PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911758

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911758

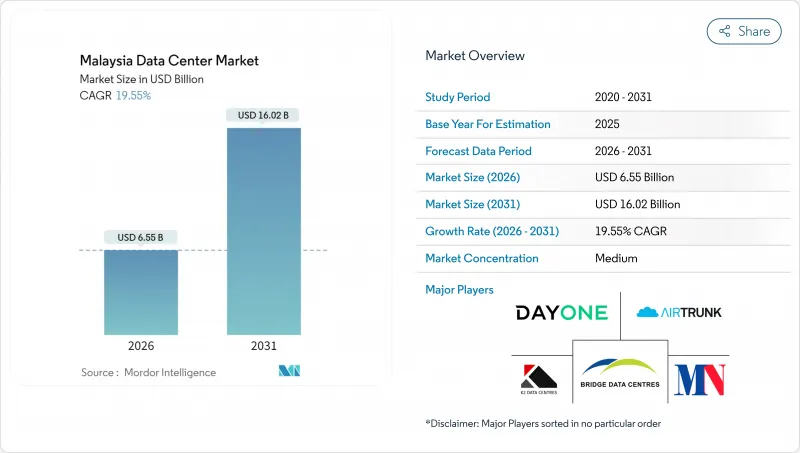

Malaysia Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia data center market was valued at USD 5.48 billion in 2025 and estimated to grow from USD 6.55 billion in 2026 to reach USD 16.02 billion by 2031, at a CAGR of 19.55% during the forecast period (2026-2031).

Power demand rises even faster, with IT load capacity projected to jump from 1.53 GW to 6.43 GW, a 33.24% CAGR, as artificial-intelligence workloads drive higher rack densities. The market segment shares and estimates are calculated and reported in terms of MW. Government incentives, hyperscaler commitments of MYR 90.2 billion (USD 20.3 billion), and submarine-cable additions reinforce Malaysia's status as Southeast Asia's new digital hub. Johor Bahru captures Singapore overflow demand while Cyberjaya benefits from the Multimedia Super Corridor infrastructure. Operators confront rising electricity tariffs and water supply constraints, prompting the need for renewable energy procurement strategies.

Malaysia Data Center Market Trends and Insights

Rising hyperscale cloud deployments

Google's USD 2 billion region, Oracle's USD 6.5 billion plan, and Microsoft's USD 2.2 billion expansion redefine capacity needs by pushing rack power densities beyond 15 kW. These mega-projects require specialized cooling, redundant substations, and high-speed interconnection, which traditional colocation facilities seldom offer. YTL's MYR 10 billion (USD 2.25 billion) NVIDIA alliance signals a shift among domestic players toward AI-ready campuses. Land and power procurement cycles are tightening as operators compete for sites in Johor and Negeri Sembilan with direct submarine cable access. The construction supply chain scales up to meet hyperscaler design standards, opening opportunities for local engineering, procurement, and construction firms. Long-term contracts also lock in renewable energy demand, which accelerates the national solar build-out.

Surge in FinTech and e-commerce digitalization

Touch 'n Go eWallet, DuitNow, and regional cross-border payment schemes require sub-millisecond processing that legacy bank data centers cannot sustain. Digital wallets captured 39% of online-transaction volume in 2023, amplifying demand for scalable compute and real-time fraud analytics nodes. Open-banking APIs further intensify traffic spikes as third-party fintech applications proliferate. Edge facilities in Kuala Lumpur and Penang shorten latency for densely populated urban centers, while disaster-recovery nodes in Johor ensure compliance with Bank Negara Malaysia's resilience guidelines. The expanding e-commerce base is pushing merchants toward cloud-native architectures, reinforcing the upward trend in the Malaysian data center market.

High electricity tariff volatility

Tariff restructuring increased industrial rates by 14.2% in 2024, with ultra-high-voltage users, such as data centers, being hit hardest. Subsidy removal ties prices to natural-gas benchmarks, exposing operators to fluctuations in the commodity market. Renewable supply lags demand, keeping spot prices elevated. Operators hedge through on-site solar and battery-storage projects, but capital expenditure rises and project timelines lengthen. Contract ambiguity around future tariff escalations complicates hyperscaler total-cost-of-ownership models.

Other drivers and restraints analyzed in the detailed report include:

- Rapid submarine-cable landings boosting connectivity

- Shortage of accredited Uptime-qualified engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium facilities are expected to open in 2026 with a 30.20% CAGR forecast, outpacing other tiers as enterprises and content providers seek edge-appropriate footprints that support regional 5G rollouts. Large facilities account for 24.18% of Malaysia's data center market share, driven by hyperscaler pre-lease commitments that secure power blocks of 20-50 MW. Small sites specialize in disaster-recovery niches, while mega and massive campuses cater to AI training needs.

The Malaysian data center market favors modular builds that add capacity in 4-6 MW increments, allowing operators to manage capital deployment effectively. Medium halls integrate economizer cooling, cutting power usage effectiveness to 1.3 and meeting green tax incentive thresholds. Large-site dominance persists near submarine cable stations, where land parcels can accommodate 100 MW substations. Power-grid constraints cap mega-campus growth, but upcoming 132 kV upgrades may unlock future supply.

Tier 3 captured 75.88% of the revenue in 2025 and maintains the top growth rate at a 34.10% CAGR, confirming enterprises' preference for concurrent maintainability without Tier 4 premiums. Tier 1-2 footprints shrink as SMEs migrate to cloud and colocation platforms.

Operators retrofit Tier 2 sites to Tier 3 by adding redundant distribution paths and diesel-rotary UPS systems, unlocking higher rack rates. Financial and e-commerce workloads demand 99.982% availability, aligning with Tier 3 specifications. Regulatory guidance from the Malaysian Communications and Multimedia Commission reinforces this mid-tier standard for the localization of critical data. Tier 4 remains a niche for core banking and defense workloads, but new-build economics deter widespread adoption.

The Malaysia Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, and More), and Hotspot (Kuala Lumpur, Cyberjaya, and More). The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Bridge Data Centers (Chindata Group)

- MN Holdings Bhd (in partnership with Shanghai DC-Science Co Ltd.)

- DayOne (GDS Holdings Ltd.)

- K2 Strategic (Kuok Group)

- AirTrunk Operating Pty Ltd.

- AIMS Data Centre Sdn. Bhd. (DigitalBridge Group, Inc.)

- Telekom Malaysia Berhad

- NTT Ltd.

- CSF Group

- Alibaba Cloud

- Keppel Data Center

- Open DC Sdn Bhd

- SAP SE

- Vantage Data Centers

- Telstra Group Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising hyperscale cloud deployments

- 4.2.2 Surge in FinTech and e-commerce digitalization

- 4.2.3 Rapid submarine cable landings boosting connectivity

- 4.2.4 Government tax incentives for green ICT investments

- 4.2.5 Penang-Johor industrial corridor edge demand

- 4.2.6 AI training clusters driving 100-200 MW campuses

- 4.3 Market Restraints

- 4.3.1 High electricity tariff volatility

- 4.3.2 Lengthy Tier 3/Tier 4 approval cycles

- 4.3.3 Scarcity of low-carbon power PPAs in Malaysia

- 4.3.4 Shortage of accredited Uptime-qualified engineers

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale/Self-built

- 5.3.2 Enterprise/Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Kuala Lumpur

- 5.5.2 Cyberjaya

- 5.5.3 Johor Bahru

- 5.5.4 Rest of Malaysia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bridge Data Centers (Chindata Group)

- 6.4.2 MN Holdings Bhd (in partnership with Shanghai DC-Science Co Ltd.)

- 6.4.3 DayOne (GDS Holdings Ltd.)

- 6.4.4 K2 Strategic (Kuok Group)

- 6.4.5 AirTrunk Operating Pty Ltd.

- 6.4.6 AIMS Data Centre Sdn. Bhd. (DigitalBridge Group, Inc.)

- 6.4.7 Telekom Malaysia Berhad

- 6.4.8 NTT Ltd.

- 6.4.9 CSF Group

- 6.4.10 Alibaba Cloud

- 6.4.11 Keppel Data Center

- 6.4.12 Open DC Sdn Bhd

- 6.4.13 SAP SE

- 6.4.14 Vantage Data Centers

- 6.4.15 Telstra Group Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment