PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911752

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911752

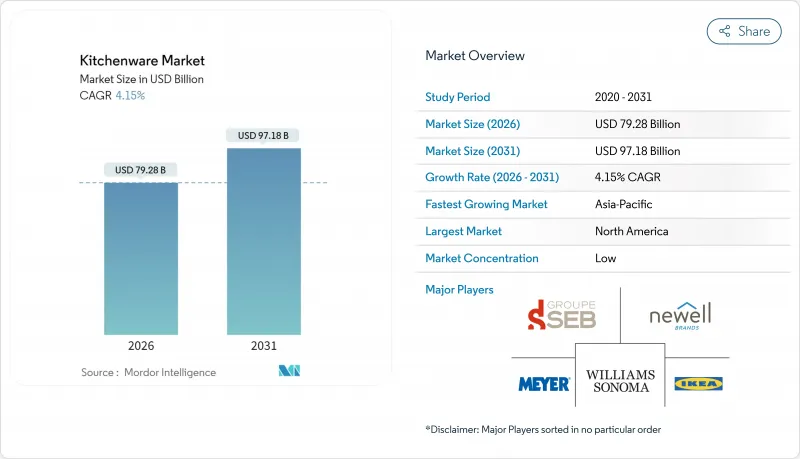

Kitchenware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Kitchenware market size in 2026 is estimated at USD 79.28 billion, growing from 2025 value of USD 76.12 billion with 2031 projections showing USD 97.18 billion, growing at 4.15% CAGR over 2026-2031.

Disposable-income growth, stricter material safety rules, and the continued habit of cooking at home-even after food-service recovery-are the strongest structural tailwinds. Stainless steel maintains its dominant position amid PFAS phase-outs, while ceramic and other PTFE-free coatings are expanding fastest as consumers equate safety with value. Online retail penetration, amplified by social-media product discovery, is upending traditional distribution models and allowing niche brands to scale rapidly. Meanwhile, manufacturers that can verify low-carbon footprints or offer induction-ready designs are securing premium shelf space in both digital and physical channels.

Global Kitchenware Market Trends and Insights

Rising Disposable Income and Renovation Spending

Higher household earnings are translating into premium kitchen upgrades that drive repeat purchases across dinnerware, cookware, and storage categories. India's houseware segment, for example, is forecast to double to USD 6 billion by 2026 as middle-income consumers prioritize kitchen aesthetics as symbols of lifestyle advancement . Parallel upticks in home-renovation budgets across Germany and other European markets sustain demand for coordinated sets that match open-concept living spaces. The visibility of cookware on countertops and dining tables now influences buying criteria as strongly as functional performance. Commercial builders are also specifying branded dinnerware packages for serviced apartments, reinforcing baseline volume growth.

Expansion of E-commerce and D2C Channels

Digital channels compress go-to-market timelines and enable personalized marketing that quickly converts interest into sales. Direct-to-consumer brands report double-digit repeat-purchase rates because data analytics allow targeted upselling of complementary items such as knives or bakeware. The convenience of next-day delivery, combined with video tutorials hosted on brand websites, reduces the perceived risk of buying premium items online. Retailers with omnichannel strategies that blend live demos with QR-code ordering are capturing higher basket sizes per visit in North America and Western Europe. Lower barrier-to-entry also encourages regional specialists to introduce locally preferred materials such as carbon steel woks for Southeast Asian consumers.

Raw-Material Price Volatility

Swinging prices for nickel, chromium, and ferromolybdenum are compressing margins, especially for mid-tier brands that compete on price yet lack long-term hedging programs. European producers face added pressure from rising energy taxes, prompting some firms to localize production closer to raw-material sources to stabilize costs. In response, design teams are reducing material thickness where safety permits and substituting aluminum cores for cost-effective heat conduction. Smaller suppliers without vertical integration risk ceding shelf space as retailers favor partners that can guarantee stable pricing.

Other drivers and restraints analyzed in the detailed report include:

- Social-Media Demand for Niche Tools

- Regulations Accelerating Induction-Ready Cookware

- Counterfeit and Grey-Market Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dinnerware generated 35.82% of 2025 sales, underscoring its role as the kitchenware market's most dependable category. Repeat purchases triggered by breakage and seasonal design updates keep volumes steady, enabling cross-selling into bakeware, which is slated to grow at a 6.95% CAGR through 2031. Bakeware's upswing is driven by social-media baking tutorials that spotlight specialty pans and proofing tools easily purchased online. Cookware remains core with daily meal preparation, with steady replacement cycles in both homes and restaurants. Tableware benefits from hosting trends that call for color-coordinated sets, while multifunctional utensils and prep tools address the demand for space-saving solutions in urban kitchens.

Manufacturers leverage dinnerware's broad installed base to launch complementary product lines and limited-edition patterns, often bundled for holiday promotions. The kitchenware market size attributed to bakeware is projected to expand faster than historical norms as more consumers attempt artisan-style bread and confectionery at home. Cookware innovation focuses on temperature sensors and modular lids, enhancing versatility without increasing cabinet footprint. Food-storage items, especially glass containers with silicone lids, gain popularity as sustainability concerns curb single-use plastic reliance. Entry barriers in tools and gadgets remain low, fostering continuous product refresh but also intensifying price competition.

Stainless steel held a 55.88% share in 2025 and remains the benchmark for durability, corrosion resistance, and regulatory acceptance. The kitchenware market size for non-stick ceramic and other PTFE-free coatings is forecast to rise at 6.55% CAGR because state-level PFAS bans take effect starting in 2026 . Innovations such as Plaslon coatings developed by Fraunhofer institutes promise 8-10-year lifespans, narrowing the performance gap with traditional PTFE. Aluminum retains relevance in commercial settings where rapid heat transfer supports high-volume cooking, while cast iron enjoys renewed consumer interest tied to longevity and natural seasoning. Bamboo, glass, and silicone occupy niche roles bolstered by sustainability marketing yet face scrutiny over true cradle-to-cradle performance claims.

Large producers increasingly disclose carbon footprints to differentiate premium stainless lines; Outokumpu's Circle Green steel, for instance, touts a 93% lower carbon profile than market averages. Hybrid constructions that fuse stainless exteriors with aluminum cores balance browning performance against weight considerations. As PFAS regulation widens, R&D budgets shift toward sol-gel ceramics and titanium-reinforced surfaces, aiming to replicate PTFE's food release without chemical liabilities. Material choice also influencing cookware aesthetics, with brushed finishes and warm metallic tones aligning with interior-design trends.

The Kitchenware Market is Segmented by Product Type (Cookware, Bakeware, and More), by Material (Stainless Steel, Aluminum, and More), by End-User (Residential, and Commercial / HoReCa), by Distribution Channel (Supermarkets / Hypermarkets, Specialty Stores, and More), by Region (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.05% of 2025 revenue, supported by a mature consumer base and established culinary culture. Retailers such as Williams-Sonoma logged 3.4% comparable-brand growth in Q1 2025, confirming ongoing premium purchases despite inflationary pressures. PFAS regulations in several states stimulate domestic innovation and the reshoring of certain production lines, benefiting manufacturers with USMCA-compliant facilities. E-commerce growth continues to outpace legacy channels, with social-media influencer partnerships driving flash sales for limited-edition cookware.

Asia-Pacific, expanding to 7.12% CAGR, is the primary growth engine through 2031. India has potential growth, with the houseware market expanding at 25-30% annually and projected to grow from USD 3 billion to USD 6 billion, supported by government performance-linked incentive schemes and export benefits. China's cooking-machine segment exceeded CNY 800 billion, with domestic brands intensifying competition in mid-range price tiers 163.com. Cultural diversity necessitates localized assortments: carbon-steel woks dominate Chinese catalogs, while ceramic rice cookers find traction in Japan and Korea.

Europe's market dynamics are increasingly shaped by sustainability regulations and circular economy initiatives that are creating competitive advantages for environmentally conscious brands and manufacturing processes. European Union directives on PFAS and energy labeling set performance benchmarks that ripple into global sourcing decisions. Southern European markets, buoyed by tourism-driven hospitality refurbishments, are upgrading commercial kitchens to induction systems, lifting demand for compatible pots and pans.

- Groupe SEB

- Newell Brands

- Meyer Corporation

- Williams-Sonoma

- IKEA

- TTK Prestige

- Le Creuset

- Hawkins Cookers

- Lodge Manufacturing

- Tramontina

- Conair (Cuisinart)

- Farberware

- The Vollrath Company

- Libbey Inc.

- Arc International

- Zwilling J.A. Henckels

- Brabantia

- Winco

- Lenox Corporation*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Income And Renovation Spending

- 4.2.2 Expansion Of E-Commerce And D2C Channels

- 4.2.3 Social-Media Demand For Niche Tools

- 4.2.4 Regulations Accelerating Induction-Ready Cookware

- 4.2.5 Sustainability Push Toward Circular Materials

- 4.2.6 Open-Kitchen Concepts In Food-Service

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Counterfeit And Grey-Market Products

- 4.3.3 Pfas-Coating Phase-Outs (Compliance Cost)

- 4.3.4 Shrinking Urban Kitchens Limit Set Sizes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Cookware

- 5.1.2 Bakeware

- 5.1.3 Tableware and Dinnerware

- 5.1.4 Kitchen Tools and Utensils

- 5.1.5 Food Storage and Accessories

- 5.2 By Material

- 5.2.1 Stainless Steel

- 5.2.2 Aluminum

- 5.2.3 Cast Iron

- 5.2.4 Non-stick Ceramic and PTFE-free

- 5.2.5 Others (Glass, Bamboo, Silicone)

- 5.3 By End-user

- 5.3.1 Residential

- 5.3.2 Commercial / HoReCa

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets / Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail

- 5.4.4 Others (Direct Sales, Department Stores)

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.4.8 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Groupe SEB

- 6.4.2 Newell Brands

- 6.4.3 Meyer Corporation

- 6.4.4 Williams-Sonoma

- 6.4.5 IKEA

- 6.4.6 TTK Prestige

- 6.4.7 Le Creuset

- 6.4.8 Hawkins Cookers

- 6.4.9 Lodge Manufacturing

- 6.4.10 Tramontina

- 6.4.11 Conair (Cuisinart)

- 6.4.12 Farberware

- 6.4.13 The Vollrath Company

- 6.4.14 Libbey Inc.

- 6.4.15 Arc International

- 6.4.16 Zwilling J.A. Henckels

- 6.4.17 Brabantia

- 6.4.18 Winco

- 6.4.19 Lenox Corporation*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment