Logistics Parks Boosting Hub Connectivity

- Volatile Diesel Prices Despite Fuel Tax Rationalization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing contributed 30.62% of the India full-truck-load market share in 2025 while registering a stellar 10.02% CAGR between 2026 and 2031, underscoring its pivotal role in both baseline freight generation and incremental growth. Advanced chemistry cell batteries, electronics assembly, and specialty chemicals-all beneficiaries of INR 1.97 lakh crore (USD 1.97 trillion) in Production Linked Incentive allocation-command specialized truck specs spanning hazardous-goods compliance and thermal shielding. Simultaneously, construction, boosted by infrastructure outlays on highways and logistics parks, supplies a steady stream of bulk building materials that anchor fleet backhaul planning. Agriculture, fishing, and forestry ride on food-processing PLI cues that trigger seasonal but high-yield refrigerated loads. Remaining verticals, including renewable-energy equipment and defense manufacturing, coalesce into an "Others" pocket that is emerging from pilot stage into scalable lane volumes. The India Full-Truck-Load market size for manufacturing-bound transport continues to widen as factory capacity utilization edges toward 75% and exporters scale finished-goods shipments to both coast-bound and regional land-border outlets.

On the operating front, manufacturers prefer multi-year dedicated fleet contracts bundling telematics, cold-chain integrity, and guaranteed turnaround windows. Carriers leveraging predictive-maintenance analytics and route-planning APIs now report 5-7% higher on-time service compared with conventional point-to-point dispatch. Additionally, upgraded industrial corridors reduce empty repositioning legs, sharpening service reliability and amplifying margins. These dynamics establish manufacturing as the structural backbone of the India Full-Truck-Load market.

The India Full-Truck-Load (FTL) Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Destination (Domestic and International). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABC Express

- Abhi Impact Logistics

- Allcargo Logistics Ltd. (including Gati Express)

- BLR Logistiks

- CJ Darcl Logistics Limited

- Delhivery Ltd.

- DHL Group

- KRS Logistics Services

- Navata SCS

- Om Logistics Supply Chain

- Relay Express Pvt. Ltd.

- Sahara Logistics

- Shree Azad Transport Co.Pvt.Ltd

- Skyblue Logistics

- SRD Logistics Pvt.Ltd

- Suntek Axpress

- Transport Corporation of India Ltd. (TCI)

- VRL Logistics Ltd.

- V-TRANS

- XpressBees

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Surge in Organised Retail and E-Commerce Shipments

- 4.20.2 Expansion of Dedicated Freight Corridors Lowering Transit Times

- 4.20.3 GST-Enabled Hub-and-Spoke Warehousing Growth

- 4.20.4 National Logistics Policy-Driven Multimodal Logistics Parks Boosting Hub Connectivity

- 4.20.5 Digital Freight Marketplaces Improving Asset Utilisation

- 4.20.6 Mandatory Fastag Tolling and Distance-Based Pricing Cutting Haulage Dwell Times-

- 4.21 Market Restraints

- 4.21.1 Acute Driver Shortage and High Attrition

- 4.21.2 Volatile Diesel Prices Despite Fuel Tax Rationalisation

- 4.21.3 Fragmented Ownership Among >95 % Small Fleet Operators

- 4.21.4 Infrastructure Bottlenecks at Urban Freight Consolidation Nodes

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 ABC Express

- 6.4.2 Abhi Impact Logistics

- 6.4.3 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.4 BLR Logistiks

- 6.4.5 CJ Darcl Logistics Limited

- 6.4.6 Delhivery Ltd.

- 6.4.7 DHL Group

- 6.4.8 KRS Logistics Services

- 6.4.9 Navata SCS

- 6.4.10 Om Logistics Supply Chain

- 6.4.11 Relay Express Pvt. Ltd.

- 6.4.12 Sahara Logistics

- 6.4.13 Shree Azad Transport Co.Pvt.Ltd

- 6.4.14 Skyblue Logistics

- 6.4.15 SRD Logistics Pvt.Ltd

- 6.4.16 Suntek Axpress

- 6.4.17 Transport Corporation of India Ltd. (TCI)

- 6.4.18 VRL Logistics Ltd.

- 6.4.19 V-TRANS

- 6.4.20 XpressBees

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment