PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911716

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911716

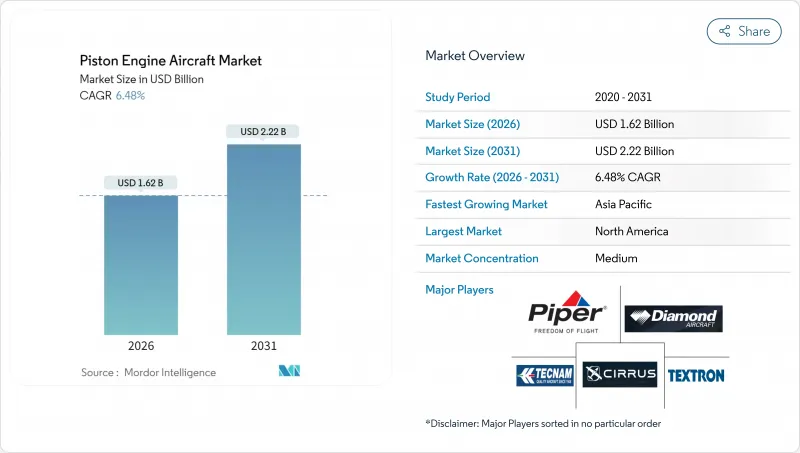

Piston Engine Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The piston engine aircraft market was valued at USD 1.52 billion in 2025 and estimated to grow from USD 1.62 billion in 2026 to reach USD 2.22 billion by 2031, at a CAGR of 6.48% during the forecast period (2026-2031).

Escalating pilot shortages, an expanding flight-training fleet, and rising demand for economical personal and charter flying solutions anchor this growth trajectory. Flight schools favor reliable piston designs because their acquisition and operating costs are lower than those of turbine alternatives. Manufacturers sharpen competitive edges by integrating electronic ignition and Full Authority Digital Engine Control (FADEC) technology to trim maintenance expenses and improve dispatch reliability. Regulatory momentum, including the Federal Aviation Administration's (FAA's) MOSAIC rule that widens the scope of light-sport aircraft, unlocks additional demand for higher-weight, better-equipped piston models. Diesel engine retrofits and new installations enhance the appeal for cost-conscious operators, as Jet A-1 fuel is cheaper and widely available globally.

Global Piston Engine Aircraft Market Trends and Insights

Growing Demand for Training Aircraft due to Pilot Shortage

Boeing estimates that airlines and business aviation operators will need 674,000 new pilots by 2043, a gap that keeps flight training demand elevated. Prominent academies, such as Embry-Riddle, expanded their fleets in 2024 with 50 Piper Archer TX aircraft, underscoring a sustained appetite for modern piston trainers. Regional airlines in Asia-Pacific are launching ab-initio programs that demand single- and twin-engine aircraft for every pilot-licensing stage. Regulations requiring hour-building on piston types ensure a steady utilization profile. These factors establish a multi-year revenue stream for manufacturers and aftermarket providers.

Rising Adoption of Piston-diesel Engines for Fuel Efficiency

Diesel powerplants consume up to 40% less fuel than avgas engines and can burn widely available Jet A-1, easing logistics outside North America. Piper's tie-up with DeltaHawk to retrofit PA-44 Seminole trainers illustrates how OEMs court operators chasing lower direct-operating costs. Diamond's Austro-powered DA40 NG and DA42 NG models dominate European flight-school fleets, confirming market acceptance. Diesel engines also extend the time between overhauls by roughly 25%, which contributes to total lifecycle savings and improves resale values.

Stringent Emission Regulations on Leaded Avgas

The European Union (EU) and several US states are moving to phase out 100-LL avgas by 2030, compelling owners to transition toward unleaded options that remain under certification. Swift Fuels and Shell are testing 100-octane unleaded formulations, but fleet-wide approval is unlikely before 2026. Operators of older engines face retrofit costs or erosion of resale value. Uneven regional fuel availability could restrict cross-border operations during the transition period, depressing the utilization of legacy aircraft.

Other drivers and restraints analyzed in the detailed report include:

- Expanding General Aviation Infrastructure in Emerging Markets

- Recreational Flying Boom Among HNWIs

- Supply-chain Disruptions for Critical Engine Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Twin-engine aircraft held 51.15% of the piston-engine aircraft market share in 2025, thanks to mandatory multi-engine training and the redundancy needs of charter operators. The segment benefits from established models, such as the Piper Seminole and Tecnam P2006T. Nevertheless, single-engine variants post a robust 6.83% CAGR, propelled by demand for lower operating costs within primary training and personal ownership.

The strong forward-order book for the Cessna 172S and Cirrus SR20 illustrates confidence in the economics of single-engine aircraft. Diesel dual-engine retrofits also gain traction because savings compound across two power plants. Electronic-ignition upgrades for the Lycoming IO-540 and Continental IO-550 families further reduce direct operating costs and enhance ignition reliability, thereby sustaining twin appeal in higher-utilization settings.

The Piston Engine Aircraft Market Report is Segmented by Engine Type (Single Engine and Twin Engine), End-User Service (Civil/Commercial, and Government and Military), Application (Sports, Pilot Training, Aerial Surveying, Agriculture and Forestry, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.10% of the piston engine aircraft market share in 2025, primarily driven by the US's extensive network of over 5,000 public-use airports and well-developed maintenance facilities. The region recorded a historical 4.12% CAGR from 2020 to 2025, and momentum is expected to strengthen to 5.62% through 2031 as pilot shortages drive training fleet expansion. Canada and Mexico add incremental demand for utility and recreational roles, and FAA regulatory updates accelerate new-aircraft certifications.

The Asia-Pacific region is the growth engine, with a projected 6.98% CAGR to 2031. China's approval of 239 new general-aviation airports in 2024 positions the country as a key buyer. India's faster charter-operator licensing rules shrink barriers to entry, and Southeast Asian tourism rebounds, reviving charter demand. Australia and Indonesia add specialized markets in agricultural spraying and remote logistics, favoring rugged piston models.

Europe delivers steady expansion through diesel-power leadership and recreational flying. Harmonized EASA rules enable seamless cross-border operations, while environmental policies accelerate the shift from leaded avgas to unleaded blends. The Middle East invests heavily under Saudi Arabia's Vision 2030, and Africa shows pockets of growth in South Africa and Nigeria, where charter services fill connectivity gaps.

- American Champion Aircraft Corporation

- Cirrus Design Corporation (Aviation Industry Corporation of China)

- Cub Crafters, Inc.

- Diamond Aircraft Industries GmbH

- Extra Flugzeugproduktions- und Vertriebs- GmbH

- Flight Design general aviation GmbH

- Piper Aircraft, Inc.

- Costruzioni Aeronautiche TECNAM S.p.A.

- Textron Inc.

- Mooney International Corporation

- COMPAGNIE DAHER SA

- Vulcanair S.p.A.

- Vashon Aircraft

- ICON Aircraft, Inc.

- Glasair Aviation USA, LLC (Hanxing Group)

- Van's Aircraft, Inc.

- Sonex, LLC

- Zenith Aircraft Co.

- BRM AERO, s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for training aircraft due to pilot shortage

- 4.2.2 Rising adoption of piston-diesel engines for fuel efficiency

- 4.2.3 Expanding general aviation infrastructure in emerging markets

- 4.2.4 Recreational flying boom among high-net-worth individuals (HNWIs)

- 4.2.5 Light sport aircraft regulatory relaxation

- 4.2.6 Electronic ignition and FADEC innovations reducing maintenance costs

- 4.3 Market Restraints

- 4.3.1 Stringent emission regulations on leaded Avgas

- 4.3.2 Supply chain disruptions for critical engine components

- 4.3.3 High insurance premiums for general aviation operators

- 4.3.4 Competition from advanced eVTOL and turboprop options

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Engine Type

- 5.1.1 Single Engine

- 5.1.2 Twin Engine

- 5.2 By End-User Service

- 5.2.1 Civil/Commercial

- 5.2.2 Government and Military

- 5.3 By Application

- 5.3.1 Sports

- 5.3.2 Pilot Training

- 5.3.3 Aerial Surveying

- 5.3.4 Agriculture and Forestry

- 5.3.5 Air Taxi and Charter

- 5.3.6 Special Mission

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Indonesia

- 5.4.3.6 Australia

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Qatar

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 American Champion Aircraft Corporation

- 6.4.2 Cirrus Design Corporation (Aviation Industry Corporation of China)

- 6.4.3 Cub Crafters, Inc.

- 6.4.4 Diamond Aircraft Industries GmbH

- 6.4.5 Extra Flugzeugproduktions- und Vertriebs- GmbH

- 6.4.6 Flight Design general aviation GmbH

- 6.4.7 Piper Aircraft, Inc.

- 6.4.8 Costruzioni Aeronautiche TECNAM S.p.A.

- 6.4.9 Textron Inc.

- 6.4.10 Mooney International Corporation

- 6.4.11 COMPAGNIE DAHER SA

- 6.4.12 Vulcanair S.p.A.

- 6.4.13 Vashon Aircraft

- 6.4.14 ICON Aircraft, Inc.

- 6.4.15 Glasair Aviation USA, LLC (Hanxing Group)

- 6.4.16 Van's Aircraft, Inc.

- 6.4.17 Sonex, LLC

- 6.4.18 Zenith Aircraft Co.

- 6.4.19 BRM AERO, s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment

8 KEY STRATEGIC QUESTIONS FOR PISTON ENGINE AIRCRAFT CEOS