PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911750

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911750

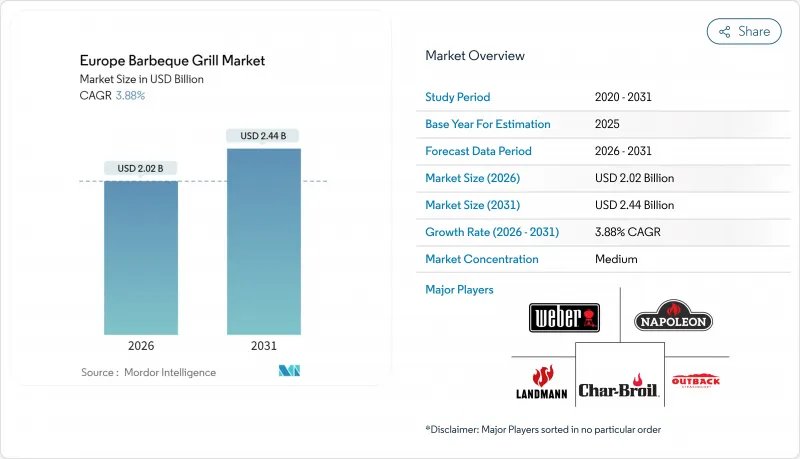

Europe Barbeque Grill - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Barbeque Grill market was valued at USD 1.94 billion in 2025 and estimated to grow from USD 2.02 billion in 2026 to reach USD 2.44 billion by 2031, at a CAGR of 3.88% during the forecast period (2026-2031).

This measured advance reflects a maturing industry in which premium features, smart connectivity, and energy-efficient formats offset slowing replacement volumes. Gas grills still anchor household demand, yet electric and smart-connected models capture the bulk of incremental revenue as urban density, balcony restrictions, and EU sustainability rules reshape purchase criteria. Germany, with its well-established outdoor kitchen culture, maintains regional leadership, while Spain delivers the fastest percentage growth thanks to an extended grilling season and rising disposable income. Competitive intensity remains moderate, with Weber, Napoleon, Char-Broil, Landmann, and Traeger defending share through product innovation and selective consolidation moves such as Weber's pending merger with Blackstone Products.

Europe Barbeque Grill Market Trends and Insights

Rising Outdoor Living & Staycation Culture

European gardens, terraces and balconies have become permanent entertainment zones rather than seasonal amenities. This shift gained momentum after the pandemic and now underpins steady demand for modular grills built with marine-grade stainless steel and weather-resistant finishes that suit year-round operation. Millennials seek visually appealing setups for social media moments, while older homeowners invest in durable outdoor kitchens that raise property value. Brands responding with integrated storage, lighting and refrigeration features capture higher average selling prices. Germany and the UK display the highest penetration of multi-appliance islands, yet similar patterns emerge in France and the Nordics as staycation habits persist.

Innovation in Smart-Connected Grills

IoT functionality moves grilling from manual supervision to app-guided precision. Weber's SUMMIT SmartControl allows real-time temperature regulation, recipe prompts, and firmware updates that foster brand lock-in and recurring software revenue. Early adoption centers on Germany and Scandinavia where smartphone penetration and premium willingness coincide. Local data processing helps vendors meet EU privacy rules and differentiates European models from North American cloud-heavy versions. As connectivity spreads, replacement demand accelerates because retrofitting older units is rarely cost-effective, pushing the Europe barbeque grill market toward higher digital content per unit.

Stringent Open-Fire / Particulate Regulations

Several German and French cities now impose seasonal bans on charcoal or wood grilling in dense neighborhoods to curb particulate emissions. Studies show that electric grills can still emit ultrafine PM1 particles due to fat vaporization, challenging assumptions of zero-emission operation. Charcoal quality audits across Central Europe found 39 of 42 samples failing EN 1860-2 standards for fixed carbon content and particle size, prompting calls for stricter market surveillance. Such measures push consumers toward gas or approved electric models, pressuring vendors reliant on solid-fuel categories. Municipal authorities respond with seasonal burning restrictions and balcony grilling prohibitions that directly constrain market demand in high-density residential areas. The regulatory trend favors electric and gas alternatives over solid fuel grills, creating segmentation shifts that benefit some manufacturers while constraining others.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce & D2C Sales

- EU Energy-Efficiency Push Toward Electric & Pellet Grills

- Premium Grill Price Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gas products commanded 45.92% of 2025 revenue, confirming their entrenched role in the Europe Barbeque Grill market. Yet electric grills are projected to post a 4.68% CAGR, the fastest among all fuels, as balcony restrictions and renewable-energy consciousness reshape consumer preferences. The Europe Barbeque Grill market size for electric units is set to expand rapidly as Weber's LUMIN platform demonstrates searing capability in a slim form factor . Charcoal retains cultural appeal but faces regulatory scrutiny and inconsistent fuel quality. Pellet options occupy a premium niche that blends wood-smoke flavor with digital thermostats, drawing serious hobbyists.

Hybrid and infrared formats remain specialized choices with limited share, though their high heat performance sustains elevated price points. Regulatory compliance under the revised EN 1860 standard now favors established producers that can finance rigorous laboratory testing, sidelining low-cost imports. Consumers weigh flavor authenticity against convenience, with many adopting dual-fuel households that pair a weekday electric grill with a weekend charcoal smoker. Manufacturers that communicate energy savings and quick preheat times accelerate electric uptake, reinforcing the long-term trajectory toward cleaner fuels across the Europe Barbeque Grill market.

Freestanding carts accounted for 57.34% of 2025 sales, serving homeowners seeking generous cooking surfaces and storage. Portable grills, however, are rising at a 4.21% CAGR. The Europe Barbeque Grill market share for portable models climbs as city dwellers opt for lightweight units like the Weber, which compresses into car trunks yet reaches 315 °C within minutes. Built-in systems dominate the premium tier thanks to outdoor kitchen projects that integrate refrigeration, sinks, and stone countertops.

Consumers embrace modular accessories, pizza stones, rotisseries, and griddle plates that augment versatility without requiring multiple appliances. Disposable units are losing favor amid single-use plastic bans and circular economy targets. Meanwhile, telescopic leg designs and multi-zone burners enhance cooking flexibility in confined spaces. Compliance with EN 1860-1:2024 construction rules has pushed manufacturers to upgrade materials and add child-safe locking lids, contributing to ASP growth. Portable formats thus capture new households and extend brand reach across campsites, beaches and balconies, reinforcing brand loyalty for later upscale purchases.

The Europe Barbeque Grill Market Report is Segmented by Fuel Type (Gas, Charcoal, Electric, Pellet, Hybrid/Alternative Fuel, Infrared), Product Design (Built-In, Freestanding, Portable/Table-top, Disposable/Single-use), Technology (Conventional, Smart/Connected), End-User (Residential, Commercial), Distribution Channel (B2B/Direct, B2C/Retail), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Big Green Egg Europe

- Broil King (Onward Manufacturing)

- Campingaz (Coleman)

- Char-Broil LLC

- Char-Griller (Middleby)

- Cobb International

- Dansons Inc (Pit Boss Grills)

- Everdure by Heston Blumenthal

- Landmann GmbH & Co. KG

- LotusGrill GmbH

- Monolith Kamado Grills

- Morso Jernstoberi A/S

- Napoleon Gourmet Grills

- Nexgrill Industries Inc.

- Ninja

- Outback Barbecues Ltd.

- Outdoorchef

- Rosle GmbH & Co. KG

- Severin Elektrogerate GmbH

- Tefal

- Traeger Inc.

- Weber-Stephen Products LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Outdoor Living & "Staycation" Culture

- 4.2.2 Innovation In Smart-Connected Grills

- 4.2.3 Expansion Of E-Commerce & D2C Sales

- 4.2.4 Eu Energy-Efficiency Push Toward Electric & Pellet Grills

- 4.2.5 Growth Of Compact Balcony-Friendly Appliances

- 4.2.6 Premiumization Linked To Outdoor Kitchen Trend

- 4.3 Market Restraints

- 4.3.1 Stringent Open-Fire / Particulate Regulations

- 4.3.2 Premium Grill Price Inflation

- 4.3.3 Steel & Aluminum Price Volatility

- 4.3.4 Short Grilling Season In Northern Europe

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Energy-Efficiency Standards for BBQ Grill in Key European Countries

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Fuel Type

- 5.1.1 Gas Grills

- 5.1.2 Charcoal Grills

- 5.1.3 Electric Grills

- 5.1.4 Pellet Grills

- 5.1.5 Hybrid/Alternative Fuel

- 5.1.6 Infrared

- 5.2 By Product Design

- 5.2.1 Built-In

- 5.2.2 Freestanding

- 5.2.3 Portable / Table-top

- 5.2.4 Disposable / Single-use

- 5.3 By Technology

- 5.3.1 Conventional

- 5.3.2 Smart/Connected

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Distribution Channel

- 5.5.1 B2B/Direct from the Manufacturers

- 5.5.2 B2C/Retail

- 5.5.2.1 Specialty Stores

- 5.5.2.2 Home Centers & DIY Stores

- 5.5.2.3 Mass Merchandisers

- 5.5.2.4 Online

- 5.5.2.5 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Big Green Egg Europe

- 6.4.2 Broil King (Onward Manufacturing)

- 6.4.3 Campingaz (Coleman)

- 6.4.4 Char-Broil LLC

- 6.4.5 Char-Griller (Middleby)

- 6.4.6 Cobb International

- 6.4.7 Dansons Inc (Pit Boss Grills)

- 6.4.8 Everdure by Heston Blumenthal

- 6.4.9 Landmann GmbH & Co. KG

- 6.4.10 LotusGrill GmbH

- 6.4.11 Monolith Kamado Grills

- 6.4.12 Morso Jernstoberi A/S

- 6.4.13 Napoleon Gourmet Grills

- 6.4.14 Nexgrill Industries Inc.

- 6.4.15 Ninja

- 6.4.16 Outback Barbecues Ltd.

- 6.4.17 Outdoorchef

- 6.4.18 Rosle GmbH & Co. KG

- 6.4.19 Severin Elektrogerate GmbH

- 6.4.20 Tefal

- 6.4.21 Traeger Inc.

- 6.4.22 Weber-Stephen Products LLC

7 Market Opportunities & Future Outlook

- 7.1 Electrified Smart Grills With Iot Integration

- 7.2 Subscription-Based Pellet Supply & After-Sales Services