PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911772

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911772

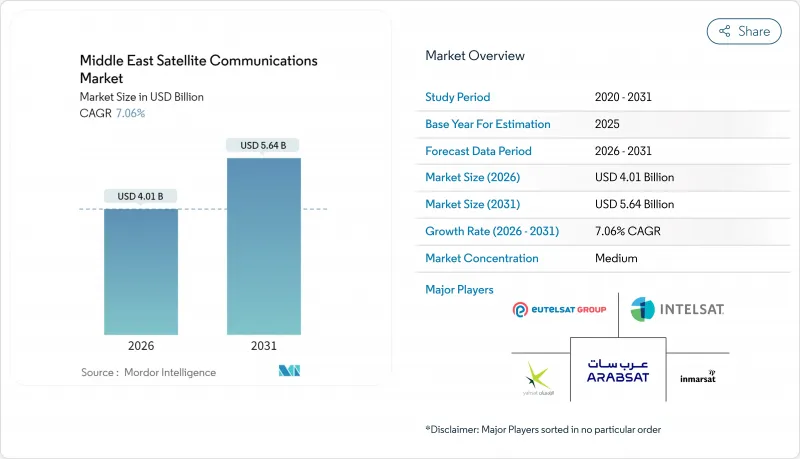

Middle East Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East satellite communications market size in 2026 is estimated at USD 4.01 billion, growing from 2025 value of USD 3.74 billion with 2031 projections showing USD 5.64 billion, growing at 7.06% CAGR over 2026-2031.

Geopolitical complexities, government-backed broadband mandates, and a surge of IoT deployments across oilfields, ports, and aircraft are collectively amplifying demand. Operators are prioritizing high-throughput satellite (HTS) investments to meet bandwidth-intensive enterprise and defense needs, even as spectrum coordination challenges raise the cost of new launches. Competitive positioning increasingly hinges on vertically integrated service bundles that blend cloud gateways, managed connectivity, and edge analytics capabilities. Maritime and airborne connectivity, 5G private-network backhaul, and direct-to-device (D2D) initiatives are emerging as high-margin niches that will shape the next growth wave of the Middle East satellite communications market.

Middle East Satellite Communications Market Trends and Insights

Increasing Uptake of IoT-Enabled Oilfield Equipment

Thousands of satellite-connected sensors now track pressure, flow, and emissions in remote wells, enabling predictive maintenance and lowering unplanned downtime. Saudi Aramco's real-time well-monitoring network exemplifies how energy majors leverage space-borne links where fiber is impractical. Space42's AI-powered analytics further enhance extraction efficiency, while Globalstar's tank-monitoring tools reduce supply interruptions across Gulf terminals. These deployments cut operating expenses and create recurring bandwidth demand that sustains the Middle East satellite communications market.

Rapid Adoption of VSAT-Based Maritime Connectivity

Major ports in Dubai, Jeddah, and Doha rely on VSAT for vessel traffic management and cargo analytics, driving fleet-wide upgrades by shipping lines. Marlink's agreements with regional operators showcase how HTS capacity delivers video, IoT telemetry, and crew welfare services. Integration with autonomous navigation platforms opens fresh revenue streams as unmanned surface vessels gain regulatory traction.

Spectrum Congestion and Cross-Border Frequency Disputes

Rapid satellite proliferation has exacerbated interference risks, and ITU coordination procedures struggle to keep pace. Quadsat's spectrum-monitoring deal with Arabsat signals is growing, and industry recognition that automated tools are vital. Still, unresolved C- and Ku-band overlaps can delay launches and elevate insurance premiums, adding friction to the Middle East satellite communications market.

Other drivers and restraints analyzed in the detailed report include:

- Government Programs for Universal Broadband (KSA, UAE)

- Growth of Private Inter-Satellite Data Relay Networks

- High CAPEX of HTS Fleet Upgrades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground equipment retained a 58.05% share of the Middle East satellite communications market in 2025, anchored by teleport, gateway, and VSAT deployments across Saudi Arabia and the UAE. Yet services revenue is projected to outpace hardware at an 7.85% CAGR, buoyed by managed bandwidth packages, cloud gateways, and satellite-enabled IoT platforms.

Services momentum reflects enterprise appetite for pay-as-you-go models that offload network management overhead. Es'hailSat's OSS/BSS partnership with neXat exemplifies how automation trims operating costs and accelerates onboarding. As HTS payloads proliferate, operators bundle cybersecurity, edge analytics, and SLA-backed uptime guarantees, expanding wallet share within the Middle East satellite communications market.

Maritime applications accounted for 40.30% of the Middle East satellite communications market share in 2025, due to dense shipping lanes through the Suez Canal and Strait of Hormuz. Airborne connectivity, however, is forecast to post the quickest 8.22% CAGR as airlines race to satisfy passenger streaming expectations and defense UAV fleets scale up.

Regional carriers adopt Ka-Band inflight Wi-Fi to differentiate customer experience, while the UAE's urban-air-mobility pilots lean on low-latency satellite links for command and control. Land platforms remain critical for oilfield SCADA backups and disaster-recovery networks, reinforcing diverse demand pillars that underpin the Middle East satellite communications market.

The Middle East Satellite Communications Market Report is Segmented by Type (Ground Equipment and Services), Platform (Portable, Land, Maritime, and Airborne), Frequency Band (L-Band, C-Band, Ku-Band, and Ka-Band), End-User Vertical (Maritime, Defense and Government, Enterprises, and More), Application (Voice Communications, Data Communications, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Inmarsat Global Limited (now Viasat Inc.)

- Arab Satellite Communications Organization

- Intelsat S.A.

- Eutelsat Communications S.A.

- SES S.A.

- Thuraya Telecommunications Company PJSC

- Gulfsat Communications Company K.S.C.C.

- Saudi Telecom Company (Saudi Telecom Co.)

- Etisalat and (Emirates Telecommunications Group Co. PJSC)

- Telesat Canada

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Kratos Defense and Security Solutions Inc.

- Cobham Limited

- Huawei Technologies Co. Ltd.

- Anuvu Operations LLC

- SatADSL S.A.

- OneWeb Holdings Ltd.

- Taqnia Space Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing uptake of IoT-enabled oilfield equipment

- 4.2.2 Rapid adoption of VSAT-based maritime connectivity

- 4.2.3 Government programs for universal broadband (KSA, UAE)

- 4.2.4 Growth of private inter-satellite data relay networks

- 4.2.5 Rising demand for satellite back-haul of 5G private networks

- 4.2.6 Expansion of cooperative deep-space missions via GCC consortiums

- 4.3 Market Restraints

- 4.3.1 Spectrum congestion and cross-border frequency disputes

- 4.3.2 High CAPEX of HTS fleet upgrades

- 4.3.3 Geopolitical launch-service restrictions on select states

- 4.3.4 Shortage of SatCom-grade radiation-hardened chips in region

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Ground Equipment

- 5.1.1.1 Satellite Gateway

- 5.1.1.2 VSAT Equipment

- 5.1.1.3 Network Operation Center (NOC)

- 5.1.1.4 Satellite News Gathering (SNG) Equipment

- 5.1.2 Services

- 5.1.2.1 Mobile Satellite Services (MSS)

- 5.1.2.2 Earth Observation Services

- 5.1.1 Ground Equipment

- 5.2 By Platform

- 5.2.1 Portable

- 5.2.2 Land

- 5.2.3 Maritime

- 5.2.4 Airborne

- 5.3 By Frequency Band

- 5.3.1 L-Band

- 5.3.2 C-Band

- 5.3.3 Ku-Band

- 5.3.4 Ka-Band

- 5.4 By End-User Vertical

- 5.4.1 Maritime

- 5.4.2 Defense and Government

- 5.4.3 Enterprises

- 5.4.4 Media and Entertainment

- 5.4.5 Oil and Gas

- 5.4.6 Other End-User Verticals

- 5.5 By Application

- 5.5.1 Voice Communications

- 5.5.2 Data Communications

- 5.5.3 Broadcasting

- 5.5.4 Remote Sensing

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Turkey

- 5.6.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Al Yah Satellite Communications Company PJSC (Yahsat)

- 6.4.2 Inmarsat Global Limited (now Viasat Inc.)

- 6.4.3 Arab Satellite Communications Organization

- 6.4.4 Intelsat S.A.

- 6.4.5 Eutelsat Communications S.A.

- 6.4.6 SES S.A.

- 6.4.7 Thuraya Telecommunications Company PJSC

- 6.4.8 Gulfsat Communications Company K.S.C.C.

- 6.4.9 Saudi Telecom Company (Saudi Telecom Co.)

- 6.4.10 Etisalat and (Emirates Telecommunications Group Co. PJSC)

- 6.4.11 Telesat Canada

- 6.4.12 L3Harris Technologies Inc.

- 6.4.13 Raytheon Technologies Corporation

- 6.4.14 Kratos Defense and Security Solutions Inc.

- 6.4.15 Cobham Limited

- 6.4.16 Huawei Technologies Co. Ltd.

- 6.4.17 Anuvu Operations LLC

- 6.4.18 SatADSL S.A.

- 6.4.19 OneWeb Holdings Ltd.

- 6.4.20 Taqnia Space Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment