PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911771

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911771

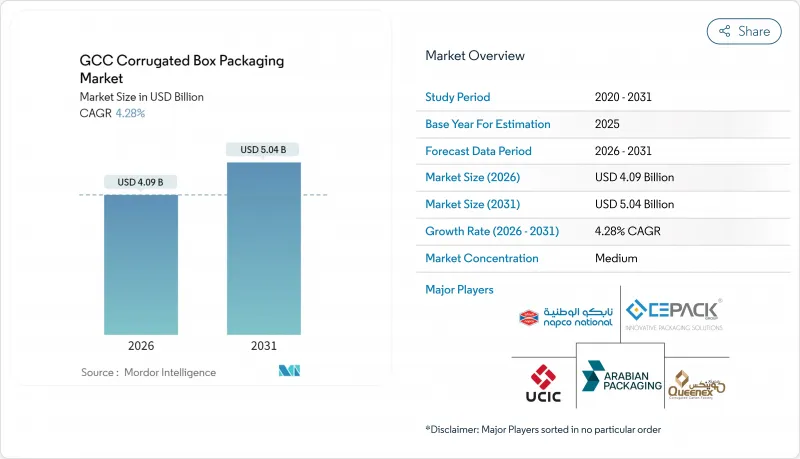

GCC Corrugated Box Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

GCC corrugated box packaging market size in 2026 is estimated at USD 4.09 billion, growing from 2025 value of USD 3.92 billion with 2031 projections showing USD 5.04 billion, growing at 4.28% CAGR over 2026-2031.

Steady growth is unfolding on the back of accelerating e-commerce activity, national localization agendas that incentivize domestic manufacturing, and policy-backed pivots away from single-use plastics. Saudi Arabia's Vision 2030 and the United Arab Emirates' 2024 plastics phase-out collectively stimulate capital expenditure in containerboard mills, high-speed case packing lines, and digital converting equipment. Retail and fast-moving consumer goods (FMCG) brand owners are increasingly specifying lightweight, high-strength substrates that reduce freight charges while meeting stricter sustainability scorecards. Meanwhile, automation of fulfillment facilities, coupled with omnichannel retail models that generate up to 20 handling touchpoints per parcel, amplifies demand for precise dimensional tolerances and drop-test resilience. However, the volatility of recycled old corrugated cardboard (OCC) prices and chronic water scarcity add cost pressure. Ongoing investment in closed-loop water systems, high-performance coatings, and predictive maintenance technologies shields converters from the worst margin swings.

GCC Corrugated Box Packaging Market Trends and Insights

Surge in E-commerce Fulfillment Centres

The rapid build-out of fulfillment infrastructure is fundamentally reshaping shipment profiles and packaging performance requirements. Dubai now anchors a regional network of high-throughput hubs capable of processing millions of parcels per day, each subject to automated sortation, robotic picking, and last-mile courier hand-offs. Twenty handling events may occur before a package reaches its recipient, intensifying the requirement for compression strength, precise creasing, and tear-resistant liners. Dimensional weight pricing by integrators penalizes excess void, fueling uptake of box-on-demand systems that slash up to 18% of wasted air per shipment. Saudi Arabia's NEOM logistics zones replicate this model at inland freight villages, shortening the lead times between converters and fulfillment centers and sparking the development of new micro-converting plants equipped with digital die-cutters for same-day box production. In parallel, omnichannel retailers demand print-on-box personalization that converts shipping cartons into marketing media, accelerating investments in single-pass digital presses and water-based ink sets that meet food-safe migration standards.

Shift Toward Lightweight High-Strength Containerboard

Regional converters pilot nano-fiber reinforcement, dual-phase bonding resins, and micro-flute profiles that achieve 15-20% basis-weight reduction without sacrificing edge crush performance. Freight operators across the GCC levy dimensional weight surcharges that can inflate shipping costs by 37% for oversized consignments, making right-weight corrugated a direct cost-avoidance strategy for brand owners. Proprietary high-performance grades also unlock downstream efficiencies: in double-wall constructions, optimized liner combinations allow converters to reduce from 350 gsm to 290 gsm while preserving pallet-stack compression targets. Capital expenditure is invested in upgraded corrugators featuring closed-loop moisture control and laser-profiled pressure rollers, ensuring flute integrity despite fluctuations in Gulf humidity. Lightweighting aligns with circular economy mandates by reducing raw material inputs, lowering inbound transport emissions, and increasing container fill rates on return loops to recycling centers.

Volatility in Recycled OCC Import Costs

Quarterly swings of 25-30% in global OCC prices reached USD 200 per metric ton landed at Dubai in 2024, forcing converters to rewrite contracts every two months. The GCC currently imports more than 70% of its reclaimed fiber, exposing mills to freight rate hikes, container shortages, and U.S. dollar-denominated invoices that clash with local-currency sales. Some producers hedge with forward contracts on the Chicago Board of Trade, while others secure exclusivity deals with European material recovery facilities in exchange for multiyear tonnage guarantees. High holding costs encourage just-in-time inventory buffers, yet port congestion or shipping-line blank sailings can paralyze corrugator calendars within days. Capacity investment in domestic sorting plants remains constrained by low consumer participation rates in recycling, although pilot curbside schemes in Riyadh and Abu Dhabi show early promise.

Other drivers and restraints analyzed in the detailed report include:

- GCC Government Zero-Waste Initiatives

- Retailers Switch to Plastic-Free Secondary Packaging

- Scarcity of Water for Kraft Pulping in GCC

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, single-wall constructions retained 46.78% of the GCC corrugated box packaging market share, driven by their cost-effectiveness for day-to-day FMCG shipments. Double-wall grades, however, are anticipated to post a 5.03% CAGR through 2031 as e-commerce merchants specify higher edge-crush performance for drop-test integrity over multi-stage distribution. The GCC corrugated box packaging market size for double-wall configurations is expanding fastest in the consumer electronics and personal care verticals, where the average item value justifies premium packaging expenditures.

Converters upgrade corrugators with dual-bonding applicators, edge-profile sensors, and real-time starch viscosity controls, ensuring flute symmetry despite high ambient humidity. Advances in containerboard engineering enable double-wall solutions to meet protective thresholds at lower grams per square meter than legacy single-wall solutions, reducing per-unit fiber input by up to 12%. Consequently, new orders increasingly stipulate double wall even for mid-priced kitchen appliances and beverage multipacks when automated case-packing lines require dimensional stability at 30 cycles per minute.

The GCC Corrugated Box Packaging Market Report is Segmented by Board Type (Single Wall, Double Wall, and Triple Wall), Printing Technology (Litho-Laminate, Flexographic Printing, and Digital Printing), End User (Processed Food, Fresh Food, Beverages, Personal Care, Electronics, and Other End Users), and Geography (Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arabian Packaging Co. LLC

- Queenex Corrugated Carton Factory LLC

- United Carton Industries Company

- Napco National CJSC

- Cepack Group

- Falcon Pack Industries LLC

- World Pack Industries LLC

- Universal Carton Industries Group

- Express Pack Print Factory LLC

- Green Packaging Boxes Industries LLC

- Tarboosh Packaging Co. LLC

- Unipack Containers and Carton Products LLC

- Al Rumanah Packaging Industries

- NBM Pack Industries LLC

- Saudi Paper Manufacturing Co.

- Modern Pack Company LLC

- Saudi Arabian Packaging Industry W.L.L.

- Smurfit Westrock plc

- International Paper Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce fulfilment centres

- 4.2.2 Shift toward lightweight high-strength containerboard

- 4.2.3 GCC government zero-waste initiatives

- 4.2.4 Retailers switch to plastic-free secondary packaging

- 4.2.5 Automated high-speed case-packing lines adoption

- 4.2.6 Vision 2030 localisation of corrugated supply chains

- 4.3 Market Restraints

- 4.3.1 Volatility in recycled OCC import costs

- 4.3.2 Scarcity of water for kraft pulping in GCC

- 4.3.3 Rising adoption of reusable plastic crates in produce

- 4.3.4 Limited availability of skilled packaging engineers

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Board Type

- 5.1.1 Single Wall

- 5.1.2 Double Wall

- 5.1.3 Triple Wall

- 5.2 By Printing Technology

- 5.2.1 Litho-Laminate

- 5.2.2 Flexographic Printing

- 5.2.3 Digital Printing

- 5.3 By End User

- 5.3.1 Processed Food

- 5.3.2 Fresh Food

- 5.3.3 Beverages

- 5.3.4 Personal Care

- 5.3.5 Electronics

- 5.3.6 Other End Users

- 5.4 By Country

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Kuwait

- 5.4.5 Oman

- 5.4.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arabian Packaging Co. LLC

- 6.4.2 Queenex Corrugated Carton Factory LLC

- 6.4.3 United Carton Industries Company

- 6.4.4 Napco National CJSC

- 6.4.5 Cepack Group

- 6.4.6 Falcon Pack Industries LLC

- 6.4.7 World Pack Industries LLC

- 6.4.8 Universal Carton Industries Group

- 6.4.9 Express Pack Print Factory LLC

- 6.4.10 Green Packaging Boxes Industries LLC

- 6.4.11 Tarboosh Packaging Co. LLC

- 6.4.12 Unipack Containers and Carton Products LLC

- 6.4.13 Al Rumanah Packaging Industries

- 6.4.14 NBM Pack Industries LLC

- 6.4.15 Saudi Paper Manufacturing Co.

- 6.4.16 Modern Pack Company LLC

- 6.4.17 Saudi Arabian Packaging Industry W.L.L.

- 6.4.18 Smurfit Westrock plc

- 6.4.19 International Paper Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment