PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911775

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911775

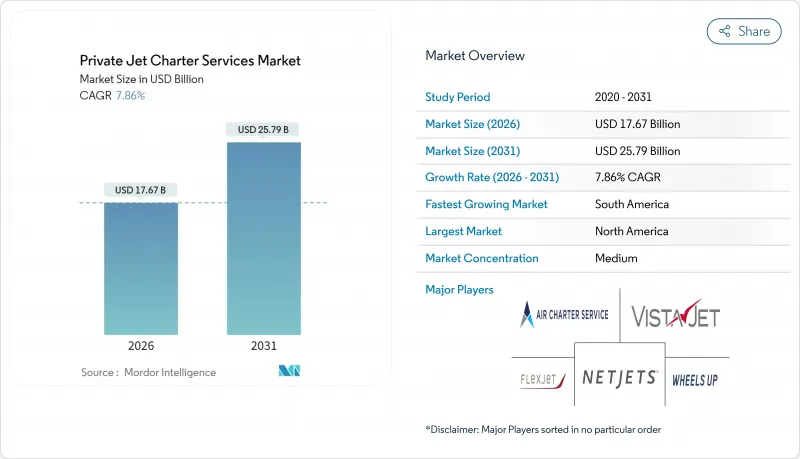

Private Jet Charter Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The private jet charter services market was valued at USD 16.38 billion in 2025 and estimated to grow from USD 17.67 billion in 2026 to reach USD 25.79 billion by 2031, at a CAGR of 7.86% during the forecast period (2026-2031).

Growing ultra-high-net-worth wealth, accelerating corporate globalization, and technology-driven booking solutions foster sustained tailwinds for the private jet charter services market. Operators widen fleets to meet long-range requirements, while the light-aircraft category provides cost-efficient regional connectivity. North America remains the revenue stronghold on the back of mature infrastructure and concentrated wealth. Yet, South America shows the steepest trajectory as airport upgrades and economic diversification fuel regional demand. Competitive intensity rises as incumbents pursue fleet renewal, subscription pricing, and sustainable aviation fuel initiatives to protect their private jet charter services market share.

Global Private Jet Charter Services Market Trends and Insights

Accelerating growth in global ultra-high-net-worth individuals (UHNWIs)

The wealthy population surpassed 625,000 people worldwide in 2025, controlling assets of USD 30 trillion and expanding 4% yearly. Rising affluence in China and India strengthens Asia's contribution to the private jet charter services market as younger high-net-worth travelers prioritize immersive experiences over material goods. Corporate executives use point-to-point connectivity to reconcile intense schedules with lifestyle choices, turning private aviation into a productivity tool. The demographic shift toward diversified wealth centers supports fresh demand in Southeast Asia and the Middle East. Consequently, fleet strategies now balance long-range jets for transcontinental journeys with light jets aimed at domestic connectivity, helping operators capture incremental share in the private jet charter services market.

Heightened demand for flexible, post-pandemic travel alternatives

Business jet activity re mained 10% above 2019 levels through mid-2025, despite commercial aviation's full recovery. The pandemic introduced thousands of first-time users to private flying, and retention has proven strong as travelers value minimal exposure to congested hubs and tailored itineraries. North American leisure itineraries, such as Caribbean resort hops, noticeably increased. European charter patterns blend corporate and leisure segments, often on light or mid-size aircraft that can land at secondary airports. In the Middle East, business jet traffic has more than doubled from 2019, reflecting the region's status as a connector between Europe, Africa, and Asia. These shifts sustain utilization rates and underpin optimism among operators expanding fleets inside the private jet charter services market.

Escalating operating expenses and charter pricing pressures

Insurance, crew, and maintenance outlays continue to rise, squeezing margins for operators with smaller balanced sheets. Annual hull and liability premiums range from USD 10,000 to USD 500,000, depending on aircraft value and pilot experience, and weather-related claims drive further pricing volatility. Supply chain disruptions extend aircraft downtime, increasing charter-substitution costs. Jet fuel prices remain sensitive to geopolitical events, limiting operators' ability to lock long-term rates. To remain competitive, market leaders negotiate volume discounts and retrofit older aircraft with predictive-maintenance systems that reduce unscheduled repairs, yet elevated cost structures still restrain near-term pricing flexibility in the private jet charter services market.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of jet-card, subscription, and membership models

- Adoption of AI-enabled real-time pricing and booking algorithms

- Stricter environmental compliance mandates and expanding carbon levies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large jets contributed 52.74% of the private jet charter services market revenue in 2025, favored for intercontinental range and spacious cabins that match corporate protocols. Fleet data confirms that heavy-cabin models capture roughly two-thirds of capital expenditure in new deliveries, as owners seek speed, comfort, and nonstop reach from New York to Tokyo. The private jet charter services market size for light-jets, however, is projected to grow at a 7.92% CAGR between 2026 and 2031 as cost-efficient airframes like the Phenom 300 and Citation CJ3 Gen2 open private aviation to regional executives and medical-evacuation providers.

Fleet modernization programs underscore a shift toward performance and sustainability. Honeywell forecasts 8,500 new business jet deliveries worth USD 280 billion by 2035, with North America absorbing 66% of shipments. Operators such as Wheels Up trimmed fleet complexity by retiring older turboprops and standardizing on two jet families to lower maintenance expenses and simplify crew scheduling. Light-jet models entering service in 2025 arrive SAF-ready, aligning with environmental mandates and encouraging adoption among first-time charter clients. This dual demand curve reinforces balanced growth across size categories within the private jet charter services market.

On-demand trips generated 51.62% of the private jet charter services market revenue 2025, reflecting reliance on flexible arrangements for last-minute executive travel and special events. Corporate flight departments use aircraft interchangeably without long-term contractual lock-in, minimizing balance-sheet exposure. Though still emerging, subscription models are expected to record a 9.63% CAGR through 2031 as clients value guaranteed availability, price certainty, and loyalty credits.

Jet cards position themselves between ad-hoc and fractional programs, offering deposits that roll over and transparent hourly rates. Empty-leg marketplaces commoditize otherwise idle repositioning flights, slicing hourly costs, and feeding new traffic. Shared-seat operators target leisure groups willing to pay above commercial fares for lounge privacy and flexible departure windows. As pricing algorithms mature, operators refine segmentation to capture demand pockets, fortifying recurring-revenue pipelines and diversifying the private jet charter services market size streams.

The Private Jet Charter Services Market Report is Segmented by Aircraft Size (Light, Mid-Size, and Large), Service Model (On-Demand Charter, Jet Card Membership, Subscription-Based Charter, and More), Flight Type (Domestic and International), End User (Corporates and SMEs, HNWI/Private Individuals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America retained 81.93% revenue dominance in 2025 due to a 5,000-plus fleet, dense FBO networks, and favorable depreciation allowances. The United States houses the most concentrated UHNWI base globally, translating into consistent domestic and trans-Atlantic flight demand. Canada and Mexico contribute incremental volumes through resource-sector travel and tourism flows. Route liberalization under the USMCA supports seamless cross-border scheduling, cementing regional leadership in the private jet charter services market.

Europe stays resilient despite intensifying carbon levies and SAF mandates. The United Kingdom, France, and Germany remain the primary hubs, with London Biggin Hill and Paris Le Bourget reporting utilization above pre-pandemic peaks. Operators retrofit fleets with SAF-compatible engines to safeguard slot access under ReFuelEU thresholds. This allows them to preserve their share in the private jet charter services market size even as compliance costs rise. Eastern Europe exhibits pent-up potential as wealth accumulation spreads beyond legacy capitals.

South America's 9.78% forecasted CAGR positions the region as the fastest-expanding pocket of opportunity. Brazil spearheads infrastructure spending, modernizing secondary airports such as Campinas and Goiania, which reduces reliance on Sao Paulo Congonhas congestion. Argentine mining projects and Colombian tech investments fuel inter-city air-taxi requirements. Currency volatility and regulatory complexity remain obstacles, yet demand fundamentals support commitment from global operators seeking white-space growth.

Asia-Pacific presents a mixed outlook. China's regulatory tightening cooled domestic charter activity in 2024, yet outbound leisure traffic pushes flights to Singapore, Phuket, and the Maldives. Indonesia, Vietnam, and the Philippines witness double-digit business-jet traffic expansion as manufacturing hubs integrate deeper into global value chains. Australia maintains a stable demand through resource-sector shuttle work. Middle East and Africa combine natural-resource wealth and tourism-led diversification; Saudi Arabia's Vision 2030 funnels investment into Riyadh's King Salman International Airport, strengthening regional linkage within the private jet charter services market.

- NETJETS IP, LLC

- Flexjet LLC

- VistaJet Group Holding Limited

- Wheels Up Experience Inc.

- flyExclusive

- XO Global LLC

- Jet Linx Aviation, LLC

- GAMA Aviation Plc

- Air Charter Service Group Limited

- PrivateFly Limited

- Sentient Jet

- Paramount Business Jets

- GlobeAir AG

- Luxaviation Group

- Jetex FZE

- RoyalJet Group

- DeerJet

- Club One Air

- Metrojet Limited

- Executive Jets Asia Pte. Ltd.

- Magellan Jets

- FXAIR

- Flapper Technologia S.A.

- Global Jet Centre

- Insijets Ltd.

- OJets Pte. Ltd.

- Jettly Inc.

- Prime Jet LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating growth in global ultra-high-net-worth individuals (UHNWIs)

- 4.2.2 Heightened demand for flexible, post-pandemic travel alternatives

- 4.2.3 Proliferation of jet-card, subscription, and membership models

- 4.2.4 Adoption of AI-enabled real-time pricing and booking algorithms

- 4.2.5 Increasing client preference for sustainable aviation fuel (SAF)-compatible charters

- 4.2.6 Expansion of secondary airports and FBO infrastructure across emerging markets

- 4.3 Market Restraints

- 4.3.1 Escalating operating expenses and charter pricing pressures

- 4.3.2 Stricter environmental compliance mandates and expanding carbon levies

- 4.3.3 Growing shortage of qualified business-aviation flight crews

- 4.3.4 Upward spiral in aviation-insurance premiums following safety incidents

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Size

- 5.1.1 Light

- 5.1.2 Mid-size

- 5.1.3 Large

- 5.2 By Service Model

- 5.2.1 On-Demand Charter

- 5.2.2 Jet Card Membership

- 5.2.3 Subscription-based Charter

- 5.2.4 Fractional Charter Integration

- 5.2.5 Empty-Leg/Shared Charter

- 5.3 By Flight Type

- 5.3.1 Domestic

- 5.3.1.1 Short Haul

- 5.3.1.2 Long Haul

- 5.3.2 International

- 5.3.2.1 Short Haul

- 5.3.2.2 Long Haul

- 5.3.1 Domestic

- 5.4 By End User

- 5.4.1 Corporates and SMEs

- 5.4.2 HNWI/Private Individuals

- 5.4.3 Sports and Entertainment

- 5.4.4 Government and NGO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NETJETS IP, LLC

- 6.4.2 Flexjet LLC

- 6.4.3 VistaJet Group Holding Limited

- 6.4.4 Wheels Up Experience Inc.

- 6.4.5 flyExclusive

- 6.4.6 XO Global LLC

- 6.4.7 Jet Linx Aviation, LLC

- 6.4.8 GAMA Aviation Plc

- 6.4.9 Air Charter Service Group Limited

- 6.4.10 PrivateFly Limited

- 6.4.11 Sentient Jet

- 6.4.12 Paramount Business Jets

- 6.4.13 GlobeAir AG

- 6.4.14 Luxaviation Group

- 6.4.15 Jetex FZE

- 6.4.16 RoyalJet Group

- 6.4.17 DeerJet

- 6.4.18 Club One Air

- 6.4.19 Metrojet Limited

- 6.4.20 Executive Jets Asia Pte. Ltd.

- 6.4.21 Magellan Jets

- 6.4.22 FXAIR

- 6.4.23 Flapper Technologia S.A.

- 6.4.24 Global Jet Centre

- 6.4.25 Insijets Ltd.

- 6.4.26 OJets Pte. Ltd.

- 6.4.27 Jettly Inc.

- 6.4.28 Prime Jet LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment