PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911759

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911759

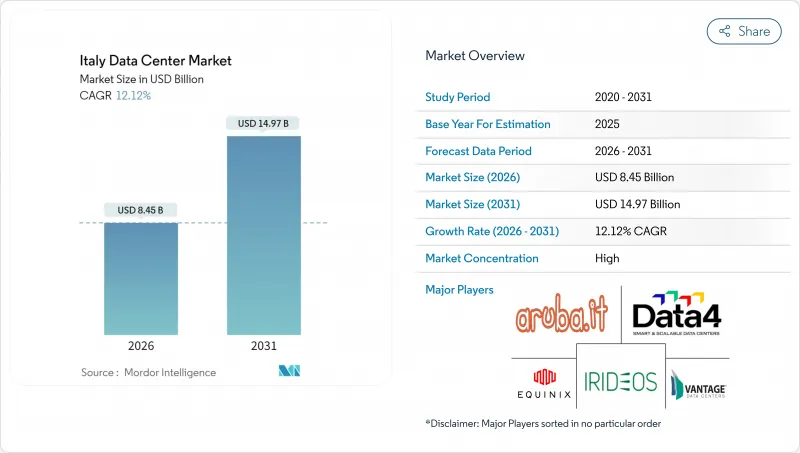

Italy Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Italy Data Center market is expected to grow from USD 7.54 billion in 2025 to USD 8.45 billion in 2026 and is forecast to reach USD 14.97 billion by 2031 at 12.12% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 1.08 thousand megawatt in 2025 to 4.09 thousand megawatt by 2030, at a CAGR of 30.49% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Hyperscale cloud expansion, aggressive public sector digitalization programs, and rising AI-driven computing needs fuel demand. Milan's proximity to trans-European fiber routes, improvements in power procurement, and a growing pipeline of submarine cables keep the country attractive for high-density builds. International investors also favor Italy because land and power are still easier to secure than in Frankfurt, London, Amsterdam, Paris and Dublin. Heightened merger activity suggests the market could enter a consolidation phase as scale economies become decisive.

Italy Data Center Market Trends and Insights

Accelerated Hyperscaler Cloud Expansion

Italy is now a top-tier destination for global cloud providers that need capacity relief from congested Northern European hubs. Microsoft earmarked EUR 4.3 billion (USD 4.6 billion) for new Lombardy facilities that will bring multiple availability zones online by 2027. Google Cloud opened twin regions in Milan and Turin, spanning six buildings to meet local data-residency requirements. Amazon Web Services is evaluating former Enel power-plant sites such as Montalto di Castro to condense permitting timelines and leverage existing transmission links. The influx of foreign capital lifts construction standards, accelerates adoption of liquid cooling, and pushes bulk-power engagement with Terna, the national grid operator.

Public Sector Cloud Migration Under PNRR

Italy's EUR 191.5 billion Recovery and Resilience Plan accelerated nationwide digital transformation. The National Strategic Hub (Polo Strategico Nazionale) awarded contracts worth EUR 520 million in 2024, representing a 73% year-over-year increase, to migrate ministerial workloads to sovereign clouds. The initiative obliges data to remain on domestic soil, favoring Tier 4 sites with quantum-safe encryption and 99.995% uptime. TIM committed EUR 130 million (USD 141 million) for a 25 MW facility near Rome, scheduled for completion in late 2026, specifically designed for GPU clusters. As municipalities seek compliance, demand is emerging for smaller edge nodes across public hospitals and schools.

High Electricity Costs and Grid Constraints

Italian wholesale power averaged EUR 133/MWh (USD 144/MWh) in 2024, 30% higher than France and 40% above Spain, eroding operating margins. Terna received 42 GW of connection requests by March 2025, dwarfing current generation reserves and exposing capacity shortfalls. Renewable approvals are sluggish: regions cleared only 1% of solar applications filed in 2022. For the Italy data center market, operators must therefore sign multi-year renewable PPAs, invest in on-site batteries, and phase construction to match sub-station upgrades.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven High-Density Compute Demand

- Strategic Submarine and Terrestrial Connectivity Upgrades

- Regulatory Uncertainty and Permitting Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The large-facility tier led the Italy data center market with 46.45% revenue in 2025. Operators such as Digital Realty and Aruba use these sites to cluster wholesale colocation suites and multi-tenant cloud nodes. Meanwhile, massive campuses above 60 MW are set to post a 29.10% CAGR through 2031 as hyperscale clouds migrate AI training workloads in-house. The resulting construction swing is visible around Milan's eastern ring road, where three projects totaling 350 MW broke ground in 2025. Utility-scale footprints justify private 150 kV grid connections and on-site substations that mitigate volatile transmission tariffs. Small facilities decline steadily because edge use cases can be served from modular annexes attached to factories or telecom central offices.

Acceleration toward larger footprints compresses the total cost of ownership. Spreading power infrastructure over more racks lowers capex per kW by up to 25% and improves PUE through centralized heat-recovery loops that feed district heating in towns like Bergamo. At the same time, local municipalities favor consolidated zoning to minimize land-use conflicts. The momentum toward massive campuses, therefore, reinforces long-term land banking strategies, especially in Lombardy and Piedmont, where motorway access and dark fiber routes already exist. Within this context, the Italy data center market size for massive projects is positioned to expand almost fourfold over five years, eclipsing medium-tier deployments in new-build capex.

Tier 4 facilities held 55.05% of 2025 revenue and are forecast for a 30.20% CAGR, reflecting enterprise appetite for concurrent-maintainable infrastructure. Financial institutions, telecom operators, and public-sector entities all specify 2N+1 architectures with dual 132 kV feeds, diesel day-tanks sized for 72 hours, and fully fault-tolerant cooling loops. Tier 3 sites, though cheaper by 15% in build cost, remain relegated to disaster-recovery roles or third-party hosting of non-critical workloads. Tier 1-2 installations fill niche edge scenarios such as local content caches or factory data dumps.

Regulatory reforms anticipated for 2026 may codify uptime requirements for public cloud providers serving government contracts, effectively mandating Tier 4 certification. This prospect further tilts investment toward the highest tier and is expected to push the Italy data center market share of Tier 4 to approximately 60% by 2027. Demand elasticity is low because most mission-critical applications cannot tolerate more than five minutes of annual downtime. Accordingly, vendors focusing on Tier 4 builds gain pricing power, while Tier 3 operators need to add revenue streams such as managed security services to stay competitive.

The Italy Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Telecom Italia S.p.A.

- IBM Corporation

- Data4 Group S.A.S.

- Google LLC

- Microsoft Corporation

- Retelit S.p.A.

- STACK Infrastructure, Inc.

- CloudHQ, LLC

- Vantage Data Centers, LLC

- ReeVo S.p.A.

- Equinix, Inc.

- Aruba S.p.A.

- Cloudflare, Inc.

- Eni S.p.A.

- Oracle Corporation

- Digital Realty Trust, Inc.

- Amazon Web Services, Inc.

- CyrusOne LLC

- Iron Mountain Inc.

- Irideos S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated hyperscaler cloud expansion

- 4.2.2 Public sector cloud migration under PNRR

- 4.2.3 AI-driven high-density compute demand

- 4.2.4 Strategic submarine and terrestrial connectivity upgrades

- 4.2.5 District heating waste-heat recovery adoption

- 4.2.6 Brownfield and underground site repurposing

- 4.3 Market Restraints

- 4.3.1 High electricity costs and grid constraints

- 4.3.2 Regulatory uncertainty and permitting delays

- 4.3.3 Water availability and cooling restrictions

- 4.3.4 Limited domestic capital for large-scale builds

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Milan

- 5.5.2 Genova

- 5.5.3 Rest of Italy

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telecom Italia S.p.A.

- 6.4.2 IBM Corporation

- 6.4.3 Data4 Group S.A.S.

- 6.4.4 Google LLC

- 6.4.5 Microsoft Corporation

- 6.4.6 Retelit S.p.A.

- 6.4.7 STACK Infrastructure, Inc.

- 6.4.8 CloudHQ, LLC

- 6.4.9 Vantage Data Centers, LLC

- 6.4.10 ReeVo S.p.A.

- 6.4.11 Equinix, Inc.

- 6.4.12 Aruba S.p.A.

- 6.4.13 Cloudflare, Inc.

- 6.4.14 Eni S.p.A.

- 6.4.15 Oracle Corporation

- 6.4.16 Digital Realty Trust, Inc.

- 6.4.17 Amazon Web Services, Inc.

- 6.4.18 CyrusOne LLC

- 6.4.19 Iron Mountain Inc.

- 6.4.20 Irideos S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment