PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911762

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911762

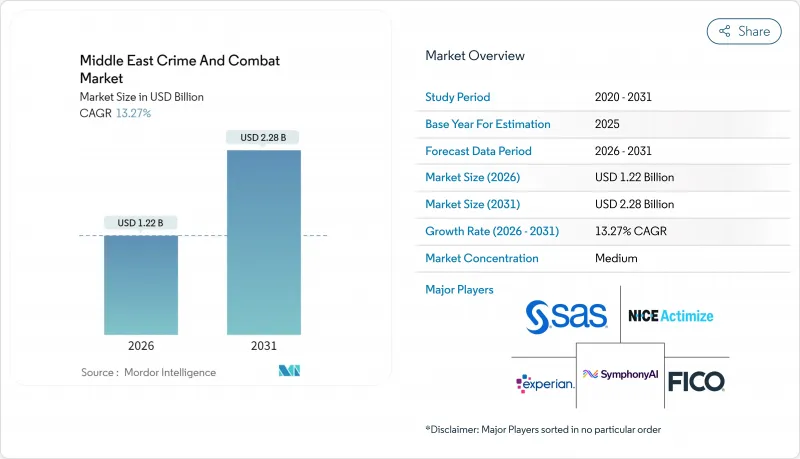

Middle East Crime And Combat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East crime and combat market size in 2026 is estimated at USD 1.22 billion, growing from 2025 value of USD 1.08 billion with 2031 projections showing USD 2.28 billion, growing at 13.27% CAGR over 2026-2031.

This vigorous expansion reflects rising digital-payments usage, mandatory e-KYC rules in the UAE and Saudi Arabia, and Vision 2030-linked financial-sector modernization that turns compliance spending into a growth catalyst. Transaction-volume acceleration, heightened geopolitical risk, and rapid cloud adoption jointly create steady demand for real-time monitoring tools, AI-driven anomaly detection, and cross-border data-sharing hubs. Competitive intensity stays moderate because specialized Arabic-language and jurisdiction-specific requirements deter new entrants, allowing regional specialists to coexist with global vendors. Cloud deployment dominates as banks pursue scalable infrastructure, yet on-premise systems persist where data-sovereignty mandates apply. Across the region, investment decisions increasingly favor integrated platforms that unify AML, fraud, CTF, and reporting functions, streamlining vendor footprints and implementation timelines.

Middle East Crime And Combat Market Trends and Insights

Rapid Digital-Payments Penetration Drives Infrastructure Modernization

Mobile and contactless payments now dominate retail spending across the Gulf, pushing daily transaction counts into the multi-million range. Saudi Arabia risks losing 5.74% of GDP to financial crime despite allocating USD 1.10 billion to compliance, reinforcing the need for high-throughput monitoring engines. Mandatory e-KYC in the UAE standardizes onboarding rules that neighboring states are replicating, trimming verification times, and raising baseline data quality. Higher digital volumes enlarge attack surfaces, especially for synthetic-identity fraud and gaming-platform laundering, compelling banks to refresh algorithms quarterly. Cloud-native tools offer elastic processing that scales with seasonal spending peaks, explaining the 21.24% CAGR logged by cloud deployments. Institutions that integrate AI-scoring models report double-digit drops in false positives and materially faster customer-acceptance cycles.

Intensifying GCC Cross-Border Trade Surveillance Creates Regional Standards

The Gulf's logistics corridors channel multi-currency trade between Asia, Europe, and Africa, turning trade-based money-laundering (TBML) into a systemic risk. Banks deploy AI analytics to flag over- or under-invoices and to correlate customs, shipping, and payment data in near real time. Blockchain pilots in trade finance introduce transparency but also generate vast datasets that require purpose-built analytics engines. Newly formed intelligence-sharing centers in Dubai and Riyadh distribute red-flag indicators, cutting the average detection window from days to hours. As regulations converge, vendors capable of delivering multilingual, sanctions-screening-ready solutions gain a price premium, and smaller institutions adopt shared-service models to lower entry costs.

Shortage of Arabic-Speaking Compliance Analysts Constrains Implementation

Regulations require suspicious-activity reports to be prepared in Arabic, yet the talent pool of experienced analysts lags demand. Salary premiums exceed 40% compared with English-only roles, inflating cost bases and prolonging hiring cycles. Banks turn to automated translation and AI summarization, but regulators insist on human oversight for high-risk cases, preserving the bottleneck. Large Saudi banks now sponsor university programs, yet experts note a 3-5-year maturation window before graduates achieve case-handling proficiency. Vendors that embed Arabic interfaces and localized workflows gain faster deployment approvals.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Anomaly Detection Adoption Transforms Detection Capabilities

- Regional Crypto-Asset Regulation Alignment Standardizes Compliance

- Fragmented Legacy Core-Banking Stacks Impede Integration Efficiency

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transaction Monitoring solutions generated 28.74% of 2025 revenue, underscoring their status as the regulatory workhorse anchoring every AML program. That share equates to roughly USD 0.31 billion of the Middle East crime and combat market size. Cloud-native engines that screen millions of daily micro-payments without latency maintain vendor lock-in across Tier-1 banks. Fraud Detection and Case Management, the fastest-growing line at 14.73% CAGR, benefits from rising synthetic-identity abuse and deepfake-enabled mule networks. Vendors are converging these once-separate modules into unified suites, lowering the total cost of ownership and easing model-risk governance.

Generative-AI components now draft investigation narratives, recommend SAR filing dispositions, and rank escalation urgency. Oracle's agents exemplify the trajectory, autonomously querying third-party databases to enrich alerts. Regional players such as EastNets respond by embedding Arabic natural-language generation to preserve cultural context. Institutions that consolidate vendors report smoother model-validation audits and reduced integration overhead.

Cloud models held a 60.98% share in 2025, equivalent to roughly USD 0.66 billion of the Middle East crime and combat market share. Adoption will continue at 20.82% CAGR as regulators in the UAE and Saudi Arabia ratify off-premise hosting for critical workloads. SaaS offerings allow smaller fintechs to access enterprise-grade analytics without large upfront capital outlays. Hybrid designs appeal to banks that must keep certain personally identifiable data on domestic soil yet still harness elastic analytics in regional data centers.

On-premise deployments retain niche relevance among sovereign-wealth entities and defense-linked banks that prioritize physical data segregation. Yet even these stakeholders pilot containerized micro-services to slash patch-management cycles. Vendor roadmaps emphasize single-tenant cloud options that satisfy data-sovereignty statutes while preserving upgrade cadence parity with multi-tenant releases.

The Middle East Crime and Combat Market is Segmented by Solutions (KYC Systems, Compliance Reporting Suites, and More), Deployment Mode (Cloud, On-Premises), End-User Vertical(BFSI, Fintechs and Payment Service Providers, and More), Application (Anti-Money Laundering, Counter-Terrorist Financing, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SAS Institute Inc.

- NICE Ltd (Actimize Solutions)

- Fair Isaac Corporation (FICO)

- ACI Worldwide Inc.

- Oracle Financial Services Software Ltd.

- Fiserv Inc.

- Experian plc

- Refinitiv Ltd (LSE Group)

- EastNets FZ-LLC

- Tata Consultancy Services Ltd.

- Temenos AG

- Wolters Kluwer NV

- Fidelity National Information Services Inc. (FIS)

- SymphonyAI Financial Crime

- iSPIRAL IT Solutions Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid digital-payments penetration

- 4.2.2 Intensifying GCC cross-border trade surveillance

- 4.2.3 Mandatory e-KYC frameworks (UAE, KSA)

- 4.2.4 AI-driven anomaly detection adoption (Tier-1 banks)

- 4.2.5 Regional crypto-asset regulation alignment

- 4.2.6 Public-private financial-crime information-sharing hubs

- 4.3 Market Restraints

- 4.3.1 Shortage of Arabic-speaking compliance analysts

- 4.3.2 Fragmented legacy core-banking stacks

- 4.3.3 High on-premise system switching costs

- 4.3.4 Evolving sanctions complexity linked to regional geopolitics

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Know-Your-Customer (KYC) Systems

- 5.1.2 Transaction Monitoring

- 5.1.3 Compliance Reporting Suites

- 5.1.4 Auditing and Analytics

- 5.1.5 Fraud Detection / Case Management

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Government and Law-Enforcement Agencies

- 5.3.3 FinTechs and Payment Service Providers

- 5.4 By Application

- 5.4.1 Anti-Money Laundering (AML)

- 5.4.2 Counter-Terrorist Financing (CTF)

- 5.4.3 Fraud and Cyber-crime Detection

- 5.4.4 Regulatory and Tax Compliance (FATCA, CRS)

- 5.5 By Geography

- 5.5.1 United Arab Emirates

- 5.5.2 Kingdom of Saudi Arabia

- 5.5.3 Qatar

- 5.5.4 Egypt

- 5.5.5 Kuwait

- 5.5.6 Bahrain and Oman

- 5.5.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAS Institute Inc.

- 6.4.2 NICE Ltd (Actimize Solutions)

- 6.4.3 Fair Isaac Corporation (FICO)

- 6.4.4 ACI Worldwide Inc.

- 6.4.5 Oracle Financial Services Software Ltd.

- 6.4.6 Fiserv Inc.

- 6.4.7 Experian plc

- 6.4.8 Refinitiv Ltd (LSE Group)

- 6.4.9 EastNets FZ-LLC

- 6.4.10 Tata Consultancy Services Ltd.

- 6.4.11 Temenos AG

- 6.4.12 Wolters Kluwer NV

- 6.4.13 Fidelity National Information Services Inc. (FIS)

- 6.4.14 SymphonyAI Financial Crime

- 6.4.15 iSPIRAL IT Solutions Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment